准确、公正地对各种航空资产进行估值

专业估值能力与商业和行业知识的强劲组合,使我们的员工脱颖而出。通过访问IBA Insight独特的历史记录和最新的航空信息,可确保资产基本价值的透明度。只需轻触按键,您就可以对单个资产和汇总资产进行公正、灵活的估值。航空资产评估是一项专业度极高的工作,需要深入了解全球市场。即使遭受当地或国际政治、经济、公共卫生或环境动荡的影响,我们的判断也不会偏离正轨。我们的合作将以独立的数据和丰富、全面的经验为基础,以确保您高枕无忧。

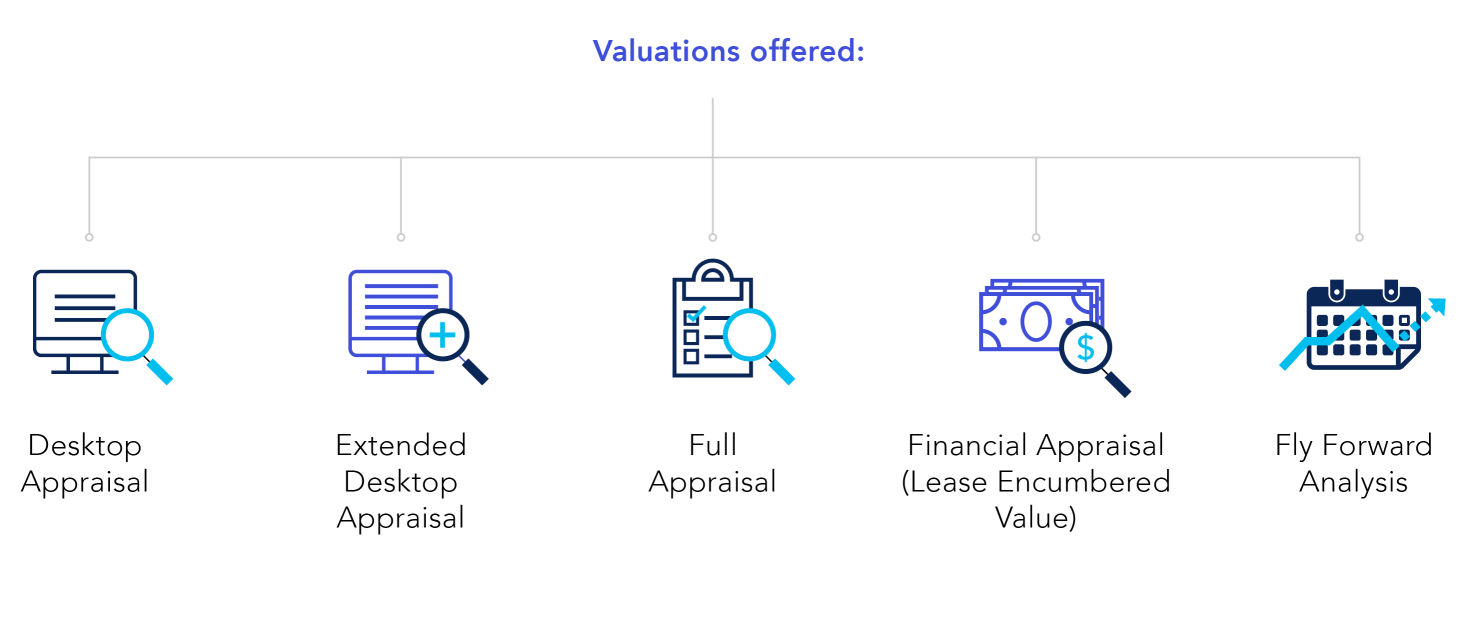

估值定义随外部环境而有所不同。在蓬勃、稳定的市场中,资产价值将不同于在低迷市场中或减价出售情形下的资产价值。我们的专家针对不同情况确定估值定义,并与客户合作,在以下专业领域提供可靠的评估和建议:

Asset Expertise includes:

我们的信息平台IBA Insight可提供广泛的最新数据和历史估值数据。您将了解实时的全球市场机遇、飞机流动性(按类别、型号和地区划分)、航班和利用率以及风险状况。

.png)