13/12/2021

Read IBA's updated Aviation Carbon Emissions Index. The article ranks aircraft & more by CO2 emissions. Find out more here.

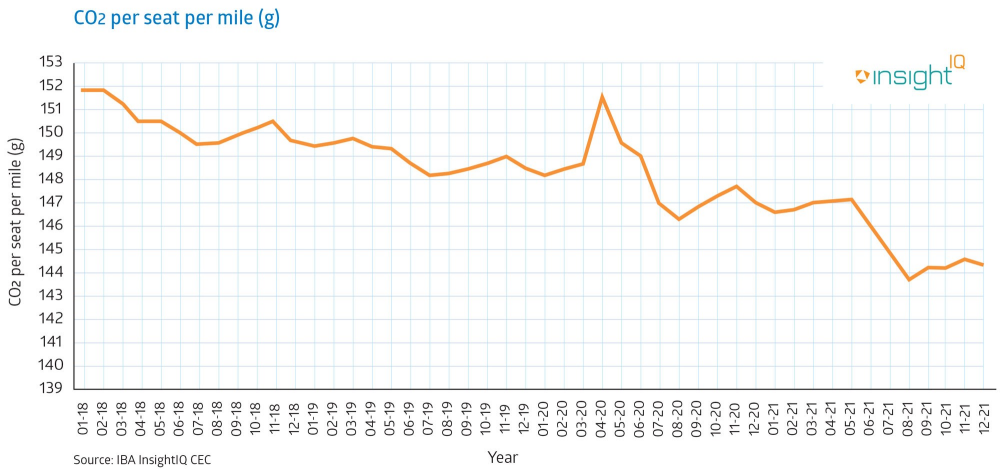

The commercial aviation industry averaged emissions of 144.314 grams of CO2 per-seat per-mile this month, with overall efficiency improving by 0.1%, This represents a continued trend on recorded changes in the past releases of this index, showcasing the industry's clear efforts to drive down overall emissions.

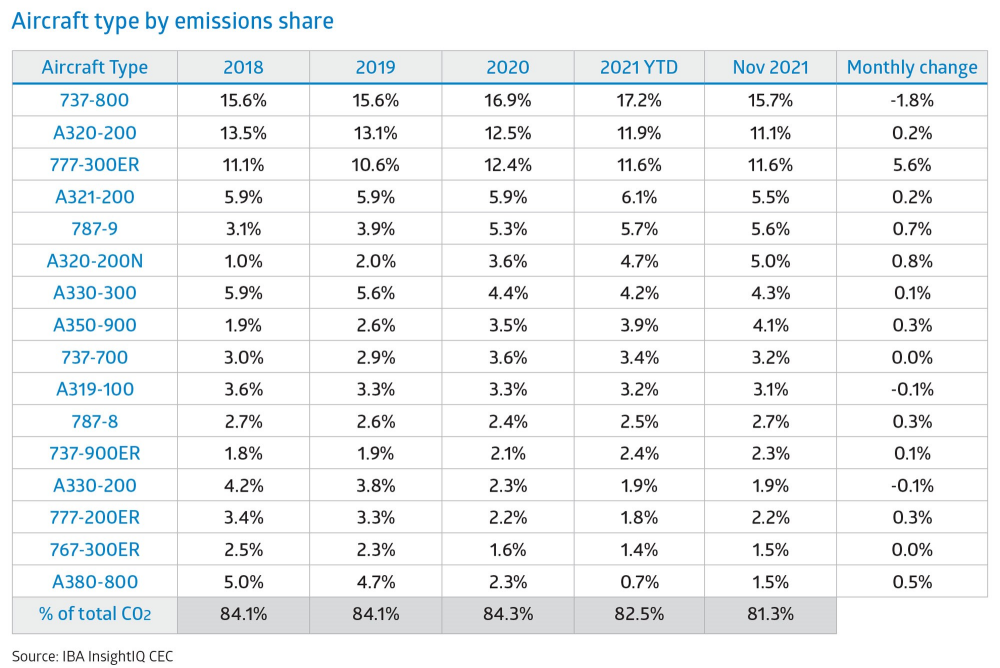

The Boeing 737-800 aircraft retains the highest share of CO2 emissions, though its share has fallen by 1.8% in the past month. This is a result of a significant increase in emissions share for the Boeing 777-300ER, which increased by 5.6% in November. Interestingly, the overall flight volumes for the 777-300ER reduced around 5% in this period, but average sector length increased by around 6% (with the average emissions per flight increasing by a similar amount).

Other movers include the Airbus A320-200neo, which saw flight volumes increase by 2.1%. 22 of these aircraft were delivered in October, increasing its emissions share by 1%. As British Airways and Qantas return the A380 to service, we will expect to see its figure grow beyond the current 1.5% emissions share.

