10/11/2022

IBA has published its latest aviation Carbon Index in partnership with KPMG. In our latest analysis, we use IBA NetZero to shine a light on regional attitudes to emerging CORSIA emissions regulation.

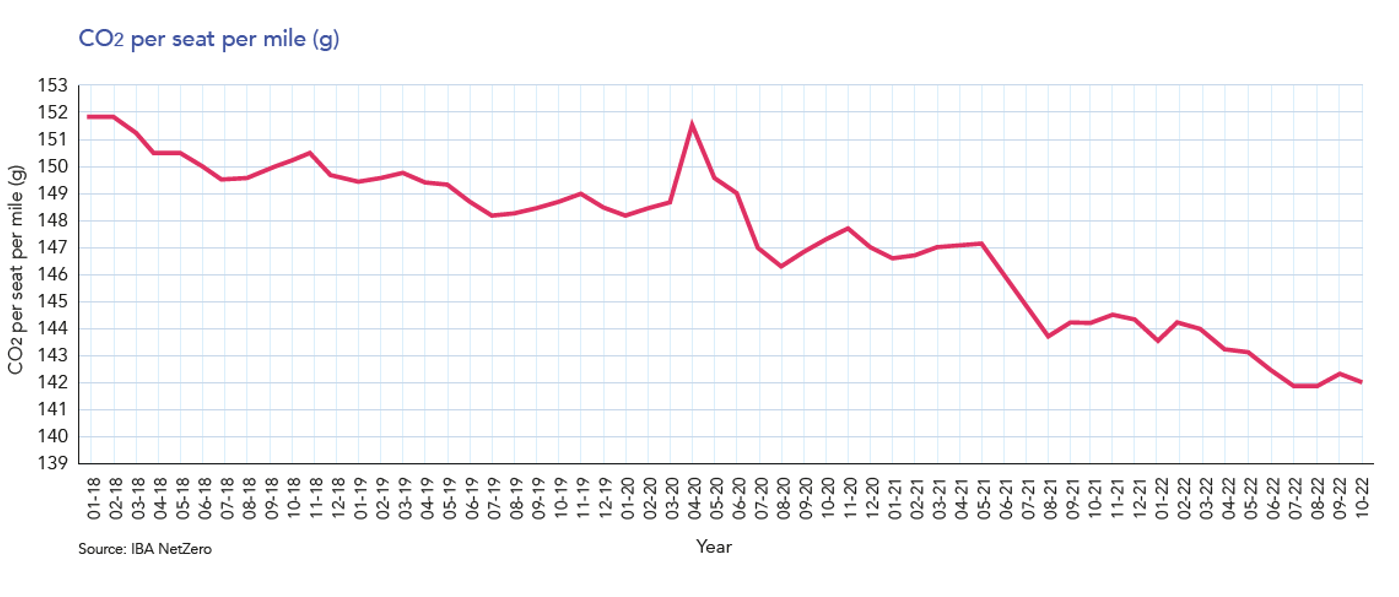

Aviation carbon emissions intelligence from IBA NetZero reveals that CO2 emissions from the commercial aviation industry averaged 142.07 grams of CO2 per-seat-per mile in October 2022, decreasing by 0.1% month on month and tracking back towards the summer’s new lows. This represents a 1.4% reduction in CO2 intensity year-on-year. The total number of flights in October decreased by less than 1% in comparison to September.

Total emissions are up 18% year-on-year from October 2021 due to increased passenger confidence with vastly reduced COVID restrictions. Comparisons to pre-pandemic show the improvement in fleet efficiency. Total emissions were down 25% from October 2019, outstripping the decrease in flight numbers of 18.6% from the same period.

"We can take positives from a 1.4% reduction in CO2 intensity year-on-year, albeit it we know the industry’s 2050 targets will need that pace to accelerate. We see a widening momentum on the decarbonisation topic, with lessors also increasingly involved – for example, 32 members of Aircraft Leasing Ireland (ALI) signed an industry-first Sustainability Charter during ALI's first Global Aviation Sustainability Day event in Dublin on 27th October 2022.

This sets the basis for aircraft lessors to take a united position on sustainability on what has often, to date, been seen as an issue for airlines and OEMs. Shane O'Reilly, our Director for Sustainable Futures at KPMG and head of the working group leading the charter's drafting, said a combination of surveys and interviews with ALI members had been used to arrive at the set of principles across environmental, social, and governance priorities. We expect assertive lessors to take increasingly direct interventions on the decarbonisation topic, across a range of actions – from off-setting schemes and placing new propulsion small aircraft through investment in SAF production".

