02/08/2022

IBA's expert team share the latest updates to commercial aircraft values as part of our mid-year market update webinar.

Image: Don-vip, Wikimedia Commons

IBA's valuations team have identified that narrowbody aircraft values are broadly trending back towards base in August 2022. New generation aircraft are performing particularly well, aided by a competitive aircraft trading market and their compliance with increasingly stringent ESG regulations.

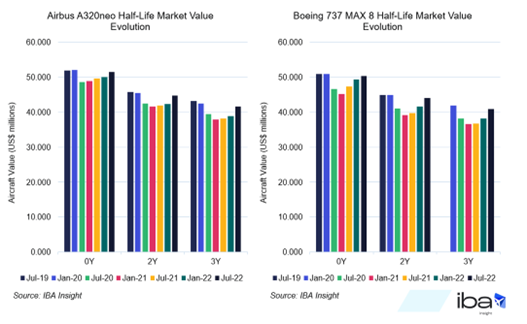

Aircraft values data from IBA Insight indicates that the MAX family is closing the values gap with the Airbus A320neo as new generation narrowbody values trend back to base. The A320neo currently sits at around 98-9% of base value, with the MAX 8 slightly behind at 96%. The smaller Airbus A220 currently sits at 97%, and we anticipate that market values will equal or exceed base value for all these types by the end of 2022. The A321neo family has already achieved a consistent market and base value.

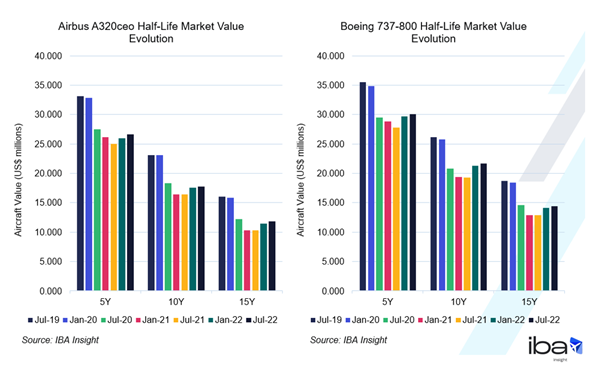

Whilst the value recovery trend for previous generation narrowbody aircraft is less positive than that of new generation aircraft, we have observed a positive overall trend and a strong on-lease trading environment. The best performing previous generation aircraft from Airbus and Boeing are the A321ceo and the Boeing 737-800, which are at 92-95% and 86-91% of base value respectively. Previous generation narrowbody aircraft base values are on watch as the pressures of ESG regulations build. This is particularly true for the smaller Airbus A319-100 and Boeing 737-700 models, which face a tide of replacement as production rates ramp up.

IBA Insight flexibly illustrates multiple asset, fleet, and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.