29/06/2022

IBA has published its latest aviation Carbon Index in partnership with KPMG. Our latest retrospective analysis for May 2022 includes a spotlight on the North American domestic market.

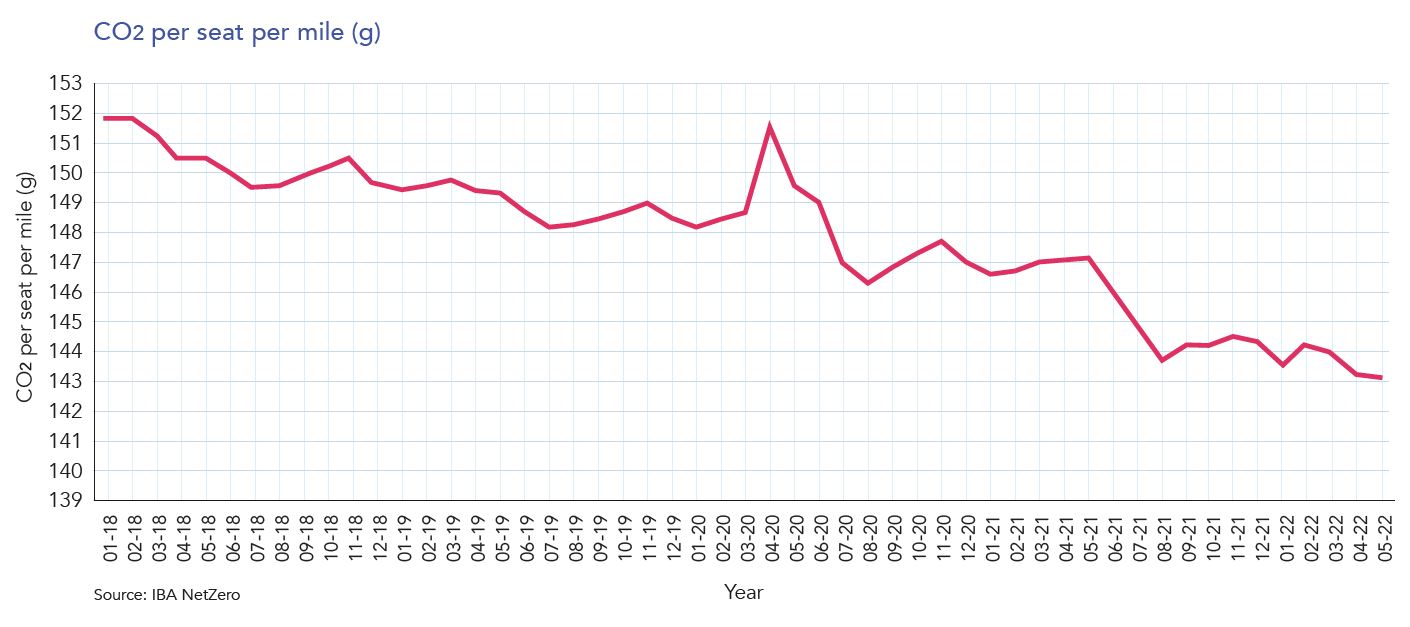

IBA NetZero has revealed CO2 emissions in the commercial aviation industry averaged 143.1 grams of CO2 per-seat-per mile in May 2022, with overall carbon intensity per seat decreasing by less than -0.5%. This represents a -2.5% reduction year-on-year in CO2 intensity per seat per mile.

Spring saw the same steady growth in global traffic, and May was no exception. Global traffic grew by 2.7% month-on-month, and flight volumes have increased across the board.

The most notable growth was in the Asia Pacific region, with a 14% increase in domestic traffic and a 12% increase in international traffic. International traffic growth is largely attributed to increased operations by the top 5 operators in the region, namely IndiGo, China Southern Airlines, Japan Airlines, All Nippon Airways and China Eastern Airlines. These operators account for over 19% of the entire Asia Pacific flight network. Around 33% of these flights are operated by high density narrowbody aircraft. The combination of more efficient narrowbodies and a high number of seats results in lower CO2 intensity per seat per mile.

European traffic has also seen a steady increase in activity. 459,000 flights operated in Europe in May 2022, compared to 397,000 in April. Europe also saw a 15% growth in intercontinental traffic in May 2022.

