20/03/2023

“My grandfather rode a camel. My father drove a car. I fly in jet planes. My son will drive a car. My grandson will ride a camel.”

This contested quote relates to the desire to diversify away from an oil-export-dominant economy. Following Qatar and the UAE, it’s now a focus for Saudi Arabia.

Aside from the emergence of Avilease last year with the announcement of a 12-aircraft SLB with flynas, the Saudi Public Investment Fund also launched Riyadh Air this week. This was closely followed by the $37Bn list price order for up to 121 x 787-9s to be split between the airline and Saudia. That’s a lot of capacity, and links closely with the Saudi vision to carry 330m passengers by the end of the decade (with close to a third visiting the country).

Having spent much of my childhood in Riyadh and witnessing the speed of development, I have no doubt that they can succeed. Might this trigger a Middle Eastern power play whereby Emirates, Etihad and Qatar fight against the Saudi growth to destabilise the profitability for European and Asian carriers hoping to recapture market share? The combined carriers already have 465 passenger aircraft in active service, 95 parked or in storage, and 307 on backlog, I sense that, given their deep pockets, growth will proceed at any cost.

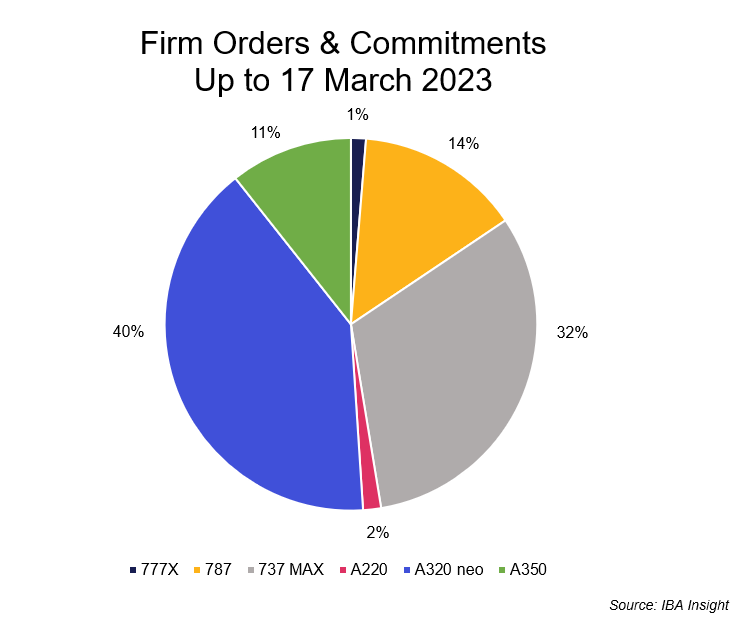

This all depends on when the aircraft arrive. The order tallies this year for Airbus and Boeing are already at 883, an estimated book-to-bill of 0.68. Given that supply chains are a total mess, with problems potentially persisting on and off until the latter part of this decade, the total backlog won’t be falling any time soon. That said, the lack of progress in the widebody sector in recent years could mean that first deliveries come sooner than expected. There are 572 x 787s left in the firm backlog (excluding the ones yet to commit from Saudi Arabia and India) which under old rates would be done in just four years - much less than the 12-year total backlog and 6-year initial lead time for narrowbody aircraft.

Don’t miss out on the latest aviation intelligence.

The IBA team share regular insights on all aspects of commercial aviation, from airline capacity and travel trends to aircraft values and ESG strategy. Sign up today to get the latest intelligence from the IBA Weekly newsletter delivered straight to your inbox.

Cheers!

Stu.