Dr. Stuart Hatcher

Chief Economist & ISTAT Certified Senior Appraiser

I have talked a lot about the large orders that have been 'announced' recently and are set to spice up the Paris Air Show for sure. But it got me thinking about the potential lead times, especially when I see that the Ryanair order has a 2027 date attached to it.

It’s long been a factor in this industry that whilst lead times are expected to be of a certain length, there remains a number of situations, where for some, lead times are less of a problem. Or, where there are sudden deferrals, aircraft swiftly become available, so the odd immediate order/delivery event can occur too.

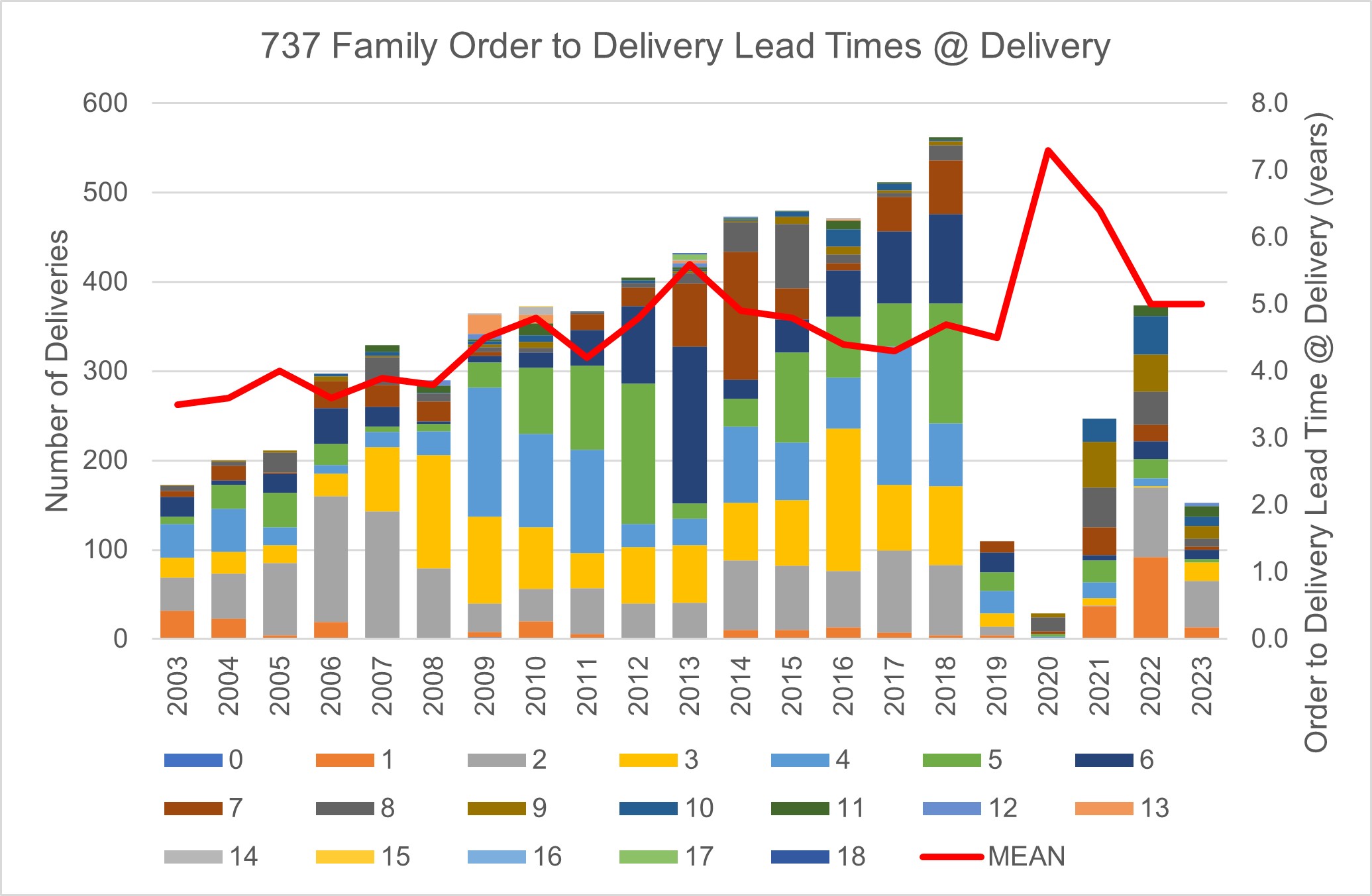

We have seen this in most narrowbody programs, for poor demand years like 2002 or 2009. For Boeing, large orders from Ryanair or any of the top four US carriers, will normally trigger some shorter lead times. When looking back at deliveries for the last 18 months, it is interesting to see, that out of the 527 Boeing 737-family aircraft delivered, 43% were ordered within 2 years of delivery, whilst the remainder had been on order for ~8 years. Naturally, the extent of this has been affected by the delays to the MAX 7 certification and bringing forward the deliveries for the MAX 8s, but I’m generally not surprised by 20% levels of sub-two-year lead times, as seen over many years.

