13/08/2019

This year, Airbus announced that Airbus A380 production will cease in 2021. There are 12 Airbus A380-800 orders remaining to be fulfilled, of which 11 aircraft are for lead operator Emirates and one aircraft is for All Nippon Airways. IBA is aware that several operators have announced their future plans for the Airbus A380 and it appears that there will be a number of fleet exits over the next 3 to 10 years.

A selection of the announced fleet exits are included below:

Lufthansa - Six A380s to exit the Lufthansa fleet by 2023.

Qatar - Will exit A380's at 10 years old - 2024-2028 exit schedule for the Qatar fleet.

Air France - All A380s will exit the fleet by 2022.

Emirates - Fleet to be withdrawn by mid-2030s.

The level of attrition to the A380 over the next two to three years is likely to be relatively minimal, however the recent Air France announcement that all of their A380 aircraft will come to market by 2022 is significant. This is not only because it represents a near term A380 exit, but also because the French fleet is Engine Alliance-powered.

In terms of market dominance, currently the Engine Alliance GP7000 series leads, powering more A380's than their counter part the Trent 900. However, this dominance is within a highly concentrated fleet, predominantly with Emirates and it will be short-lived. Emirates has switched to Rolls-Royce for its remaining deliveries, taking the Trent 900 into poll position over the GP7270 which powers its earlier aircraft.

Qatar has an Engine Alliance fleet, but it is divesting its aircraft at 10 years old and is not known for taking used aircraft, so there is little chance of placing the aircraft there. Etihad is unlikely to take more aircraft given their current situation and Korean Air appears to be following the increasing trend of taking larger numbers of efficient, high capacity twins in favour of large, four-engine aircraft.

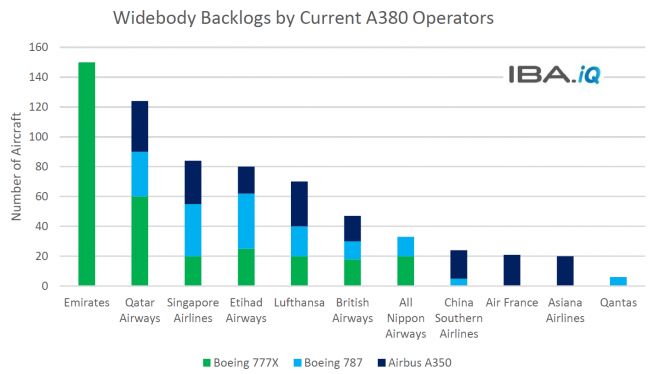

When we consider the order books of the current A380 operators, we can clearly see the trend of operators moving into the large twin engine aircraft, albeit there are dwindling options in the four-engine market. The end of A380 production has been announced and the Boeing 747-8I has garnered no new orders since the US Air Force PAR program in 2017.

Quoting fleet data from IBA.iQ, Emirates has a significant backlog of 150 Boeing 777X aircraft across both the smaller and longer-range Boeing 777-8 model and the higher capacity Boeing 777-9. The Boeing 777-9 is the most popular model and is on order with numerous other key A380 operators such as Qatar, Singapore Airlines and more recently British Airways. Qatar Airways, Etihad and British Airways all hold significant backlogs. Qatar has already inducted its first A350-1000 aircraft as launch customer and British Airways has recently inaugurated the aircraft within its fleet.

From recent experience, IBA understands that used A380 aircraft have not transitioned easily into secondary operators. One of the early ex-Singapore Airlines aircraft has moved into operation with Portuguese ACMI operator Hi Fly and is now flying for Venezuelan carrier Estelar Latinoamerica while its aircraft is out of service for maintenance. Three Malaysia Airlines' aircraft are now flying with flynas to serve the Malaysian Hajj and Umrah market. IBA's data team is also aware that two A380 aircraft are stored at Tarbes and this number seems likely to increase over the coming years.

With key A380 operators selecting twin-engine aircraft for their future widebody fleet requirements and limited apparent interest from potential secondary operators, placing used aircraft in the market will be challenging.

Contact Mike Yeomans, Head of Valuations, for more detailed analysis on the A380, the Trent 900 and the GP7270.

Author

See full profileRelated content