11/04/2023

IBA's experts Jamie Davey and Phil Seymour took a deep dive into the latest trends in widebody engine values and utilisation in our latest webinar 'IBA Insight - How are engine values performing?'.

Our intelligence reveals that, overall, new generation engine values remain strong, whilst the mature engine market is unlikely to recover to pre-pandemic levels.

The Covid-related lag in the recovery of the widebody market is still apparent in engine values.

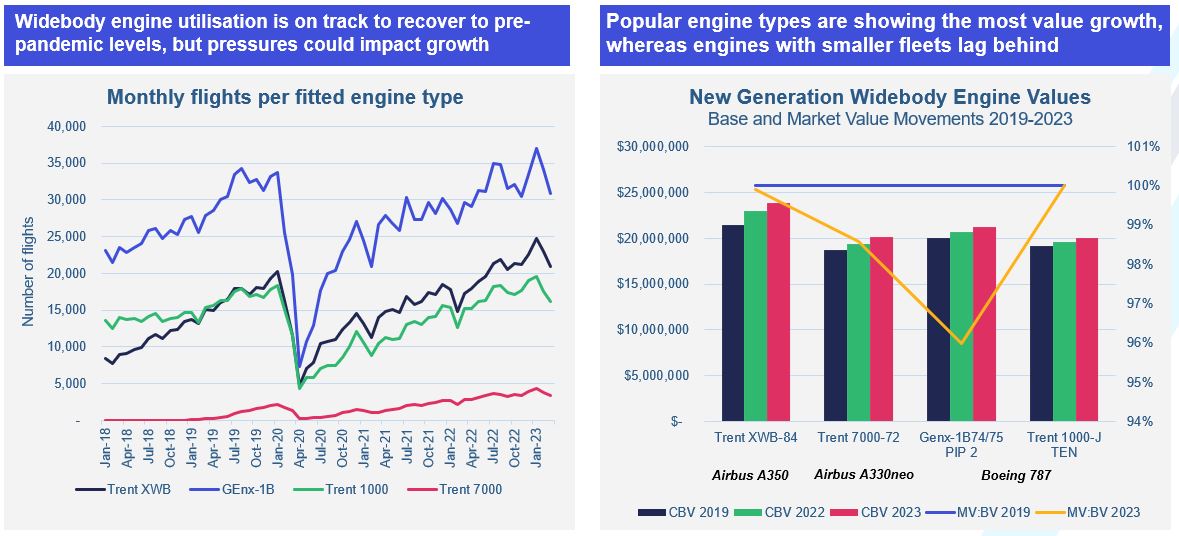

Monthly flights per fitted engine type on the GEnx-1B were at 27,670 in January 2019, increasing to 36,951 by January 2023.

Popular engine types are showing the most growth, whereas engines with smaller fleets are lagging.

Base values for the popular Trent XWB-84 (used on the Airbus A350were at US$21.45m in 2019 and have now increased by 11.5% to US$23.89m in 2023.

Trent XWB values are notably strong. A full-life engine will cost over $30 million, lease rates around $200k per-month.

The secondary market for these engines is negligible, and the OEM’s tight control of the aftermarket will drive up values.

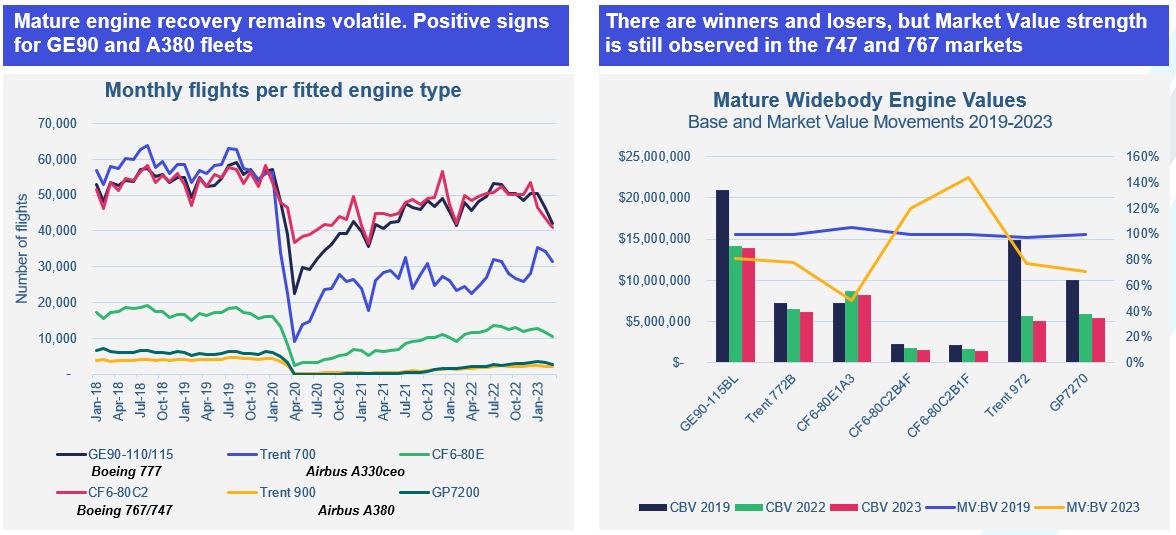

We anticipate that this market will not recover to pre-pandemic levels, but we will see greater value stability as long-haul markets open.

Monthly flights per fitted engine type on the Trent 700 (used on the Airbus A330ceo) were at 19,783 in July 2020, increasing to 31,411 in March 2023. Pre-Covid flight numbers were at 56,917 in March 2019.

We are observing some market value strength in the 747 and 767 engine markets. The GE90-115BL was valued at US$20.98m in 2019, decreasing to US$13.92m in 2023. By comparison, the CF6-80C2B4F was at US$2.26m in 2019 and is now at US$1.6m in 2023.

IBA has one of the largest teams of certified senior appraisers in the industry who partner with aviation and financial sector clients globally to give independent advice on wide-ranging, complex asset valuation requirements.