30/09/2021

IBA has partnered with KPMG to launch the Aviation Carbon Index

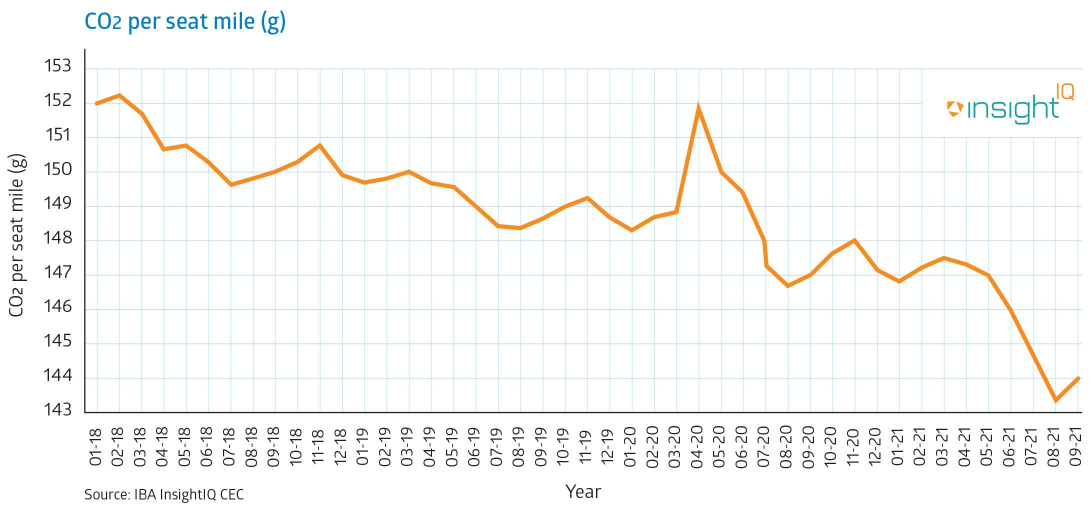

IBA, the award-winning aviation advisory and analytics company, has today launched the Aviation Carbon Emissions Index in association with KPMG. The index tracks the monthly emissions efficiency of the global commercial aircraft fleet using the widely accepted measure of grams of CO2 per Available Seat Mile (ASM).

Each month IBA will publish its Index of overall industry efficiency, with spotlights on aircraft types, airlines and lessors, accompanied by an analysis of related trends.

With data points from the start of 2018, the IBA Aviation Carbon Emissions Index showcases the industry's efforts and success at improving the efficiency of their fleets. It shows an overall year on year reduction of 5.2% on a rolling three-month basis over the last four years.

The efficiency improvements have been fairly linear over the last four years, apart from a spike at the start of the pandemic (Q2 2020) when Middle Eastern airlines, predominantly flying Boeing 777-300ERs, remained flying while many other carriers suspended operations.

General efficiency improvements have largely come from the older aircraft retirements, particularly four-engined types such as the Boeing 747, and Airbus A340 and A380 families, which have aided in the overall reduction in emissions. The twin factors of airlines favouring the latest generation aircraft, and the particular mix of airlines flying during the pandemic, have contributed significantly towards better overall efficiency within the active global fleet.

