09/11/2020

Over the last 12 months, passenger flights experienced some resurgence as we approached the Northern Hemisphere's summer. Many people managed to get a summer holiday and the freight market remained solid.

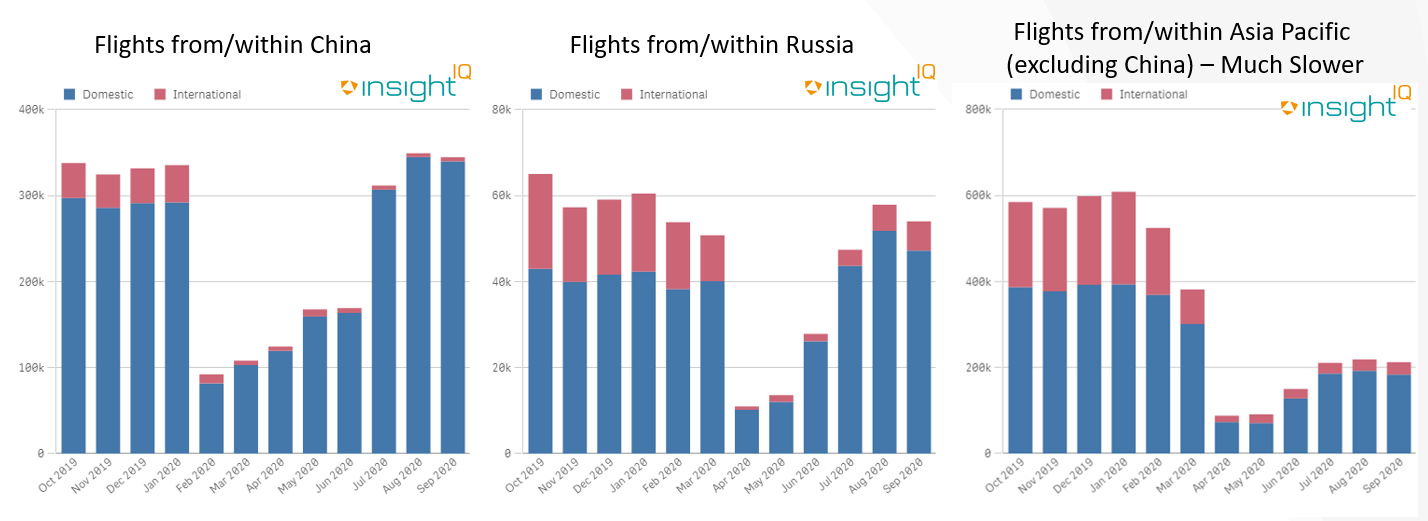

Using flight data from our new data intelligence platform InsightIQ, we identify two markets with capacity growth: domestic China and Russia. Whilst China's Revenue Passenger Kilometres (RPKs) are down 20%, Russia's are positive at 3.8% with load factors in the 80s. Excluding China, the rest of the Asia Pacific region looks bleak with one of the largest capacity reductions in the world.

