14/03/2022

IBA has published its latest aviation Carbon Index in partnership with KPMG. Our latest analysis for February 2022 includes a spotlight on the CO2 efficiency of popular aircraft engines fitted to widebody and narrowbody aircraft.

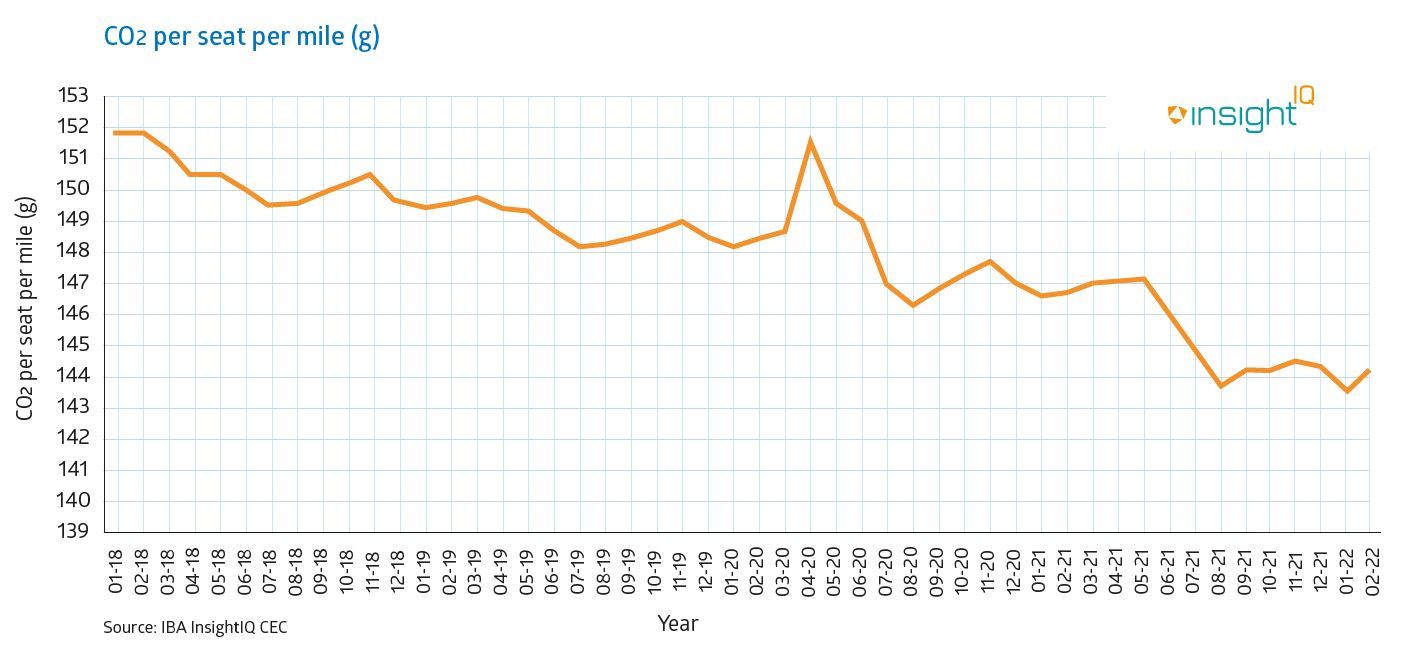

CO2 emissions in the commercial aviation industry averaged 144.2 grams of CO2 per-seat-per-mile in February 2022, with overall carbon intensity per seat increasing by just under 0.3%. The marginal growth in these figures is driven by a slight reduction in operations from newer generation aircraft in February 2022, and by a shorter stage length from key contributors (which increases emissions on a per-seat per-mile basis). February 2022 saw a significant reduction in both domestic and international flights globally, with a reduction of 9% in domestic flights and an 8% reduction in international flights from January 2022 to February 2022. The overall reduction in flight volumes is largely driven by a drop in international flights departing from the Europe & CIS, Asia Pacific and North American regions.

Chris Brown, Head of Strategy at KPMG, said: "As we'd expect, the carbon intensity of competitor engine options on the same generation of plane type differs modestly when compared with older generations. And yet the difference within a single generation is still around 3-5% in many cases. This is surprisingly high when we consider that over the whole Jan'2018 to Jan'2022 period, the fleet-wide CO2 per-seat per-mile fell at under 2% per year."