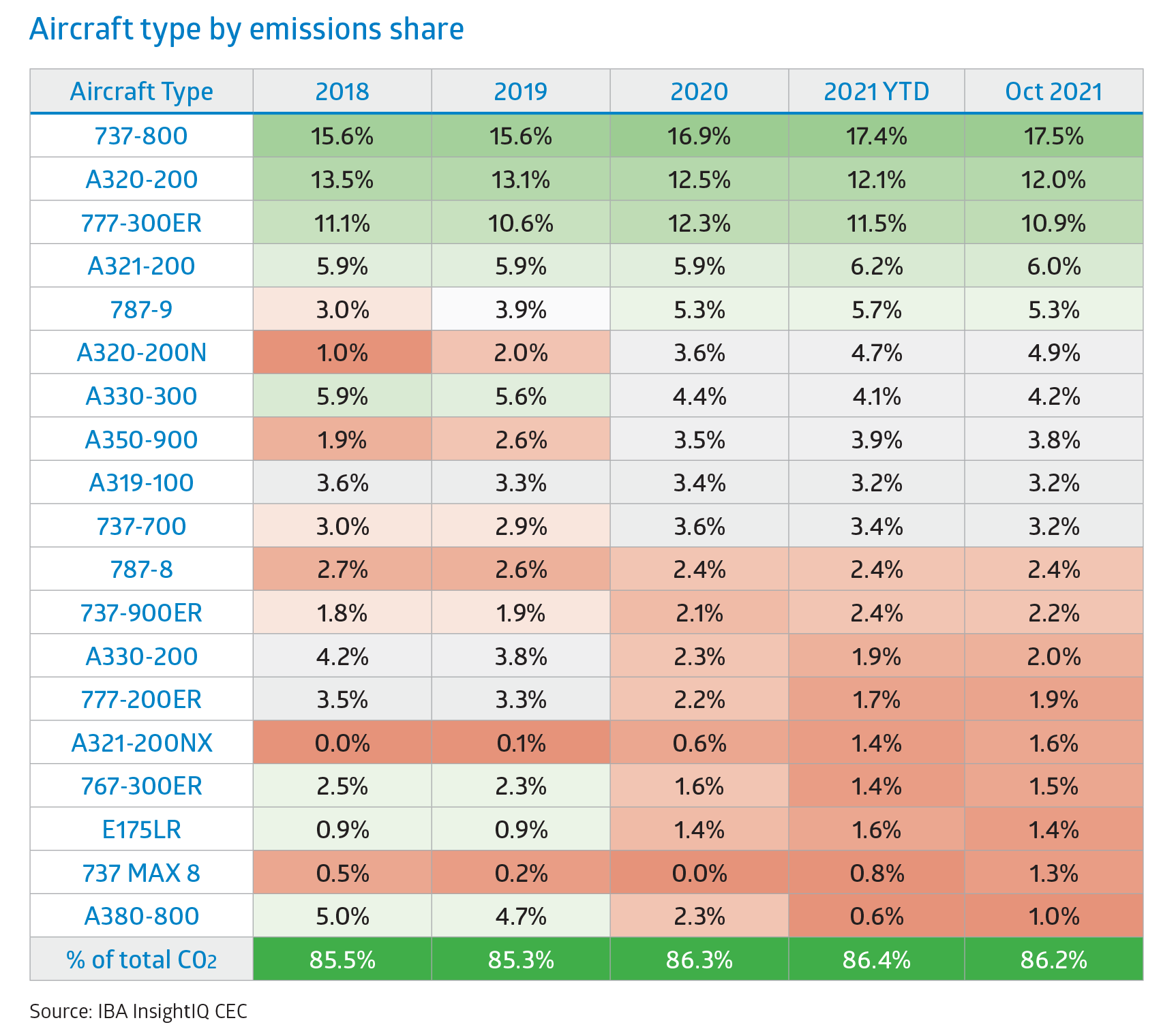

The table below shows the most operated passenger aircraft ranked by total CO2 emissions during each period, and demonstrates the changing mix of types used globally.

The table illustrates the rapid reduction in emissions from the A380, the gradual reductions in the operation of most widebodies in the ranking, the active phasing out of older aircraft, and the introduction of the new, more efficient models.

Data from IBA's InsightIQ analytics platform shows that the active A380 fleet dropped 80% from 2018 to September 2021. Many operators placed their A380s in long term storage and IBA predict that many will not re-enter service, with the only airline still operating significant numbers of the type being Emirates which predominantly uses them to feed its Dubai hub.

The Boeing 777-200ER and 767-300ER have seen a significant spike in retirements and long-term storage. The total proportion of parked, stored and retired aircraft has reached 60% of the entire 777-200ER fleet whilst the 767-300ER has experienced a 72% increase in parked, retired or stored inventory levels. However, unlike the 777-200ER with an average fleet age of 19 years old, there is a healthy freighter conversion programme for the 767-300ER, and IBA forecasts that a good percentage will return to service with operators such as Amazon Air.

The Boeing 787-9 has seen a marked jump in market and overall CO2 emissions share, partly due to a 40% increase in fleet size, but also because a large portion of the fleet has remained active throughout the pandemic. This has filled the void left by legacy aircraft such as the 777-200ER and 767-300ER on routes which, due to the pandemic, no longer require the same levels of capacity. This delivers a significant reduction in CO2 per trip and per seat mile, giving airlines some respite in costs in a difficult operating environment.

