23/06/2023

Whilst Paris Air Show is known to be quiet on the last two weekdays, no one quite expected the absence of significant business that would continue until late on Monday. This quiet was broken by a blockbuster 500 aircraft order from IndiGo. Air India then followed up by firming their 470 aircraft order the next day.

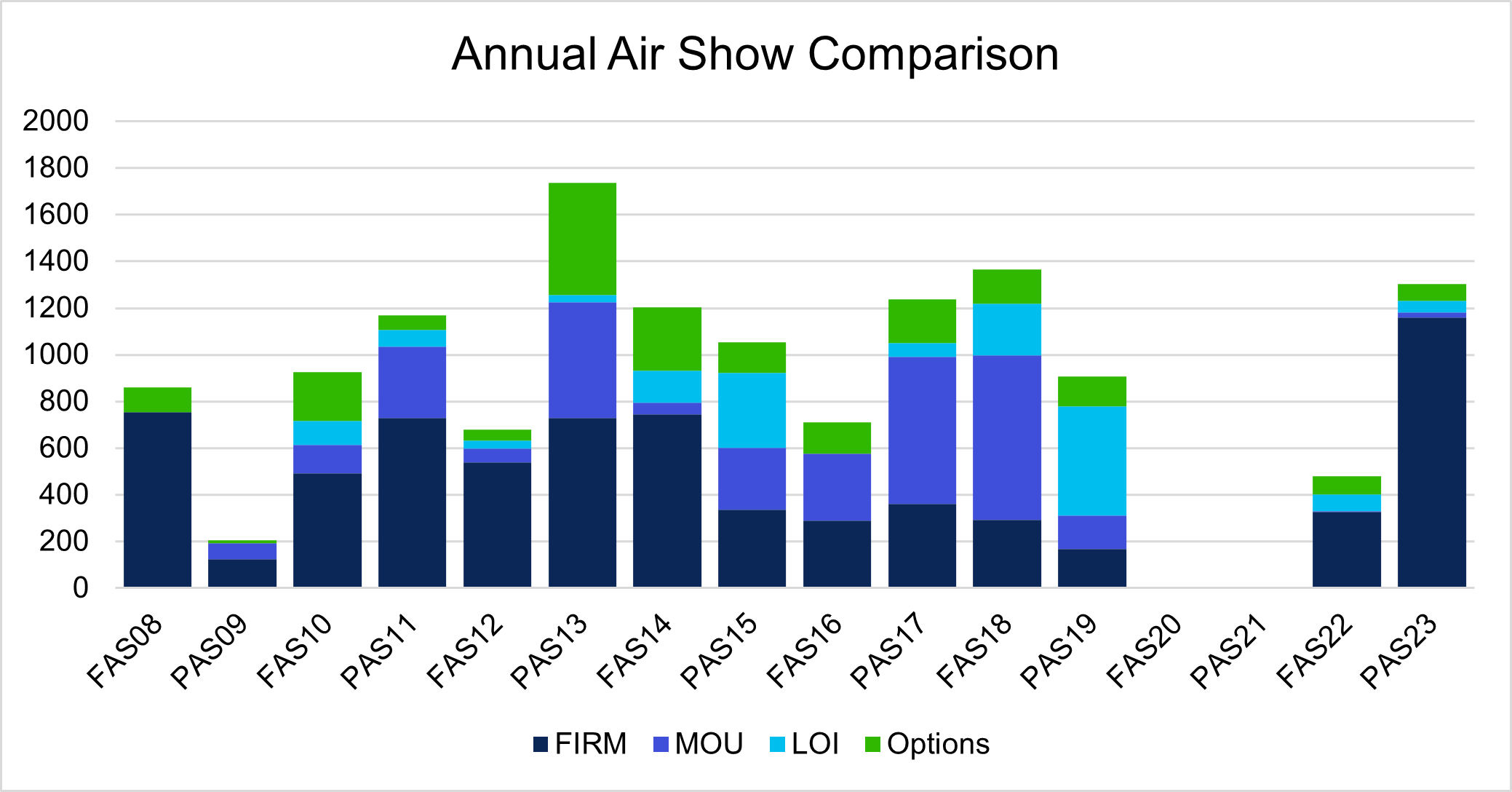

The week had been flush with rumours of large orders, leading IBA to forecast a total greater than 2,000 aircraft. We did not hit that estimate. However, if Turkish Airlines had committed to their rumoured 600 aircraft order, we would’ve been very close!

