18/05/2022

IBA has published its latest aviation Carbon Index in partnership with KPMG. Our latest analysis for April 2022 includes a spotlight on ABS structures.

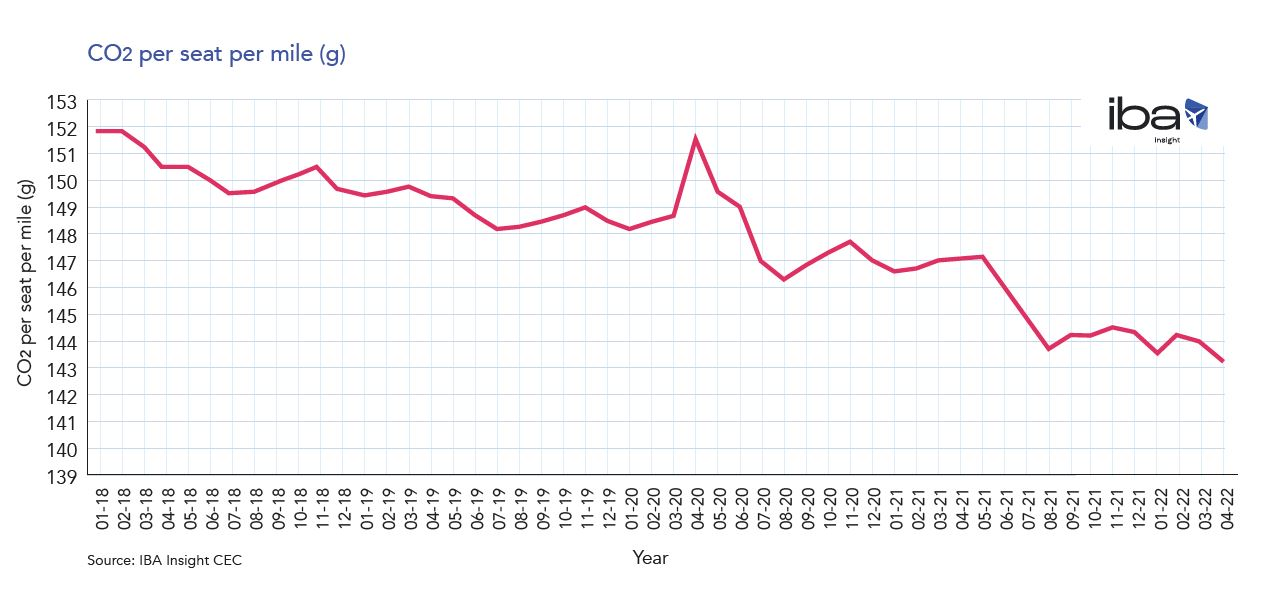

CO2 emissions from the commercial aviation industry averaged 144 grams of CO2 per-seat-per mile in April 2022, with overall carbon intensity per seat decreasing by just under 0.5%. This represents a 2.5% reduction in CO2 intensity year-on-year per-seat per-mile.

April 2022 saw growth remain steady for the spring months, with month-on-month global traffic growth reaching 2.2% leading into the summer season. This growth was driven by a 13.5% increase in international flights originating within Europe & CIS. 75% of these flights used high density narrowbodies operated by the top three low-cost carriers in Europe; helping to drive down overall CO2 intensity per seat per mile.

Ryanair, Lufthansa, Turkish Airlines, Wizz Air and easyJet were the operators that drove the increase in European international flights, and these airlines account for over 36% of the entire European international flight network. In contrast, global domestic flights experienced a 3.2% decrease in April.

"How will ESG impact the ABS market? European aviation is determined to achieve carbon-neutrality by 2050, with the EU proposing an intermediate target of a 55% reduction by 2030 compared to 1990 levels. What does that mean for the ABS market, will current assets become redundant faster than previously thought?" - Chris Brown, KPMG.

Scroll down to read our full analysis of ABS structures.

