06/09/2021

Using aviation intelligence fleet and values data from our InsightIQ platform, IBA has published adjustments to aircraft values across the global Turboprop fleet.

Following our recent webinar, we have updated value expectations across Regional Jet and Turboprop types. View our summary of changes to Regional Jet aircraft values here.

Turboprop values and utilisation are trailing those of regional jets. Orders for Turboprop aircraft have remained below 100 aircraft since 2018, and less than 20 aircraft have been delivered in 2020 and 2021 so far. IBA anticipates healthier Turboprop aircraft values and lease rates as the impact of European and Asian aviation recovery starts to filter through.

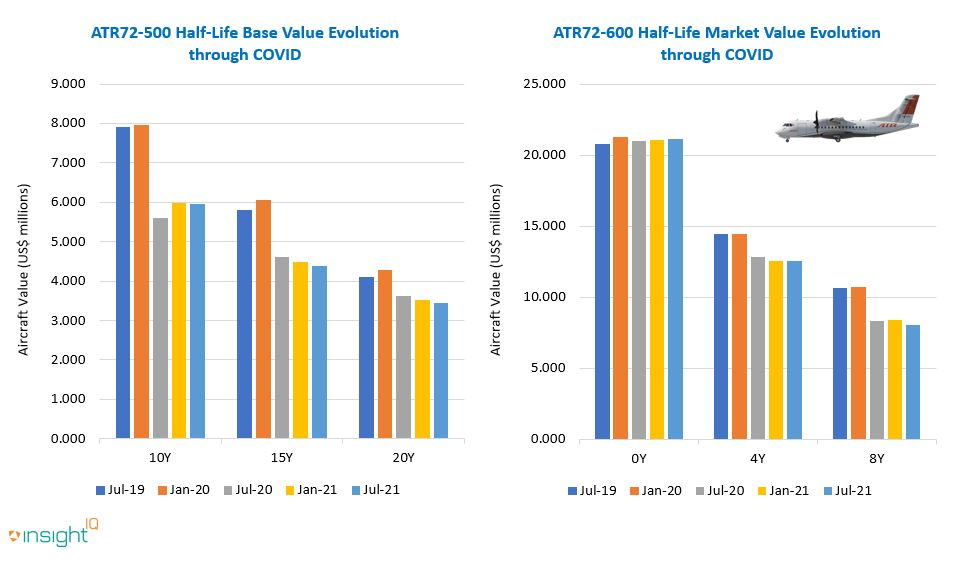

The ATR72-600 is a prime example of values and lease rates awaiting recovery. High storage levels of the ATR72-600 and -500 series have continued, with ATR72-500 storage reaching 50% during the peak of the Coronavirus pandemic.

Despite sustained narrowing of passenger market opportunities and consequent value softening, the ATR72-500 is enjoying increased freighter conversion 'P2F' demand, and the ATR72-600 series aircraft's premium over equivalent DCH8 Dash 8 Q400 still applies. IBA has witnessed significant discounts on ATR72-500 airframes which are in a weaker maintenance condition, or with less attractive provenance.

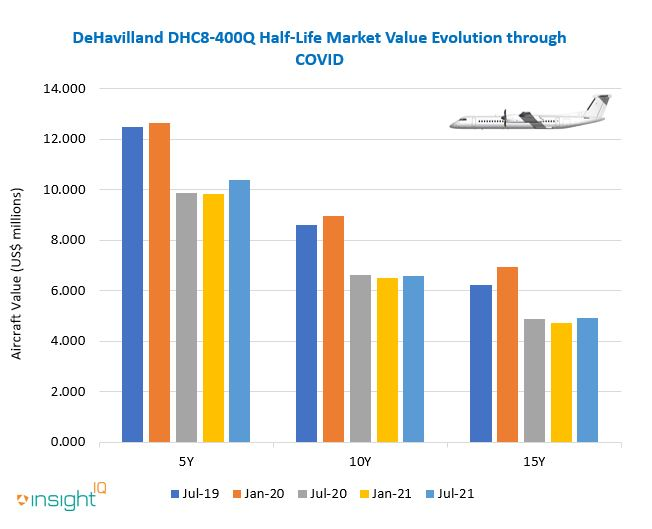

The outlook for the DCH8 Dash 8 Q400 is improving, after market values suffered considerably during Covid.

The DCH8's future looks brighter of late. We have witnessed movement of some former Flybe aircraft to the airline's new incarnation, as well as to Connect Airways. Values and lease rates are starting to stabilise; we're seeing leases in the range of $50 - $75K and while bulk deals have been struck around $3 - $4M, single transactions are starting to firm.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.