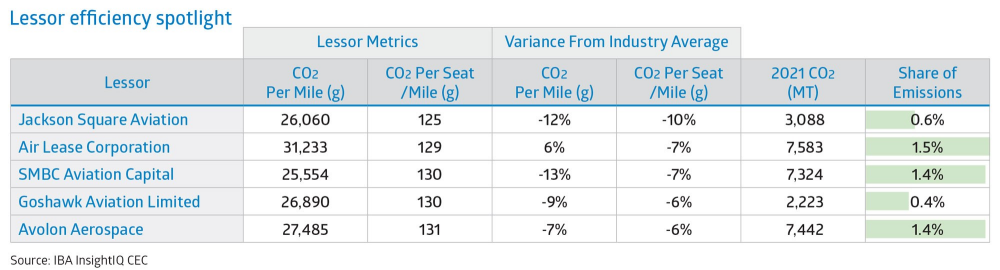

Examining lessors through the lens of CO2 per-seat per-mile, Jackson Square Aviation and Air Lease Corporation are at the top of this month's ranking. IBA anticipates these figures to improve over the coming years as more orders are fulfilled by the OEMs and new generation aircraft are delivered to the airlines. The overall share in emissions attributable to lessors has increased by around 0.01% in line with increased lessor activity in the market.

Chris Brown, Partner & Head of Strategy at KMPG, acknowledges why this information in this month's Index is important and how it relates to aircraft lessors:

"Any effective corporate climate change strategy requires a detailed understanding of your greenhouse gas (GHG) emissions. The leading lessors now understand the need to also account for GHG emissions associated with their asset portfolios to comprehensively manage GHG-related risks and opportunities, which falls into scope 3 of the GHG protocol."

"The Scope 3 Standard recommends that companies identify which scope 3 activities are expected to have the most significant GHG emissions, offer the most significant GHG reduction opportunities, and are most relevant to the company's business goals."

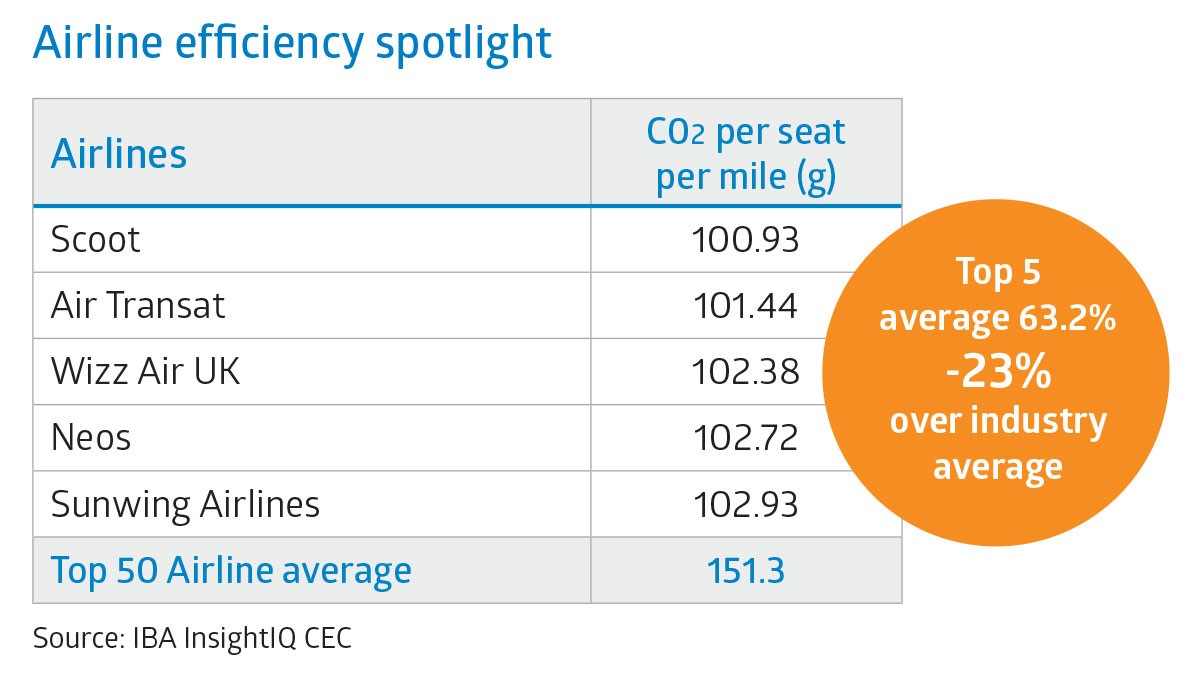

Scoot ranks at the top of our airline efficiency ranking this month based on CO2 emissions per-seat per-mile. Scoot has climbed the rankings in 2021 due to a large portion of its Airbus A320-200 fleet being stored in 2020. The average age of their stored fleet is 9.7 years - which is young for the type. Scoot's position in the ranking is bolstered by the remaining fleet make-up, comprising high-density dual class Boeing 787-8, 787-9s and single class Airbus A320-200neo aircraft with an overall average age of 5.7 years.

Wizz Air UK also ranks promisingly this month. Whilst the fleet consists largely of A321-200ceo aircraft, these are fitted with the comparatively efficient IAE V2533-A5 SelectOne engine, and are late-delivery examples with an average age of just 3.1 years old. Another noteworthy development is a 3-fold increase in utilisation at Sunwing Airlines in the latter half of 2021, with the operator benefitting from the Boeing 737 MAX 8 entering the fleet and taking up a growing share of flights through November and into December.