Chris Brown, KPMG

After two weeks of discussions at the International Civil Aviation Organisation’s (ICAO) 41st assembly, states came together to adopt a collective long-term aspirational goal (LTAG) in early October. The agreement, described as a historic outcome, outlines the commitments of all ICAO member states involved to a global goal of net-zero carbon emissions by 2050. The assembly placed particular emphasis on viable financing and ICAO support to boost SAF development, while also naming innovative aircraft technologies and streamlined flight operations as crucial to meeting the challenge.

Air France-KLM Group agreed an expansion of their existing cooperation with key SAF producer, Neste. This equates to over 1 million tonnes over a period of 8 years, starting in 2023. Part of the Group’s 30% CO2 reduction target by 2030. This is one of the largest deals of its kind to date. Additionally, they have signed a 60,000-tonne offtake with American SAF producer, DG Fuels, over 10 years from 2026, from their planned Louisiana plant.

Air New Zealand has taken delivery of their first SAF shipment from Neste to help with testing and supply chain development. This comes as Neste expands its Singapore refinery, alongside its European facilities. This initial delivery will aid in the potential development of a localised SAF supply chain in New Zealand.

Members of parliament in France are discussing adding taxes to business jet operations to target their disproportionate environmental impact. This comes after claims from groups such as the European Federation for Transport and Environment that a fuel tax could generate upwards of €660 million USD.

Bill Gates’ Breakthrough Energy, and its collection of public and private sector partners, have announced its first Catalyst Project funding winner as SAF technology company, LanzaJet. The $50 million grant will go to their Freedom Pines Fuels plant in Georgia, USA: the world’s first alcohol-to-jet facility.

Etihad Airways have combined SAF with leading contrail mitigating technology, SATAVIA, to mitigate both the CO2 and non-CO2 impacts of a flight from Tokyo. SAF was supplied through Neste and the ITOCHU Corporation, abating 75.2 tCO2, in addition to the flight plan being optimised to avoid contrail creation, saving an estimated climate impact of 71 tCO2

Keep track of how these initiatives impact commercial aviation with IBA NetZero. It empowers users with unparalleled detail for CO2 emissions analysis, mapping out potential mitigation strategies and projecting cost impacts over time.

Despite the growing spotlight on aviation emissions thanks to COP27 in Sharm El-Sheikh, Ryanair Group CEO Michael O’Leary remains confident that demand for flights can continue to grow post-COVID, and that the industry is adapting to decrease carbon intensity:

“There is very little evidence of the impact of (environmental) flight-shaming. Propensity to travel remains high in Europe as a result of full employment, rising wages and two years of pent-up demand and accumulated savings while people were ‘locked up’ during COVID.”

Ryanair also recently announced the retrofitting of their Boeing 737NG fleet with Scimitar winglets, saving an additional 1.5% of fuel burn and corresponding CO2 emissions across over 400 aircraft. This illustrates the agile nature of operators in response to high fuel prices and an increasingly climate-conscious consumer base.

