20/06/2022

One year beyond our original analysis, we have re-examined the global picture for start-ups, identifying where they are, and the classes of aircraft they plan to use by 2023.

In June 2021 we examined the phenomenon of a modest boom in start-up airlines, and whether a global crisis provides a fertile ground for new operators. Using aviation intelligence from IBA Insight, we identified over 130 start-up airlines that planned to commence operations by 2022. Since then, we have seen many of these airlines progress closer to launch and some commence operations. The launches have been most prolific in Europe CIS and the Americas.

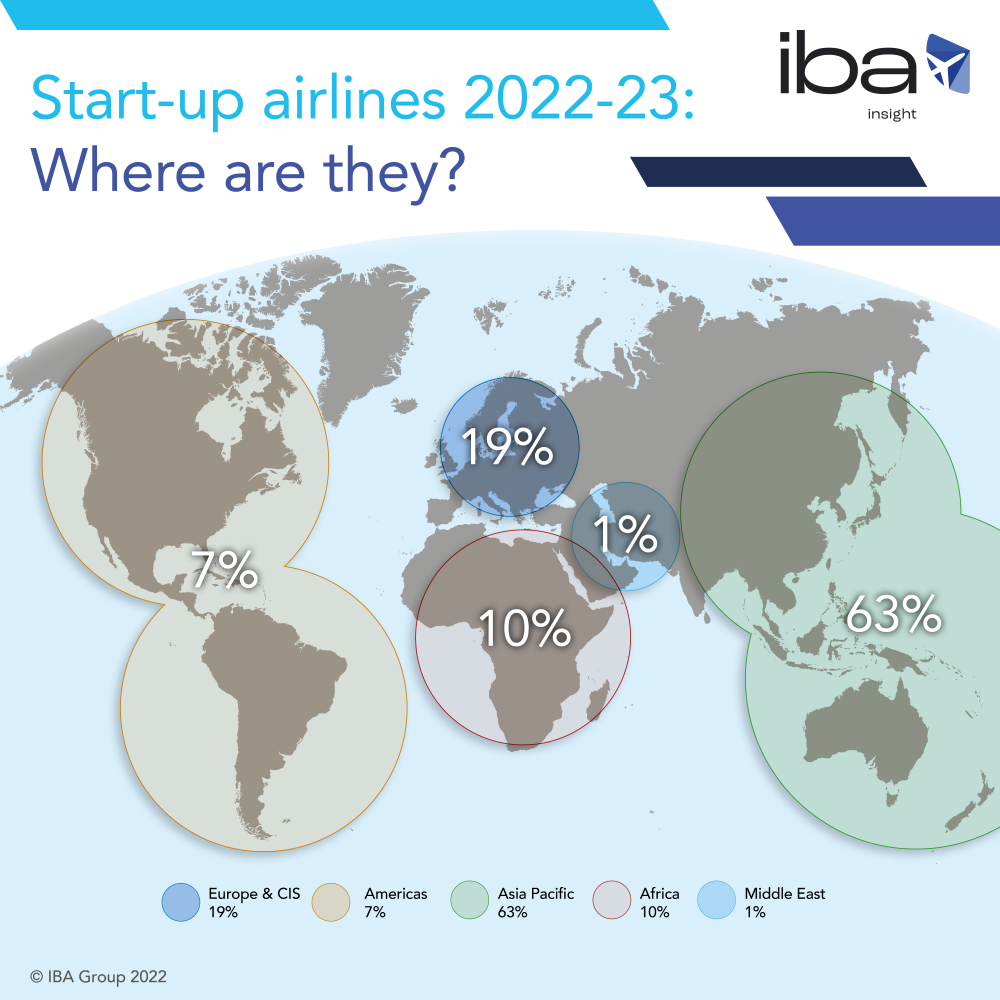

The largest increase is in the Asia Pacific Region, where our insight shows that 63% of start-ups plan to commence operations in 2022 and 2023. This represents a 34.7% increase for the region compared to last year.