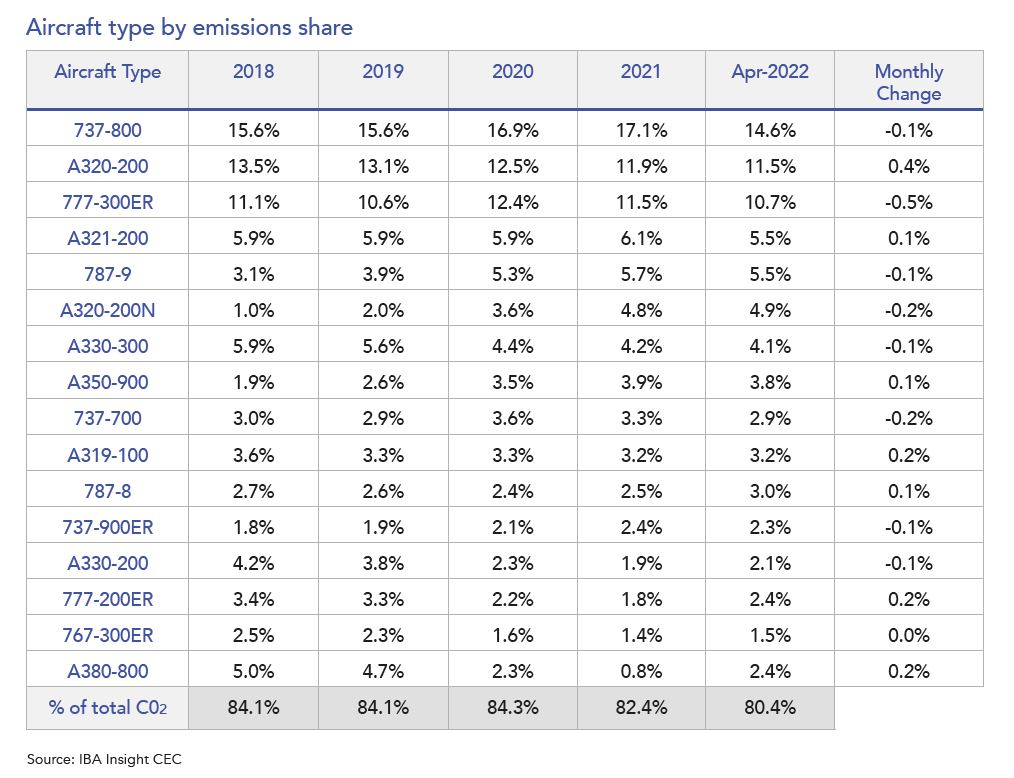

The global share of emissions in April 2022 shifted slightly, with the Airbus A320-200ceo experiencing a 0.4% increase on the previous month. The Boeing 777-300ER saw a decrease in its monthly share. Flight data from IBA Insight has identified a continued month-on-month increase, which itself is driven by growth elsewhere in the global fleet mix (with aircraft such as the Airbus A220-300, Boeing 737 MAX 8200, and Embraer E195-E2 seeing an increase in utilisation of 15%, 18% and 23% respectively). IBA expects this growth to continue as deliveries of these types ramp up.

