06/10/2023

Aircraft redeliveries are complex contractual transactions involving multiple stakeholders. Delays have significant financial ramifications; IBA has previously estimated a typical narrowbody overspend can be around $2M with widebodies even more costly at $4.5M. The parties concerned face numerous, often interdependent, challenges each with different consequences for timescales and having varying financial impacts.

This 2023 Redelivery Survey, IBA’s first full review since 2019, investigates the key issues influencing schedules and considers whether the major causes of delay have altered over time. We also explain the outcomes different parties experience and provide contextual reference points for the survey including market supply and demand, supply-chain disruption post-Covid, economic considerations, social unrest, and armed conflicts.

During the Covid pandemic, airline resources dropped off as demand plummeted, and many experienced personnel were forced to leave the industry. At the same time, airlines and lessors delayed returns because of lockdown restrictions. They used short-term lease extensions in exchange for deferred lease payments while aircraft couldn’t be operated. Disruption and worldwide travel restrictions were eased as we emerged from the pandemic. However, economic uncertainty hit many areas of the world, with high inflation, armed conflicts and unrest in Europe and Africa being major causes. Despite this, air travel has remained resilient in response to pent-up demand for both leisure and business flights. Monthly global passenger capacity continues to edge closer to a full recovery, reaching 98% of pre-pandemic ASKs in August 2023, a gain of +1% compared to July 2023.

This optimism is, however, tempered by several well-published delays in new aircraft development, including 777X setbacks. Combined with quality issues affecting aircraft engines and airframe manufacturing, aircraft deliveries have not fulfilled demand. A robust market for lease extensions and new lease agreements on older aircraft has resulted in increased pressure being felt to redeliver aircraft on time and to a high standard.

The scope of IBA’s 2023 Redelivery Survey gives us a deeper insight into the diverse components of aircraft management and their common pitfalls. As in previous years, most respondents were attached to airlines or lessors. The second biggest section came from a consultancy background, those who are regularly engaged in supporting redeliveries.

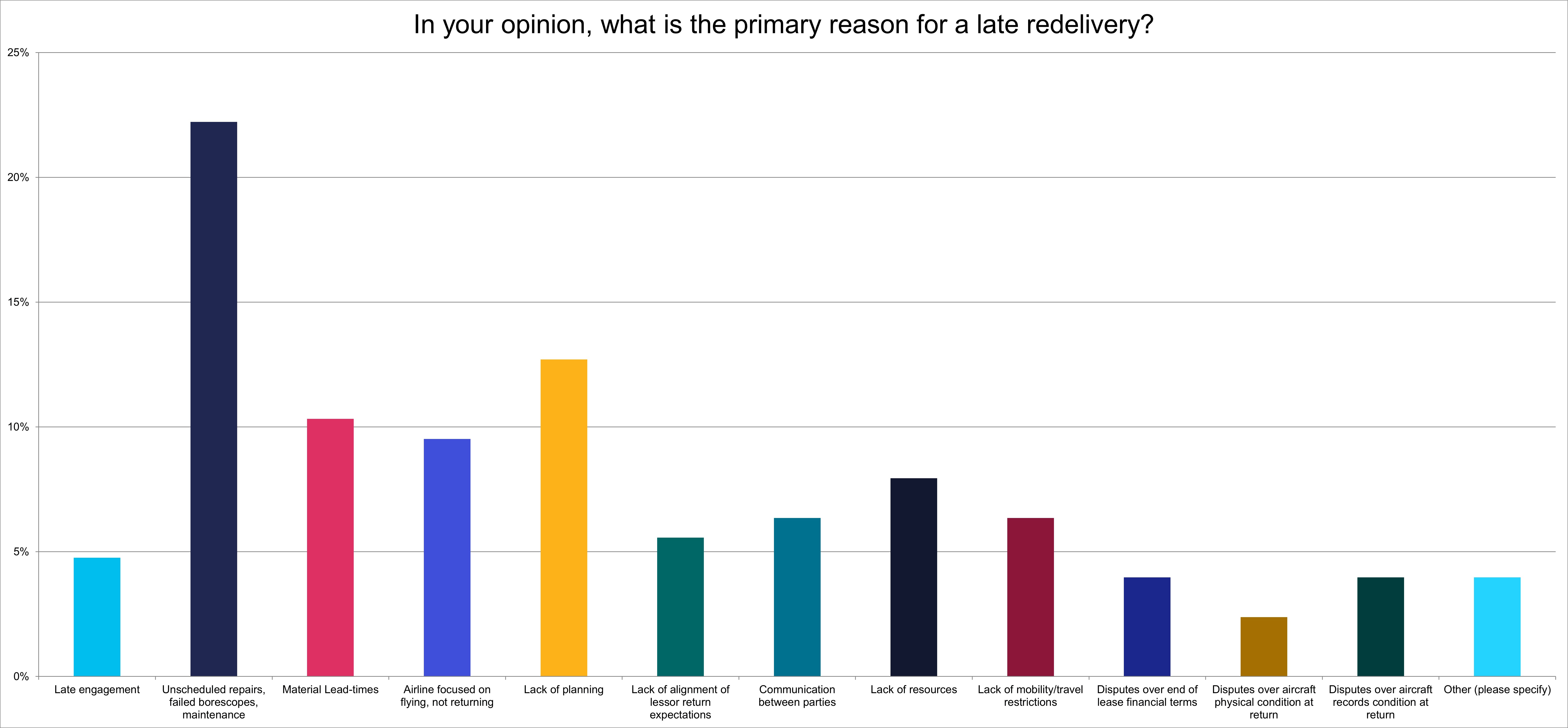

The data clearly shows the main challenges at lease end are unscheduled repairs and maintenance obligations. For their part, lessors view these matters as a result of lessees’ lack of planning, citing such unpreparedness are the primary reason for late returns. This failure to allow ample time and resource to handle lease-end activity is unsurprising. Given that airlines’ primary focus is on flying passengers and cargo; most organisations don’t have the support of dedicated engineering, technical and records personnel to manage redeliveries. Typically, airlines don’t place the same emphasis on protecting the aircraft’s value as an asset as lessors do.

