15/08/2022

IBA has published its latest aviation Carbon Index in partnership with KPMG. Our latest analysis for June 2022 includes a spotlight on the efficiency of lessors, focussed on regional jets and turboprops.

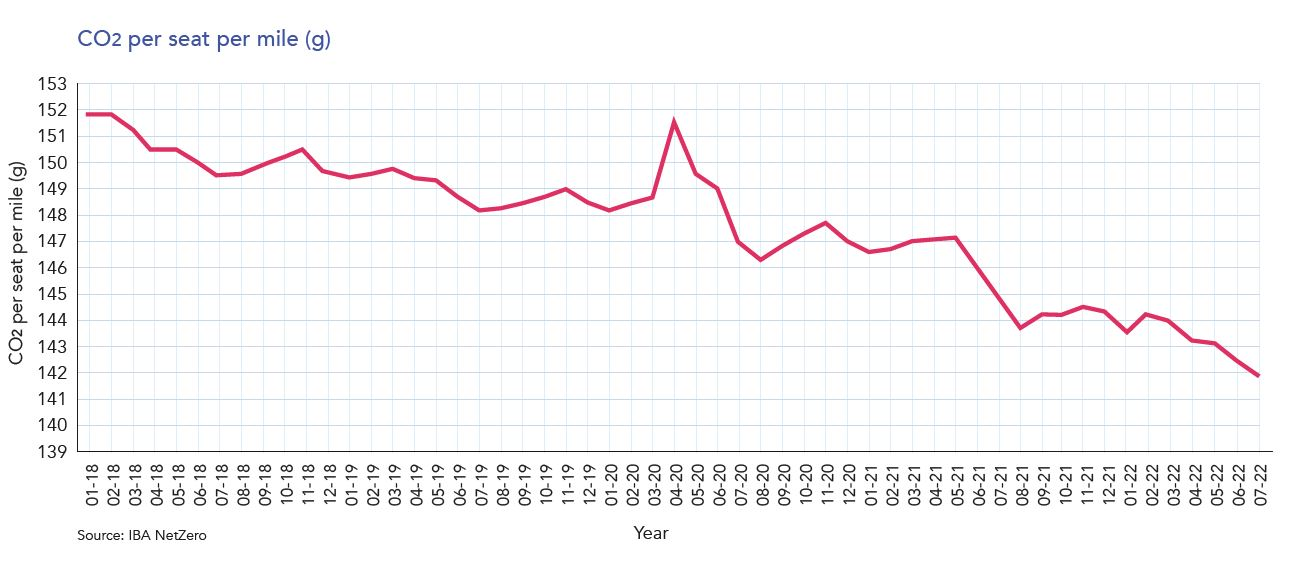

Aviation carbon emissions intelligence from IBA NetZero has revealed that CO2 emissions from commercial aviation averaged 141.9 grams of CO2 per-seat-per mile in July 2022, and that overall carbon intensity per-seat decreased by 0.4% compared to June. This represents a 1.9% reduction in CO2 intensity per-seat per-mile year-on-year, another record low for the industry.

We would also like to take this opportunity to highlight the work of Impact on Sustainable Aviation. IMPACT is a global platform formed by key players in aviation finance. Aimed at providing tangible and practical solutions to the challenges of net-zero, the group will shortly be issuing a white paper on the decoupling of ESG and aircraft.

