09/07/2020

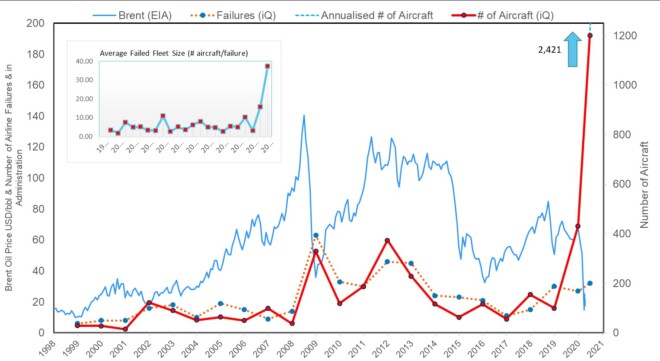

Using data from IBA.iQ, the chart below illustrates the impact of the current crisis on airline failure rates.

For 2020, failures have intensified and survival of the fittest now depends on factors such as cash reserves, payment holidays and government aid until such time as the market re-opens and passenger demand returns.

As the crisis persists, the ability to cover business expenses becomes more difficult and for some, administration offers a way through to restructure debt, fleets and resources to create more robust organisations for the new norm.

At IBA we track the number of airline failures (or those going into administration) using the orange dotted line, and the number of aircraft involved (in red) - overlaid with Brent pricing.

During June, we observed 6 airlines involving 56 aircraft entering administration or failing. To put this into perspective, this equates to the total number of aircraft impacted by failures for the whole of 2016.

When Aeromexico & Aeromexico Connect are added, the total number of aircraft impacted for 2020 surpassed 1,200 aircraft from 32 airlines and therefore takes the monthly rate to 200 or 2,400 if annualised. The rate per event is now around 37 per fleet, down from last month's high of 42.5.

We remain concerned that Q3 of 2020 will bring more failures once lifelines and cash reserves are depleted. In the meantime, IBA expects to see lease and debt restructuring depending on how the return to normal shapes up.

If you have any further questions, comments or feedback on this topic please contact Stuart Hatcher

For information about our airline credit risk monitoring services please fill out the form via the form below.