23/08/2021

As Embraer announces a rethink on its latest Turboprop concept, we use fleet data from our aviation intelligence platform InsightIQ to analyse the global Embraer civil jet fleet.

Image source: Embraer

Brazilian aircraft manufacturer Embraer has revealed a new turboprop concept which represents a shift in thinking for turboprop design. A 70-90 seat aircraft is proposed to feature aft-mounted engines, and intended to be pitched as a replacement to 50 seat regional jets.

Embraer's civil jets fall into two families, the Embraer Regional Jet ('ERJ') and Embraer E-Jet series. The E-Jet series represents 65% of the entire global fleet, with the ERJ representing the remaining 35%. Leasing trends are generally less profound, with 54% of in-service E-Jet and 58% of in-service ERJ jets leased globally.

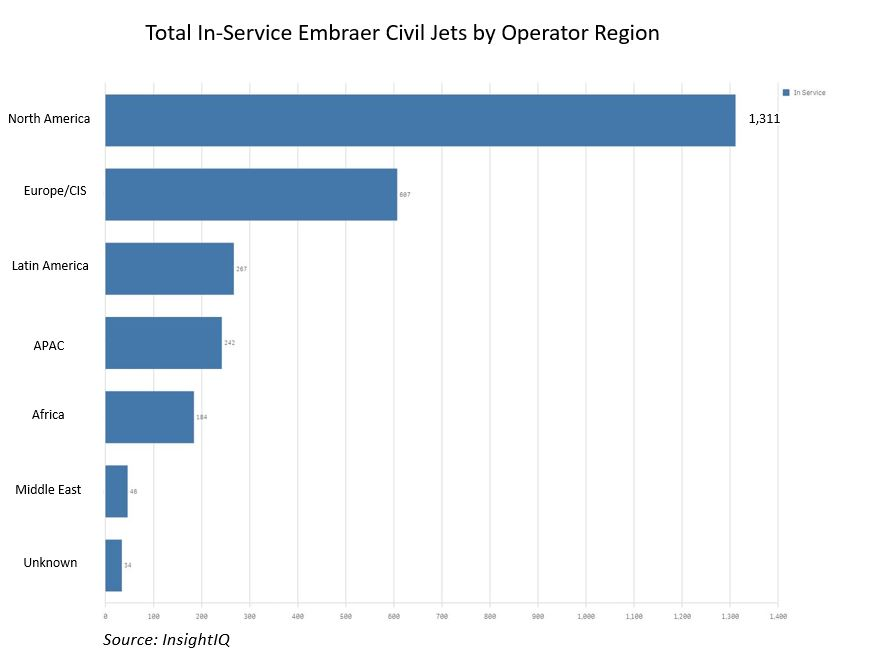

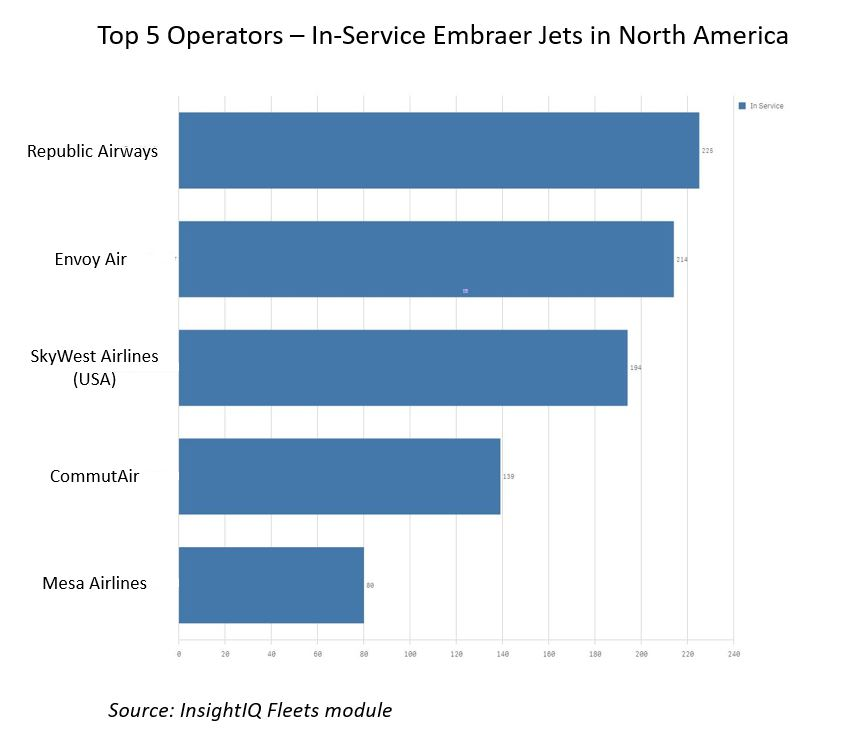

InsightIQ fleet data reveals that both of the Embraer jet families enjoy particular proliferation in the North American market, with 48% of Embraer jets in-service globally being operated by North American entities. Despite being out of production for some years, InsightIQ reveals there are still some 539 ERJ family aircraft in service in North America, representing 41.1% of Embraer civil jet airframes in service in the region. Embraer is squarely aiming their new turboprop concept at operators of the ageing ERJ and competing CRJ variants (one such operator being Jet Blue, who recently launched their inaugural transatlantic service).

Embraer Chief Executive Francisco Gomes Neto recently indicated that US airlines were already showing interest in the new turboprop concept, suggesting that the new aircraft could prove an attractive replacement for the market's ageing 50-seat regional jets.

The question that remains is whether the Turboprop itself can strike a chord with operators that typically prefer regional jets. It is clear that Embraer's sell-in will have to focus on efficiency, cost and capability; effectively positioning the new turboprop concept as a genuinely viable alternative. The indications so far are that the aircraft will do just that, with Embraer stating that the airframe will offer the same cross-section as the venerable E-Jet series and the additional efficiency of turboprop power.

A high-tech Turboprop aircraft with rear-mounted engines is also likely to significantly contribute to a reduction in cabin noise, a noted bugbear of turboprop passengers. The plan to use the same cross-section as the jet fleet will also remove limitations in cabin and overhead bin space often experienced in smaller turboprops.

Embraer's Turboprop concept is shaping up to be an exciting prospect in regional aviation. Embraer Commercial Aviation chief executive Arjan Meijer stated that Embraer could launch the concept in 2022, with entry to service from 2027-8.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.