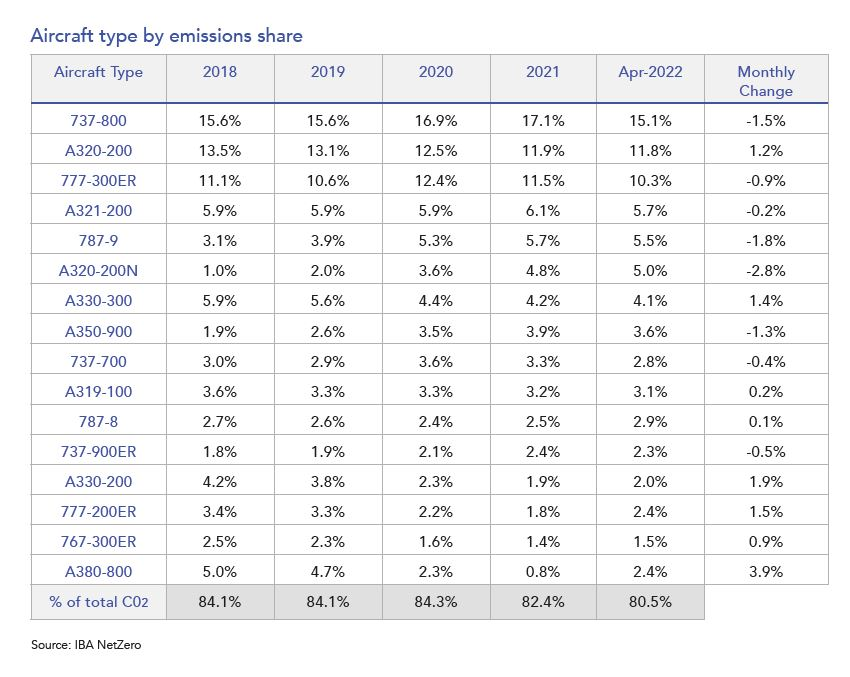

Narrowbodies - the global share of emissions by aircraft type has shifted marginally towards the Airbus A320-200ceo family, which saw an increase of 1.2% compared to April 2022.

Widebodies - the Boeing 777-300ER saw a 0.9% decrease in its monthly share of CO2 emissions. The number of flights operated by older generation widebodies grew this month, with the Airbus A330-200, A330-300, Boeing 777-200ER, Boeing 767-600ER and Airbus A380-800 all seeing an increased number of flights in May.

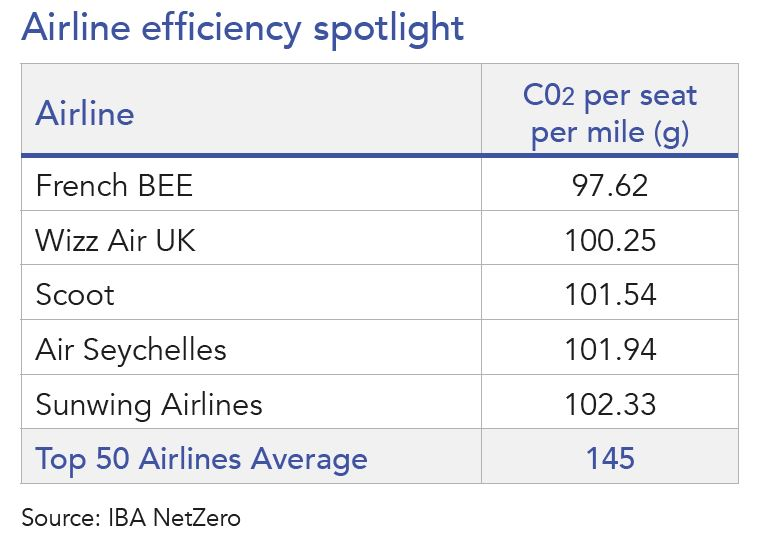

French BEE remains at the top of our ranking of the most efficient airlines in May 2022. The operator utilises a focussed fleet of high-density Airbus A350 aircraft, resulting in a consistently low CO2 per-seat per-mile performance. It is important to recognise that significant trends can be observed when comparing operators of similar sector length, and analysing CO2 emissions through the lens of another metric, available seat kilometre ‘ASK'. In our recent analysis, we identified the most improved long, medium and short haul operators since 2019, observing significant improvements from operators including SAS, Beijing Capital Airlines and Air Canada. In the coming months, we will explore similar trends and highlight improvements amongst airlines and lessors.

Jackson Square Aviation continues to rank as the most efficient lessor in May 2022. Within the lessor index, overall CO2 per-seat per-mile performance amongst lessors has not changed this month, remaining at an average of 129 grams per seat per mile. Whilst we would expect significant changes in the case of widespread fleet changes, it is likely that this picture will only fluctuate slightly in the coming months, based on the schedules adopted by lessees.