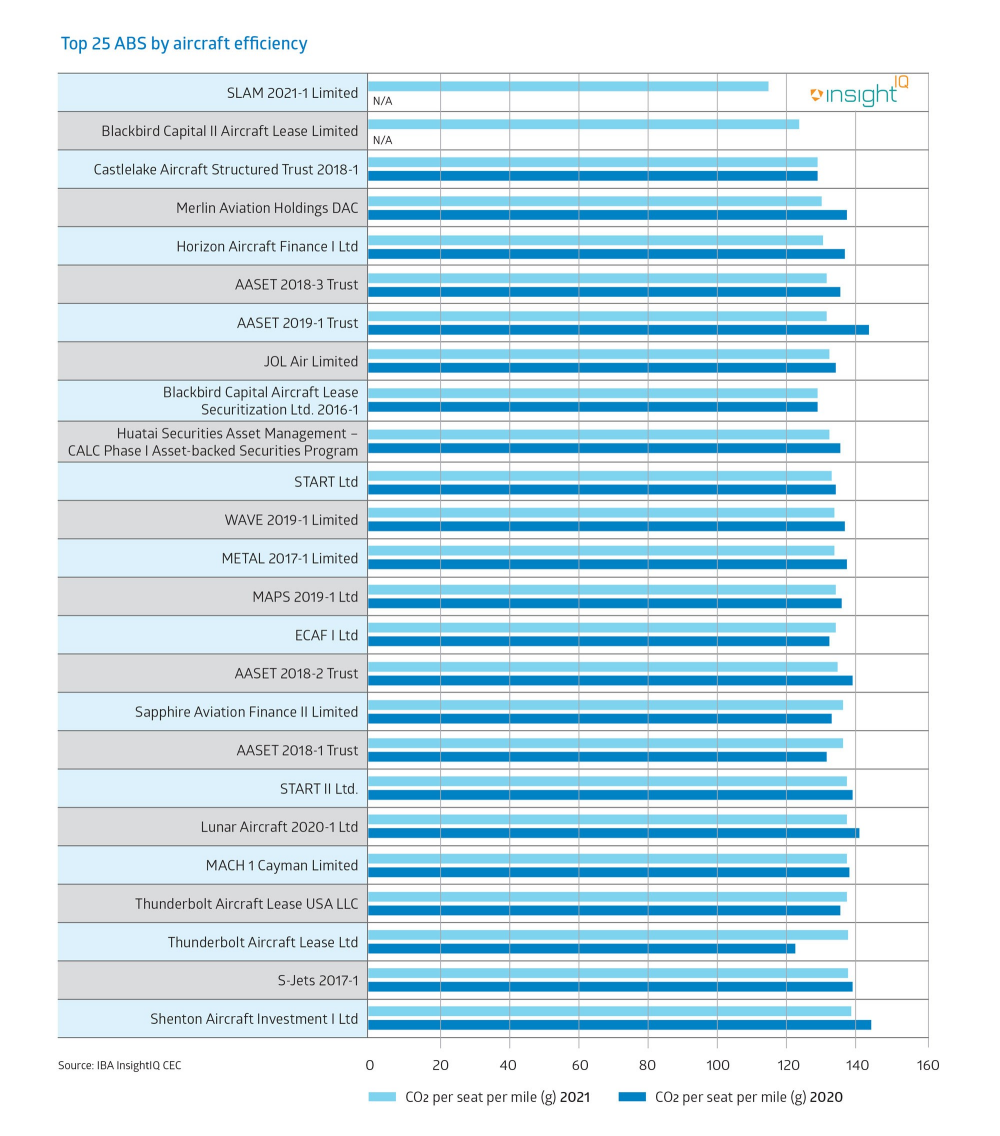

This month, IBA highlights the top 25 ABS structures in terms of aircraft efficiency, measured by CO2 per seat per mile from the start of to 2021 YTD.

Within pre-pandemic ABS structures, we did not typically see younger asset types represented. Assets were usually around 6-8 years old when they entered portfolios, and so will inherently have higher per seat figures than the newer aircraft due to the generational change in efficiency. The best performer within the ABS efficiency ranking is SLAM 20211 Limited, which consists of a blend of 8 Airbus A321-200neo's, 3 Boeing 737-900ERs and one Airbus A330-900. The composition of aircraft within this ABS lends itself towards a good efficiency rating based upon a majority of the A321-200neo's being in a high-density single class configuration. SLAM 2021-1 Limited, among other ABS' in 2021 have followed a traditional composition of mainly narrowbodies, but have bucked the trend with an overall average age of 2.4 years old; much younger than previous ABS'.

Further down the ranking we see ABS' that follow a more typical trend of asset composition, such as Sapphire Aviation Finance II Limited, with an average asset age of 10.4 years old. This ABS consists of aircraft mostly operating with Eastern European and Russian operators and benefit from A330ceo aircraft with high density dual class layouts, helping drive the overall efficiency rating on the portfolio.

IBA's aviation Carbon Emissions Index is powered by our Carbon Emissions Calculator, part of InsightIQ.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.

関連コンテンツ