18/10/2022

IBA has published its latest aviation Carbon Index in partnership with KPMG. Our latest analysis leverages IBA NetZero's scenarios and projections to forecast the mix of emissions by aircraft type in 2025 based on expected retirements and deliveries.

Aviation carbon emissions intelligence from IBA NetZero reveals that CO2 emissions from the commercial aviation industry averaged 142.25 grams of CO2 per-seat-per mile in September 2022, increasing by 0.2% month on month - the first month-on-month increase since February 2022. This represents a 1.3% reduction in CO2 intensity year-on-year.

The number of flights in September decreased by approximately 8.5% month on month resulting in a fall in total monthly passenger emissions from 59 to 54 million tonnes. However, total flights have increased by 17% year-on-year, tracking just 19% below the pre-pandemic levels of September 2019.

In the news: what happened in Global sustainable aviation in September 2022?

The US Department of Energy (DOE) released a roadmap towards net zero emissions by 2050, including plans to scale production technology, lower costs and improve sustainability of SAF in the American market. US airlines and the government have pledged to support the production of and purchase just over 10 billion litres of SAF by 2030. This equates to the US market committing to producing over a third of IATA's SAF global production targets to reach Net-Zero by 2050.

Air Company, the SAF manufacturer, signed a multi-year agreement MoU with JetBlue and Virgin Atlantic, who have pledged to buy approximately 100 and 400 million litres of SAF respectively between 2027 and 2032.

Gevo announced its ground-breaking SAF 245 acre commercial-scale facility in South Dakota, with construction expected to start in 2023 and deliveries in 2025.

Aemetis finalised its $7 billion contract for 3.5 billion litres of blended SAF (40% SAF and 60% Jet fuel) with airline partners including Delta Air Lines, JetBlue Airlines and Oneworld Alliance airlines.

DG Fuels establish a new plan to deliver 200 million litres every year from 2027, for 7 years to Delta Air Lines.

United Airlines committed to invest $15 million on 200 eVTOL vehicles from EV Air Mobility

EasyJet set to abandon carbon offsets from December 2022, shifting focus to new aircraft and fuel saving technologies. EasyJet hopes to reduce its direct emissions by 78% by

OMV and Lufthansa signed a MoU to produce more than 800,000 tons of SAF between 2023 and 2030.

IATA expects global production of SAF to reach 5 billion litres by 2025, with the US government aiming to produce 11 billion litres by 2030.

Lufthansa Technik and BASF SE puts an emphasis on the use of the “AeroSHARK” or “Shark skin”, a film like material to install on the underbelly of the aircraft to reduce air friction, thereby reducing fuel consumption and by extension carbon emissions. “AeroSHARK” reportedly helps reduce air friction by 0.8% and could reach up to 3%. It has already been installed on all 10 of its 777F aircraft and on a 747-400. They are now looking to fit all the 12-strong 777 fleet with the skin technology, and this could lead to an approximate 1% reduction in carbon emissions.

While there is an increasing clamour of new sustainability initiatives, the lack of cost transparency is a big question mark. IBA NetZero empowers users with that clarity, mapping out potential mitigation strategies and projecting cost impacts over time.

Chris Brown, Partner and Head of Strategy in Ireland, KPMG, shared his comments on developments in the EVTOL sector:

“Tailpipe CO2 emissions only contribute around 40% of the total airside climate forcing impact. That's why we looked at the low hanging fruit in ground operations, including engine use in the taxi cycle in our recent thought leadership papers. We have also updated our ‘Air Taxi Readiness Index' for 2022, highlighting the roles of countries, lessors, and other players in smaller electric and hybrid aircraft helping to decarbonise the sector. Whilst our modelling suggests that only around 3% of all commercial aircraft energy needs will be met by electric solutions by 2050, this masks much higher penetration rates on some short-haul and regional routes. In our 2021 index, we foresaw both the entry into electric S/VTOL by existing lessors (think Avolon-e), as well as niche lessors drawn to this growing market as type and production certifications are granted.”