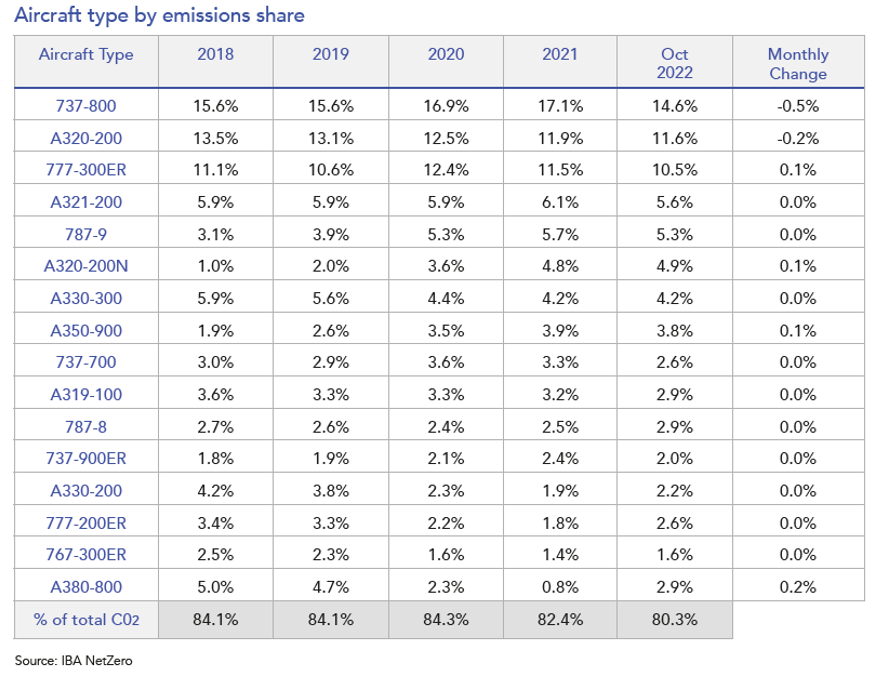

We use IBA NetZero to review the balance of emissions by aircraft type. This allows us to understand the most popular aircraft types today, and the likely changes in the coming years. Our recent analysis indicated that the Airbus A321neo would show the highest growth in popularity amongst new generation aircraft types by 2025, thanks to its market-leading performance and efficiency.

Whilst the Boeing 737-800 retained its position at the top of our ranking, its share has continued to decline and has dropped by 1.1% since August 2022, now standing at 14.6% of total CO2 emissions.

We believe that fleet renewal is currently the leading driver of change in this ranking. That said, operators continue to optimise their current generation fleets, as with Ryanair’s scimitar winglet retrofit program. The 737NG is generally falling behind in terms of overall operational efficiency compared to its new generation counterparts, notably the A320neo and A321NX, and 737 MAX family. Newer generation aircraft are, on average, around 20% more fuel efficient than their current generation counterparts, with aircraft such as the Airbus A321Nx proving particularly attractive to operators.

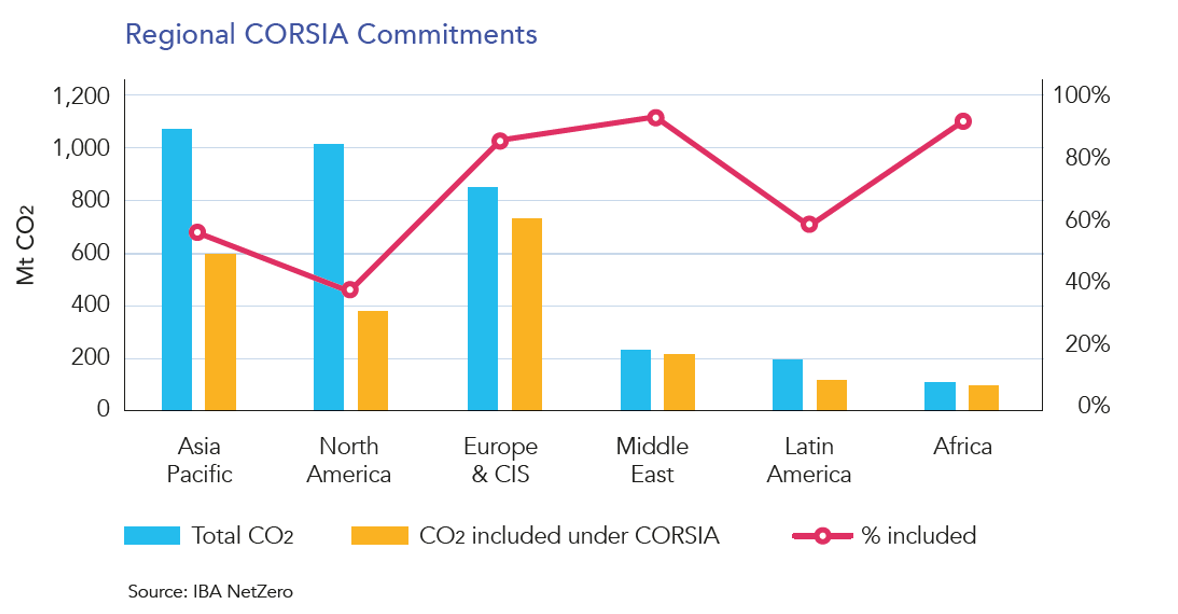

We used IBA NetZero to assess sustainability commitments on a regional basis, and their emissions exposure under ICAO’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). CORSIA is the first global market-based measure for any sector, but will not become mandatory for ICAO member states until 2027. The voluntary status is therefore a solid indication of which regions and their airlines are best preparing for upcoming increases in the cost of compliance.

