10/10/2023

IBA’s recent post-summer market update highlighted several key insights on the aviation market over the past year while providing an outlook for expectations into 2025.

Utilising combined IBA research from our ISTAT-certified experts and aviation intelligence from our IBA Insight platform, we saw mixed, but generally positive performance for the industry across airline performance, aircraft leasing and trading. Measured against pre-pandemic levels, this market recovery continues to rebound despite strong economic pressure and cost factors.

To summarise the key takeaways from that session, we’ve broken down some of the central points from that webinar below.

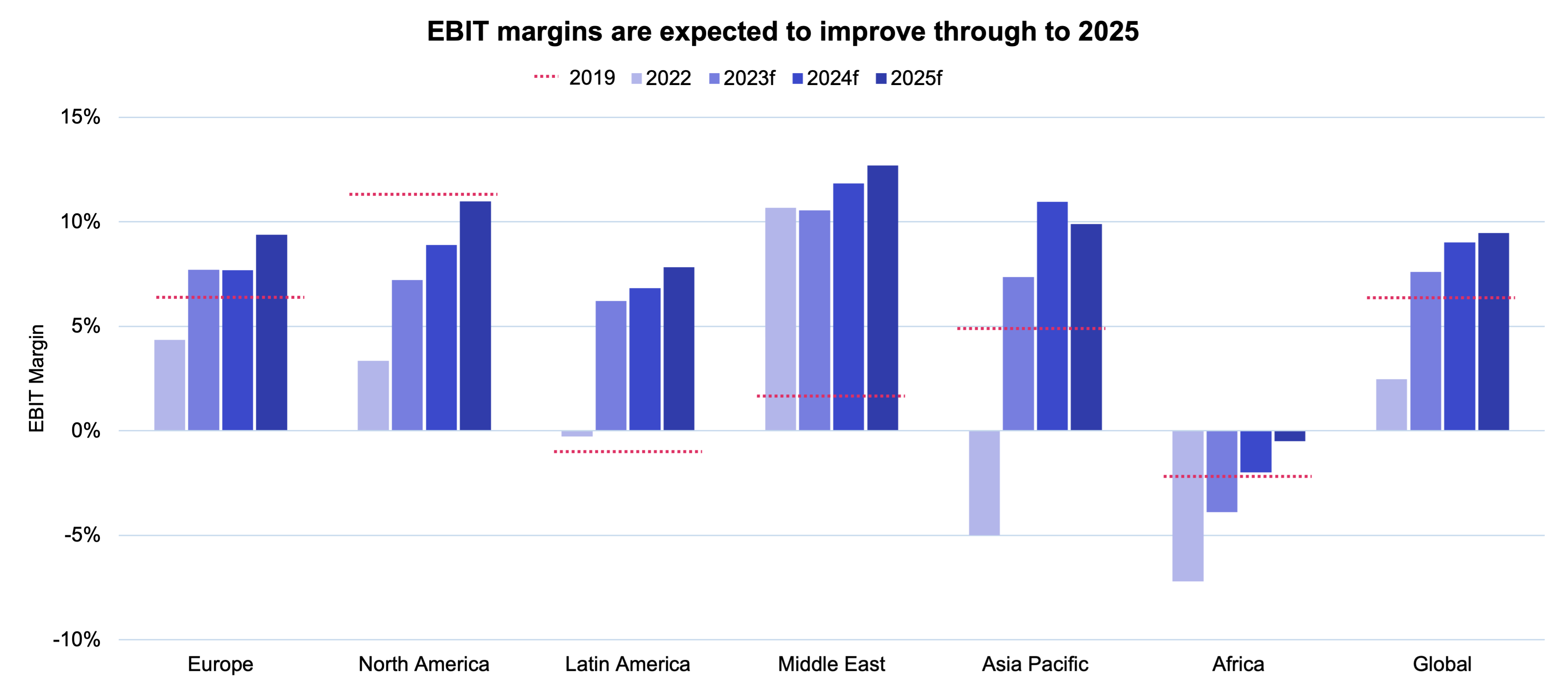

IBA forecasts a positive outlook for global airline profits with improvements in average EBIT rising to 9% in the 2025 financial year. This is compared to just 2% in 2022 and 7% in 2019 before the COVID-19 pandemic.

