23/01/2019

Freight volumes are continuing to trend on an upward trajectory and at a solid rate when compared to historical data. It should be noted however, that due to the inventory restocking cycle having concluded and manufacturing export orders remaining low, demand factors are lacking when compared to 2017. This paper looks at the current and future freighter market, production, routes into the market and takes a close look at a B737 conversion.

Boeing and Airbus forecast robust freighter fleet additions for both growth and replacement in the next 20 years. Boeing forecasts, in their Current Market Outlook 2018-2037, that the freighter market will require 2,650 additional freighters (1,670 conversions and 980 new) with Airbus predicting in their Global Market Forecast 2018-2037 that an additional 2,386 freighters (1,560 conversions and 826 new) will be needed.

According to IATA's October 2018 Freight Analysis report, global freight volumes rose by 3.1% year-on-year, which whilst below the five-year average of 5.1%, is in line with what is expected following the conclusion of the inventory restocking cycle. From a seasonally adjusted perspective Freight Tonne Kilometres (FTKs) have grown by just under 4% over the previous six months. Whilst the inventory restocking cycle is no longer driving demand, we have seen high levels of consumer confidence, in addition to the ever-growing e-commerce market.

There is an interdependence between the demand for air-cargo and economic growth. Before the onset of the 2008 global financial crisis, demand for air-cargo was strong but like many markets this shifted as global economies slowed in the years following, and demand flattened. In 2018, once more, the global economy and improved industrial production is driving demand for air-cargo and the extraordinary growth in e-commerce, and the demand for express delivery services is driving bullish growth forecasts for air-freight from the OEMs. It is not just industries which rely on the movement of time-sensitive and high-value goods, such as consumer electronics and perishables, that want air-freight; rapidly growing e-commerce, changes in consumer expectations for fulfilment, and express delivery services are driving the growth in demand for air-freight. E-commerce items reportedly make up 20% of global air-cargo volume.

Current market conditions still favour older generation aircraft, feedstock is still available for the short term and fuel prices are low. However, the market is facing a transition to new generation converted freighters for the long term. IBA expects an acceleration for replacement and growth from 2020, but not before, due to current high market value of new generation feedstock aircraft for conversion.

Production freighters

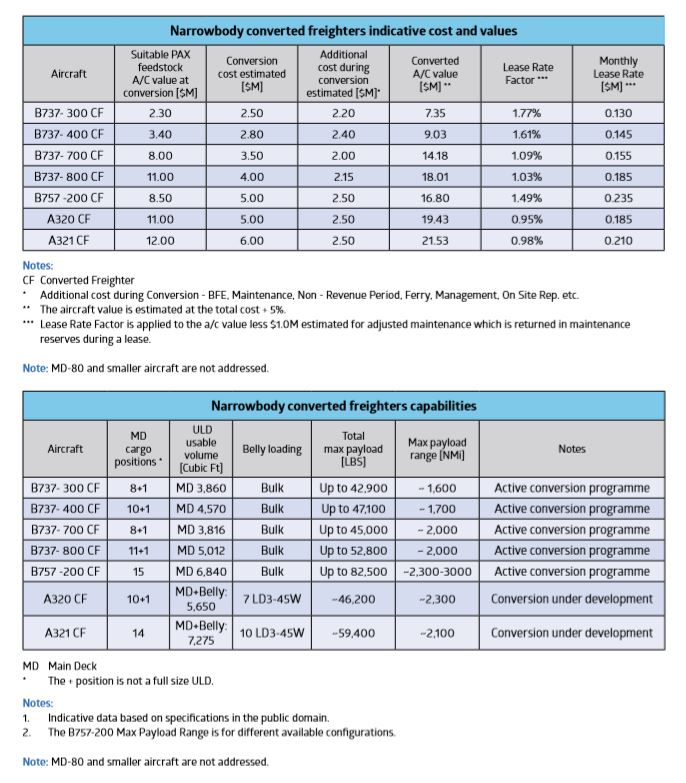

New production freighters are available only in the widebody category (above 40 tonnes payload) and include the B747-8F, B777F, B767-300ERF and A330-200F. Active cargo conversion programmes are only for medium widebody aircraft (40-80 tonnes payload) and include the B767-300ER and the A330-300/-200, both of which entered service in 2018 with DHL and Egypt Air respectively. In the large widebody aircraft (above 80 tonnes payload) the last conversion programme was for the B747-400, with two B747-400 Combis to be converted by IAI for Asiana in 2017.

