22/02/2024

Where are aircraft values and lease rates going in 2024? The general sentiment for 2024 is that values and leases will continue to soar throughout 2024 with this movement attributed to several industry factors. This includes the current tight supply, driven by lease extensions, current engine reliability issues and a lack of new aircraft deliveries.

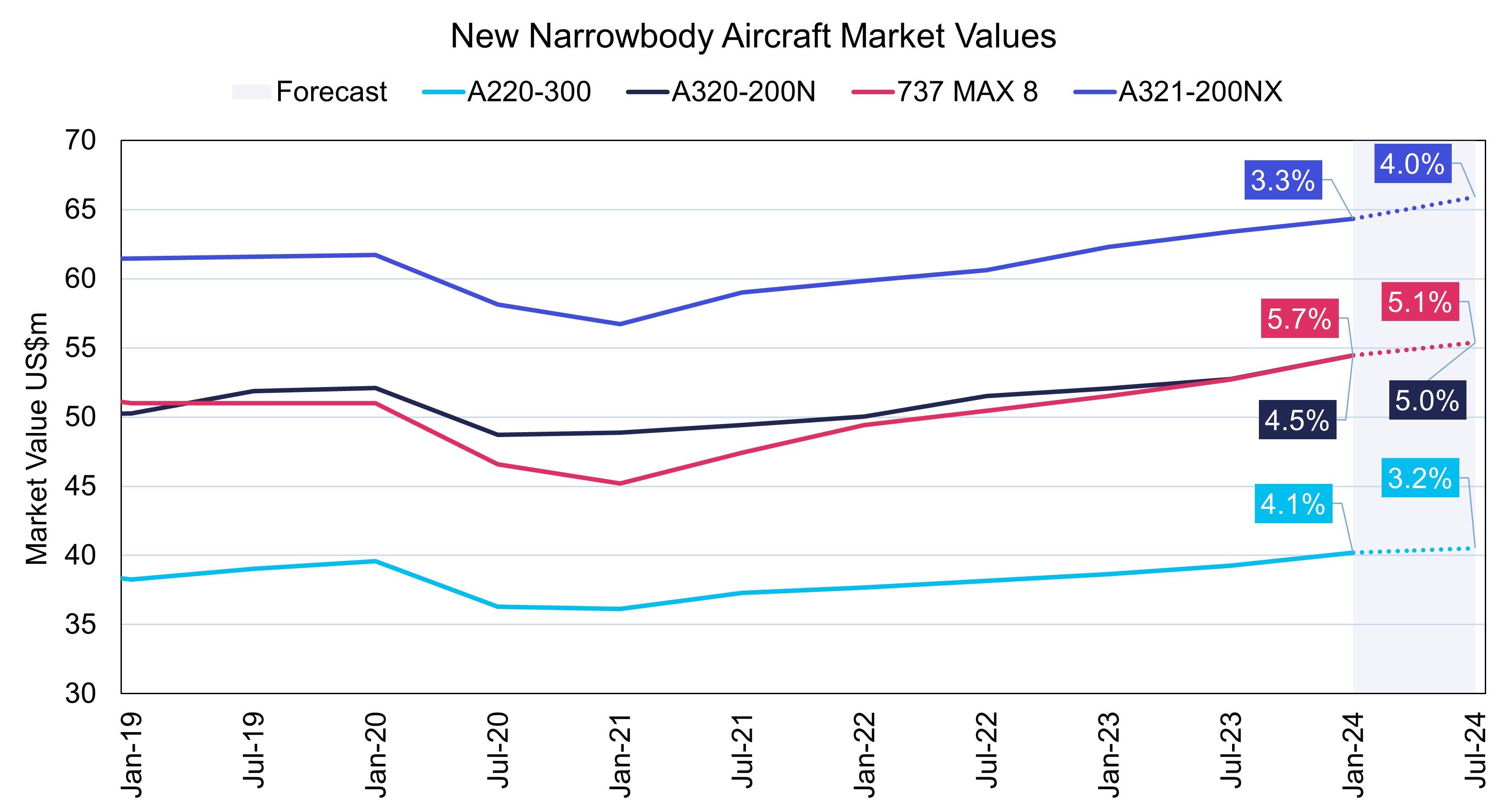

In our aviation market update webinar for Q1 2024, IBA's specialist aircraft valuations and appraisal team shared the latest updates for commercial narrowbody and widebody aircraft values. Here’s how the individual aviation asset classes have performed over the last year and the forward outlook for this year.

