20/10/2020

Using IBA's Operator Score for a sample of operators, we spotlight COVID-19's influence on the aviation industry and analyse government support for airlines as a proportion of their net profit, comprehensive margin and cash position. Below, IBA shares its opinion on government intervention to help airlines overcome the risks associated with COVID-19's downturn.

Using IBA's Operator Score for a sample of operators, we spotlight COVID-19's influence on the aviation industry and analyse government support for airlines as a proportion of their net profit, comprehensive margin and cash position. Below, IBA shares its opinion on government intervention to help airlines overcome the risks associated with COVID-19's downturn.

As of September 2020, IBA's research recorded approximately USD 63 billion in publicly announced government support for struggling operators, Europe and North America seemingly receiving most aid at around USD 51 billion. Lufthansa Group and Air France-KLM recorded the highest publicly announced government support, accepting approximately USD 13.6 billion and USD 12.3 billion respectively. While a considerable amount of government support has come in the form of debt or loan instruments (or guarantees of such facilities), in some cases governments have taken equity positions, a notable example being the German government's 20% stake in Lufthansa.

US operators have received about USD 25 billion in government aid so far via CARES Act funds and treasury loans. According to IATA, two-thirds of known government support is in the form of loans and wage subsidies, while the rest is given as loan guarantees, equity financing, taxes, operating subsidies and cash injections.

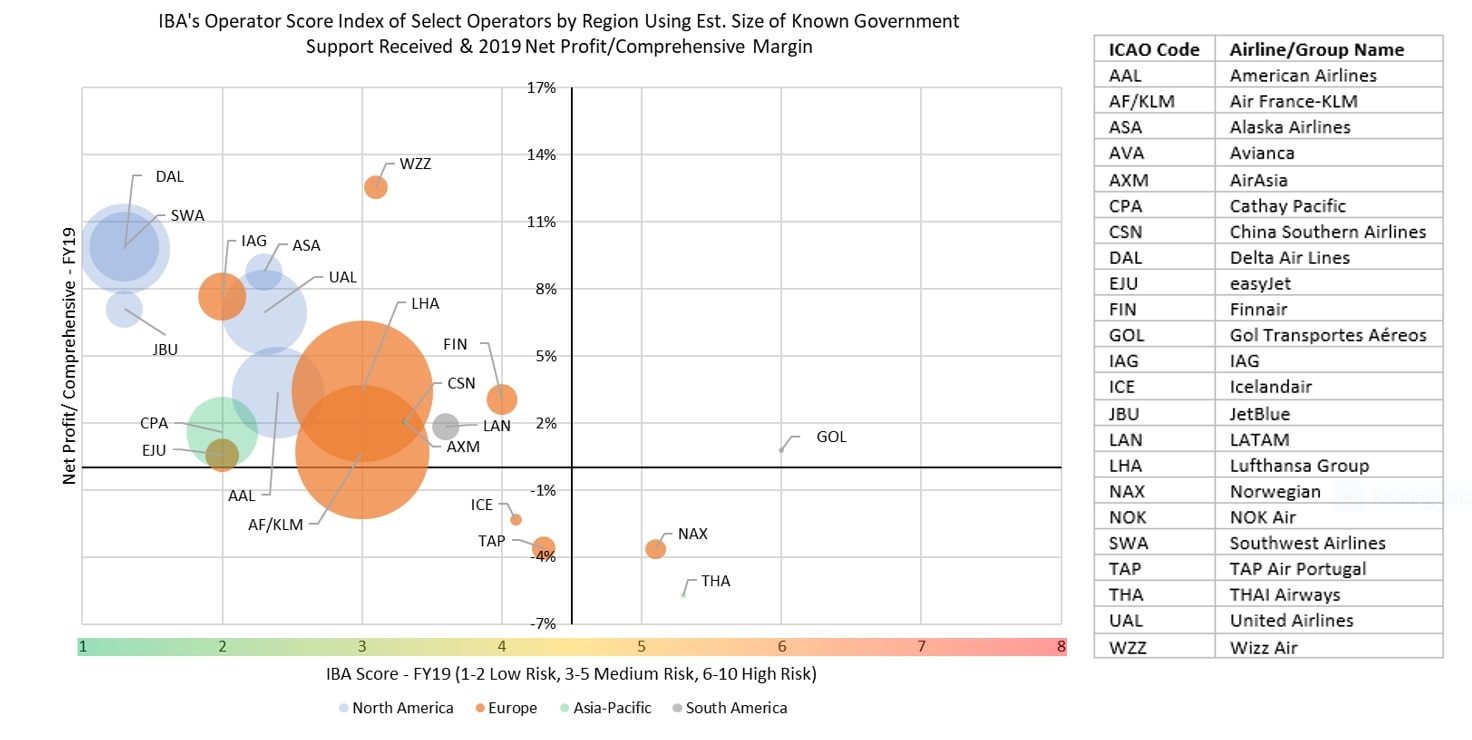

The chart below shows our risk assessment of select operators by region using IBA's Operator Score Index. It displays estimated known government support received and FY19 net profit and comprehensive margins. It represents a KPI to provide a general sense of the overall impact in each region and of the proportion of government support given to airlines. We note operators with positive net profit and comprehensive margins with a low-risk IBA score are more likely to receive large government support packages than medium and high-risk operators.

The chart below shows our risk assessment of select operators by region using IBA's Operator Score Index. It displays estimated known government support received and FY19 net profit and comprehensive margins. It represents a KPI to provide a general sense of the overall impact in each region and of the proportion of government support given to airlines. We note operators with positive net profit and comprehensive margins with a low-risk IBA score are more likely to receive large government support packages than medium and high-risk operators.