"Clearly fuel prices will now be more topical than ever given the geopolitical response to Russia. And yet the environmental scrutiny on aviation won't let up. It would be tempting to think 'If only SAF production had ramped up 15 years ago' - that we might already see falling prices from an available, alternative supply. The short-term temptation in the current context might be to resist any further policy levers around SAF, and yet that is exactly what is required to give producers the certainty of demand, in turn driving the required volumes and price fall. This realistically involves both EU-style blend percentage mandates, as well as California-style incentives on production."

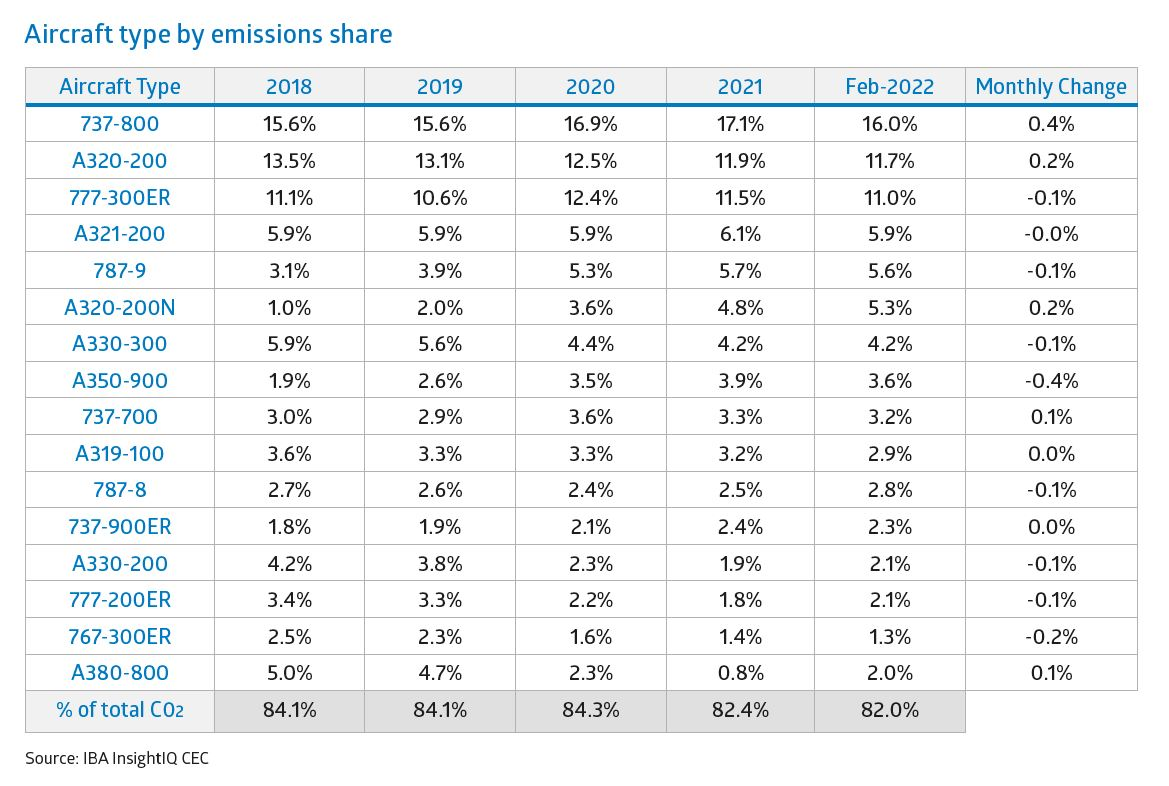

It is likely that a combination of factors are contributing to the drop in flight volumes. Recent airspace closures following the Russian invasion of Ukraine, combined with continued localised lockdowns in some regions are likely to attribute to uncertainty in the market, coupled with a global cost of living increase resulting in some passengers being less willing to travel during such significant global volatility. The emissions share of the Boeing 737-800 increased by 0.4%. This was the most significant monthly change in emissions by aircraft model. The aircraft with the largest reduction in emissions share in this period was the Airbus A350-900. These figures are fluid, and small increases and decreases should be expected month-on-month. IBA expects the aircraft efficiency spotlight to be influenced by the ongoing crisis in Ukraine, initially manifesting itself as a larger than usual fluctuation in our next monthly figures.