At the time of writing, on Friday lunchtime, the total orders including Firm, MOUs, LOIs and Options reached 1,303 aircraft, worth $72.4bn based on IBA’s 2023 Current Market Values. This is an impressive total, with only 2013 accruing a larger tally. A more interesting detail is that 1,160 (89%) were firm orders, the highest ever. Having firm orders is good news for the programmes in terms of long-term confidence in them as well as securing Pre-Delivery-Payments (PDP). Large orders will allow the operator to demand a superior price, however, the OEM may also be able to benefit from demanding higher PDP in the higher risk transactions.

Operators appear to be firming up orders to secure delivery slots in an environment of supply delays. However, with orders of such scale, questions arise as to whether the local markets can accommodate the growth. This is especially the case when the two airlines making the largest orders are in the same country.

Source: IBA Insight & Intelligence

The Airbus press conference on Monday got the tally off the ground, announcing 500 new A320 family aircraft for IndiGo. In numerical terms, this eclipsed the 470 Air India order that was firmed on Tuesday, with the Boeing and Airbus announcements happening almost simultaneously, as to avoid one getting more headlines.

It is also worth noting that IndiGo already had a backlog of 485 aircraft, putting their new total just shy of the 1,000 mark. IBA values this new order at $28.0bn. Despite the numerical inferiority, IBA value Air India’s order at $33.1bn. This difference can be attributed to Air India also ordering widebodies. Their order in full was 220 aircraft, with Boeing (190x 737 MAXs, 20x 787s and 10x 777Xs) plus 250 aircraft with Airbus (140x A320neos, 70x A321neos and 40x A350s). There is also an option with Boeing for a further 50x 737 MAXs and 20x 787s), which would take their order total to 540.

Unlike IndiGo’s Airbus loyalty, the order is split between the two large OEMs, reflecting the very mixed fleet of the Indian flag carrier and its present and future subsidiaries. Including widebodies in the order will likely solidify the airline’s dominant international market share (27.8% share compared to IndiGo’s 10.7% in 2023). The airline severely lags IndiGo in the domestic market share however (26.6% compared with 57.5% of IndiGo).

Both are expecting to gain share from each other but will also be reliant on the market’s growth. Recent estimates have the Indian aviation market growing at 9% annually and the country has pledged $12bn to Indian infrastructure. Whether that can accommodate these 970 aircraft before their first flights, is another thing.