One of the largest gains in total CO2 emissions share in the narrowbody fleet is the A320-200neo which has jumped from 1% of the worldwide fleet to 4.7% between 2018 and September 2021. It is one of the few aircraft to increase its active worldwide fleet from 484 aircraft in 2018 to 1,214 in September 2021. Comparatively, the A320-200ceo has seen a 40.1% increase in retirements with a total reduction of 967 aircraft in active service. IBA still expects large numbers of these aircraft to re-enter active service, but with older A320ceos continuing to exit active service as the A320-200neo increasingly dominates the Airbus narrowbody fleet in years to come. As the Airbus A320-200neo has on average 15% lower emissions than the ceo variant, it is plain to see the benefits in CO2 reductions in the years ahead.

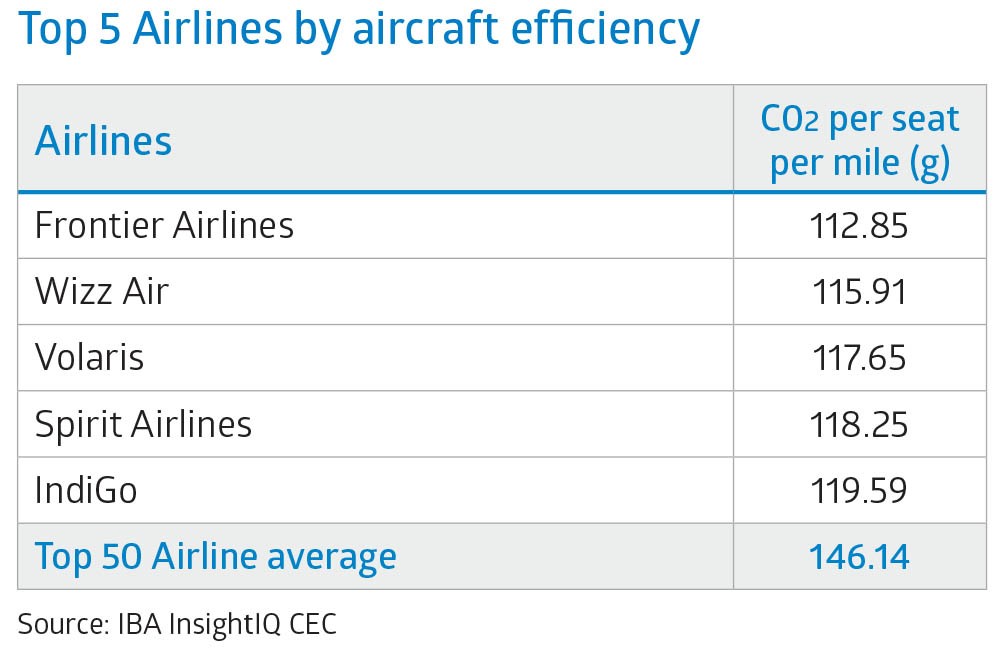

Leading the way in emissions efficiency for the airlines in 2021 are these five airlines, all operating a low-cost carrier model using predominantly latest generation aircraft:

These carriers are all operating around 20% more efficiently per seat per mile than the top 50 airlines average by total CO2 in 2021. Of the top five airlines listed above, the main emissions reductions per seat per mile have been achieved by the operators favouring the A320neo throughout the pandemic. This should not diminish perceptions of the 737 MAX 8, which possess largely comparable levels of efficiency, but its market share has been significantly hampered by its grounding and lack of deliveries in recent years. As MAX deliveries begin to ramp back up, IBA forecasts expects a much more even share in airline efficiency ratings between the Boeing and Airbus aircraft, with low cost carriers typically favouring one manufacturer to reduce operational complexity.

These five aircraft leasing firms below have delivered the most efficient fleet operations during 2021, with efficiency levels typically 10% better than the top 50 lessors average.