The B777-200ER/-300ER conversion is not yet launched and has been reportedly under evaluation for over five years.

Currently there are no narrowbody (below 40 tonnes) production freighters offered by the OEMs, except for B737-700C (Convertible) at special order (two were delivered to Air Algerie in 2016). The main barriers to an OEM offering a new narrowbody production freighter is the availability of older narrowbody passenger aircraft that can be converted to cargo aircraft at lower prices. If the OEMs developed a new narrowbody freighter it would likely need a price in excess of $60M.

Narrowbody freighters are mostly operated in low utilisation environments where the acquisition cost of a converted freighter must be low. Widebody freighters, mostly operate in higher utilisation environments (long legs).

Production freighters are favoured by operators that fly the aircraft for the entirety of its useful economic life and therefore benefit from low direct operating costs and high dispatch reliability and efficiency.

The market will continue to evolve, and IBA understands that next generation freighters under consideration may include:

new Production Freighters in the future: A350 B777X, B787, A330neo, A350.

new Conversions in the future: B737-900, B737MAX, A320NEO, B777-200/300.

With 2,000+ freighters needed to meet demand over the next 20 years, investors, financiers, lessors, operators and converters need to understand the opportunities and risks.

The acquisition of a new production freighter is relatively straightforward, albeit requiring an in-depth analysis of the operational requirements and market before aircraft selection is made. After placing the order, it is essential to remain engaged with the OEM to ensure that the aircraft is built to the agreed specification within the agreed price and delivered on time.

Acquiring production freighters in the secondary market is more complex. In addition to the necessary market and operational analysis, an in-depth assessment of the asset condition along with due diligence of the counterparties is required.

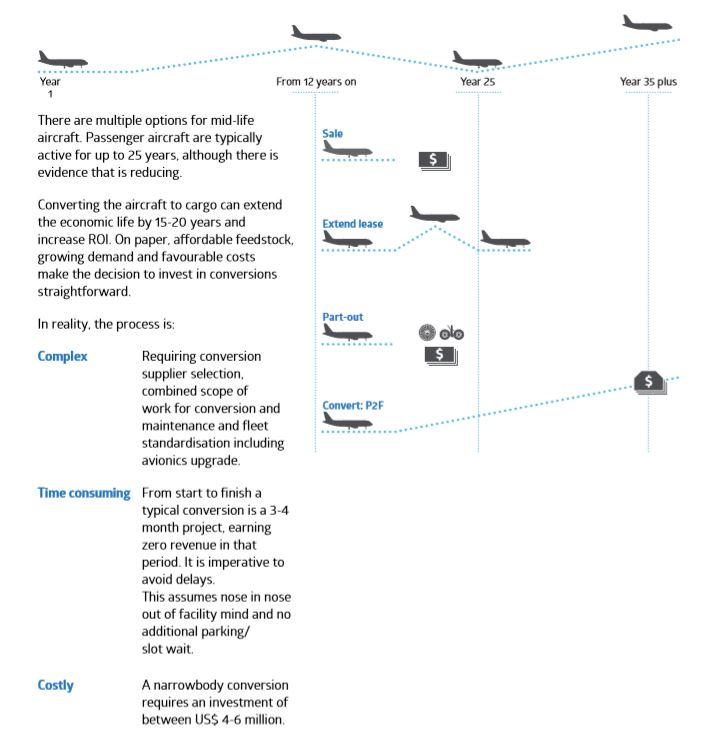

Cargo conversion is the most technically complex route to freighter acquisition and it also offers the greatest potential return. As the diagram on page 5 highlights, cargo conversion is an alternative option for mid-life aircraft.

