29/06/2021

Aircraft lease rates for new delivery narrowbody models have continued to slip, but some causes for optimism exist. We used IBA's InsightIQ trends data to highlight some positives.

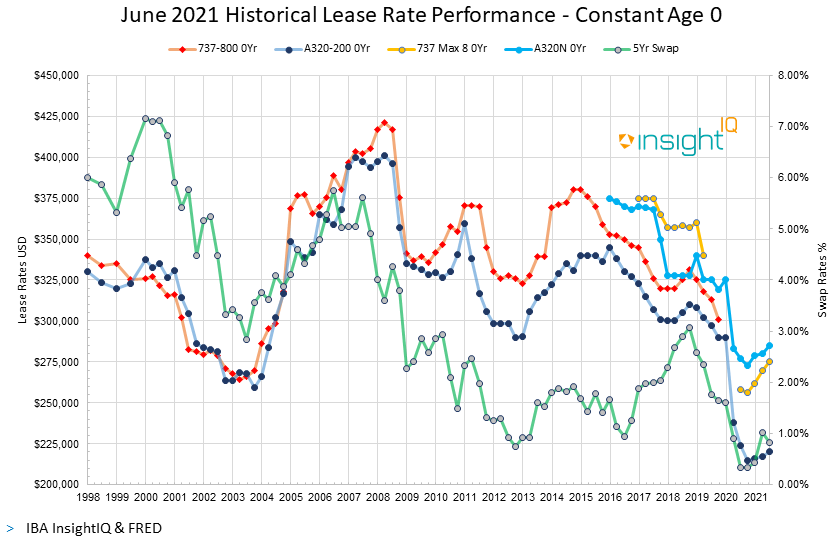

With the exception of some upward movement just prior to the Coronavirus pandemic, rates have been experiencing a persistent downward trend since 2015. The slight uplift in rates that occurred in 2018 coincided with interest rate increases before slipping further in 2019.

Once utilisation tumbled and transaction volumes eased in 2020, lease rates for the A320 NEO dropped by another 10-15%. The A320 CEO family was hit by an initial 20% drop, and then fell by another 10% towards the bottom of the cycle.

Aircraft lease rates for the Boeing 737 MAX 8 were truncated by the well documented grounding of the fleet. By the time delivery recommenced between early 2019 and late 2020, lease rates had fallen by 25% on average with heavy competition on many transactions.

On the upside, IBA have observed some positive movements for both the MAX 8 and A320 NEO towards the end of 2020, such that rates have increased by 8% and 5% respectively with a gap of around 10k in the favour of the A320neo. Recent indications suggest that rates are returning even further, with the A320 NEO approaching 300k and the 737 MAX 8 trailing by 10k at 290k (indicating a further 5% increase).

It is important to note that there is a wide variance in observed rates, with some lessors being able to place at rates above this level.

With the combined factors of market recovery, environmental pressure and low interest rates, the re-fleeting process will continue and demand and both the MAX and NEO families will grow. There are still some hurdles for the MAX 8 to overcome in receiving global acceptance, but we remain confident that these barriers will be negated.

If you have any further questions please contact Stuart Hatcher.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.