.png)

Within the lessor portfolios, the best performing lessors predominantly own newer generation narrowbody aircraft which significantly contribute towards a CO2 per seat per mile reduction. IBA predicts that Jackson Square Aviation will remain within the top lessors group as their portfolio is dominated with new generation asset types, including around 50 A320-200neos in service and over 30 737 MAX 8s on order. In future publications of its Aviation Carbon Emissions Index, IBA will focus on whether more ESG-focussed lessors are opting to sell older generation assets in favour of new technology aircraft to better improve their efficiency ratings, or instead to combine carbon offset packages with leases to compensate.

Using information from IBA's InsightIQ aviation analytics platform, IBA calculates the Aviation Carbon Emissions Index by tracking each and every commercial flight across the globe on a daily basis. It combines this flight information with airport to airport Great Circle distances, and integrates this with its proprietary InsightIQ Fleets database that includes the configuration, specification and fuel burn characteristics of all commercial aircraft and engines.

Using big data methodologies, advanced analytics techniques, the expertise of IBA's 50 strong analyst and research teams, and an iterative algorithmic approach, IBA compiles the Index and compares the results to the published sustainability reports and Scope 1 carbon emissions of over 50 global airlines. The result is Scope 1 emissions figures that match airlines' own reporting at more than 99% accuracy.

The IBA Aviation Carbon Emissions Index allows the industry to showcase its efforts to improve efficiency and reduce the emissions footprint of each available passenger seat using an impartial and independent methodology.

Airlines, lessors and banks can now benchmark their own fleets or portfolios on a monthly or periodic basis against the Index to see how they perform and where they rank. Sub-indices for aircraft or operator type are also available for accurate peer group comparison.

Using IBA's InsightIQ analytics platform, industry stakeholders can understand the constituent parts of the Index, which airlines and aircraft contribute, and compare and contrast the figures on a country by country, or regional basis.

Travel companies and flight booking platforms can use the index to provide consumers and businesses with accurate, comparable emissions figures when planning journeys. This provides travellers with a familiar, accurate and independent environmental metric to inform personal or corporate travel choices.

Ian Beaumont, Chief Executive Officer of IBA, says: "Aviation emissions are an emotive subject for an industry that is a contributor to global carbon emissions. Our objective is to demonstrate how the industry is working together to lower emissions and provide the independent industry benchmark, as well as delivering accurate and insightful analysis that helps drive further efficiency gains in the future. For our aviation finance clients specifically, the index provides the independent benchmark for TCFD (Task Force on Climate Related Financial Disclosures) reporting and gives them an expert and independent yardstick for measurement and modelling of their own portfolios."

Chris Brown, Partner, Aviation Strategy at KPMG, says: "We all know decarbonisation in aviation is topical - but this index now allows the conversation to progress beyond generalisations and into specific, transparent benchmarking across industry players. KPMG is proud to be part of this initiative which we believe will have a positive impact on the aviation industry."

"While the motivation for OEMs and operators to improve fuel efficiency is obvious and as much a case of economic logic as sustainability, the implications for lessors have been less clear cut to date. Some lessors may argue that they aren't directly responsible for these flight emissions, yet the asset mix they have does reflect their own strategic decisions. Once lessors are transparently benchmarked, this may encourage a collective shift towards newer aircraft, with its own implications for midlife valuations, and perhaps an acceleration of interest in new opportunities, like eVTOLs."

"Another factor to consider when comparing aircraft types is the full lifecycle footprint. Prematurely scrapping a less fuel-efficient aircraft, for example, only to support demand for new aircraft, doesn't make sense unless it's also accounted for the carbon footprint of construction and scrapping. Over time, lessors - particularly those with older aircraft - will need to portray this broader picture to avoid being unfairly labelled."

Further comment / interviews

Ian Beaumont, Chief Executive Officer of IBA, is available for interview to offer further comment and insight.

About IBA

IBA has over 30 years' experience in delivering independent, expert business analysis and intelligence on the aviation sector. Established in 1988, it provides a wide range of services including InsightIQ, a one-stop intelligence platform combining speed, accuracy, visual analytics and intuitive navigation.

IBA advises prominent investment funds and banks, aircraft leasing companies, operators, manufacturers and MROs. In March 2021, IBA was named 'Appraiser of the Year' by Airline Economics for the fourth time.

For more information, www.iba.aero

IBA media contacts

Charlie Hampton / Alisha Pyzer

Email: [email protected]

Mobile: +44 (0)7884 187297

Related content