IBA also considers the data could indicate that airlines are withdrawing aircraft from service later to perform end-of-lease activities. Engine issues on the A320N and 737 MAX programmes and the lack of supply from manufacturers in the widebody market, such as with the 777X and 787, are likely contributing factors.

Supply chains faced intense pressure post-pandemic. As aircraft returned to service, demand for spare parts escalated sharply which created both market strain and increased prices. The survey results reflect these stresses.

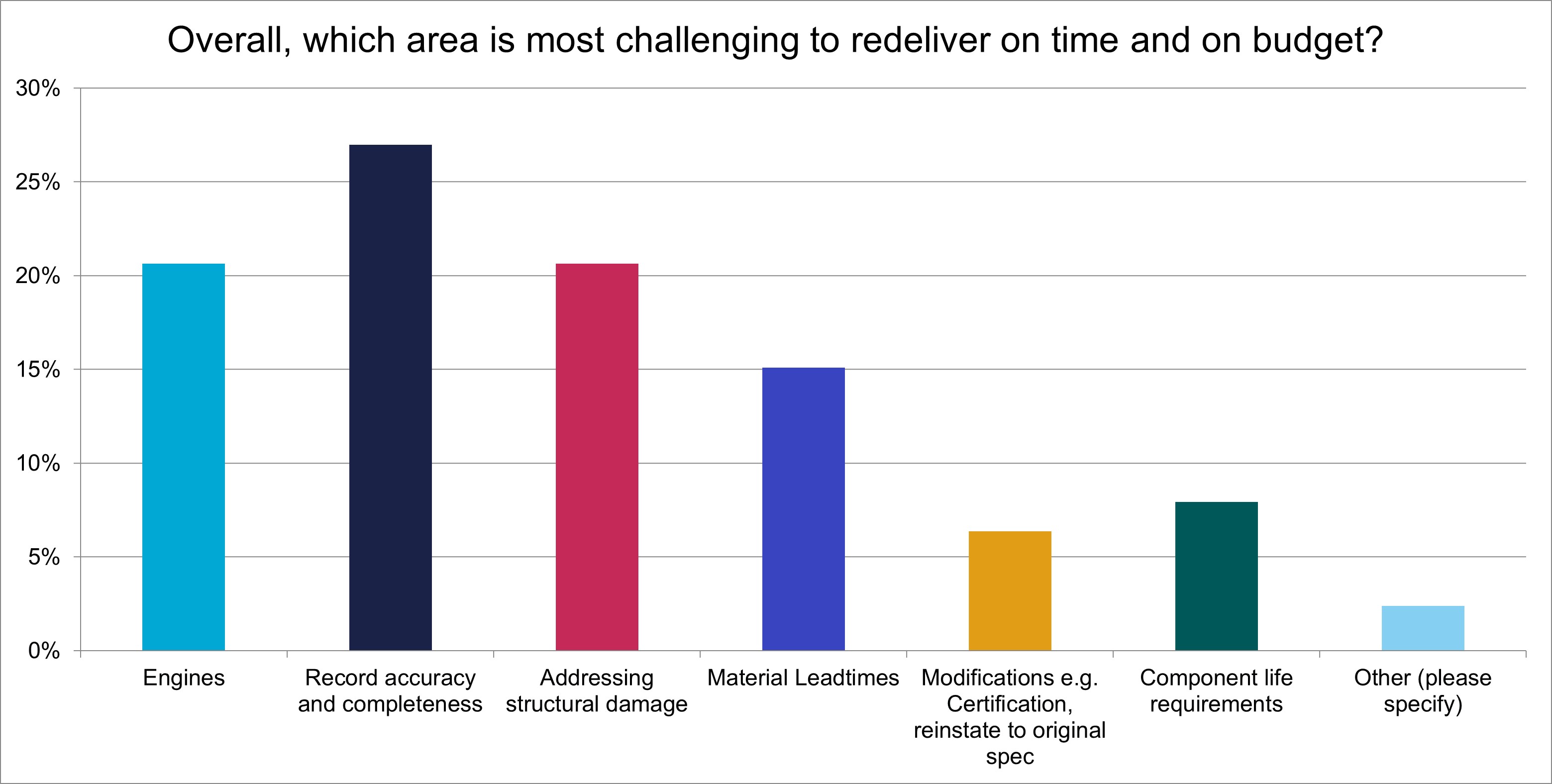

IBA’s intelligence notes material lead times carrying greater significance in 2023’s survey compared with previous years. The results show a clear divide between lessee and lessor responses regarding budgetary items. Where airlines and their representatives consider structural damage and material lead times as major drivers in redelivery costs, records accuracy is again quoted as a lessor concern. It is probable lessees fail to appreciate the level of detail lessors demand when assessing structural repairs and the future impact these may have on the aircraft.

Lessors meanwhile are forced to employ inspectors to carefully review records so they can be assured of their precision and guarantee a smooth transition. As ever, engines have a substantial bearing on financial challenges. Borescopes, which are one of the last stages of the redelivery process following a demo flight, can reveal circumstances that need expensive and time consuming remedial action.