Source: IBA Insight

In the short term, North American carriers will more than double from 3% to 7% but still trail behind on the path to reaching pre-pandemic margins. However, airlines in this region can expect a predicted margin of 11% by the 2025 financial year. By comparison, European airlines have already reached and surpassed pre-pandemic levels (6%), doubling from 4% to 8% between the financial years of 2022 and 2023. At this rate, the forecast is to reach 9% by 2025.

In Latin America, carriers continue to face heavy losses for the year ahead, with predictions of a 6% EBIT margin in 2023, reaching 8% in 2025. African carriers will see an improvement from -7% to -4% this year, while the Middle East remains steady at 11%. Asia Pacific has seen the biggest improvement of 12% from -5% in 2022 to 7% in 2023 following the removal of travel restrictions and other contributing factors.

Overall, IBA forecasts the average net profit per passenger to be US$3.50 in 2023, rising to US$8.20 in 2024.

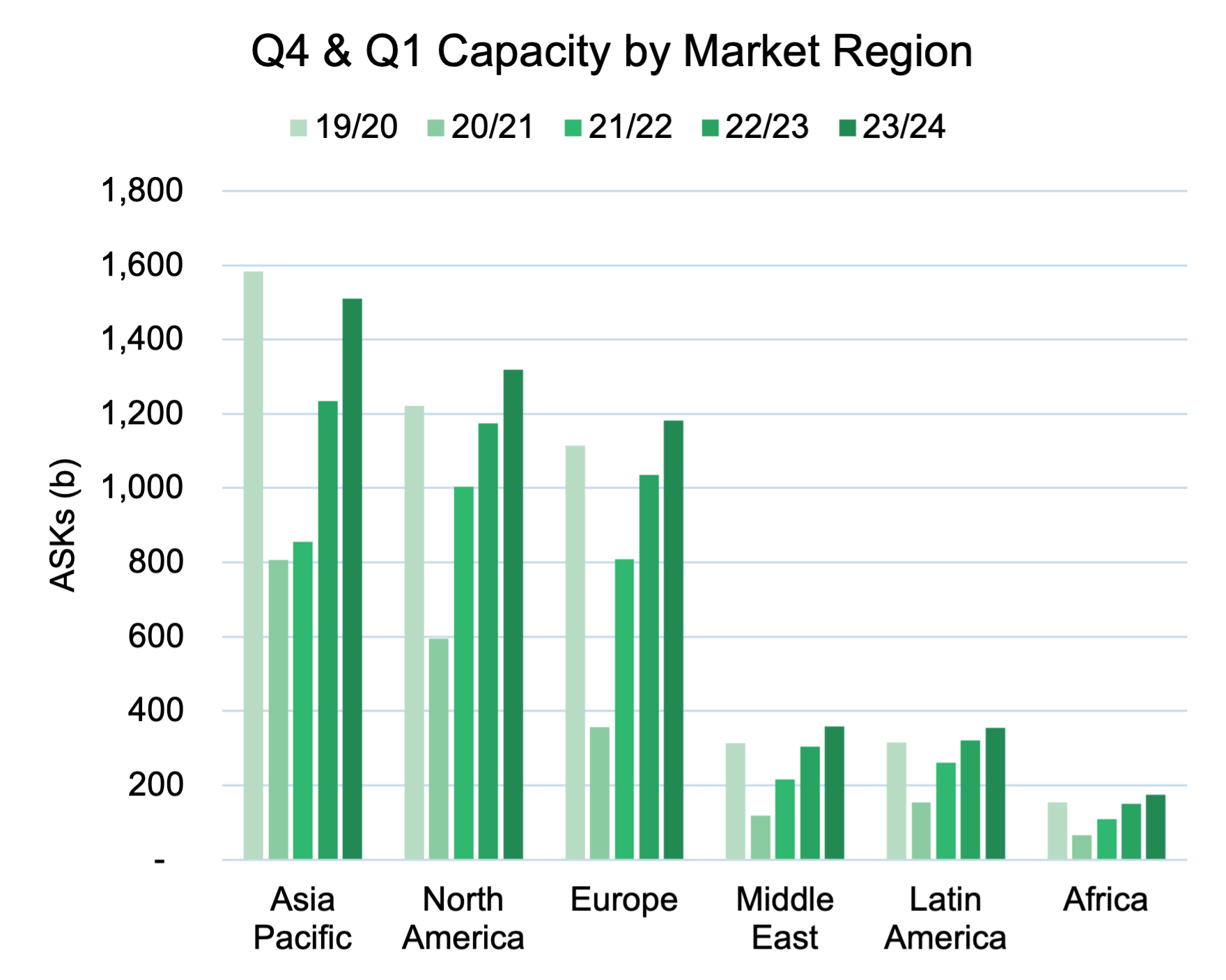

Total global capacity is currently at 98% of 2019’s ASKs (as of August 2023). This figure is constrained by several factors including lagging demand in larger markets, specifically in Asia Pacific and Europe where ASKs sit at 94% and 96% respectively. Bucking the trend, the USA’s capacity is closer to 2019 levels.

Regionally, Europe and North America are both up 11% year-on-year, with Latin America just ahead at 12%. The Middle East and Africa are up 15% and 28% respectively, whilst Asia Pacific has the biggest movement at 88% following the removal of restrictions.

Source: IBA Insight