Our data shows that Europe & CIS, the Middle East and Africa are all voluntarily including at least 85% of international flights in CORSIA. This means that CORSIA regulators will be able to calculate an accurate offsetting obligation for carbon emissions above the 2019-20 baseline of airlines, and they will subsequently be exposed to the actual costs associated with CORSIA well in advance of 2027. In contrast, airlines in North America, Latin America and Asia Pacific are lagging behind, with North America including just 38%. Whilst CORSIA is still in its trial phase, it serves as a signpost that the attitudes of regions to voluntary compliance remain adrift, even despite a coherent global target of net-zero by 2050.

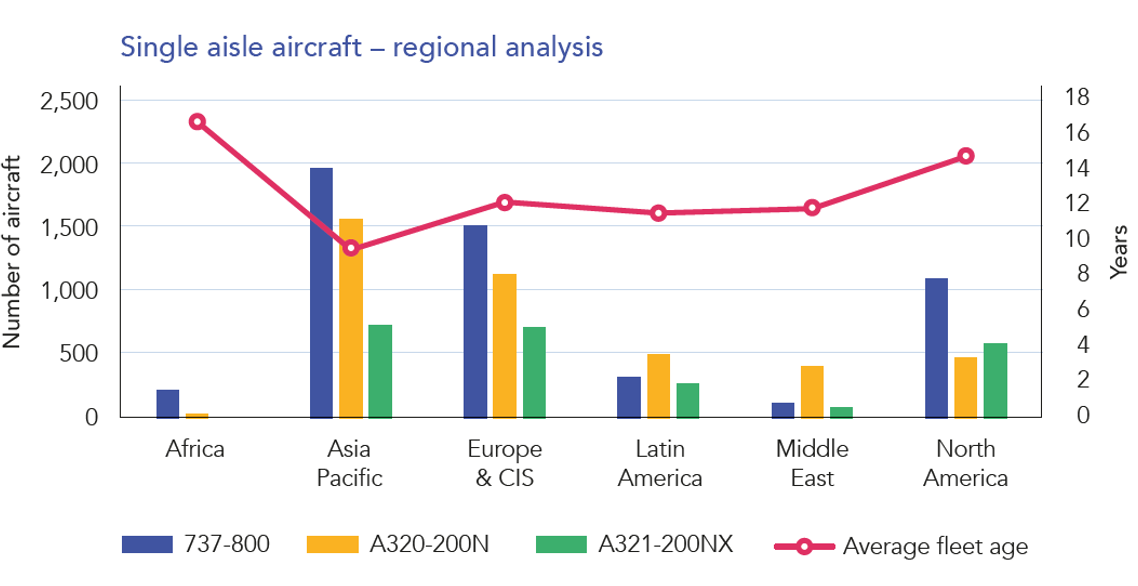

A fleet analysis sheds further light on the current state of global commitment to unilateral targets. Africa, and particularly North America (the region disclosing the least amount of international aviation to CORSIA) has the smallest share of next-generation single-aisle aircraft, along with the second-oldest average fleet age. North America has the most work to do to minimise the cost of compliance through an efficient fleet before CORSIA becomes mandatory for airline reporting in 2027.

Source: IBA Insight

Fleet renewal is just one aspect of ICAO’s pathway to meet net-zero, and they place considerably more emphasis on SAF development and uptake, and the eventual impact of CORSIA. The SAF-heavy nature of October’s sustainable aviation news offers encouragement for the investment environment into existing and new technologies. IBA’s NetZero projections will continue to provide leading mitigation pathway and cost intelligence across operators and models.

IBA NetZero is the most advanced finance-focused carbon modelling tool available. It's powered by IBA's proprietary fuel-burn intelligence integrated with the unparalleled accuracy of Insight’s Flights and Fleets module to illustrate carbon emissions by any combination of time period, airline, lessor, aircraft MSN and model, fleet, future portfolios, OEM, country, airport and route pair. IBA NetZero also builds in SAF modelling to look at the impacts of different SAF feedstocks and percentages across any flight mix.

関連コンテンツ

IBAは、KPMGと提携して最新の航空炭素指数を発表しました。2022年8月の最新分析には、世界で最も効率的な航空会社の地域別に含まれています。

IBAは、KPMGと提携して最新の航空カーボンインデックスを公表しました。2022年4月の最新分析では、ABS構造にスポットライトを当てています。