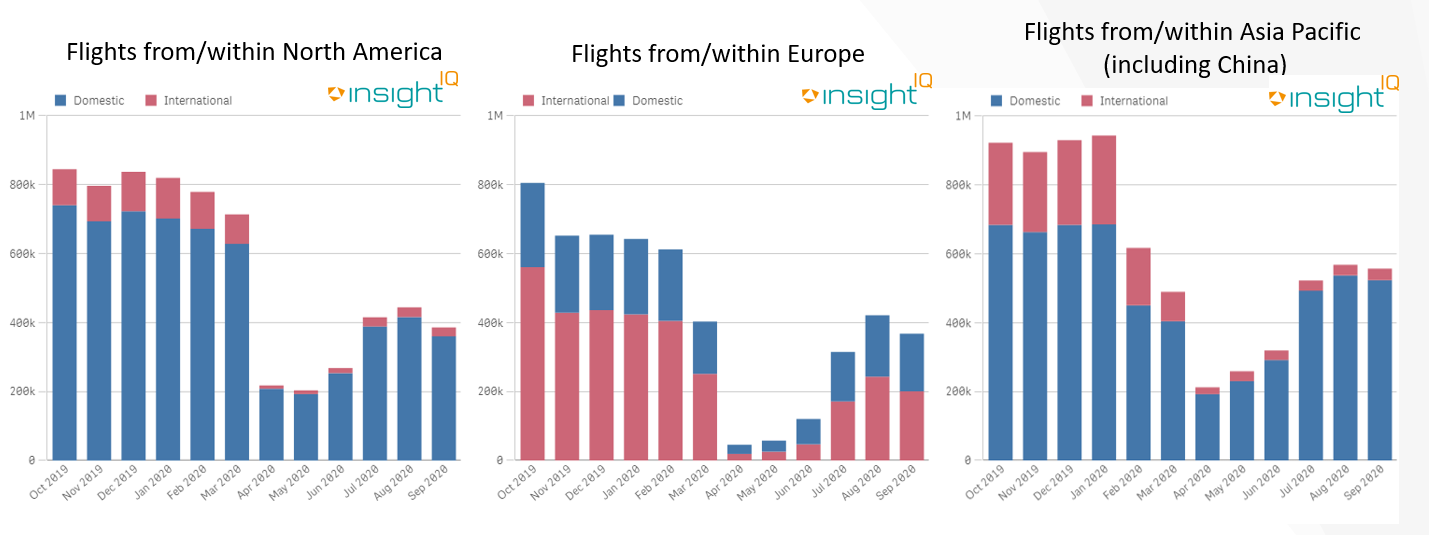

North America, Europe and Asia Pacific including China have seen signs of slow recovery. In Europe, capacity is at 50% of January levels although load factors are still low at around 50-60% and RPKs are almost 70% down. Different quarantine rules between European countries hampered recovery; despite strong demand, particularly in the UK, the complicated rules prevented people travelling.

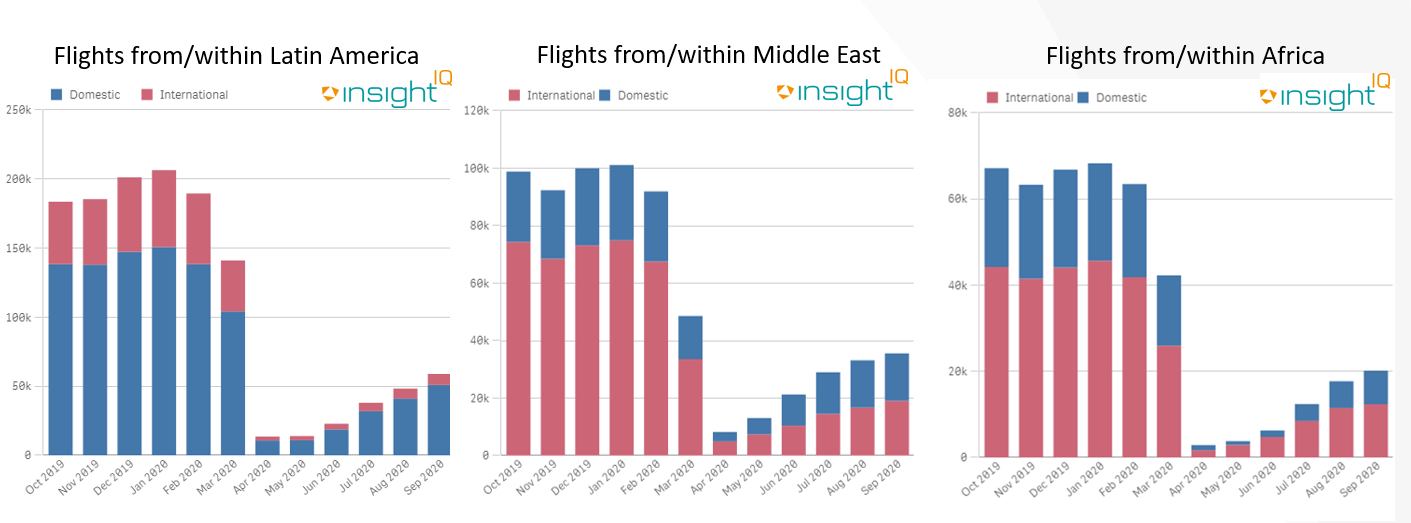

Latin America, The Middle East and Africa have been particularly hard hit. Although the Middle East benefits from government support, the regional economy has been knocked by low oil pricing.

We continue to see distress amongst airlines but there is some positive news on Covid testing and how that may support the opening of some travel corridors. Despite the negative outlook, there are pockets of good news within some markets including China and Russia showing some capacity growth.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.

Author

See full profileRelated content