While operators have increased their Q2 2023 capacity with ASKs up 28% on 2022 levels, it still trails behind 2019. IBA predicts capacity growth to slow over the coming winter season while remaining above last year’s levels. Our forecast is for capacity to reach 2,485 billion ASKs in Q4 2023 (compared to 2,064 billion in Q4 2022).

Asia Pacific leads the year-on-year growth following the lifting of travel restrictions, with a jump from 1,234 billion ASKs in 2022/23 to 1,510 billion in 2023/24. As airline traffic recovers to pre-pandemic levels by 2024, we should see the number of passengers carried globally surpass the five billion mark by 2030.

Peak seasonal travel saw passenger demand continue to rapidly boost narrowbody aircraft utilisation in summer 2023. Intelligence provided by IBA Insight, our aviation intelligence platform, and IBA Research expects annual average narrowbody aircraft utilisation to rise to 475 billion ASKs in 2023 (compared to 450 billion ASKs in 2019).

While this is primarily good news for low-cost and regional operations, widebody fleets still have some ground to recover as utilisation for 2023 is set to be 310 billion ASKs (compared to 400 billion in 2019).

Storage levels also continued to move in the right direction over the past year, with a 6% drop between September 2022 – September 2023.

Finally, high-interest rates and recessionary fears have not deterred landmark aircraft orders, with over 1,500 new commitments thus far in 2023, primarily from Indian carriers leading the way. There have been 465 Airbus and 313 Boeing passenger aircraft deliveries so far in 2023 and IBA predicts 400 more leading up to the end of the year.