Source: IBA Insight & IBA Research

(Percentages represent change in value over previous 12 months)

There has been a growth in new generation narrowbody aircraft values, particularly for the 737 MAX 8 and the A320neo models, which are closely matched in terms of Market Value. Specific aircraft valuations are influenced by aircraft specifications such as Maximum Take-Off Weight (MTOW) and engine thrust, along with the nature of the transaction and the motivations of the participants, leading to potential variations. After robust gains in 2023, there is an optimistic outlook for continued growth in 2024, extending to both the A320ceo and the 737NG.

In the mid-life narrowbody aircraft segment, there has been a significant increase in aircraft values throughout 2023, with further gains projected for 2024. This suggests a sustained progression. Operators are demonstrating interest in older aircraft, even those in less-than-ideal conditions, as they strategically acquire assets from the secondary market with plans for subsequent investments in their serviceability. This trend reflects a proactive approach from airline operators, as they anticipate future returns on their investments.

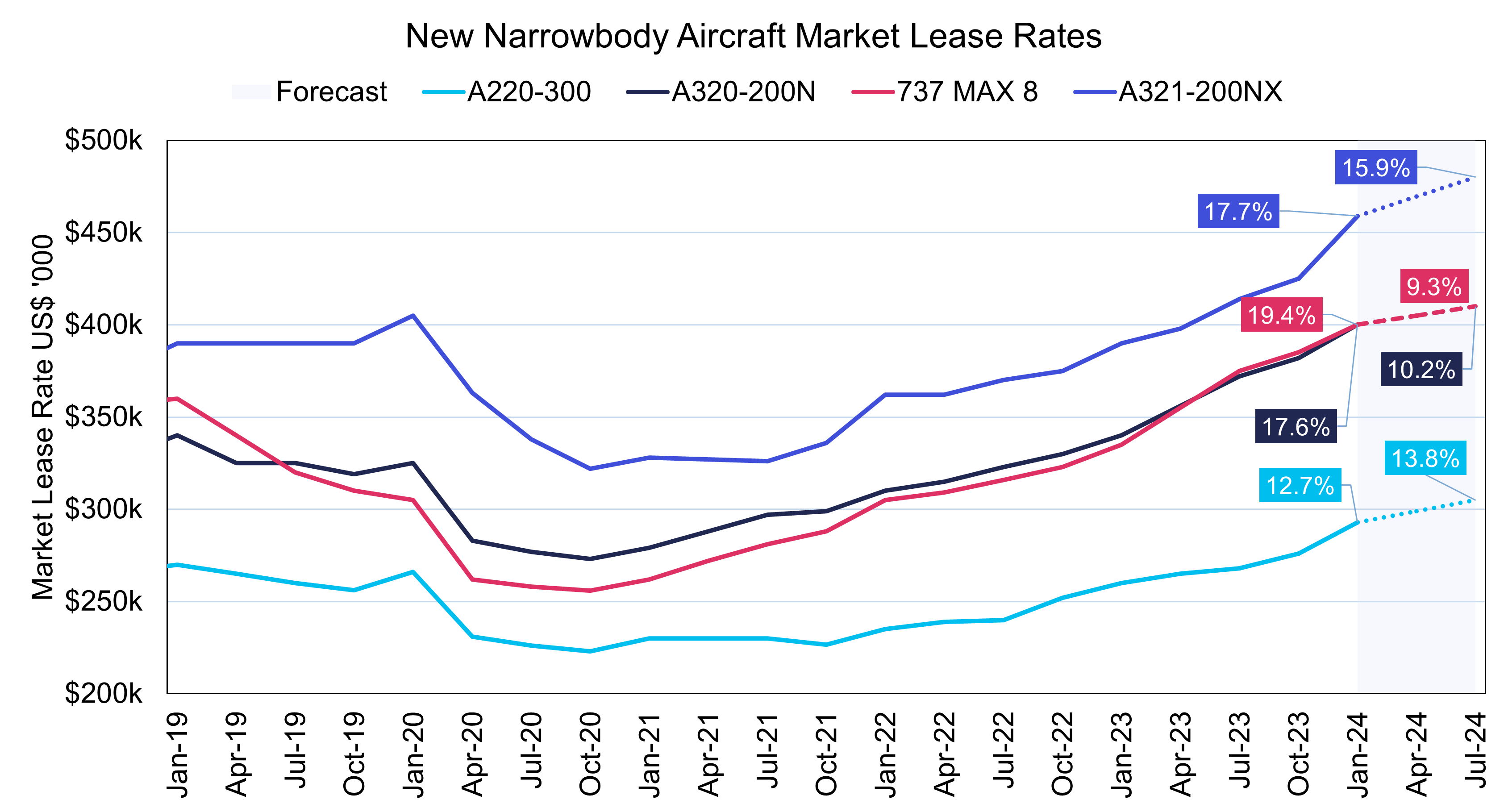

Source: IBA Insight & IBA Research

(Percentages represent change in value over previous 12 months)

Narrowbody aircraft lease rates have been characterised by a significant upward trend in 2024, particularly for the 737 MAX 8 and A320neos. IBA forecasts an increase to $410,000 per month by July 2024, signalling substantial growth. The A321neo specifically is experiencing a surge, with lease rates already in the mid-$400,000s range expected to increase as the year progresses. This is partly driven by tight supply, due to ongoing production rate recovery, and the elevated interest rate environment.

In the mid-life segment, lease rates have also seen a robust increase, especially for the A320 family (A320 and A321), with mid-life examples registering over 20% annual growth in some cases. The grounding of GTF-powered aircraft and operators extending leases to cope with supply constraints in the secondary market has fuelled this growth in lease rates. While this has caused lease rates for the A320ceo to approach parity with the 737-800, the rate of growth is anticipated to cool off, as the year progresses, reaching a plateau in the middle of the year. Lease rates for mid-life aircraft are climbing, from above $200,000 to the mid-$200,000s range.