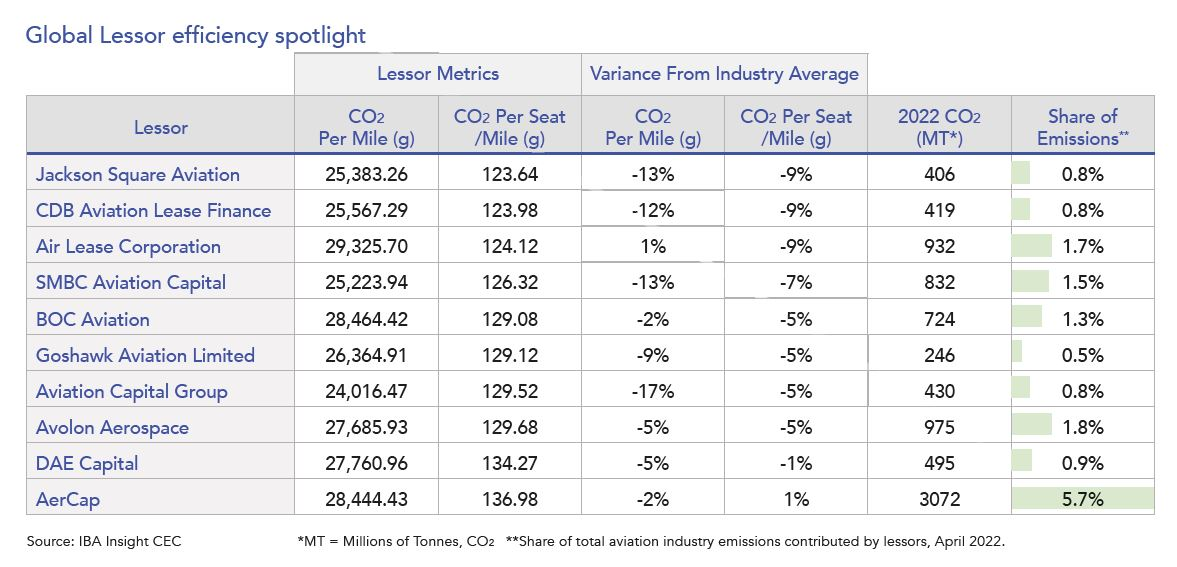

There has been little change in CO2 emissions from lessors this month, with CO2 per seat per mile figures remaining at an average of 129 grams per-seat per-mile. Jackson Square Aviation remains at the top of our lessor efficiency index in April. Overall CO2 emissions per-seat and per-mile are likely to fluctuate marginally month-on-month for each lessor. This is largely driven by utilisation characteristics, unless major new deliveries and fleet exits occur.

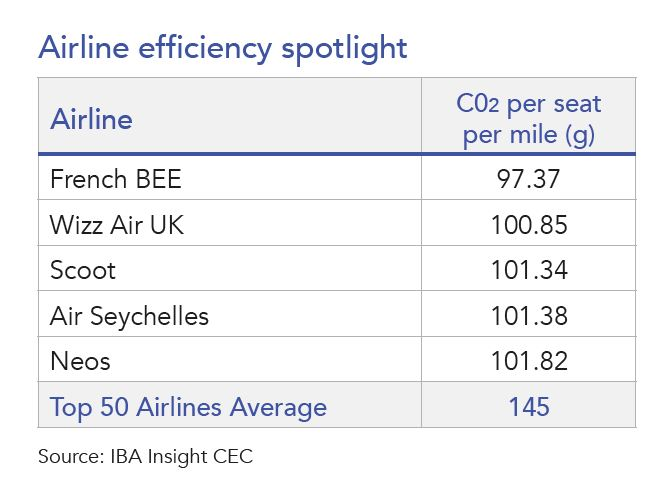

April 2022 saw changes in our Airline Efficiency Index, with Wizz Air UK re-entering our ranking. Their fleet utilises a 55%/45% split between NEO and CEO aircraft and consists of 16 active aircraft owned and managed by a mix of entities. These include BoComm Leasing, Carlyle Aviation Management Limited and AVIC Leasing.

Other operators in our ranking remain in the same positions as in March. Of these, Scoot has completed the highest number of flights in April. With aviation intelligence from IBA Insight identifying 2,327 flights across 42 aircraft. Wizz Air UK operated a total of 1,697 aircraft across its fleet of Airbus A320 family aircraft.