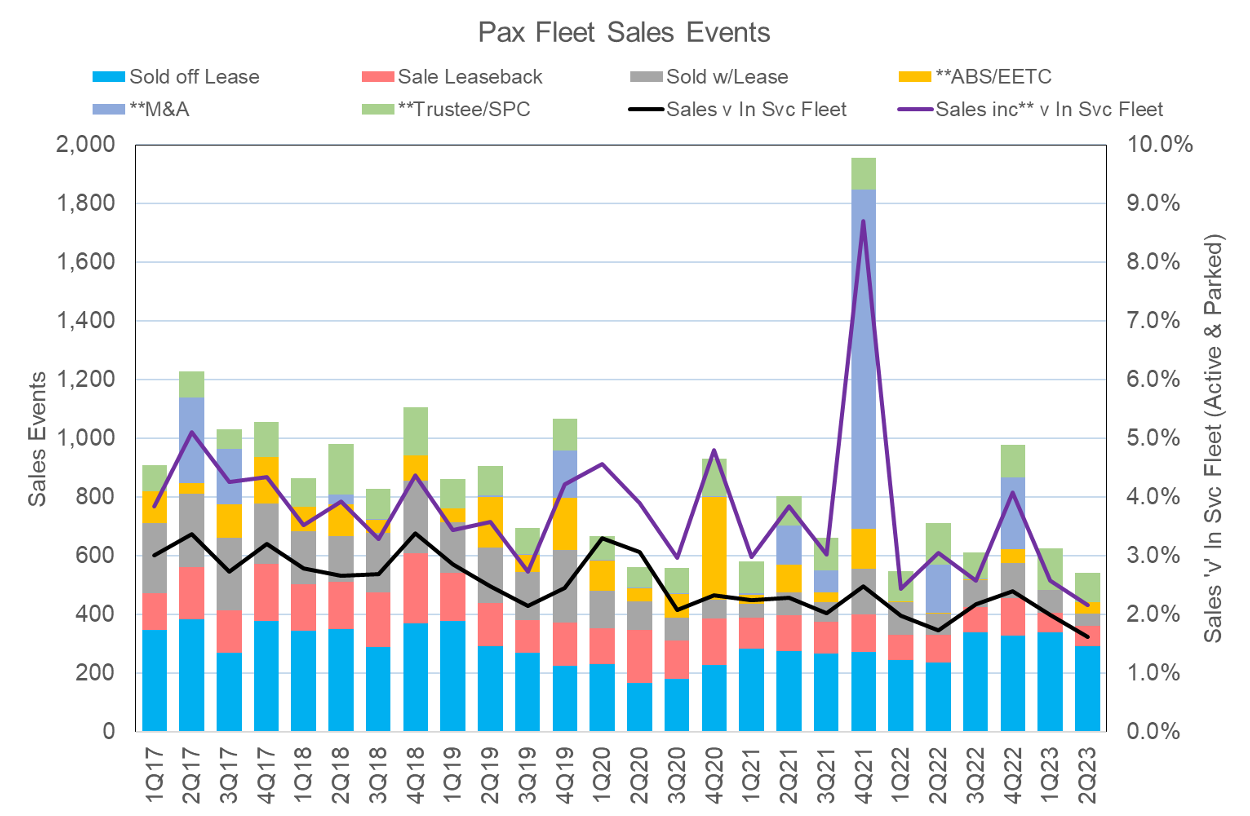

Over the last year, passenger aircraft trades have followed a downward trend due to sluggish new aircraft supply and portfolio trades. For the most part, sales off-lease are close to pre-2020 levels and flat compared to the 10-year average. The number of lease starts is close to double the number of lease ends, and IBA’s forecasts indicate that passenger aircraft leases will continue this positive trend as we remain in this heavy lease extension phase.

IBA intelligence also predicts that supply issues will have a positive effect on both narrowbody and widebody aircraft values. Using the example of a Boeing 737 MAX 8 with a market value of US$52.7m in July 2023, this is forecasted to reach US$55m by January 2024. Similarly, a new A350-1000 at US$170.5m in July 2023 is set to rise to US$173.9m by January 2024. Comparable increases are also expected for lease rate recoveries.

Click the button below to watc the full webinar on demand.

IBA delivers the best of all worlds - deep aviation consultancy expertise, and cutting-edge and actionable data insights, all delivered by a proven, expert team with a strong customer focus. To discover what makes IBA Insight the leading aviation intelligence platform and to book a demo click here.