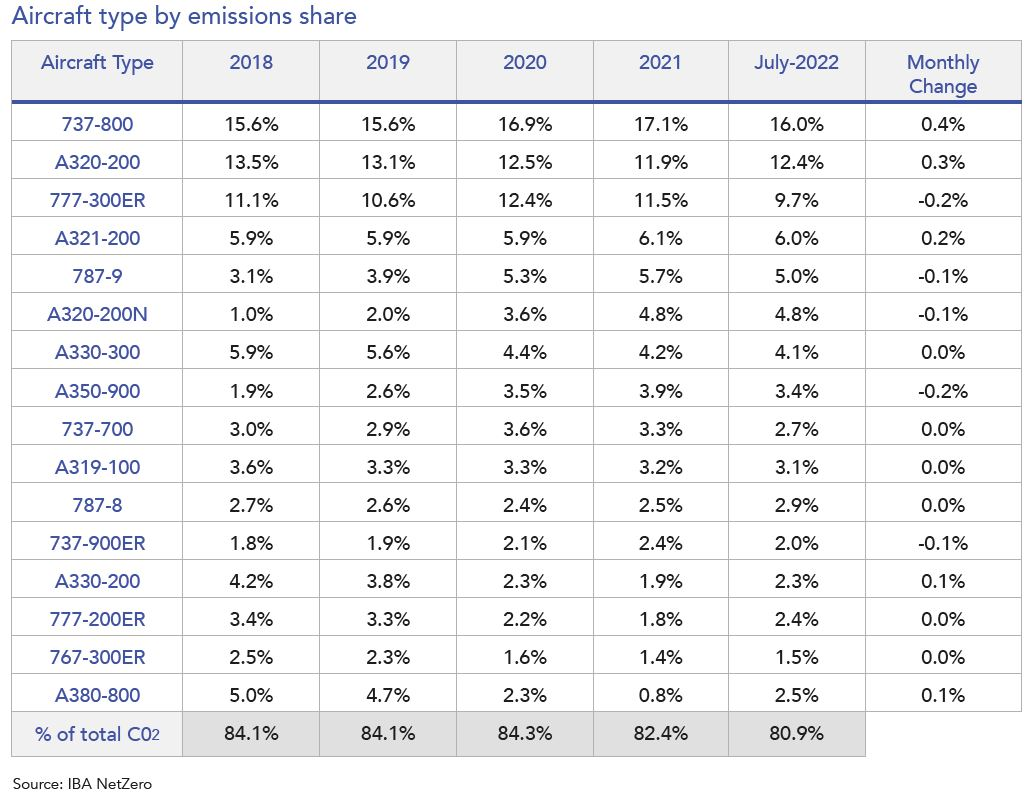

The aircraft type with the largest share of global emissions is heavily influenced by utilisation trends. The period from June to July 2022 saw little change in these trends, and, as such, our aircraft efficiency ranking shows little movement in July 2022. Whilst the Boeing 737-800 retains its position with the highest emissions share, it is important to highlight that the two most popular narrowbody types did see increased utilisation in this period, with growth of 0.4% for the Airbus A320ceo and 0.3% for the Boeing 737-800.

Also notable is the buoyant return of the Airbus A380. A380 utilisation has increased by 177% since July 2021, with notable returns to service being observed at Emirates, British Airways and Lufthansa in recent months. IBA's Geoff van Klaveren recently discussed the return of the A380 with CNN, commenting that "Operators were quite reluctant to bring it back because it's a very costly aircraft, but we've seen demand recovering much faster than people expected."

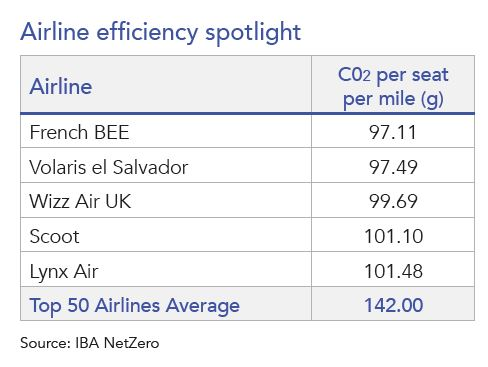

Canada's recently re-branded Lynx Air entered our ranking of the most efficient airlines in July 2022. The operator, formerly known as Energair, commenced operations with 5 x Boeing 737 MAX 8 aircraft based in Calgary in April. Fleet data from IBA Insight reveals that all these aircraft feature a high density 189 seat configuration, and are owned by Aergo Capital, SMBC Aviation Capital and Air Lease Corporation. French BEE retains its position at the top of our ranking, alongside regularly featured airlines Scoot and Wizz Air UK.

