04/05/2021

Lewis Leslie, Senior Aviation Analyst, IBA Advisory, uses IBA IBA Insight Fleets and Values intelligence to explore the structure of the Japanese aviation market.

Executive Summary

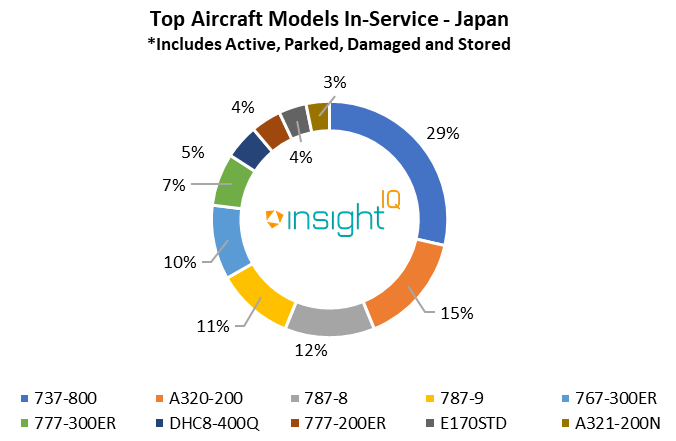

As with many countries around the world, the global pandemic has severely impacted all aspects of the Japanese aviation market. As a consequence, almost 20% of the Japanese fleet still remains either parked or stored, as illustrated below with IBA's InsightIQ Fleet data. Notably, this has improved markedly in recent months. The majority of the parked aircraft are widebodies, with the Boeing 777-200ER (12) and Boeing 777-200 (11) recording the highest numbers. In terms of stored aircraft, the Airbus A320-200 is the highest with 16.

Source: InsightIQ Fleets

Source: InsightIQ Fleets

From an aircraft finance perspective, the Japanese market is often characterised by the Japanese Operating Lease with Call Option (JOLCO) and Japanese Operating Lease (JOL). JOLCO transactions have declined in volume over the last year as the aviation industry has been adversely affected. Aircraft demand and trading volumes are down, which subsequently translates into less demand for tax solutions. However, as demand for new aircraft grows post-pandemic as well as the return of the Boeing 737 MAX programme, airlines and Japanese tax investors will likely increasingly seek out JOL and JOLCO financing.

Source: InsightIQ Fleets

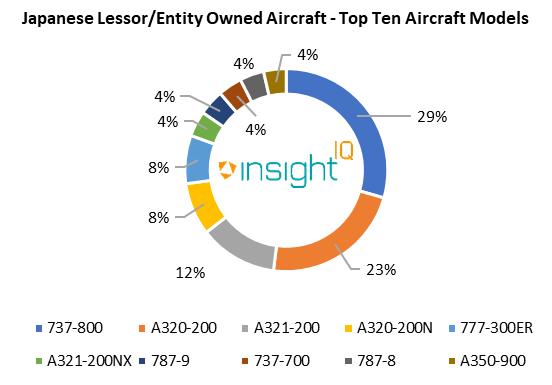

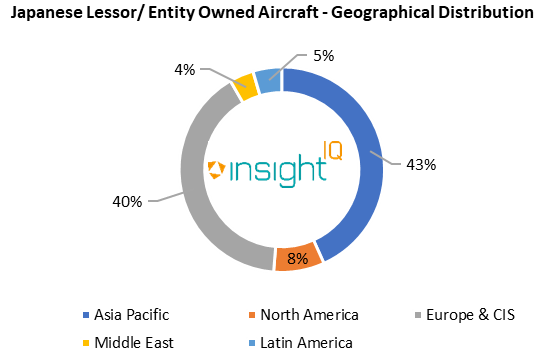

Note: the data illustrated in these graphs does not include Special Purpose Vehicles or Companies and considers aircraft owned by only entities based in Japan.

The geographical distribution chart refers to aircraft owned by Japanese lessors currently on-lease to operators. The top ten aircraft models only consider the top ten most populous aircraft models owned by Japanese lessors and currently on-lease to operators.