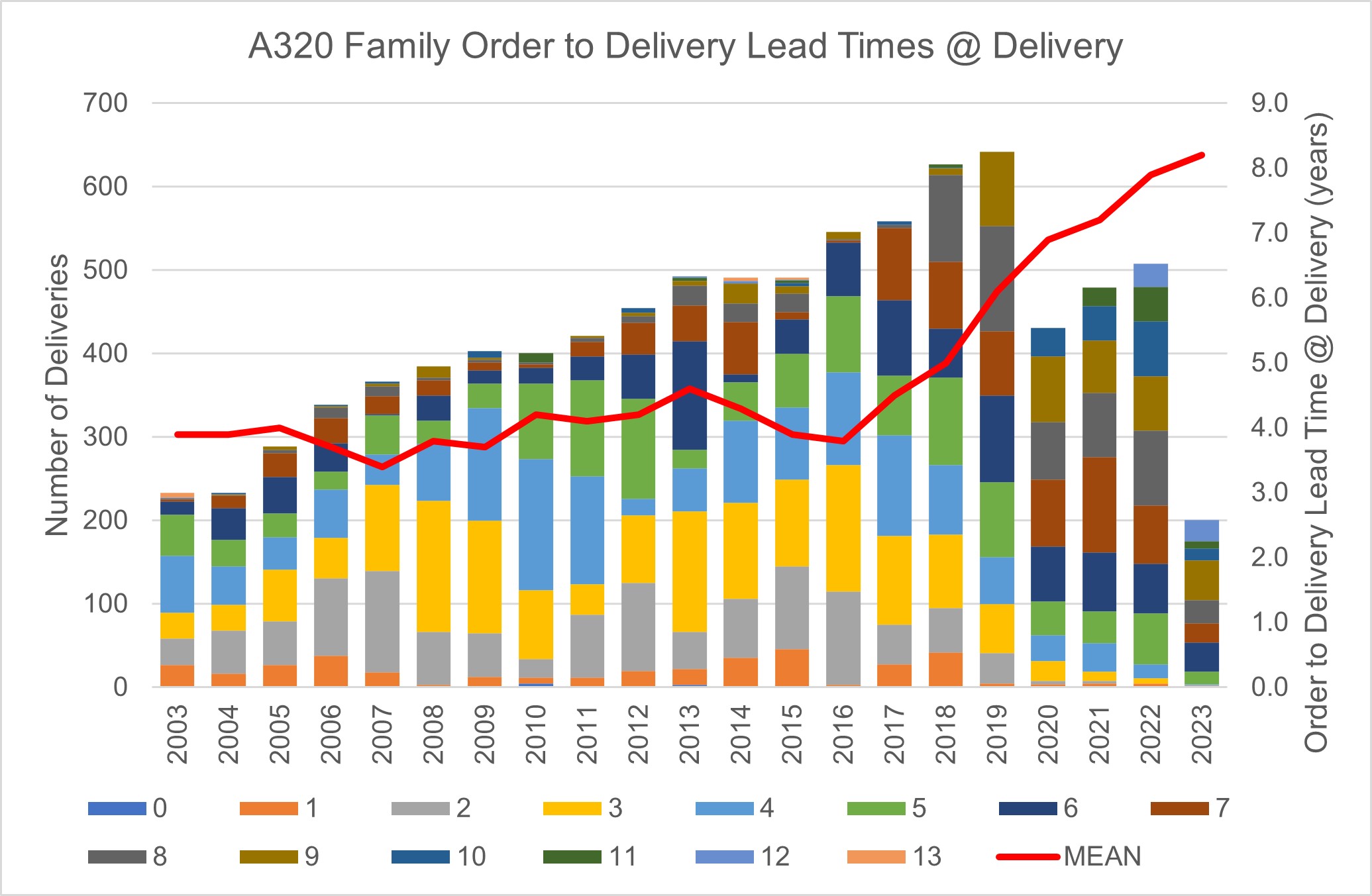

For Airbus, historically this would have been the case too, but certainly not for the past four years, whereby only 1% of the 709 deliveries that occurred over the past 18 months had been ordered within two years.