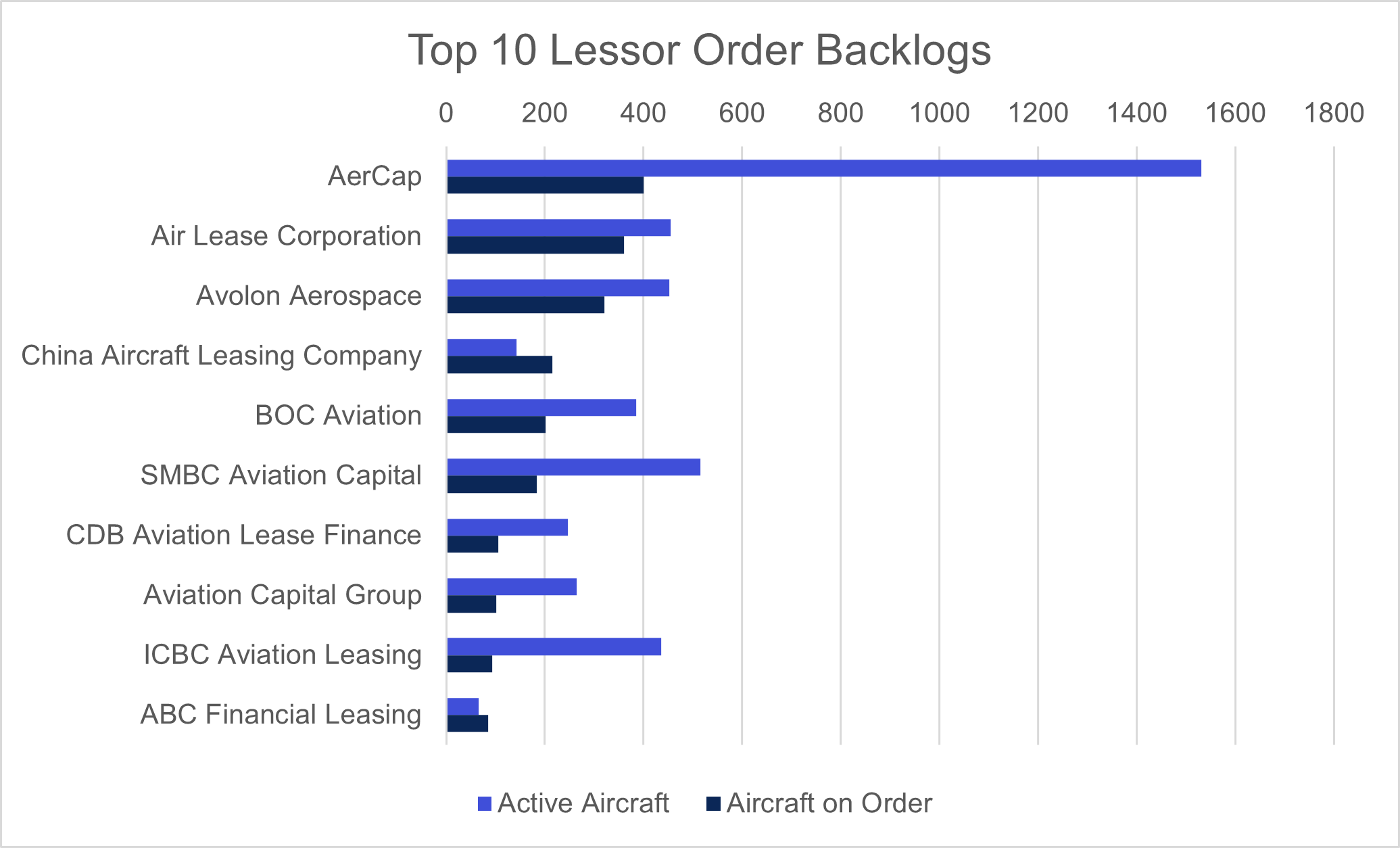

With the scale of the orders, one could be forgiven for thinking there were lots of participants. Among operators, Western Europeans were conspicuously absent, albeit Ryanair had placed a large 150 aircraft order (plus 150 option) pre-show. It was also the case with lessors. Avolon’s 40x 737s and 20x A330 order, as well as an 80 LEAP engine deal the only large business among them.

Interestingly, Avolon’s ratio of orders to current fleet is getting closer to parity, similar to the likes of well-known speculative lessors like Air Lease Corporation (ALC). In an aircraft supply bottleneck, the lessor has more control over lease rental pricing. This is compared to an operator receiving multiple lessor offers for Sale and Leaseback. This relationship of course reverses in oversupply. Their A330s are expected to be delivered through 2026-2029, with the narrowbodies likely in the 2030s. We don’t know what the market will look like then, so these orders are therefore purely speculative.