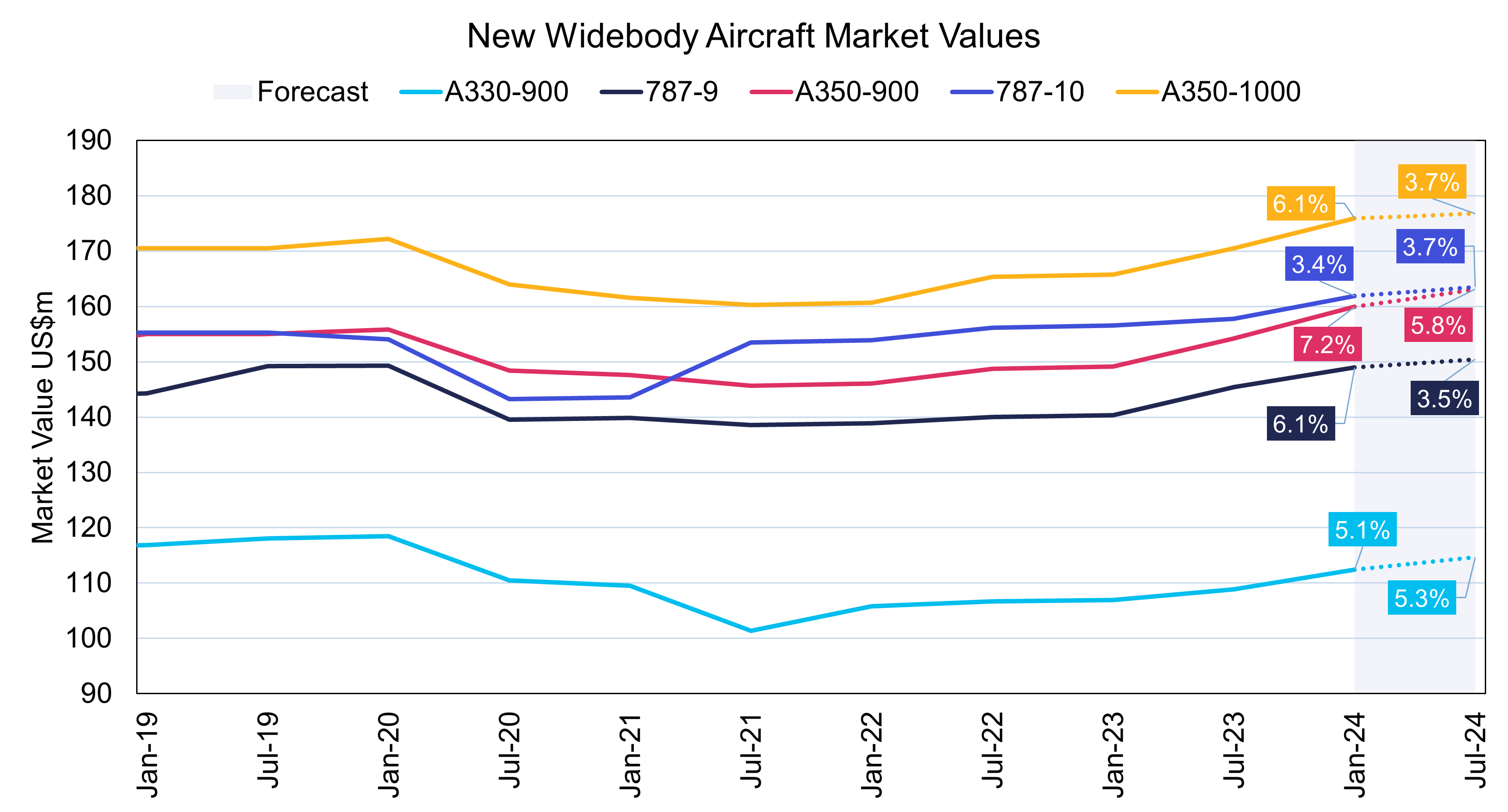

Source: IBA Insight & IBA Research

(Percentages represent change in value over previous 12 months)

In the widebody segment, we have identified a recovery in the market values of current-generation aircraft, that is expected to continue into the middle of the year. Notably, A350-900 values are closing in on those of the Boeing 787-10, erasing the latter’s premium. The continuing recovery in widebody aircraft values also mirrors the trends seen for narrowbody aircraft last year. The flurry of orders, especially for the A350 and Boeing 787, echoes the strong demand witnessed in the narrowbody segment, and while the values have not fully returned to pre-pandemic levels, there is room for further growth into the middle of the year.

IBA has seen a robust recovery in the mature widebody segment, particularly for mid-life examples. Market values for these assets are expected to have more than doubled in 12 months by mid-year, representing one of the most substantial percentage changes in the market. Acquisitions made during the pandemic at lower prices have proven to be astute investments, given the current market dynamics. Notably, the A330 and the Boeing 777-300ER are experiencing a strong uptick in values, driven in part by the solid performance of the value of their engines, which have rebounded significantly.