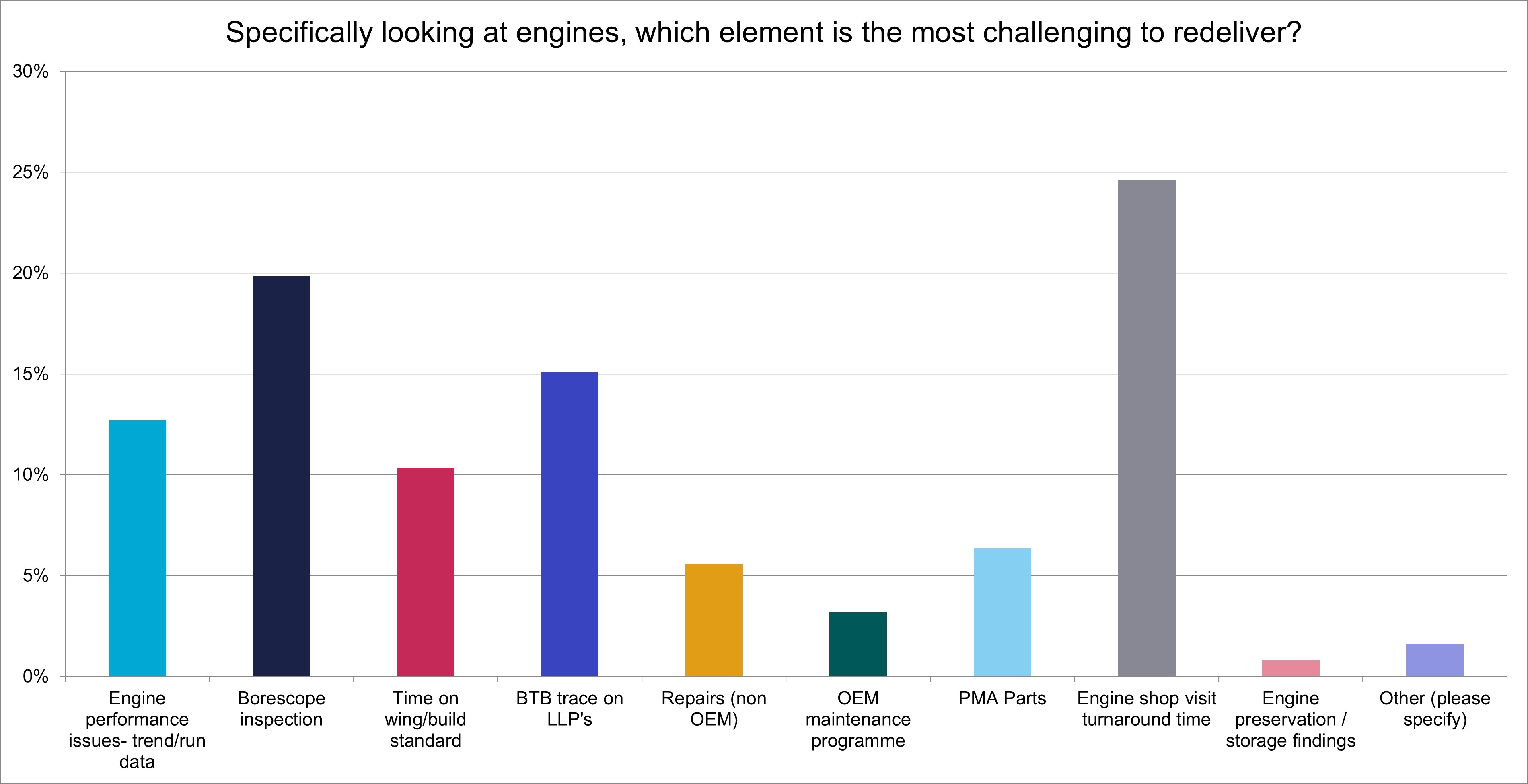

Here we see an obvious trend with engine shop visits referred to by almost 25% of respondents. IBA believes supply chain failures and the absence of engine shop visit spaces again play a part. It’s likely the situation will become more tense as shops try to manage engine repairs on newer type engines such as the PW GTF and CFM LEAP.

Comparing lessees’ and lessors’ responses, Borescopes have a greater impact on lessees. A reasonable conclusion is that lessees are assessing engines before lessors so they can avoid last-minute delays because of Borescope failures.

We still gauge Back to Birth (BTB) traceability of Life Limited Parts (LLP) as an issue. While the industry is driving attempts to enhance understanding of BTB traceability and its implications, lessors continue to discover gaps when performing assessments. Lessees are being forced to reject parts offered by OEMs because they fall short of lease BTB requirements. Shop visit delays ensue.