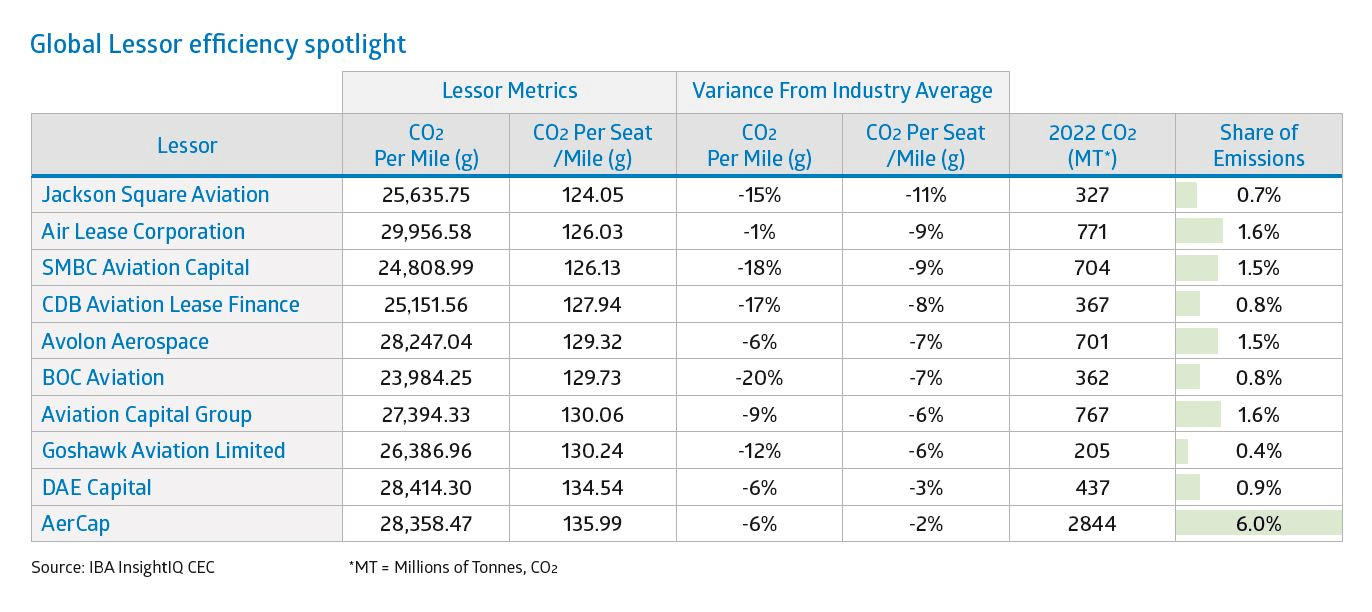

Jackson Square Aviation remains at the top of our Lessor Efficiency Spotlight for February 2022. CO2 per-seat per-mile figures have increased on average by 1 gram per mile across the board within our lessor index. This is largely influenced by the overall utilisation of assets within the lessors' portfolios. IBA has seen an increase in CO2 intensity across all the top lessors throughout February 2022. No major fleet changes or exits of note have occurred in the past month.

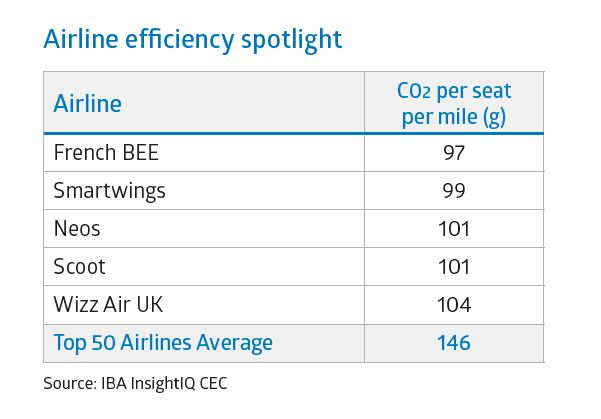

February 2022 sees Czech low-cost carrier Smartwings enter our Airline Efficiency Spotlight for the first time. Italian airline Neos also joins our ranking, operating a mixture of low-cost medium and long-haul routes using a fleet of Boeing 737-800, Boeing 737 MAX 8 and Boeing 787-9 aircraft. The Boeing 787 aircraft in the Neos fleet were largely sourced from Norwegian's long-haul low-cost fleet. The high-density configuration of these aircraft contributes to their overall efficiency per-seat per-mile.