While operators in Asia were the first to be affected by the pandemic's restrictions, it appears operators there have been slow to receive government support packages relative to their European and North American counterparts. This trend can be seen throughout Asia, Africa and the Middle East where governments seem to be holding back any large support packages from their national operators. This is probably because governments in those regions were offering operator support before Covid restrictions started. Such operators are therefore unlikely to see large single government support packages, while such aid packages are more probable for their European and North American counterparts due to the rarity of their governments offering support and the uniqueness of the situation.

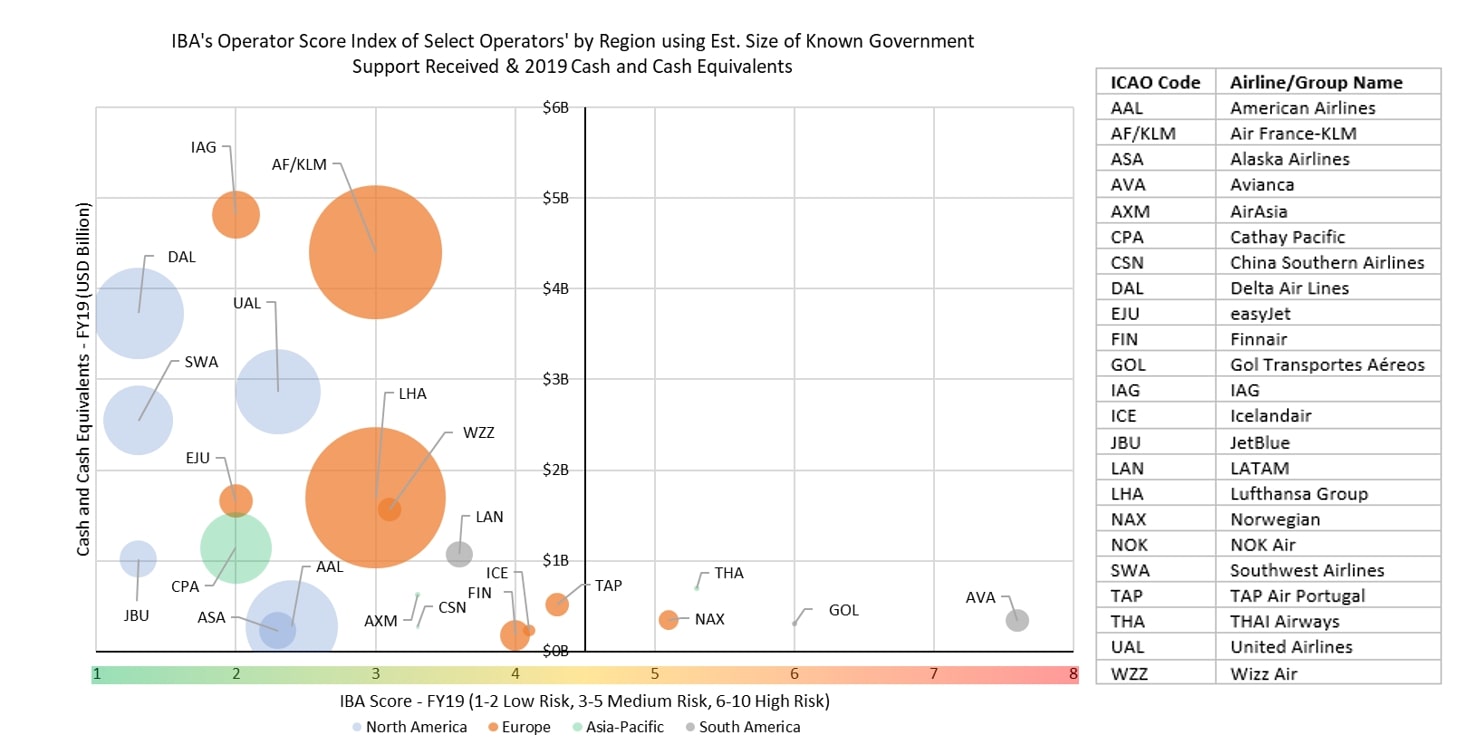

Operators with good, and easily accessible, liquidity positions prior to the pandemic (measured purely by cash and cash equivalents) seem more likely to receive large government support packages than those with weaker positions. Most observed operators with cash and cash equivalents of under USD 1 billion have received around USD 270 million on average. Those with USD 1-2 billion in cash have taken USD 1.2 billion typically and operators with cash positions greater than USD 2 billion have received USD 4-5 billion on average. In some instances, US operators received government support packages 1.5 times larger than their cash position. In the case of Lufthansa Group, a sum six times their cash and cash equivalents position was granted. The chart below shows a risk assessment of select operators by region using IBA's Operator Score Index with the estimated size of known government support received and FY19 cash and cash equivalents positions (excluding restricted cash and short-term investments).

As restrictions triggered by Covid-19 are constantly evolving and a second wave in Europe emerges, the overall impact on the industry is still being determined as restrictions continue to be imposed or removed at short notice. We believe a second wave of government support for operators is possible, as is the likelihood operators will develop more restructuring plans and raise cash privately.

Nonetheless, it is important government support remains proportional to operator size so they remain competitive when the industry eventually stabilises. We expect to see a slower recovery in the near-term, especially for Northern Hemisphere operators entering their lower capacity winter schedule (typically lossmaking) from the weak summer schedule they've experienced. The poor summer has resulted in many operators going into the winter season with weaker balance sheets than one would typically expect, making it likely we will see more casualties unless further government support is provided.

If you have any further questions, comments or feedback please contact: Rami Abdel Aziz