06/09/2021

Using aircraft values data from our InsightIQ aviation intelligence platform, IBA has published adjustments to regional jet aircraft values in August/September 2021.

Historically, regional jet market values have proven resilient in spite of market cycles, always recovering towards base. Over the last year however, significant downward pressure on demand for some assets, (especially larger jets such as the Embraer E190LR and ATR72-500) has disconnected market values from base values, so we are monitoring them closely. Additionally, further depression towards soft values could force base value adjustments. Whilst freight conversion demand is apparent, this comes with lower price expectations.

A full review of Regional Jet and Turboprop market values can be found in our recent on demand webinar. A summary of Turboprop values can be found here.

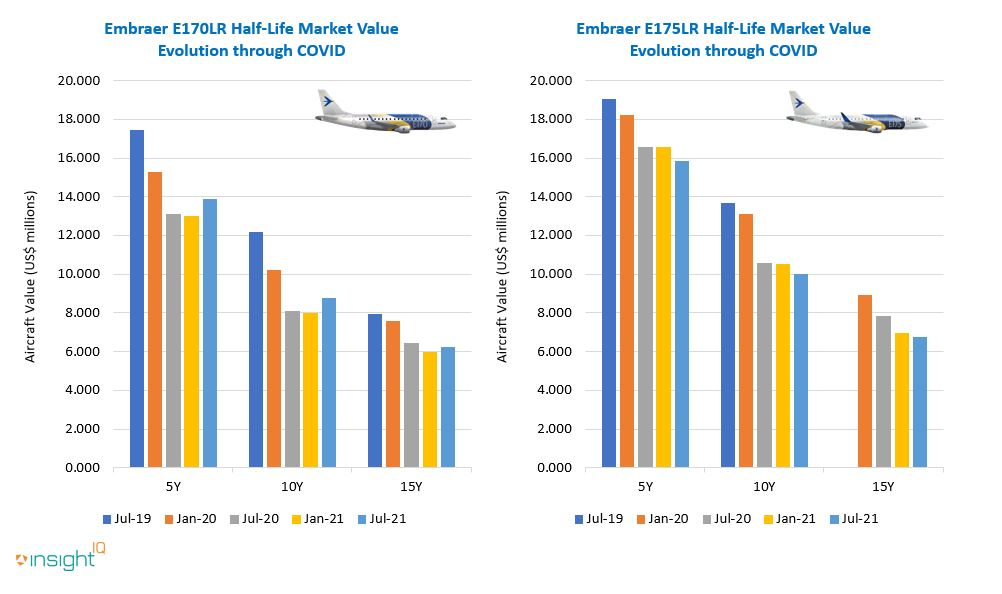

IBA is optimistic about trends in this area, which largely reflect US market recovery. The Embraer E170 shows the greatest uplift with strong demand from American Airlines, Envoy and Azorra. E175 values have seen slight softening and transactions have been fewer though we have witnessed new deliveries. Our recent analysis on Embraer's new Turboprop concept examined whether the right Turboprop design could break North America's love affair with the regional jet.