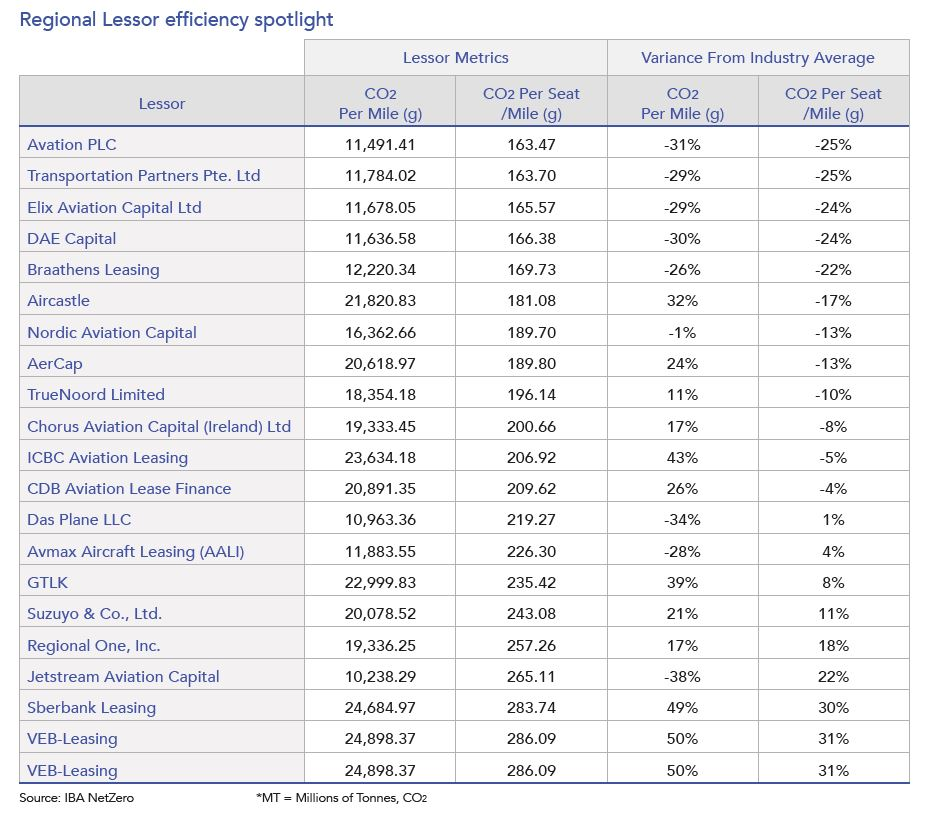

This month, we used IBA NetZero to shine a light on the efficiency of lessors focussed on regional aircraft, solely benchmarking against the performance of regional and turboprop aircraft efficiency within other lessors' portfolios. Regional jets and turboprops represent an integral part of the aviation ecosystem, increasing the intramodality between airports, feeding hubs, and serving smaller communities around the world.

It is notable that the top five lessors in our ranking own a large proportion of highly efficient ATR72 turboprop aircraft. By way of example, IBA Insight reveals that 100% of Aviation PLC's aircraft are of the ATR72 family, whilst 63% of Transportation Partners Pte. Ltd.'s portfolio are of the type. This skew towards more efficient turboprops typically drives a lower CO2 output per-seat per-mile than lessors with a more diverse portfolio.

Looking closer at those lessors more diverse portfolios, we see that Aircastle is afforded a higher position in our ranking thanks to its higher capacity Embraer E195, and more modern Embraer E2 jets. At present, Aircastle has 7 x Embraer E195-E2 aircraft leased to KLM Cityhopper, and 5 x Embraer 195AR aircraft leased to Azul Linhas Aereas Brasileriras and Portugalia. The E2 series performs well due to higher fuel efficiency, whilst the Embraer 195 benefits from the high volume of seats on board.

The best performing lessor with an exclusively regional focus is Nordic Aviation Capital (NAC). NAC manages a very diverse fleet of ATR42 and ATR72, DHC8-400Qs, Embraer 190 and E195, and CRJ-1000ER aircraft. 68% of the fleet are turboprops, again improving overall efficiency.

Chorus Aviation Capital (Ireland) Ltd sits mid-table in our ranking, with an eclectic blend of aircraft within their portfolio. Chorus absorbed a number of less efficient aircraft following the acquisition of Falko Regional Aircraft. These aircraft had an efficiency rating around 8% below the regional average, bringing down the overall efficiency of the fleet.

IBA NetZero is the most advanced finance-focused carbon modelling tool currently available; we're leading the way. It's powered by IBA's proprietary fuel-burn intelligence which, when integrated with the Flights and Fleets module, can illustrate carbon emissions by any combination of: time period, airline, lessor, aircraft MSN and model, fleet, future portfolios, OEM, country, airport and route pair.

Related content