19/01/2023

IBA has published its latest aviation Carbon Index in partnership with KPMG. This time, we use IBA NetZero to shine a light on the EU ETS scheme and what it means for operators and portfolios.

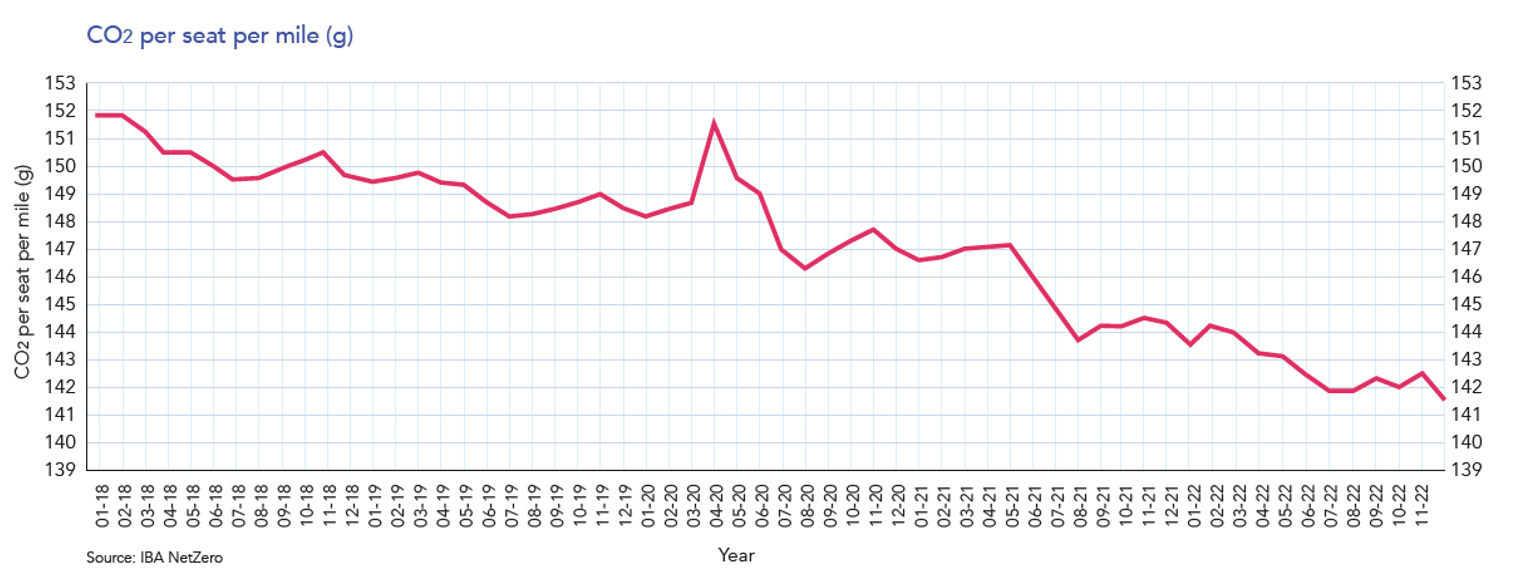

Aviation carbon emissions data from IBA NetZero reveals that CO2 emissions from the commercial aviation industry averaged 141.7 grams of CO2 per-seat-per mile in December 2022, a decrease of 0.6% from November. This was the largest monthly decrease of the year, and the largest since July into August 2021, boosted perhaps by the strong passenger numbers over the holiday period.

Total flights (and emissions) from passenger operations suggest a strong December travel market. Flights were up 5.7% from November, and emissions slightly more at 8.2%. The increase in flight numbers was mainly driven by an increase in short sector narrowbody flights. As narrowbodies have higher seating density, the CO2 per-seat-per mile decreased, despite total monthly emissions outgrowing flight numbers.

Emissions were down 22.4% from December 2019 in comparison to pre-pandemic levels, while flights were down 20.9%. However, December represents the smallest monthly difference between emission and flight comparisons to 2019 levels at 1.6%, compared to highs of over 7% during the summer. IBA will continue to track these deltas to determine absolute efficiency improvements as the global market continues to recover.

The European Commission and Council announced a compromise agreement for the future of the EU ETS between 2023 and 2027. Despite pressure from NGOs and some airlines, the EU ETS will not include extra-European destinations, but will still include the UK and Switzerland. 58% of Europe’s aviation emissions will therefore be unaccounted for under the scheme. Long-haul flights to destinations outside of Europe will be covered by CORSIA, but the commission will review CORSIA’s effectiveness in 2026, with a view to reverse the decision on which flights the EU ETS covers.

IATA announced that it estimates the yearly production of SAF to reach at least 300 million litres by the end of 2022, a 200% increase from 2021. Even with a conservative estimate, IATA position the SAF industry on the verge of an exponential capacity and production ramp up, assuming sufficient policy tools support the industry.