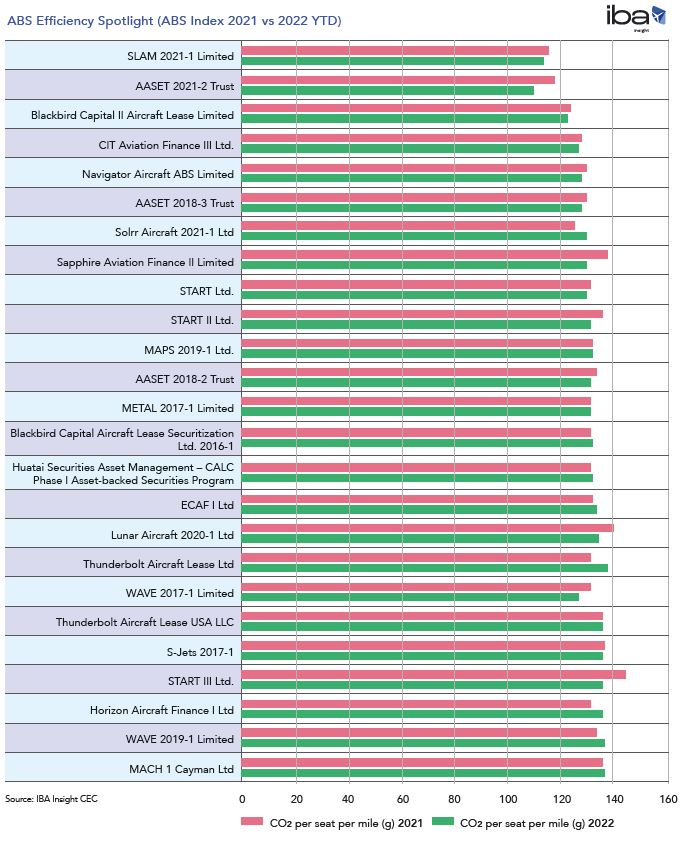

Most of the strong performers in our ABS efficiency ranking are based on ABS transactions made in 2021. These mostly, which included a blend of 8 x Airbus A321-200neo, 3 x Boeing 737-900ER, and 1 x Airbus A330-900 aircraft. The composition of aircraft within this ABS lends itself to a good efficiency rating due to most of the A321-200neo aircraft being in high-density, single class configuration.

Another notable entry in our ABS efficiency ranking is the Navigator Aircraft ABS from November 2021, managed by DAE Capital. This consisted of 22 aircraft with an average age of 6.7 years. This ABS structure includes high-density Airbus A321-200neo aircraft operated by Indigo. These work alongside 2 x 737 MAX 8 aircraft operated by American Airlines, and 2 x Airbus A330-300ceo aircraft operated by Iberia.

We can also identify ABS' that follow a more typical trend of asset composition. One such example came from Sapphire Aviation Finance II Limited, with an average asset age of 10.4 years. This ABS consists of aircraft mostly operating for Eastern European and Russian operators, and benefits from A330ceo aircraft with high density dual class layouts, helping drive the overall efficiency rating on the portfolio.

The START III Ltd ABS, managed by AerCap, consists of a range of Boeing 737 NG and Airbus A320ceo family aircraft, placed with a diverse spread of operators. These include Austrian Airlines, Tway Air, Lion Air and SAS.

"We don't yet see ESG impacting narrowbodies or widebodies until the 2030s, leaving the ABS market a viable one for the near future. However, there are two key risks.

1) SAF supply is immaterial at present and needs to rapidly ramp up - the demand is already there, even at existing price premiums, so the investment attention needs to turn more to power-to-liquid technologies at scale that will have captive markets. Without this supply side investment, expect increasingly harsh scrutiny for conventional aircraft.

2) We currently model hydrogen and electricity's total contribution to aviation's energy needs as still under 10% of total by 2050, ramping up since the late 2030s. If hybrid, fuel cell and other technologies accelerate and become commercially viable for retrofits, then regional, narrowbody and even widebody assets will face midlife decisions not previously factored in."

In our next issue, we will examine Enhanced Equipment Trust Certificates ‘EETC's, identifying key deals and the carbon intensity of those arrangements.

IBA Insight flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.

Related content

IBA's Tim Boon looks at the ramp up in Sustainable Aviation Fuel offtake agreements since 2013.

British Airways has taken delivery of UK-made Sustainable Aviation Fuel from Phillips 66 Limited