Source: InsightIQ

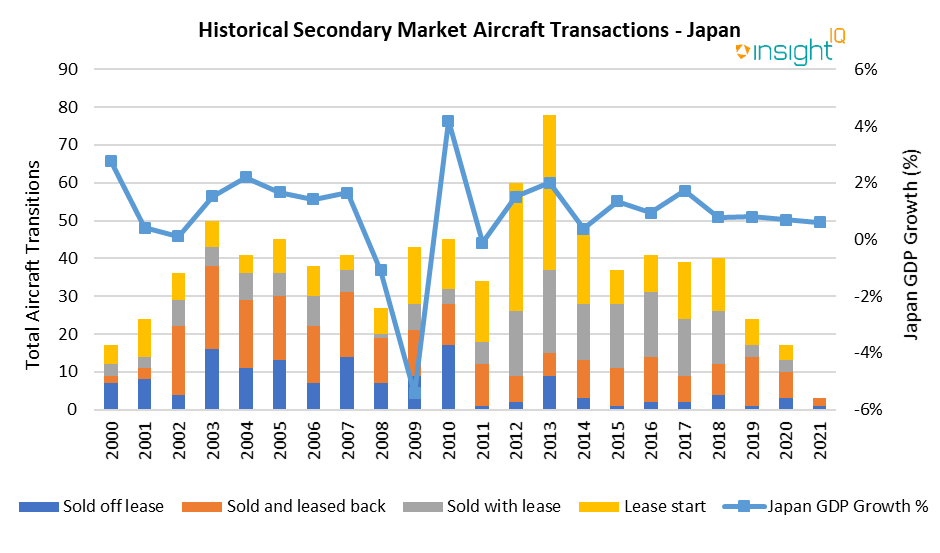

The graph above discounts transactions made by airlines to Special Purpose Vehicles/ Company's, i.e ANA Airways to ANA Holdings. As well as this, with sold off lease and sold with lease transactions, the buyers are Japan based operators, with lease start and sale and leaseback transactions, this in reference to the operator involved and when domiciled in Japan.

InsightIQ Fleets demonstrates that over the course of the pandemic, secondary market transactions have declined significantly. Sale and Leasebacks account for the majority of transactions from January 2020 to March 2021, with nine recorded. Japan Airlines sold and leased back three Airbus A350-900s, with Tokyo Century Corporation, Mitsubishi UFJ Lease & Finance and Diamond Night Ltd. All Nippon Airways has also sold and leased back three aircraft, all Airbus A321-200Ns, with SMBC Aviation Capital and the Special Purpose Vehicle (SPV), Tokyo Leasing Company. Peach sold and leased back two Airbus A320-200N with SMBC Aviation Capital and Fuyo General Lease. Fuji Dream Airlines also sold and leased back one Embraer E175STD with Mizuho Bank.

Looking to the breakdown of the current aircraft in-service in the Japanese fleet, it is likely a large number of these aircraft will be replaced over the next 10 years. The Boeing 737-800 occupies 29% of the current fleet, however, the rate of replacement of these aircraft is uncertain due to the Boeing 737 MAX delays. In terms of widebodies, the Boeing 767-300ER is also well represented in the fleet (8%), with its position likely to be replaced by the Boeing 787 in forthcoming years.

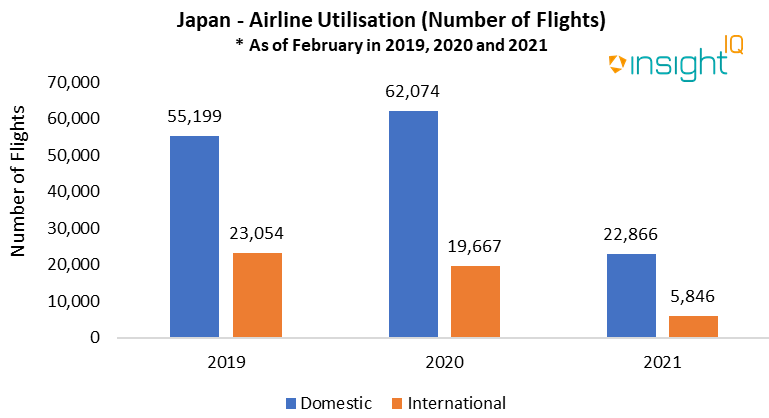

Looking to the graph above, Japan's aviation market and indeed the rest of the world have not reached a point yet whereby aircraft utilization is returning to Pre-Covid levels. As of March 2021, travel restrictions remain in place for foreign nationalities visiting Japan for tourism, with flights only currently allowed for Japanese citizens and permanent residents. As a result, international and domestic traffic as seen above is still clearly being affected. Despite this, in the long-term, IBA believes Japan's aviation market and industry as whole is robust and is well-placed for growth opportunities in the Asia-Pacific region in the coming years.

All Data used and displayed in this article is derived from IBA's proprietary data platform IBA InsightIQ.

If you have any further questions or comments or would like to discuss how IBA can support your business, please contact us.

InsightIQ is a one-stop intelligence platform combining speed, accuracy, visual analytics and intuitive navigation. Its ease of use and exportability creates information clarity which, united with IBA's trusted asset optimisation and valuation methodologies, makes it the global aviation industry's must-have tool.

InsightIQ offers market leading aircraft and engine fleet data, valuations, liquidity analysis, flight data, carbon emission calculations and market trend information.

Sign up for a system demonstration

Related content