Prior to 2019, both OEMs were at a point where the average lead time for each family was five years. Airbus had shifted from a long-term rate of four years in 2017, as the huge orders from 2011 were surpassing their delivery capacity. Meanwhile, Boeing had been steadily building from four to five years over a much longer period. However, that’s where the similarity appears to end. Whilst the lead times for A320 family aircraft have simply grown year over year, such that current year deliveries have been on order for an average of eight years, the large number of movements has kept the 737 family lead time closer to just five years. This sounds incredible given the issues with the program and the industry as a whole since 2019. Certainly, Boeing have remained more conservative on their delivery forecasts compared to Airbus, and I expect ramp-ups will be slow and cautious, whereby it could be another three years before we get close to where the original NG delivery rate was.

However, considering that there are over four thousand 737s on backlog today, with an average lead time to date of 5.7 years already, and coupled with the high interest being generated for the MAX 10, overall program lead times could rise sharply up to where the neo is today. Especially once the MAX 7s eventually reach Southwest, as those were ordered 12 years ago.

For Airbus, the neo backlog already exceeds 6,000 units, with an average lead time today of 5.2 years, so there is plenty of room for the total lead time to grow by another four years and reach twelve years by 2027. Breaking down the various sub-models within each family, it is highly probable that as Airbus continue to pump out A321neos at a higher rate than A320neos and based on the large orders for the MAX 10 already from prominent customers, Boeing must take a more aggressive stance once certification is achieved, to counter the expansion of the A321neo. Already, a lot of ground has been lost in that market, due to the absence of any competitive threat, but the gap must be narrowed.

Neil Fraser

Manager - Airline Analysis

With Ryanair and easyJet having reported Q1 (calendar year) results, this and last week respectively, we are getting an impression of the European LCC sector. On nearly all metrics Ryanair dominates.

It is of course not fair to compare the two in terms of scale of revenue or profit, with easyJet’s fleet of 329 approximately 2/3 the size of Ryanair’s 541 aircraft.However, it is meaningful to compare Ryanair’s Q1 operating margin of -12.1% to the -35.2% of easyJet. Both recording a loss will be no surprise, with Europe the most seasonal market, especially felt among LCCs who primarily serve the leisure market. Michael O’Leary predicted their loss in advance, despite their record nine months prior, with Easter falling in Q2.

For both carriers, there is a similar capacity variance, between the summer peak and winter trough,of around 50-60%. Therefore, it cannot be argued that one targets the winter season more than the other and is thus explained by the profitability of operations. Interestingly, easyJet grew their revenue in the period year-on-year (+77%) by a greater amount than Ryanair (+55%). However, their operating loss remained essentially the same magnitude as the previous year. Whilst this translates as an improvement in operating margin, it also shows those increases in operations had negligible profitability.

In the case of Ryanair, their net margin of -8.2% was also superior to their operating margin. This was due to negligible finance expenses (from all but no leasing), a tax asset and foreign exchange gains. easyJet do not report net margins in interim results, however, the expense of their 42% leased fleet will likely exceed any tax asset or FX gain.

Looking forward, pent-up demand is expected to endure and bring a strong Q3 for both airlines. It is interesting to note that Ryanair are already fuel hedged 85% of FY24. By contrast easyJet are only hedged 56% (on average) of the same period, and for approximately 28% higher price ($114bblvs $89bbl). It is important to note, however, that fuel hedging is not always a good thing. If Russia reconciles with the West, more kerosene may enter Western markets and lower the spot price. Ryanair locking in their advantage may become locking in unprofitability.

Talking of Russia, yet another country opened up operations to the pariah state this week. Georgia’s national flag carrier, Georgian Airways,started operations between the two, whilst the government also allowed Russian airlines into the country. Interestingly the President and her supporters, who opposed the government’s decision, suggested boycotting the airline. Airline CEO, Tamaz Gaiashvili, is quoted as replying for them to “keep their dirty hands-off Georgian Airways”.

The CEO did do well topointout that already Turkish, Israeli and lots of Arab airlines continued operations to the country. It was one of the big tailwinds of Turkish Airlines’ strong 2022 results. It is an interesting decision for Georgia, as they have typically had a strained relationship with Russia, around the independence movements of South Ossetia and Abkhazia.

This is perhaps again showing that financial concerns are taking greater priority over any political stances, especially with real worries of high-interest rates triggering a global recession.

Finally, revisiting the theme of consolidation from previous weeks, the US DoJ reminded us,twice this week,that mergers cannot go ahead without scrutiny. These were decisions to break up the 4-year-old Northeast Alliance (NEA) between American Airlines and JetBlue Airways and a rumoured decision to block the KoreanAir-Asiana merger.

The NEA allowed the two US carriers’ schedules to complement one another as well as establishing codeshare agreements. However, the DoJ has decided that, since its inception, it has only put upward pressure on fares. In 2022 US carriers had higher fare hikes than any other market. American Airlines isa good example of this, with revenue increasing by 67% compared to an RPK increase of only 33%. All the while, passenger numbersonly increased by 20%. The DoJ is perhaps correct to be sceptical, although they should be aware that the trend is almost universal among US airlines.