Larger Embraer E-Jet values inspire less confidence, but outperform the CRJ

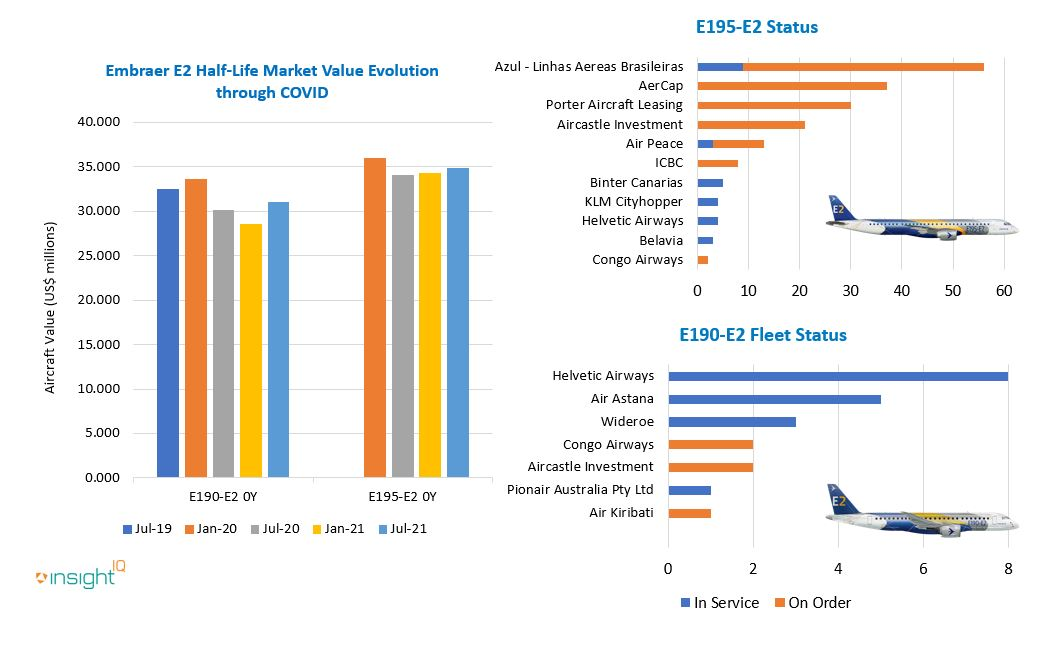

Larger Embraer E-Jet values inspire less confidence, but outperform the CRJLarger E-Jet family members like the E190 and E195 inspire less confidence in the valuation sphere. Oversupply in the market means storage levels are generally higher, and therefore values are considered stable rather than recovering. Pressure on Embraer E190 lease rates has forced pre-Covid levels around $110K - $130K below the $100K mark, and the E195's former premium over the E190 has diminished.

Whilst the younger E190-E2 has a smaller global footprint in terms of fleet size (and only a few transactions have occurred) we have actually improved our value expectations. The model has recently been certified to fly from London City Airport (LCY/EGLC) and re-fleeting requirements from operators such as BA CityFlyer and KLM Cityhopper may result in an uptick in orders for the type. Most E190-E2s deliveries have occurred but E195 orders are significantly backed up.

It should be noted that E-Jet performance clouds the CRJ's outlook. With market perception of Bombardier's CRJ being of an older aircraft with less passenger and baggage space (and thus a declining value)

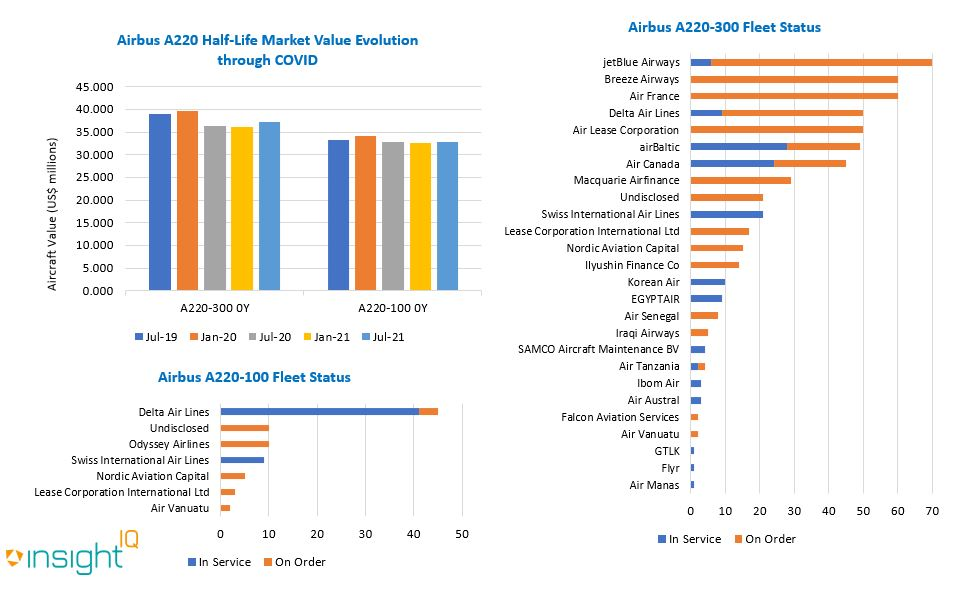

Though a narrowbody rather than a regional jet, the Airbus A220, as a competitor, is performing strongly. Jet Blue, Delta, Breeze and Air France have significant fleets within both the 120 aircraft in operation and the 430 aircraft approximately on backlog. The popular, fuel-efficient A220-300's value continued to stack up during the pandemic and we have improved our value expectations accordingly.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.