27/07/2022

In our recent Mid-Year Market Update webinar, our experts used IBA Insight to explore the impact of airline schedule cuts on capacity and mapped the likely trajectory for the coming months.

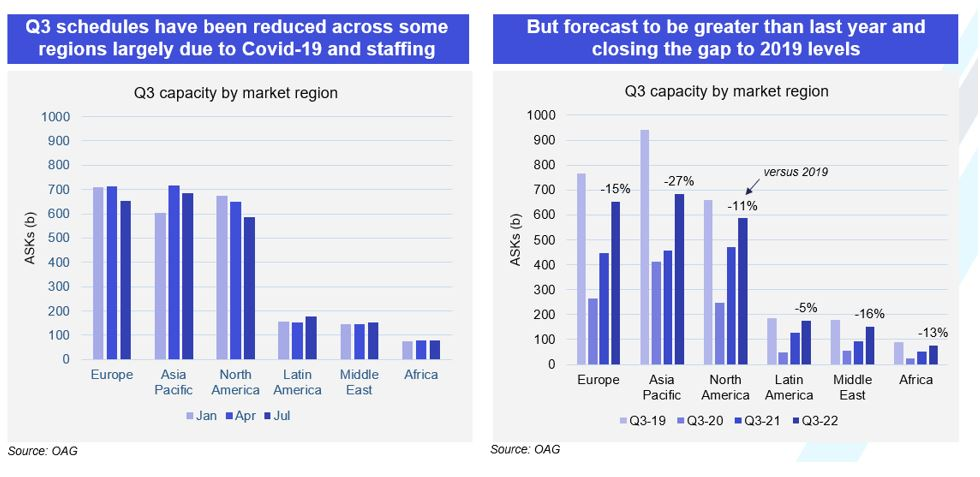

Airline capacity has been reduced by 16% in the third quarter of 2022 (July – September 2022) as Airlines and Airports cut schedules. Staffing challenges have been the key driver of schedule cuts in Europe and North America, whilst Covid-19 related restrictions are hampering capacity in the Asia Pacific region. Despite this, it is important to highlight that capacity in the third quarter of 2022 is still well ahead of that in 2021 and is closing the gap with pre-pandemic performance in 2019. In Latin America, this period is just 5% below 2019, and in North America is only 11% behind.

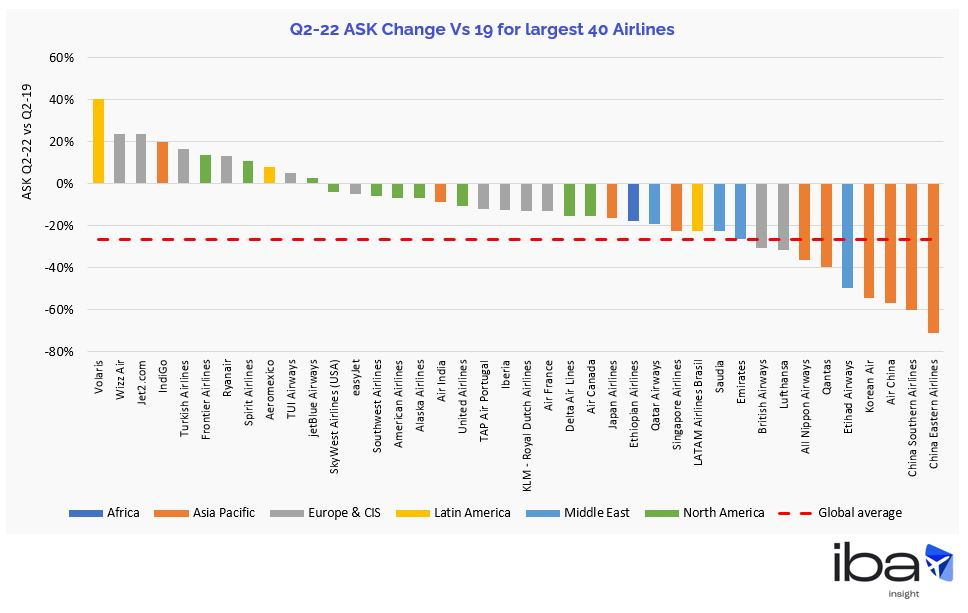

Some Airlines have even increased capacity while the global market was 26% below 2019 levels. According to IBA Insight, the largest increases in ASKs compared to 2019 were Volaris (+40%), Wizz Air (+24%) and Jet2.com (+24%).

Our award-winning experts anticipate that Airline capacity growth will slow and plateau over the fourth quarter of 2022 and the first quarter of 2023, whilst remaining significantly ahead of winter 2021 and 2022 levels.

Winter capacity in North America (Q4 to Q1) is forecast to be just 4% behind 2019 levels.

Capacity in the Asia Pacific region will lag at 25% behind 2019 levels in the same period.

Overall, IBA forecasts that passenger traffic will recover to pre-pandemic levels by the end of 2024, with an average annual growth rate of 3.2%.

IBA Insight flexibly illustrates multiple asset, fleet, and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.