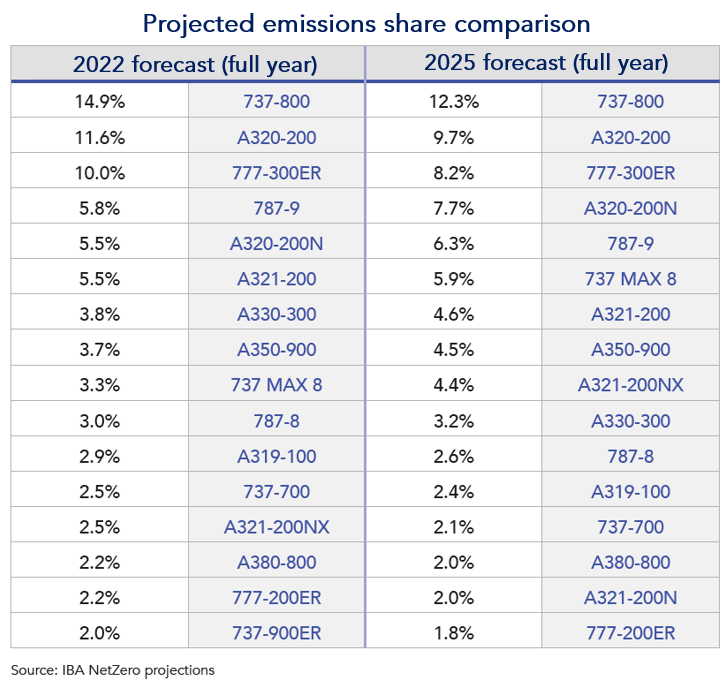

This month we used IBA NetZero to forecast the share of emissions by aircraft type in 2025. We combined the latest 6 months' utilisation and global network activity with orderbooks and aircraft retirements from IBA Insight.

New generation aircraft will drive improved efficiency

Whilst our projections show the Boeing 737-800, Airbus A320-200 and Boeing 777-300ER retain the highest share of CO2 in 2025, share is reducing. Select new generation aircraft move up our rankings by 2025, including the Boeing 737 MAX 8, Airbus A321-200NX, and A321-200neo. Along with operational improvements, new generation aircraft are the cornerstone of decarbonisation plans in the short to mid-term, and recent offerings from the OEM's are already proving popular with airlines and lessors looking to improve the efficiency of their portfolios. New generation aircraft are often on average around 15% more efficient than their previous generation counterparts, and will be driving notable efficiency savings by 2025 .

We also calculated the compound annual growth rate (CAGR) per aircraft in projected emissions between 2022 and 2025.

The Airbus A321neo has the highest growth rate of almost 50%. We expect to see the popularity of the A321neo among operators increase more than any other commercial aircraft. This is thanks to the aircraft's strong orderbook and delivery pipeline built on its proven performance and fuel efficiency.

The Airbus A321NXneo and the Boeing 737 MAX 8 follow with increases of almost 30% and the A320-200N at just under 20%. Unsurprisingly, we expect emissions from previous generation narrowbodies to grow the least due to retirements, with the more niche Boeing 737-700 and Airbus A319-100 showing the smallest increases. Finally, the negative CAGR of the 777-200ER is due to retirements and the increase in new generation widebody deliveries.

IBA NetZero is the most advanced finance-focused carbon modelling tool available. It's powered by IBA's proprietary fuel-burn intelligence integrated with the unparalleled accuracy of Insight's Flights and Fleets module to illustrate carbon emissions by any combination of: time period, airline, lessor, aircraft MSN and model, fleet, future portfolios, OEM, country, airport and route pair.

関連コンテンツ

IBAは、KPMGと提携して最新の航空炭素指数を発表しました。2022年8月の最新分析には、世界で最も効率的な航空会社の地域別に含まれています。