Today, the useful economic life of passenger aircraft is frequently less than 25 years. Converting the aircraft to freighter can extend the aircraft operation life by an additional 15-20 years given the typical low utilisation in comparison to the higher utilisation in passenger roles.

Converting is expensive and complex. Not only does the conversion require additional investment in the asset, typically millions of dollars, but critically the aircraft is also not generating revenue during the conversion period. Heavy maintenance and modifications are usually accomplished in conjunction with the conversion for convenience and cost saving, but operators and lessors should still plan for three to four months without revenue until the aircraft enters freighter service.

These include:

Current status of the Air-Freight Market and Forecast

Freighters fleet development - New and Converted Freighters market share?

Which passenger aircraft are ideal candidates to become freighters?

Passenger aircraft analysis - Feedstock availability for P2F conversion

Economic evaluation for Mid-Life aircraft - Refurbish/Sale/Lease/Part-Out or Convert

When is the right time to convert?

What is the anticipated cost to convert?

What is the anticipated conversion turnaround time?

What will be the aircraft market value after conversion?

What are the anticipated lease rates after conversion?

What are the differences (cost, specification and other aspects) between the conversion options - OEM and non-OEM?

Are in-house resources available to manage a converted freighter asset through the extended life?

C-Cubed (A320/A321) EFW (A320/A321), IAI (A320/A321) and Precision (A321) have all now launched Airbus narrowbody conversion programmes. After many years of Boeing narrowbody domination there will be competition in this converted freighter segment in the future, B737-800 vs A320 and to an extent vs A321 choice.

There are three conversion suppliers developing the B737-800 conversion: AEI, Boeing and IAI, with over 120 orders and options between them.

PEMCO initiated the development of the B737NG conversion starting with the B737-700. It is anticipated that it will develop the B737-800 in the future.

A B737-800 cargo conversion with maintenance will take between 90-120 days depending on the total scope of work. In IBA's experience, these projects often overrun, typically driven by unforeseen conditions on the aircraft such as existing repairs or production configuration differences, or major findings during inspection which interfere with the conversion kit installation. These will all impact the production flow and the turnaround time.