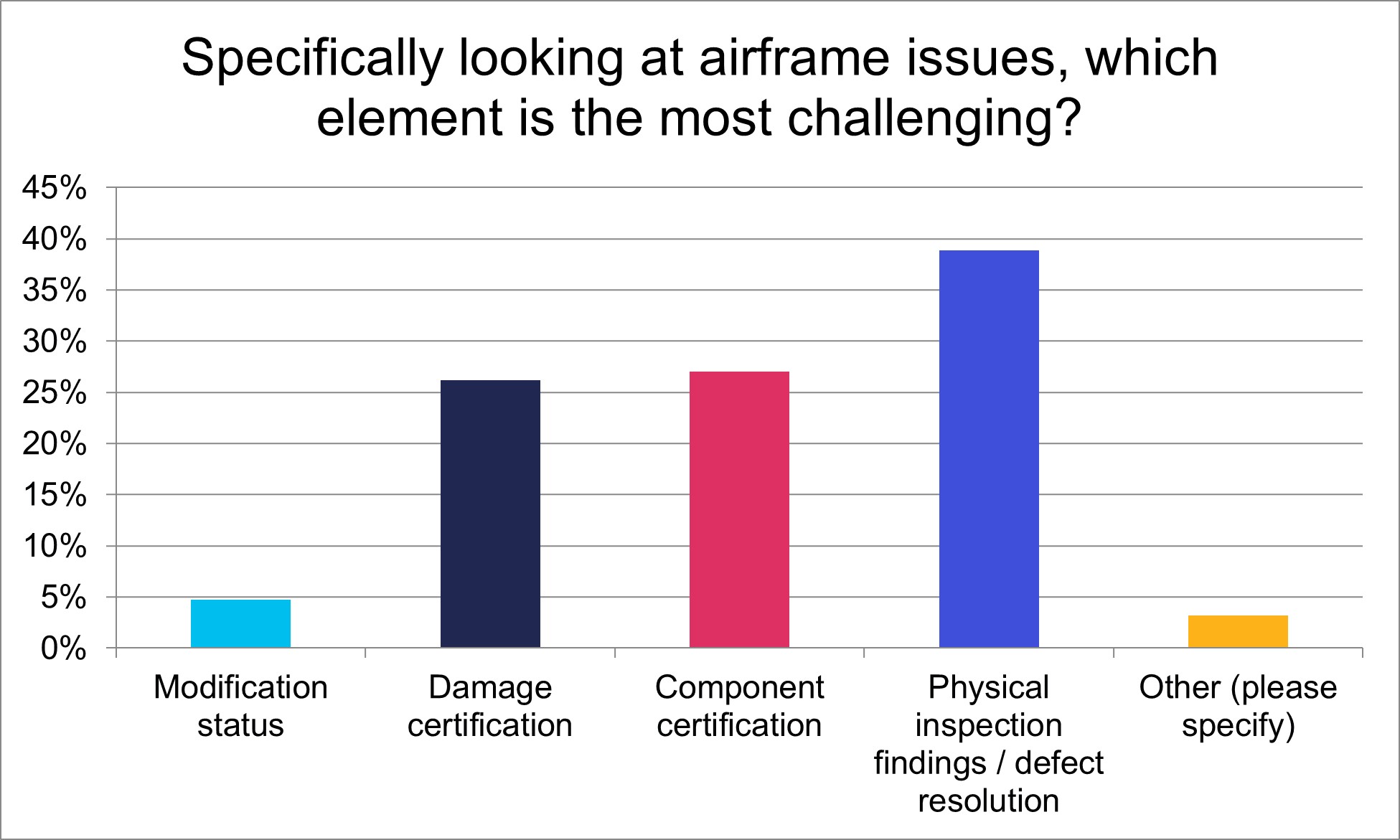

Over 39% of respondents advised that they struggle most with physical inspections. IBA believes this reflects lessees’ misunderstanding about the rigorous, exhaustive nature of the airframe examinations lessors conduct. This is definitely the case with damage certification, where lessors scrutinise aircraft repairs in detail to confirm they’re acceptable rather than trusting the certified records. Maintenance documentation must include details of the condition before and after repair, so lessors have clear evidence of the work performed.

Other survey participants such as MROs highlighted component certification as the biggest challenge. This is interesting, indicating the difficulty of tracing components which come from aircraft teardowns. Neither lessees nor lessors consider these scenarios and tracing, and recertification of parts can be a significant problem that results in expensive demands for OEM recertification.

