19/04/2023

IBA's expertsâŊexamine the latest trends in regional engine values and utilisation in our latest webinarâŊ'IBA Insight - How are engine values performing?'.Â

Looking at the wider market, loosening travel restrictions is resulting in increased passenger demand in 2023, most notably in the Asia-Pacific market, following Chinaâs relaxation of its Zero-Covid policy.

Â

Just like last year, it looks like weâre on course for a summer of high passenger travel demand and we predict that with a lack of aircraft and staff to support them, we may see various bottlenecks appearing throughout the industry.

Â

IBAâs shop visit forecast also indicates an increasing demand for MRO services as more engines come back online. This is predominantly due to many engine shop visits being deferred during the pandemic and now needing a performance restoration due to increased traffic. Â As such, expected turnaround time will have to be increased due to a lack of supply and maintenance staff to support.

Â

Â

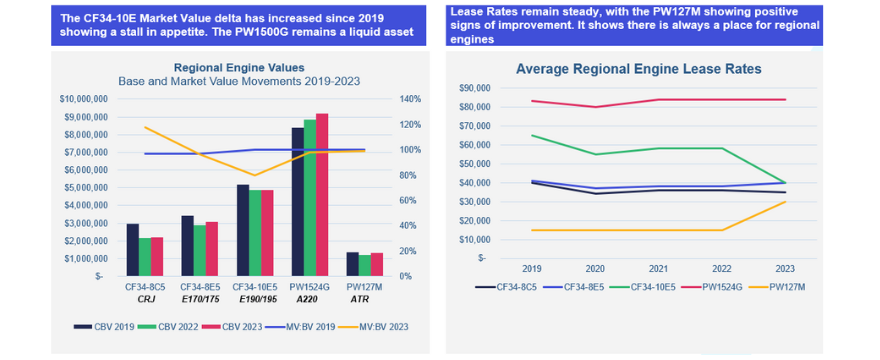

Looking across regional aircraft engine values, the E-Jet engine market remains volatile, whilst the CF34-8C has seen increased demand. PW1524G values are increasing year-on-year, having been at US$8.39m in 2019, rising to US$9.19m in 2023. For this aircraft, the market value is on par with base values at 99%.

Â

Â

Looking at lease rates, these remain largely steady with the PW127M showing positive signs of improvement having doubled from US$15,000 pm in 2022 to US$30,000 pm in 2023.

Â

Get the latest insights on regional engine values and the wider state of the market.

Click here to sign up for the latest IBA webinar and discover our take on the post-Covid recovery for regional aircraft and other sectors of the market.

Â

IBA has one of the largest teams of certified senior appraisers in the industry who partner with aviation and financial sector clients globally to give independent advice on wide-ranging, complex asset valuation requirements.

Related content