25/11/2020

Flybe was one of the earliest airline victims of the Coronavirus pandemic, ceasing commercial operations in March 2020. With recent news of a potential revival, IBA explores the former Flybe fleet in terms of redeployment, asset value and the status of the restart.

Following Flybe's collapse in March 2020, there have been several movements towards restarting the airline into commercial service. After the airline's acquisition by the Connect Airways Consortium (Virgin Atlantic, Stobart Air and Cyrus Capital) and its rebranding as Connect Airways, its intellectual property, stock and assets were purchased by Thyme Opco Limited, a hedge fund related to Cyrus Capital.

The Civil Aviation Authority (CAA) initially withdrew Flybe's Air Operator's Certificate (AOC) and route licences after its bankruptcy. However, this happened only in July 2020 because EU Regulation 1008/2008 was amended to allow for the operation of air services during the height of the Covid-19 pandemic. The current state of the discussions between the CAA and Flybe is unclear and the proposed launch of the airline's licensing will be highly dependent on the viability of the company's newly proposed business plan.

The planned business model will have to demonstrate it can avoid repeating past mistakes and therefore focus on aspects such as a homogenous fleet and ownership model, a simplified capital structure and targeting profitable domestic and regional routes.

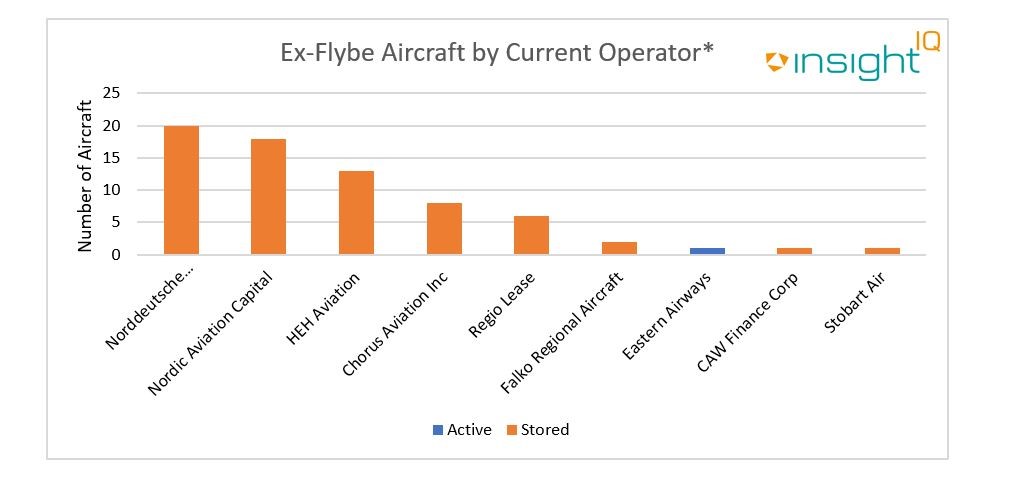

Using data from IBA's intelligence platform InsightIQ, out of the 70 aircraft listed as being operated by Flybe in March 2020, two aircraft are currently with operators: Eastern Airways and Stobart Air. The remaining aircraft that have yet to be placed by lessors and banks as of November 2020 include Embraer E175s, E190/E195s and DHC8-400Qs. Also, it is notable that the ATR72-600s subleased to Flybe through Stobart Air (branded as Aer Lingus) have been returned to Chorus Aviation Inc.

Figure 1 - Ex-Flybe Aircraft by Current Operator*

* If the current operator is shown as a lessor or bank, this means the aircraft has been returned off-lease or changed ownership and has not yet been placed with an operator

Most of these aircraft are in storage, only one currently listed as active and that, an Embraer E170LR, is being operated by Eastern Airways.

The DHC8-400Q dominated the Flybe fleet by number; its current market value range is between US$ 3 million and US$ 7 million. The present age range of these aircraft is between 9 and 18 years old, the average age of ex-Flybe DHC8-400Q aircraft being 13. At the time of its collapse in March, Flybe operated the highest number of DHC8-400Qs in the world. In terms of the asset liquidity, the introduction of a large volume of aircraft into the market is likely to cause some concern.

For the Embraer E170/E175 aircraft, IBA's current market value range is between US$ 7 million and US$ 14 million. The present age range of these aircraft is between 7 and 10 years old. The current market value range of the Embraer E190/E195 aircraft is between US$ 9 million and US$ 10 million and, finally, the up-to-date age range of these aircraft is between 12 and 13 years old.

Given the current state of the industry and the challenges aviation faces as a result of the pandemic, it's difficult to comment on the likelihood Flybe will succeed in future. It will have numerous challenges to overcome before it can be re-established as a viable business model. Assuming the CAA grants the airline's licence, it will first have to rebuild its UK domestic route network. It will now face heightened competition, the likes of Loganair having capitalised on Flybe's downfall and established flights on 16 ex-Flybe routes. Furthermore, many UK domestic routes can be considered 'thin' and will therefore create profitability issues for the airline if it selects the wrong routes and expands them too far as it did previously. On a positive note, IBA believes regional and domestic traffic is likely to return to pre-Covid levels before international traffic. Furthermore, there is still clear demand for intra-UK connectivity, primarily stimulated by time-sensitive passengers looking for an alternative to road or rail travel.

In terms of the assets, given Cyrus Capital's ownership of the DHC8-400Q, its secondary market availability and the airline's technical experience with the aircraft, it would make sense for the airline to recreate its fleet and network using this aircraft and avoid the fleet complexity issues it previously created by adding the Embraer Regional Jet aircraft into the mix.

Lewis Leslie, Senior Aviation Analyst

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.

Related content