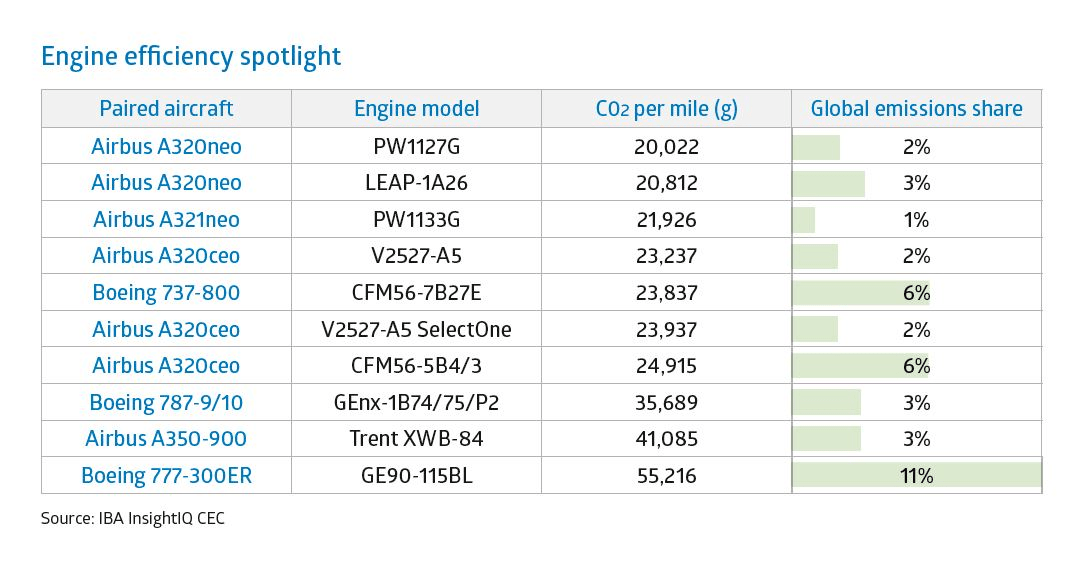

In this month's extra spotlight feature, we have benchmarked and compared a selection of popular engines fitted to the most common aircraft in the global fleet mix. IBA has identified the most efficient engine by CO2 emissions per-seat per-mile as the Pratt and Whitney PW1127G Geared Turbo Fan 'P&W GTF' fitted to the Airbus A320neo.

Our engine CO2 efficiency performance comparisons highlight relatively slim differences when comparing powerplants operating in the current generation narrowbody market. The IAE engine family holds a small CO2 efficiency advantage when compared to the CFM56 engine, which commonly power Airbus A320ceo and Boeing 737NG aircraft, respectively.

Larger efficiency trends can be observed when comparing new generation engines to older generation engines fitted to the Airbus A320 and Boeing 737 families (the two most popular aircraft types). A key example is The Pratt and Whitney PW1127G Geared Turbo Fan 'P&W GTF' engine, which is 16% more efficient than the previous generation International Aero Engines (IAE) V2500 series engine.

Looking at newer generation engines, the P&W GTF holds a slight advantage over the CFM LEAP-1A26 when fitted on the Airbus A320neo in terms of CO2 efficiency. New generation engine developments and key learnings from the previous generation of engines are the key to efficiency improvements in the A320neo family.

The selection of engine models is typically dictated by the relationships between the airline (or lessor) and the engine manufacturer. As engine technology improves and more new generation aircraft are brought online, IBA anticipates further overall efficiency improvements from newer engines will contribute to the efficiency of the global fleet.

IBA's aviation Carbon Emissions Index is powered by our Carbon Emissions Calculator, part of InsightIQ. We regularly update the functionality of InsightIQ to give our users the most diverse aviation intelligence and insight. Our latest update adds selection of 'Engine Model' in the main panel of our Carbon Emissions Calculator, allowing you to aggregate flights to engine model rather than specific aircraft.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.

Related content