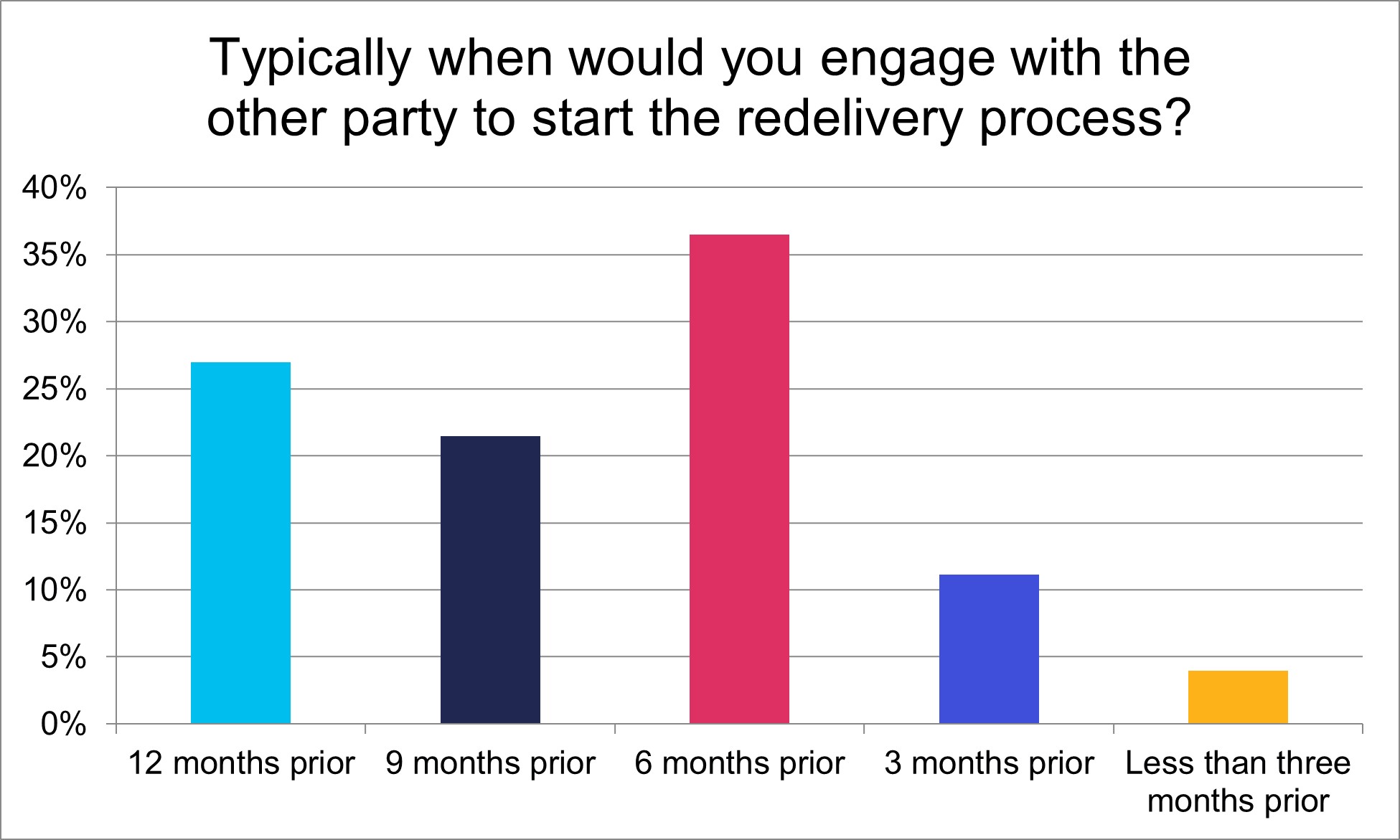

IBA’s 2023 survey shows that airlines and lessors engage between 6 and 12 months before redelivery, with other parties such as financiers becoming involved later. Our data indicates airlines commonly start the operation around 12 months before handover, with lessors engaging afterwards.

However, the data shows most parties believe engagements happen too late. With airlines having to make key decisions at least 2 years before a return and needing to manage scarce maintenance slots and workscopes, early engagement is crucial to create a successful transition which doesn’t cost more than it should.