Both Airlines are believed to be contesting the decision, although JetBlue will need to save legal resources to fight off the concurrent challenge to their Spirit merger.

The second decision of the US DoJ was, curiously, about airlines across the Pacific. With a view of city pairs between South Korea and the USA, the DoJ is rumoured to rule that a merger between Korea’s two large full-service carriers is uncompetitive.

This decision is surprising as the South Korean market is arguably one of the most competitive in the world. As well as having the busiest route in the world (Jeju-Seoul), they currently have eight low-cost carriers and two full-service carriers.

Suleiman Atif

Aviation Analyst

Our weekly look at the key trends and market indicators using data and analytics provided by IBA Insight.

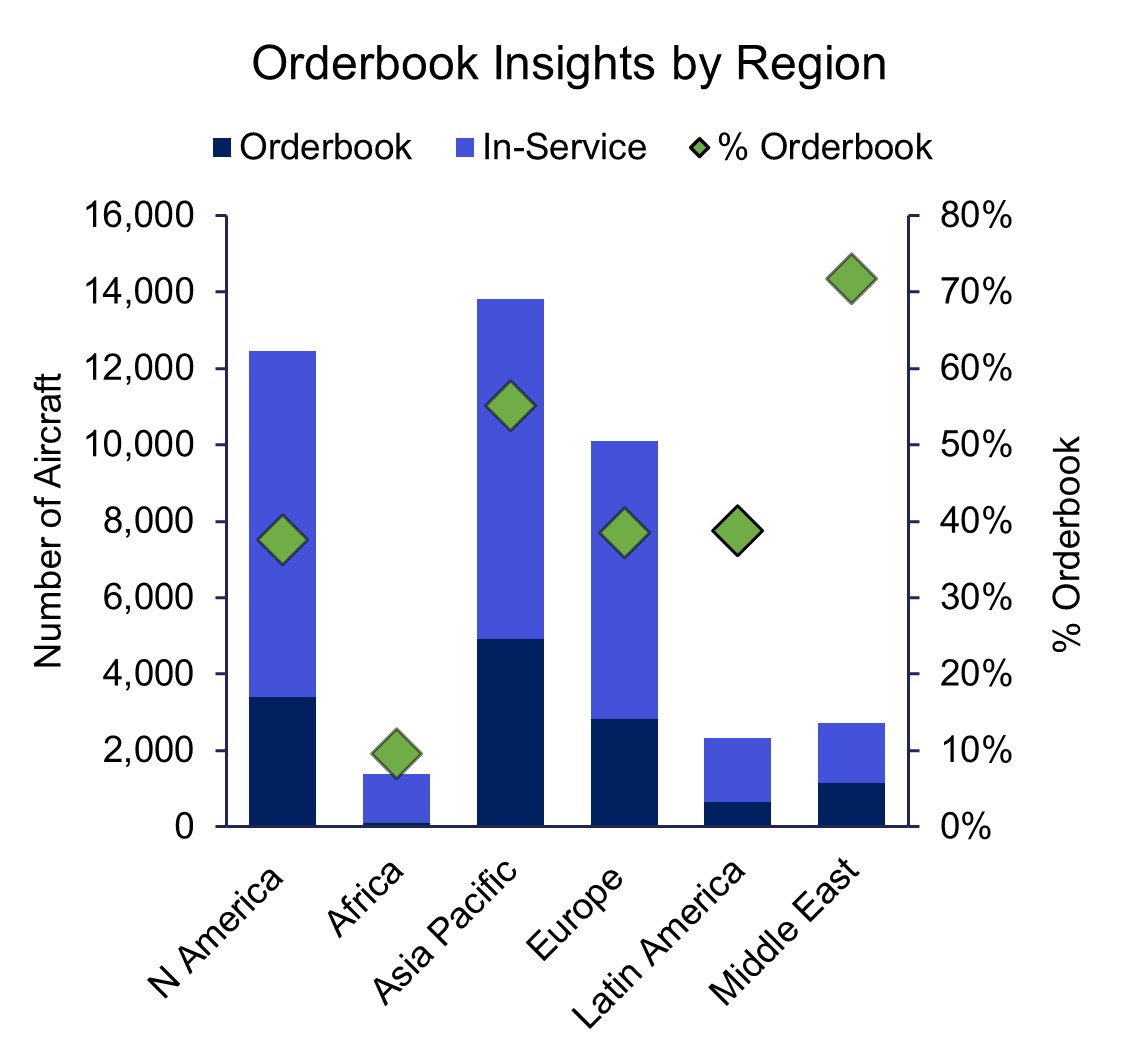

What types of operators and which global regions are most likely to see consolidation in 2023?