20/10/2021

IBA has reviewed and updated our forecasts for widebody aircraft engine trends in October 2021.

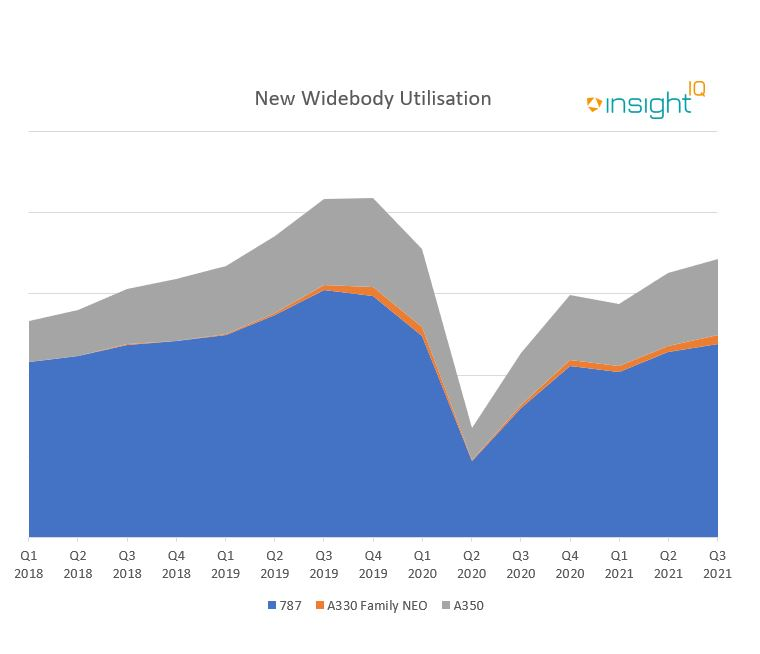

Almost all widebody aircraft engines are showing positive signs and cause for optimism in value. Data from IBA's InsightIQ shows utilisation in freight remains high, and passenger numbers are starting to climb as the world recovers from the pandemic. With Boeing 777F and 777-300ER utilisation at almost 85%, we can even see more mature aircraft come close to the latest generation widebodies, namely the Airbus A350 and Boeing 787. Unsurprisingly, the A380 continues to perform very poorly.

Whilst widebody aircraft engine values overall give cause for optimism, the Pratt & Whitney 4000-112 remains static, and GE-equipped aircraft are generally responding comparatively faster.

.png)

Thanks largely to the Covid19 pandemic, the freighter market has performed exceptionally well over the past year and beyond. As a result, we find the market in a rare position where market values are above base values. With demand so high, IBA expects issues surrounding the sourcing of good engine stock to emerge, which will, in turn, lead to more frequent shop visits.

The GE90 market continues to spark debate and remains contentious. Its freighter order book is thriving, and performance has been strong during Covid with high utilisation. Continued delays to the Boeing 777X have affected the GE9X engine. Despite this, the mass exodus of the Airbus A380's from global fleets and the A330's poor performance bode well for the GE9X. However, high ownership costs associated with the GE9X are concerning, and P2F conversion and maintenance expenses can easily break through the $15M barrier. With heavy discounts such that decent engines are struggling to attract $10M, we may need to make a base value adjustment. Despite these factors and heavily discounted pricing, we remain optimistic about this engine overall.

The market for new widebodies is largely silent, with trading activity remaining low. Despite this, the assets in this market are considered a good long-term investment with no major issues. IBA expects we may witness more movement over the winter as sale and leaseback activity increases but, for now, trades tend to be closely aligned with the list price.

Positive storage signals are apparent across all aircraft types for flights, active fleet, and utilisation. Encouragingly, narrowbody and widebody storage levels are in line with IBA's predictions in January with only a 0.1% variance, recovery being slow but consistent.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.