The largest decrease we have observed is in the Americas. Our research in 2021 identified 23.4% of global start-up airlines were to be based in this region. This has fallen to just 7% today.

Europe is no longer the biggest focus for start-up airlines, and the region's global share of planned start-ups has fallen by 57.7%.

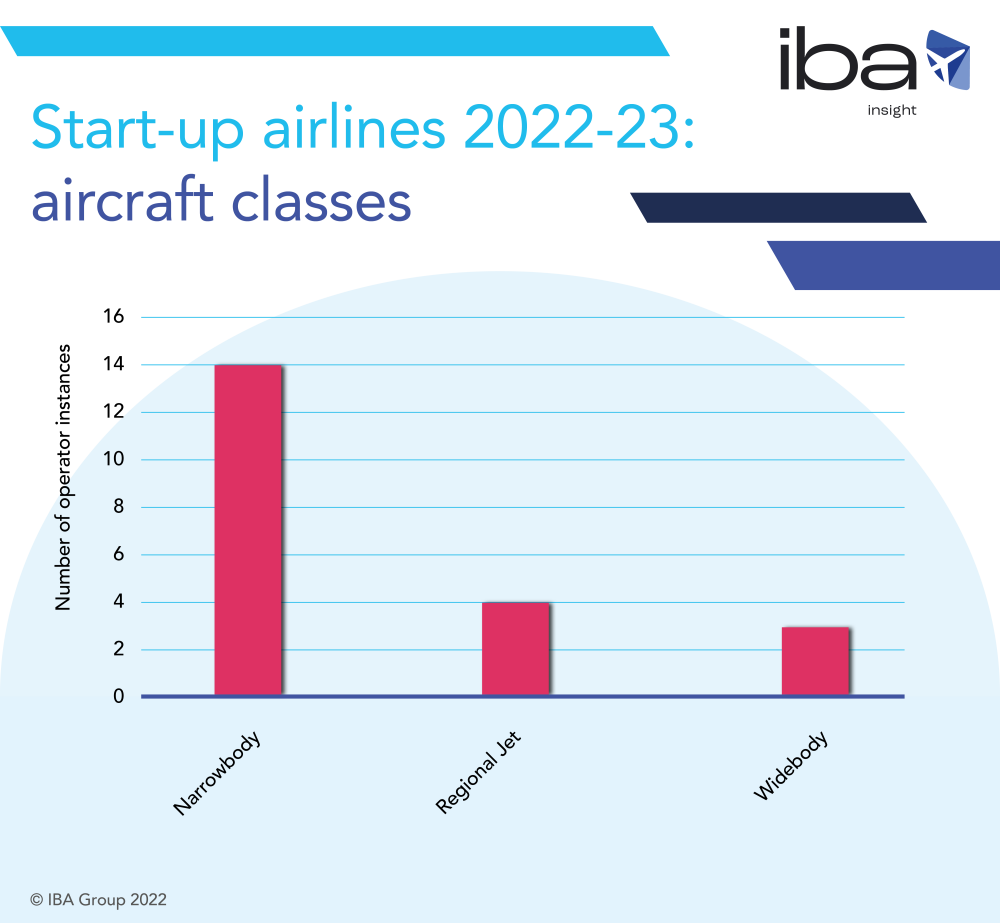

Our analysis has identified that most start-up airlines planning to launch in 2022 and 2023 will operate narrowbody aircraft. This was also the case in our previous analysis. It is important to note that whilst the total number of planned start-ups has decreased globally, the gulf between the classes of aircraft they plan to operate has increased. In 2021, narrowbodies accounted for 33% of start-ups compared to widebodies at 17%. At the time of writing, only 14% of start-ups plan to use widebodies, compared to 67% that plan to use narrowbodies. Among other factors, the launch of long-haul operators (such as Norse Atlantic Airways) has contributed to this change.

IBA Insight flexibly illustrates multiple asset, fleet, and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.

Our experts continually monitor the changing landscape for start-up airlines, and a vast array of breaking news and trends across the aviation industry. Sign up to our LinkedIn newsletter and follow us for regular updates and insights.