Source: IBA Insight & Intelligence

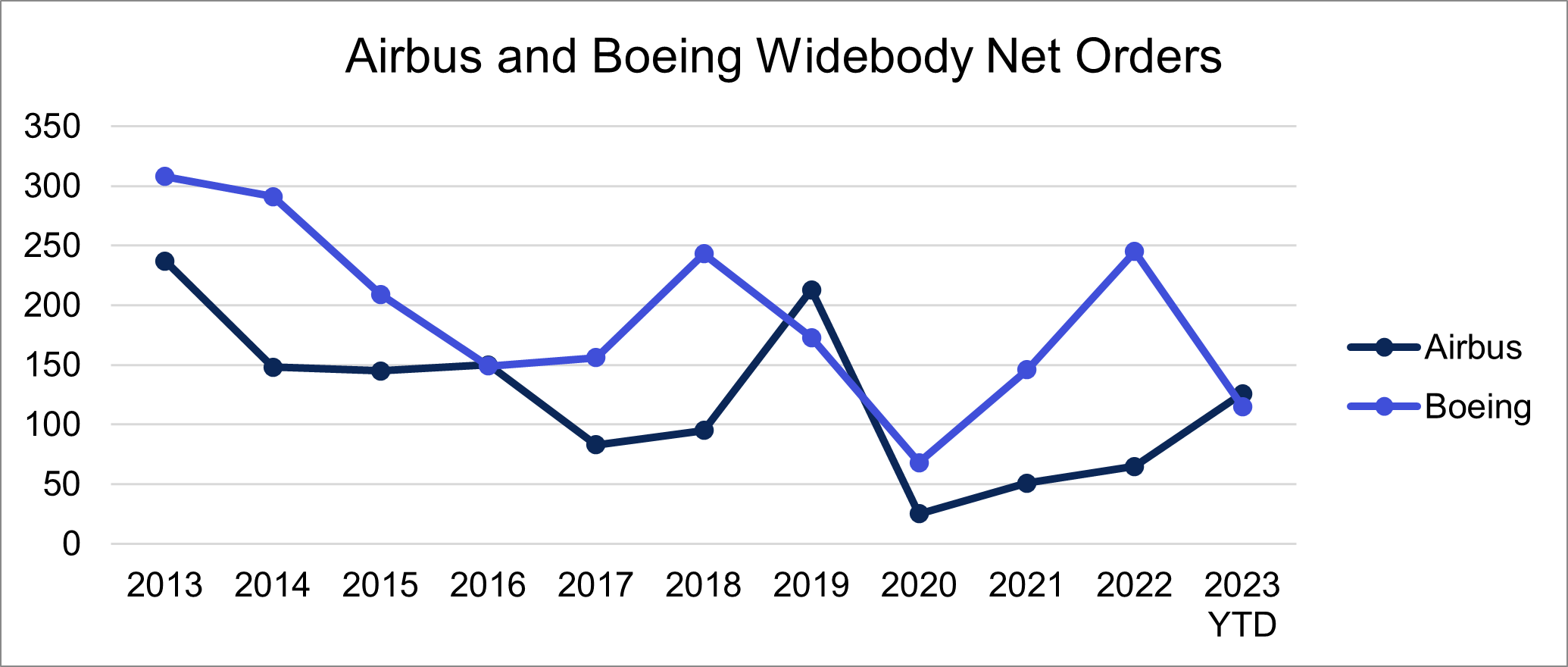

The week had success for many OEMs with De-Havilland’s 49 aircraft orders and Embraer’s 28 up among pre-Covid levels. However, the gulf between Airbus and Boeing was quite sizeable. As discussed earlier, IndiGo operate solely A320 family aircraft which pulled the OEM far ahead in the narrowbody stakes. Airbus already led pre-show in total backlog with 8,546 aircraft to Boeing’s 7,069. When looking at the A320neo and 737 MAX alone, the Airbus advantage was 1,300. This is now wider.

In the show, Airbus totalled 846 orders. This is over double Boeing’s 356 orders. What is particularly interesting is that Airbus also won on the widebody stakes this year, with 72 firm orders to Boeing’s 40 (excluding 20 on option). Boeing had exceeded Airbus in widebody orders in eight of the last ten years. Boeing will be hoping that production delays to the 777X don’t cause a turning point.

Source: IBA Insight & Intelligence

This IBA Weekly was written by:

Neil Fraser

Head of Consulting

Neil Fraser

Manager - Airline Analysis