24/01/2023

What types of operators and which global regions are most likely to see consolidation in 2023?

IBA’s January Market Update webinar revealed key global airline trends that we expect to see in 2023.

“The aviation industry has seen a remarkably low number of failures, restructurings and consolidation in the past couple of years, despite the challenging market that the Covid 19 pandemic and the Russian invasion of Ukraine helped to create” ...Says Dr Stuart Hatcher, Chief Economist at IBA.

Our experts have noted that the tide of potential failures and consolidation was stemmed by strong governmental support during the pandemic. Support which is now coming to an end.

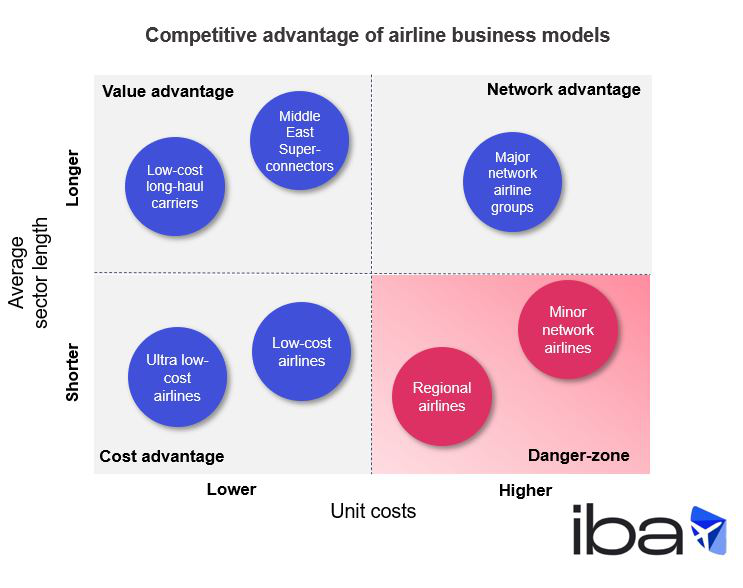

IBA’s experts forecast that small network airlines and regional operators are most at risk of failures, restructuring and consolidation in 2023. These operators do not benefit from the cost, value, or network advantages of others.

“To be sustainable, you either have to be a cost leader on short-haul or have an extensive long-haul network, and it is not clear that the smaller legacy airlines have either” – Geoff van Klaveren – Managing Director, Advisory.

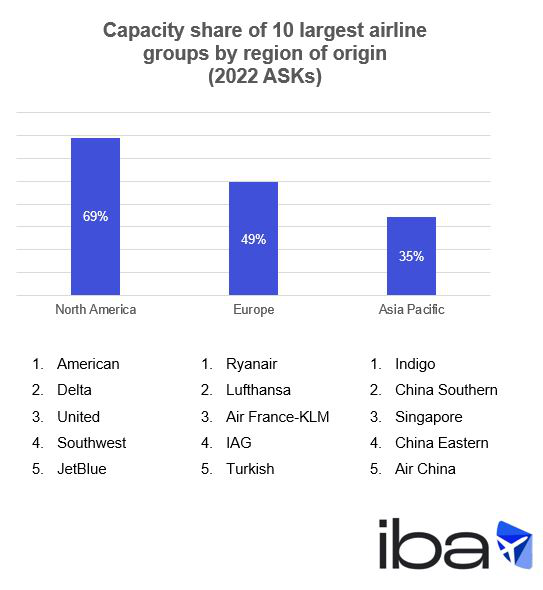

It is no coincidence that North America is both the most consolidated and most profitable region. The industry needs to consolidate to ensure it can generate a sufficient level of return to cover its cost of capital. This is good for investors and customers alike, who benefit from investment in new generation aircraft and improved connectivity.

In IBA’s view, consolidation in Europe is long overdue. The region will ultimately be left with five or six main airline groups, three network airline groups with a long-haul focus, and two or three low-cost airline groups with a short-haul focus. Airlines that were already in a weak strategic position before the pandemic are now even weaker and with distressed balance sheets, and many will have no choice but to merge with a stronger airline group.

Whilst consolidation in Asia will prove tougher due to ownership restrictions, we are seeing several pan-Asian brands emerge.

IBA provides aviation consultancy and advisory services for clients in all parts of the aviation value chain, including the manufacturers (OEMs), the operators (airlines, airports and MROs) and the finance community (lessors, banks, investors).