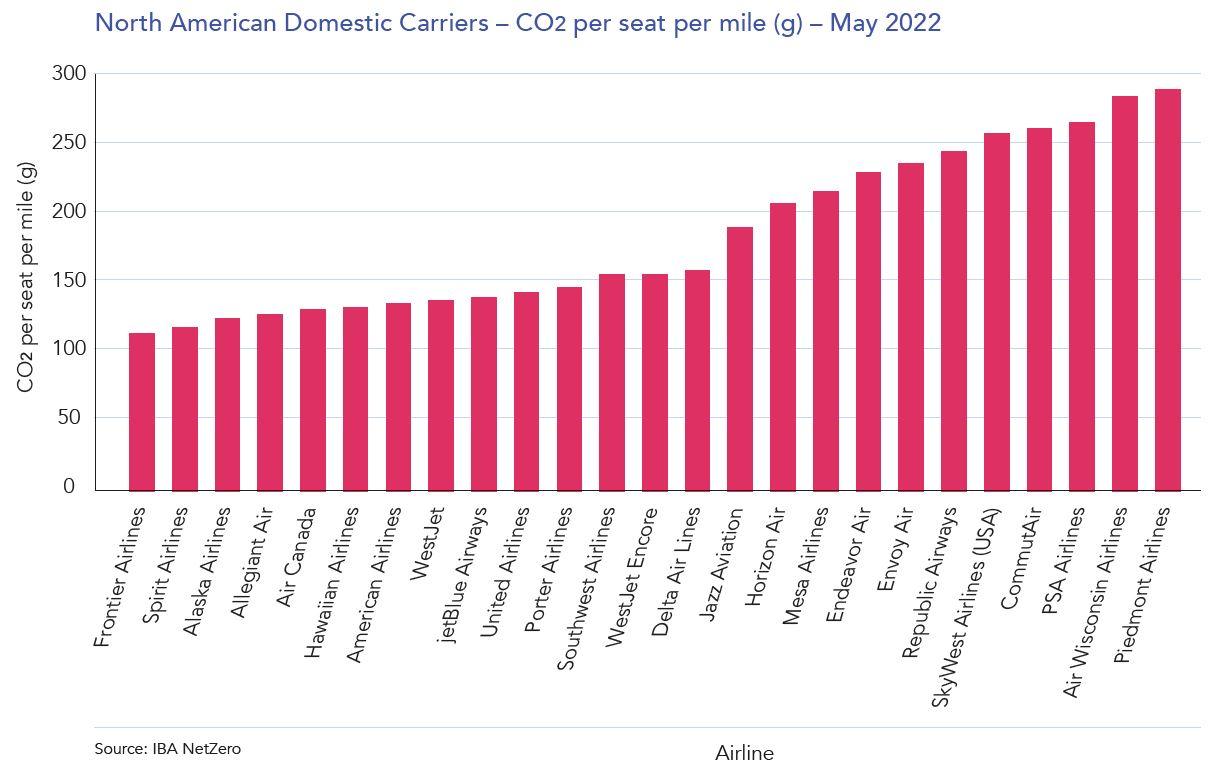

Using carbon emissions insight from IBA NetZero, our experts have examined the efficiency of key players in the North American domestic market.

Ultra-low-cost carriers with high density narrowbody aircraft are most efficient on a CO2 per-seat per-mile basis. Frontier Airlines leads the way, with a total of 114 grams of CO2 per seat per mile. Frontier benefits from a young fleet, with an average aircraft age of just 4.2 years. 70% of the fleet are CFM LEAP-1A powered, high density Airbus A320neo aircraft with 186 seats. Spirit airlines closely follow Frontier in the ranking, with a proposed merger between the two carriers still a possibility in the near future.

Alaska Airlines ranks third in our analysis, proving that CO2 efficiency in this market isn't exclusive to low-cost carriers. Alaska benefits from operating a blend of Boeing 737 NG types. 49% of these are higher capacity 737-900ER aircraft, reducing CO2 per-seat per-mile. The addition of 23 new generation 737 MAX 9 aircraft to the fleet has also improved overall efficiency. Our analysis indicates that if it were not for the blend of first, premium economy and economy seating, Alaska Airlines would have appeared higher in our ranking.

Operators using a higher proportion of turboprop aircraft perform better in our ranking than those focussed on jets. Jazz, Horizon and Mesa operate turboprops such as the DHC8-400Q on small, mission specific sectors, where narrowbodies would not prove economical. In comparison, shorter sectors flown using ageing CRJ-900, 700 200 jets at Endeavour Air results in poorer performance. Such carriers are often using multi-class seating configurations, further impacting CO2 efficiency per-seat per-mile.

IBA NetZero is the most advanced finance-focused carbon modelling tool currently available; we're leading the way. It's powered by IBA's proprietary fuel-burn intelligence which, when integrated with the Flights and Fleets module, can illustrate carbon emissions by any combination of: time period, airline, lessor, aircraft MSN and model, fleet, future portfolios, OEM, country, airport and route pair.

Related content