Offtake agreements continue to be announced following the uptake in production this year. The latest announcements will see Air France-KLM take 800 million tonnes over 10 years from 2023 from TotalEnergies, in line with their target to reduce passenger CO2 intensity by 30% in 2030 from 2019 levels. In addition, Ryanair will take 360,000 tonnes between 2025 and 2030 from Shell, and JetBlue will receive at least 92 million gallons of blended SAF from Fidelis New Energy (FNE), over the same period.

The diverse nature of mitigation pathways continued to see exciting partnerships emerge in crucial technologies in December. Airbus and Air Canada both announced investments into Canadian direct air carbon capture (DACC) company carbon engineering to help fund R&D efforts. Alongside policy such as the EU’s voluntary removal certification proposal, these potential removals will be eligible to form a component of compliance for CORSIA.

Away from the typical policy developments in the West, a Chinese energy think tank has published a report into policy signals in China and SAF development. Whilst Chinese fuel producers and airlines have not kept pace with European and American stakeholders, the report finds that the industry will remain hesitant without government policy signals. In addition, the report found that China has abundant feedstocks for HEFA based SAF production. Explore the attitudes of the ‘big three’ Chinese airlines to sustainability in IBA’s recent analysis.

IBA NetZero empowers users with unparalleled clarity in CO2 emissions analysis, mapping out potential mitigation strategies and projecting cost over time.

Following an important update from EU Parliament on the near-term future of operator compliance, we explored the current and historic state of aviation in the EU ETS scheme, leveraging publicly available data and IBA NetZero to forge insights.

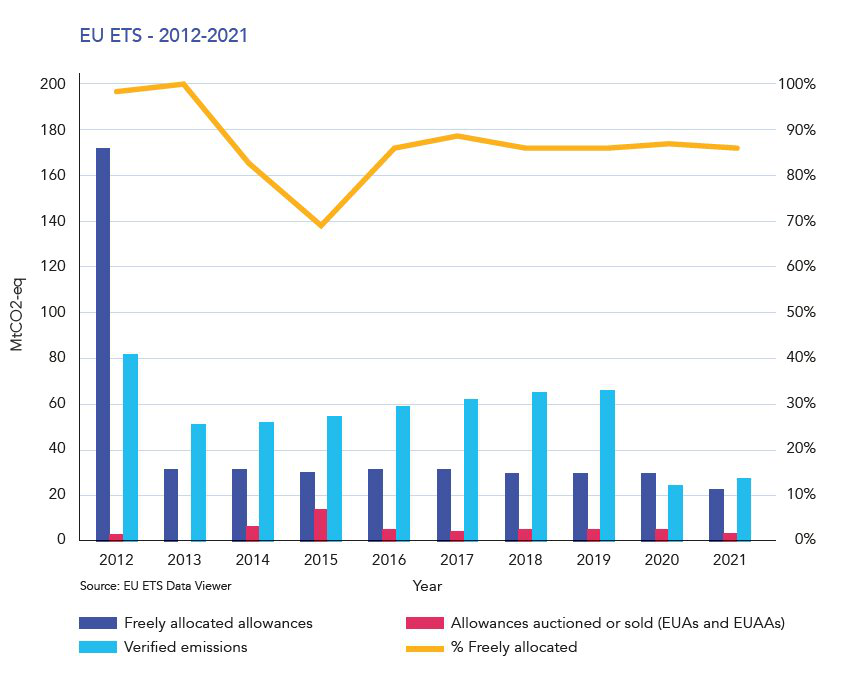

As well as the future of the ETS relative to CORSIA, the latest proposal states that free allocation of emission allowances will be phased out between 2024 and 2026 (excluding 20 million allowances to be set aside to incentivise the uptake of SAF). The graph below utilises publicly available data from the EU ETS data viewer to visualise aviation in the EU and UK since its introduction in 2012.

The level of freely allocated allowances has not dropped below 69% since 2012 and has maintained 86% in recent years. The news that this will close to zero within 3 years is of significant concern for operators and their cost of compliance. Additionally, the verified emissions shown in grey only account for intra-EU flights. If, as the proposal suggests, the EU ETS finds CORSIA to be an ineffective measure in 2026 and includes extra-EU flights, the cost of compliance could more than double.

While the intention of this stringency is to incentivise innovation into decarbonisation pathways, meeting the incoming cost of compliance will be paramount to aviation stakeholders, including operators, lessors, and financers. IBA NetZero can be used to assess the exposure of various actors and how the current scope of the EU ETS influences operators.

.png)

Source: IBA NetZero

As only intra-EU flights are to be included in the EU ETS for at least the next three years, low-cost carriers are most exposed to the increasing cost of compliance, hence the pushback at the latest announcement from Ryanair. They argue that the most polluting flights departing from Europe are long-haul sectors, emphasised by the fact that network carriers such as Lufthansa and KLM are further to the right of this graph.

It is worth mentioning that only departing flights to the UK and Switzerland are included in the EU ETS, so most of the ETS exposure of British Airways and easyJet will fall under the jurisdiction of the UK ETS. While these are just a selection of flag carriers and large-scale operators, the impact of the EU’s amendments to the ETS won’t be felt uniformly across the industry. We will continue to use IBA NetZero to monitor the situation and help inform our client’s decision-making in this increasingly uncertain market.