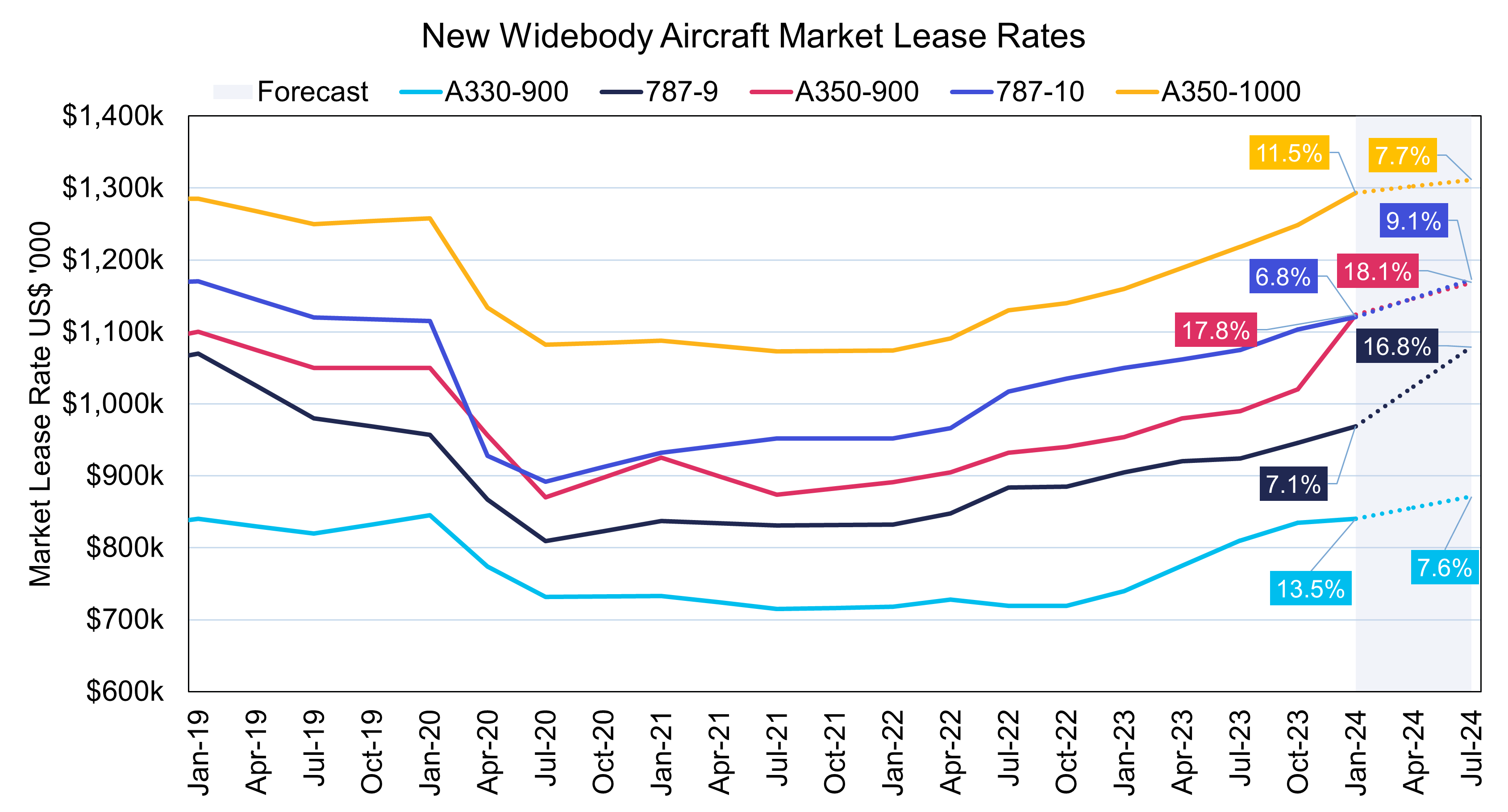

Source: IBA Insight & IBA Research

(Percentages represent change in value over previous 12 months)

Widebody aircraft lease rates demonstrate a positive outlook in 2024. There has been a notable shift for A330s in 2021 and 2022 to rates now approaching pre-2019 and which are expected to surpass by July 2024. On the Boeing side, the 777-300ER is experiencing a similar upward trend, with rates moving closer to those for a typical 12-year-old aircraft in 2019 and anticipated to surpass 2019 levels by mid-year.

A significant driver of the lease rates is the scarcity of available aircraft, characterised by a market dominated by lease extensions rather than new placements. Some extensions surpass $500,000, with operators showing a strong motivation to retain their aircraft, given the limited supply of new aircraft entering the market. Transaction volumes are on the rise, particularly on the lessor trading side, indicating increased activity in the market. While lease placements may be lower as operators opt to extend and retain their current fleet, the overall trend suggests a strengthening market with an uptick in values. This positive trajectory extends to both narrowbody and widebody aircraft, highlighting a robust and evolving landscape in the widebody aircraft lease rate market for the year ahead.

The narrowbody and widebody aircraft market in 2024, both exhibits growth and evolving dynamics. Narrowbody aircraft, such as the 737 MAX 8 and the A320neo, are focal points for this growth, with market values influenced by various factors, including inflationary pressures and market demand. Narrowbody aircraft lease rates, driven by factors like production rate recovery, supply constraints, and operator lease extension strategies, contribute to a dynamic and evolving landscape throughout 2024. On the widebody side, the market showcases recovery, convergence in values between key models, and substantial growth in mature widebody aircraft values, emphasising the resilience and evolution of the overall market landscape.

To learn more about our latest aircraft values, including turboprop and regional aircraft values, click here to watch the full webinar.

If you have any further questions, comments, or feedback, please get in touch with Mike Yeomans.