05/04/2023

The number of flights operating over the European Easter weekend between 7th – 10th April 2023 will be at 90% of 2019 levels on routes to and from Europe. Aviation intelligence from IBA Insight also reveals that some low-cost carriers will exceed pre-Covid levels.

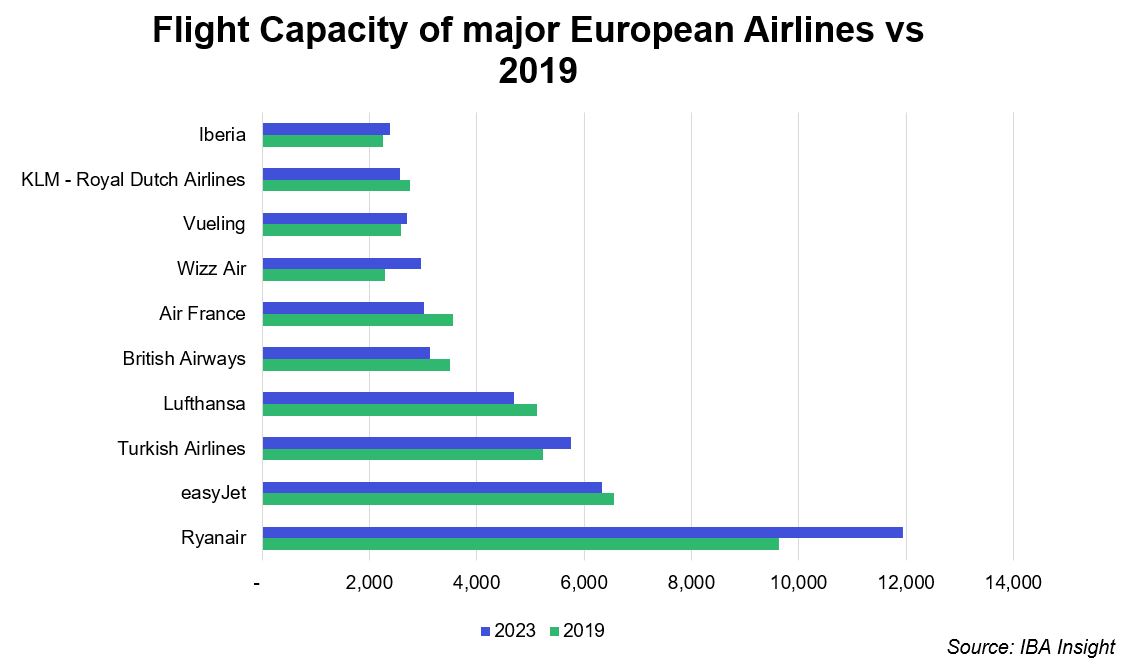

*Number of flights to and from Europe by select airlines. Easter 2019: 19-22nd April. Easter 2023: 7-10th April

Low-cost carriers Ryanair, Wizz Air and Vueling have increased the number of flights operating over the Easter weekend by 24%, 29% and 4% respectively compared to 2019 levels.

Network carriers will remain below pre-pandemic flight volumes over Easter with British Airways at -11%, Air France at -15% and Lufthansa at -8% of 2019 levels.

Planned strikes at London Heathrow over the Easter weekend and the risk of further air traffic control strikes in France indicate some flights may be impacted. British Airways has announced that it is cancelling 32 short-haul flights a day over the weekend.

Flights to the Asia-Pacific region are set to still be 36% below 2019 levels, when there were 3,546 flights over Easter compared to the 2,282 planned for this year.

The Ukraine conflict is causing some of the reduced flights through airspace closures and Russian sanctions.

China's strict pandemic travel restrictions are coming to an end of 4th April and traffic is forecast to increase.

Flights to the Middle East have fully recovered and are set to be slightly ahead of 2023 levels.

Flights to North America in 2023 are only 5% below 2019 levels.

IBA Insight is your go-to platform for aviation data and intelligence, bringing together IBA's vast fleet, flight, values, trends, and liquidity data into one cutting-edge, easy-to-use platform.