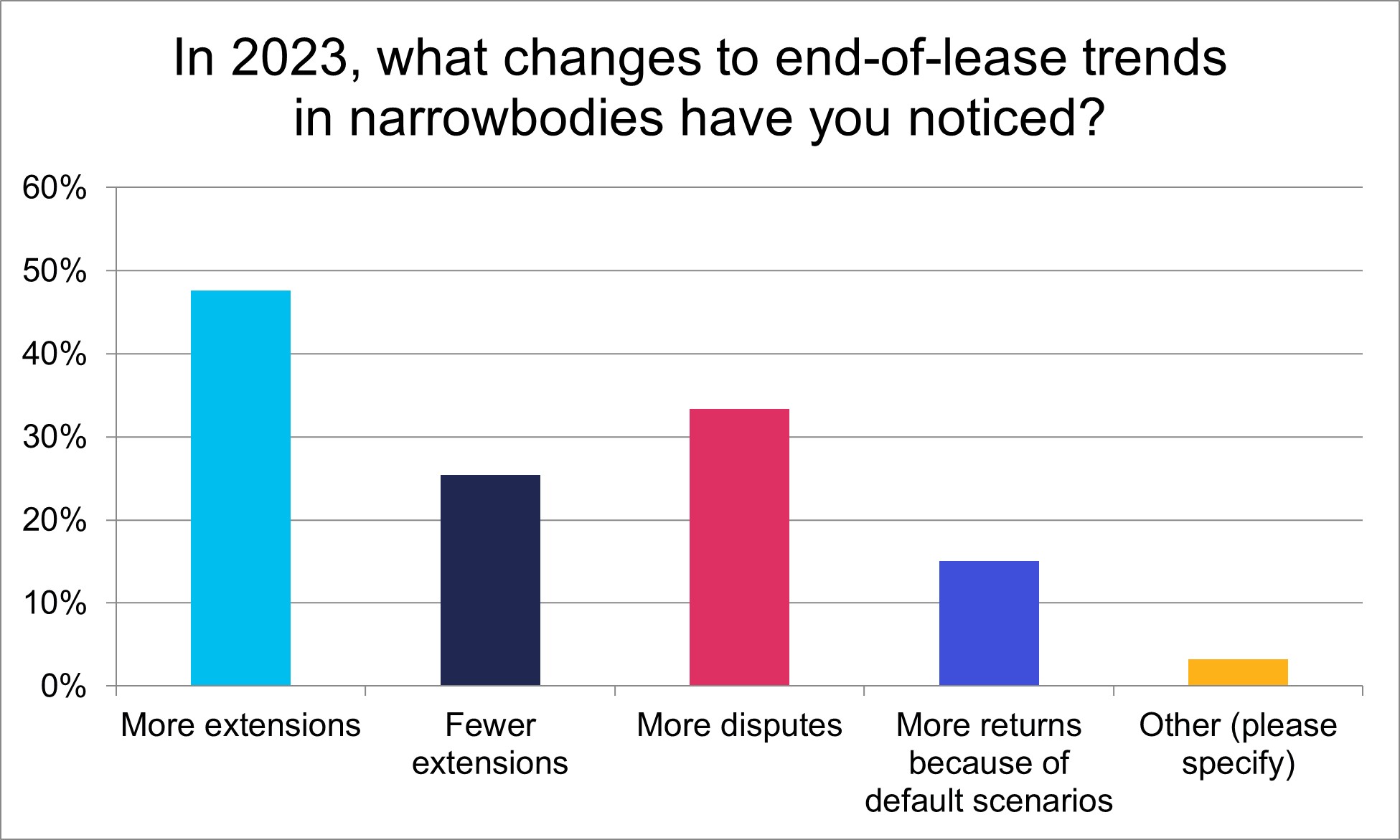

IBA’s data confirms that airlines are commonly extending leases. Late delivery of new-gen aircraft engines, particularly the 737 MAX, and/or lower engine production volumes leading to supply shortages are factors. It’s also possible that the lack of MRO availability is driving extensions.

During the Covid pandemic, market turbulence and uncertainty resulted in numerous bespoke and Power by the Hour (PBH)-style lease contracts that fulfilled the need for innovation and flexibility. As these opportune agreements end, we believe airlines are choosing to extend leases.

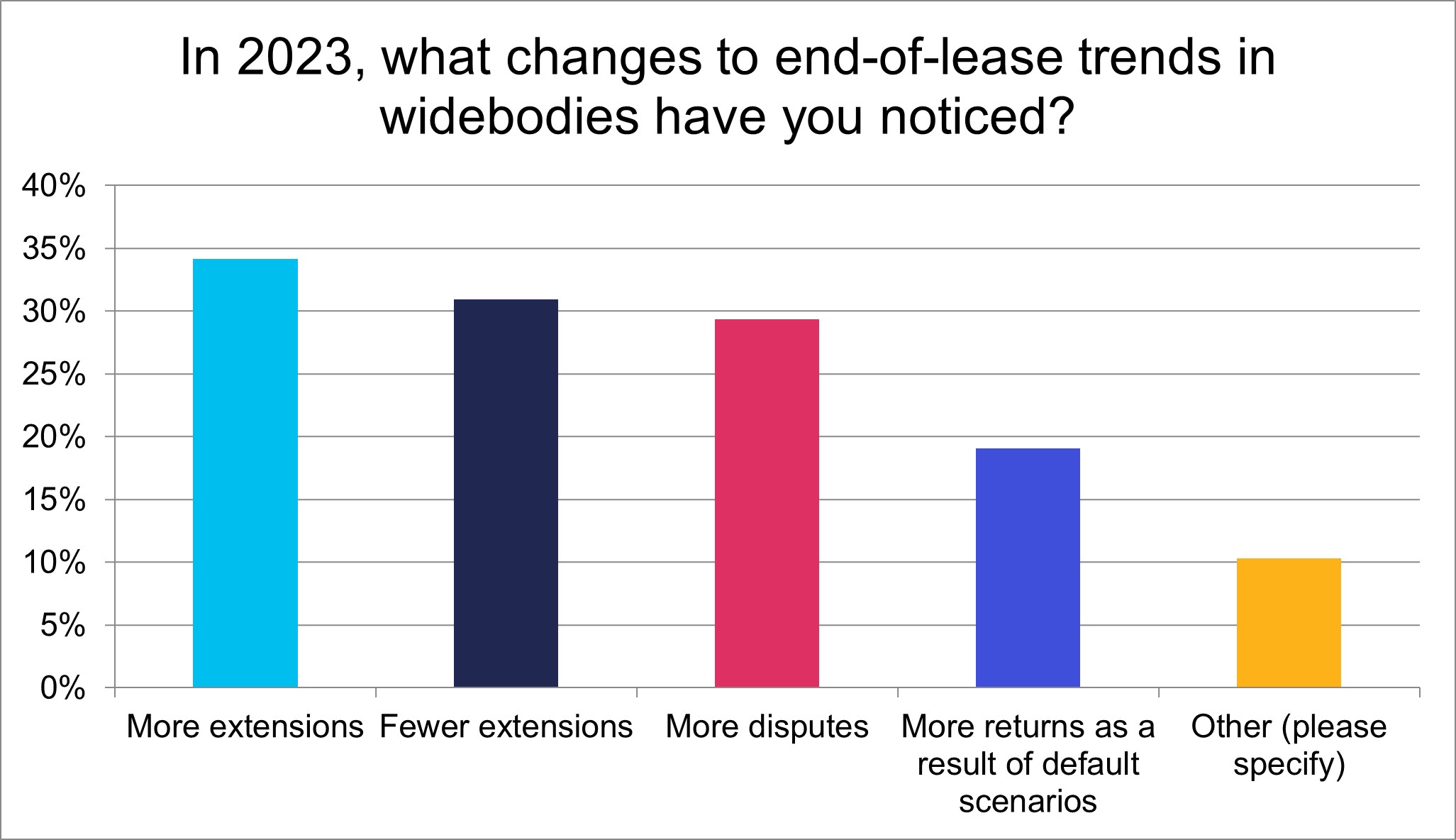

Although respondents who’ve witnessed more extensions evenly balance those who say there have been fewer, answers from airlines overwhelmingly confirm extensions have increased. IBA believes a link is likely with delays in B777X and 787 programmes which have resulted in leases on older aircraft being extended. As with narrowbodies, it’s reasonable to surmise the scarcity of MRO availability is ramping up extensions.

Over 29% of participants agree disputes have increased, a trend IBA has identified over the last seven years. Lease-end disagreements are now double 2019’s number; the greater complexity and much higher costs associated with widebody aircraft make friction more probable.