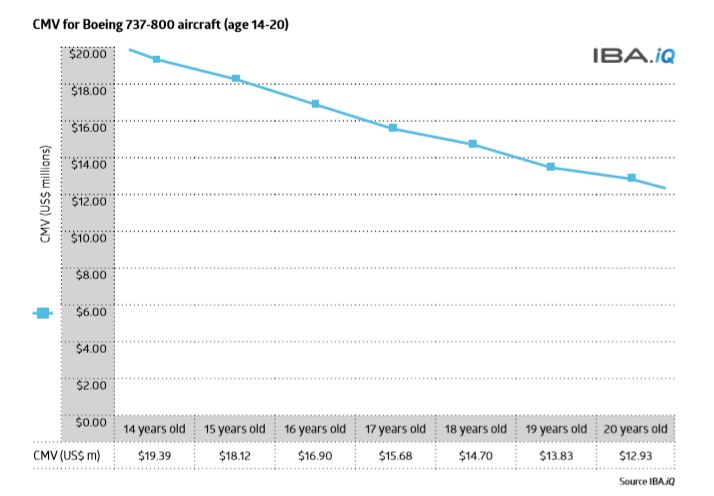

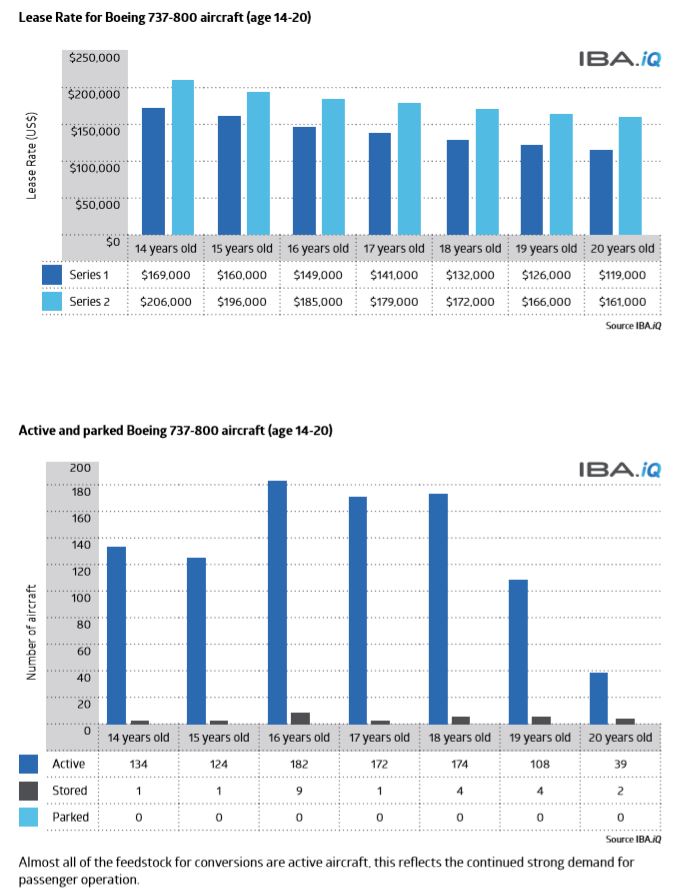

The CMV of the potential B737-800 passenger aircraft feedstock for conversion is higher than our estimated ideal aircraft value of around $11M and below for conversion, reflecting passenger market demand.

Based on this analysis, IBA forecasts that B737-800 feedstock for conversion at the $11m price point will become more available in 24-36 months, with an acceleration for replacement and growth from 2020 onwards.

This assessment takes into account that:

The adjusted value of each aircraft is pending on its maintenance status when the engine condition is a significant factor to the value adjustment

Low utilisation cargo operation does not require half-life potential engines We estimate that, with the STC now available, B737-800 aircraft at adjusted value of about $11M and below (primarily due to engines remaining life potential) will be considered for conversion. These will be leased with LRFs lower than those calculated on the typical half-life/age aircraft value basis.

The differences between Boeing, AEI and IAI with regards to the Main Deck Cargo Door (MDCD) location and the loading configurations and limitations will require different loading procedures for each conversion. In our experience, this can impact operations with mixed fleets from different suppliers.

Since suppliers use different components and parts, mixed fleets from different suppliers will require adequate spares support for each conversion type, which is an additional cost to be taken into account.

Boeing's B737-800BCF is a conversion offered by the OEM. As such, the operator does not need to pay an annual access fee for Boeing support. IAI and AEI conversions are developed under license (granted or assumed to be in progress) from Boeing. However, the operator needs to pay an annual access fee per aircraft for the first four aircraft in a fleet converted by an OEM licensed developed conversion. When evaluating conversion costs, the additional licensing cost applied to OEM licensed converted freighters must be taken into account.

Manuals -The operation and maintenance manuals of the aircraft need to be updated following a cargo conversion. This includes: IPC, MM, WD, FIM, Ops Manual, Flight Manual, Weight & Balance, MEL and more. At this stage, it is unclear if the conversion suppliers are offering Integrated Manuals or Supplements. It is assumed that certain operators will ask for Integrated Manuals. This is an additional cost to be taken into account.

Product Support - It is OEM only for the BCF, and OEM and STC Owner for OEM licensed conversions. This is dependent on aircraft owner/operator preference. For many years the OEMs were not suppliers of narrowbody aircraft conversions when almost all of the narrowbody freighters were supplied and supported by non-OEM conversion suppliers.

If carriage of live animals and perishables is required, then verify capabilities with the suppliers.

Freighter market intelligence and analysis.

Freighter fleet selection - new and converted.

Available feedstock for conversion analysis.

Freighter valuations: On Ramp Cost Estimate, Aircraft Values, Lease Rates.

Consulting on cargo conversion options, addressing all technical and commercial aspects.

Conversion and on-site management.

Second life (Cargo Conversion) or EoL decision.

Evaluation of investment in new cargo conversion development.

For more information contact us.

Related content