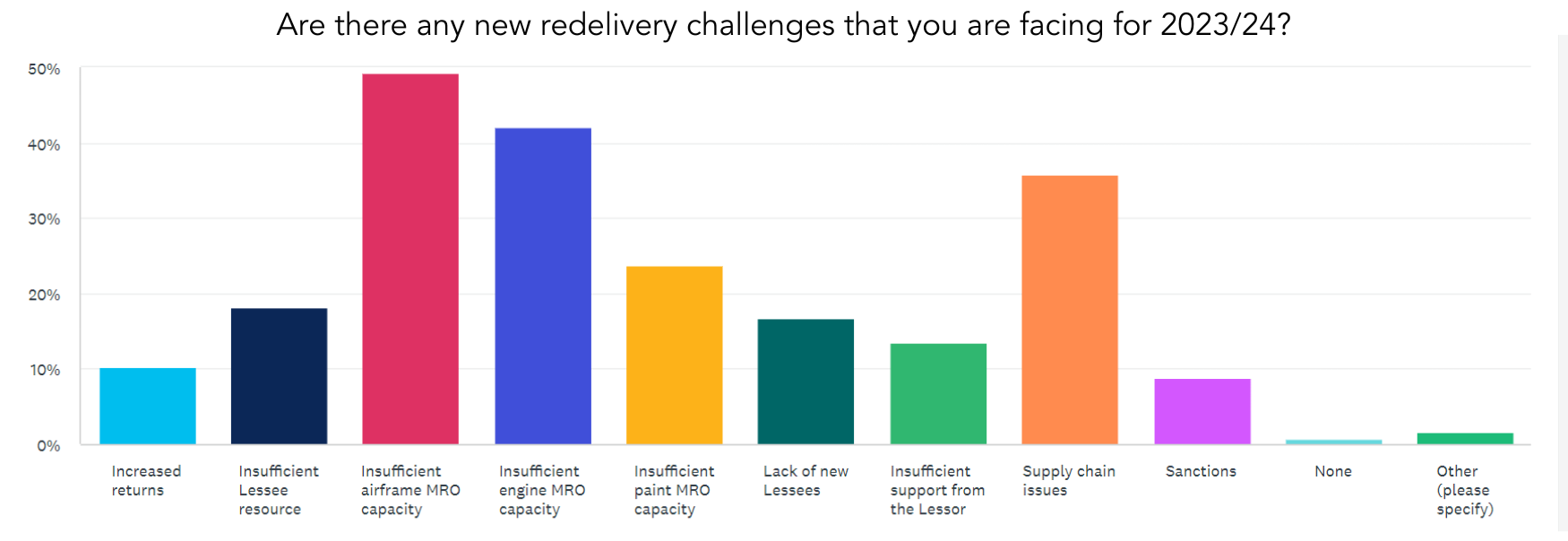

MRO capacity is a fundamental concern according to survey respondents; it will have the biggest impact on future redeliveries. IBA’s experience indicates this deficit is most likely a major fallout of the Covid pandemic. The reduced MRO capacity the pandemic created means MROs can now be incredibly choosy over the jobs they accept. They might be deliberately avoiding riskier end-of-lease returns which could overrun and block the hangar space for the next aircraft. Together with continuing supply chain issues, the difficulty of obtaining shop visits could result in more lease extensions.

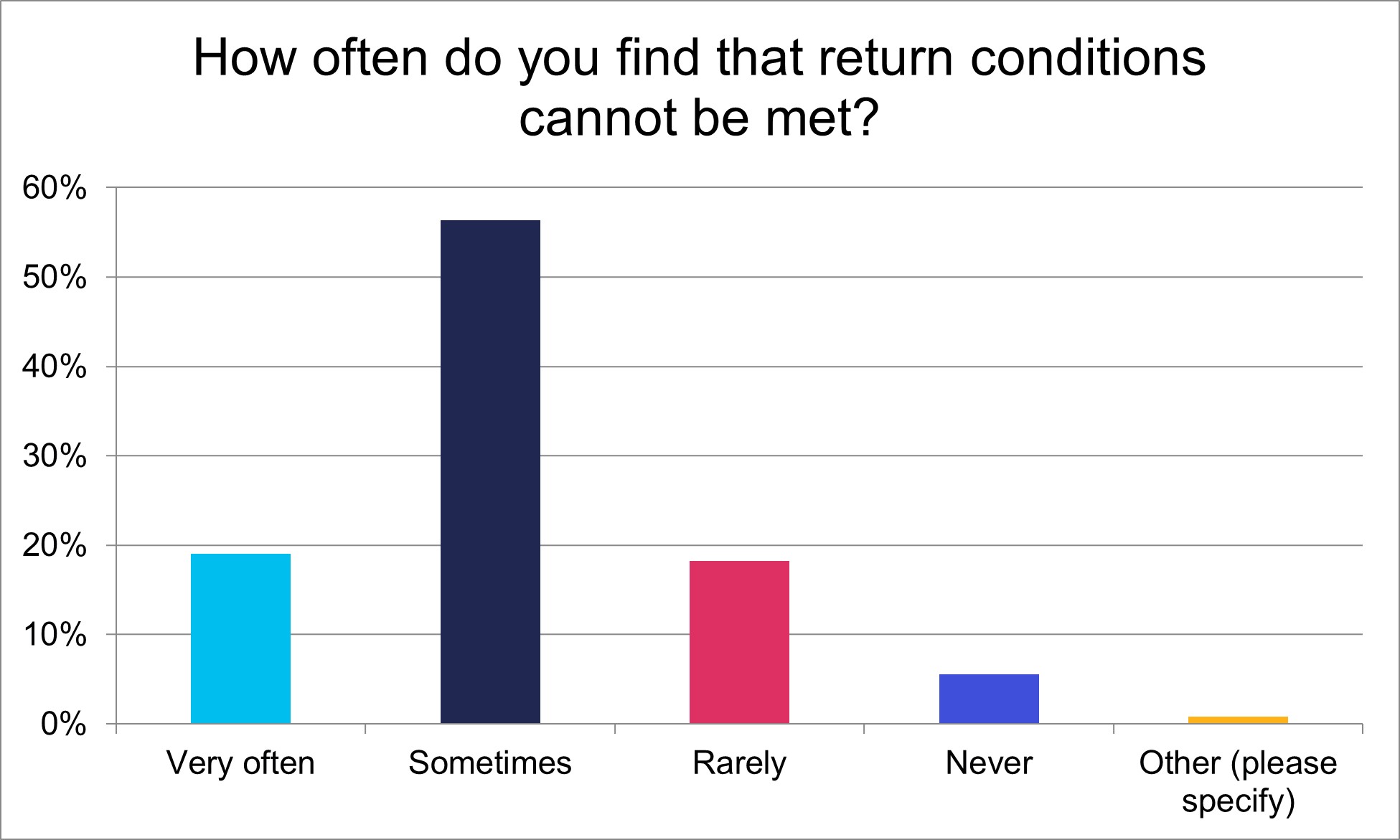

Over 56% of survey participants confirm they believe aircraft return conditions are difficult to meet and contract terms are regularly unfulfilled. As in previous Redelivery Surveys, IBA emphasises it’s crucial that both parties to the contract dedicate enough time to perform a detailed review of return conditions long before a redelivery is due. This allows airlines and lessors to completely understand each other’s interpretation of the terms and allows airlines to highlight areas where they feel they might be unable to comply. By proactively seeking agreement in good time rather than putting off difficult discussions until the end of the return process, costly buyouts or delays can be avoided.

Thorough planning for a redelivery has become more crucial than ever. Maintenance backlogs as a result of Covid restrictions are still having an impact on MRO and shop capacity. Engine shops are especially struggling with multiple engine manufacturers having in-service issues placing higher demand on shop capacity.

We recommend lessees share a clear redelivery plan detailing the return process with the lessor, giving the lessor a good understanding of when they will have access to the aircraft and its records for inspection. Lessees should control access in accordance with the lease, but allowing flexibility can be an advantage. For example, if the lessor has early access to the records, deficiencies can be identified sooner giving the lessee more time to rectify the discrepancy.

It is also good practice for both parties to agree on an interpretation of return conditions documented clearly so there is no ambiguity, The return conditions may have been very clear and logical at the time they were written, but today open to interpretation.

Our 2023 Redelivery Survey has shown an increase in lease extensions post-pandemic. If a lessee is considering their extension options, they should not stop any return planning incase an agreement to extend is not reached.

A major focus for lessors is asset value, and redelivery conditions are a key tool for lessors to predict the value and condition of the aircraft at return. Lessors will therefore be very diligent when inspecting the aircraft and any non-compliance with the redelivery condition will be required to be rectified. Our 2023 survey has shown a continued trend of lessors scrutinising repairs in detail, with the repair documentation failing to meet requirements required of the lessor. Lessees should consider that a lessor’s inspector will review each repair following the requirements of the aircraft’s structural repair manual. If there is any deviation from the manual or lack of documented evidence to confirm the correct repair has been performed, they will ask for the repair to be reviewed adding additional work to a return check. Having the records of each repair reviewed in detail by both records personnel and the structures department can avoid such a scenario.

End-of-lease Borescope inspections are commonly one of the last inspections performed by a lessor because the inspection is required to be performed after a demonstration flight. With this inspection being so close to the end of the lease, preventive full front-to-back borescopes could save return overruns, saving millions of dollars in penalties for the delay in return.

With the constraints in engine shop capacity, understanding true shop turnaround times is key to identifying when this inspection is performed.

It is always good for lessees to remember redelivery conditions in the cabin can be more stringent than those required for the lessee’s operation. Our Redelivery Survey has shown an increase in concern around supply chain issues having an impact on a return. Cabin interiors are commonly customised to lessees requirements resulting in multiple component parts being bespoke and having very high lead times. Performing a cabin survey before the return identifying cabin defects and ordering the required parts within the required lead time can avoid delays at return. When considering cabin defects cleanliness is a key factor. Always consider performing the cabin survey having had a cabin deep clean performed to help identify components which may be required to be changed for cosmetic purposes.

Aircraft records are one of the most important aspects of a redelivery. Lessors can spend months reviewing historical records. The introduction of digital records with their searching capability has made it easier for all parties but an airline's technical records team are highly skilled and one of the most important departments during a redelivery. It is commonly seen that these teams are resourced to maintain the airline's compliance obligations and have no additional capacity to support additional projects such as redeliveries. Having a dedicated member of the records team available to support a redelivery can ease strains in the returns process.

With over 35 years of experience and a portfolio of over 100+ aircraft under active asset management, IBA is ideally placed to manage your existing aviation portfolio or support the establishment of your platform. No other provider of aircraft management services has IBA's combination of independence, breadth of expertise and depth of data. We can support your investment through each stage of the cycle starting with pre-transaction analysis, fleet servicing, remarketing or transitioning.

If you have any questions, comments or feedback please contact Peter Walter.