20/12/2023

IBA, the leading aviation market intelligence and consultancy company, has today published their expectations for 2024 for global aviation, examining macro-economic factors, supply and demand, and challenges to airline and aircraft values.

Dr Stuart Hatcher, Chief Economist at IBA, forecasts that: “Providing we don’t see further aggression from the central banks, small rate cuts of approximately 25 basis points will start to emerge mid-year. Inflation, at least in the US, will continue to subside and while it will fall short of the target, the mounting pressure, both economically and politically, will take its toll. The GDP outlook remains largely flat albeit at a slightly lower level to 2023, remaining close to 3% on a global level.

“This prediction is dependent upon the increasingly dovish environment of the Chinese market, but it would be a welcome sight to see some of the tension ease, not to mention a welcome sight towards air cargo growth too. Assuming that China’s economy and oil volatility settle, and in turn, that Pacific traffic levels improve from absolute zero, jet fuel demand will become more predictable and marginally tighter.

“The dislocated nature of the central banks will maintain a difference between relative inflation. We therefore see a strong dollar persisting throughout 2024, which won’t help non-US operators balance their budgets. While demand is expected to grow, fare compression and costs will squeeze the market whereby the industry can expect defaults to rise above the current low levels.”

“Trading will improve to the extent that even asset-backed securities will be back on the agenda. Finally, OEM performance will align with the GTF engine fallout in early 2024 which, at this point, continues to remain an unknown to the industry. Deliveries will continue to improve but remain south of OEM predictions. IBA believe the in addition to Boeing’s quality issues. At this point, we don’t see 2018 delivery levels being surpassed until mid-way through 2025.”

Dan Taylor, Head of Consulting at IBA, said: “In 2024, airline capacity will finally exceed 2019 levels. IBA’s data predicts that several of the operating issues currently impacting capacity will be resolved. However, some will continue or even worsen including the additional aircraft GTF engine checks.”

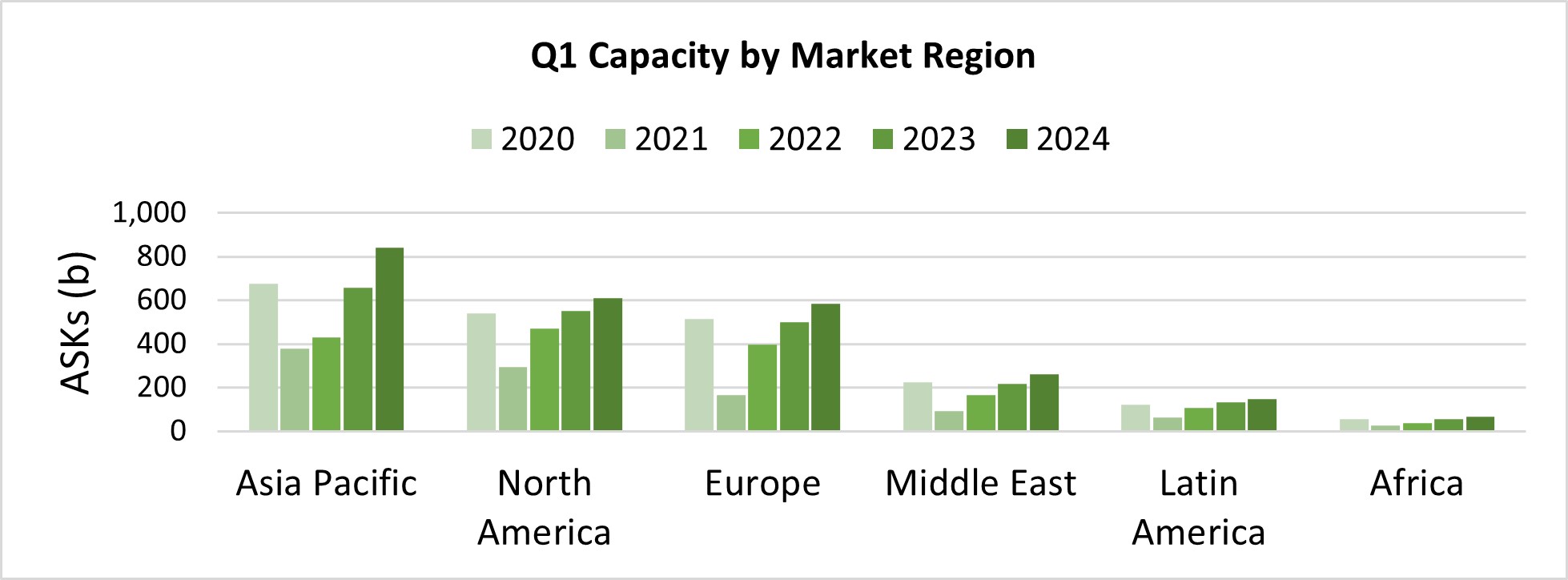

“The schedules loaded for Q1 2024 indicate that the airlines are planning significant capacity increases compared to the same period in 2023. Further, the APAC region is planning the largest annual increase of 28% and North America’s growth is slowing to 11% and is likely to continue through the year.

Figure 1 – Q1 Available Seat Kilometres (billion ASK) for 2020 to 2024

Source: IBA Insight

“Additionally, the long-haul and legacy carriers will continue to restore capacity in 2024 and try to recover the market share lost to the low-cost carriers (LCCs). For the full year, we expect that capacity will increase by 10% globally and finally surpass 2019 levels.”

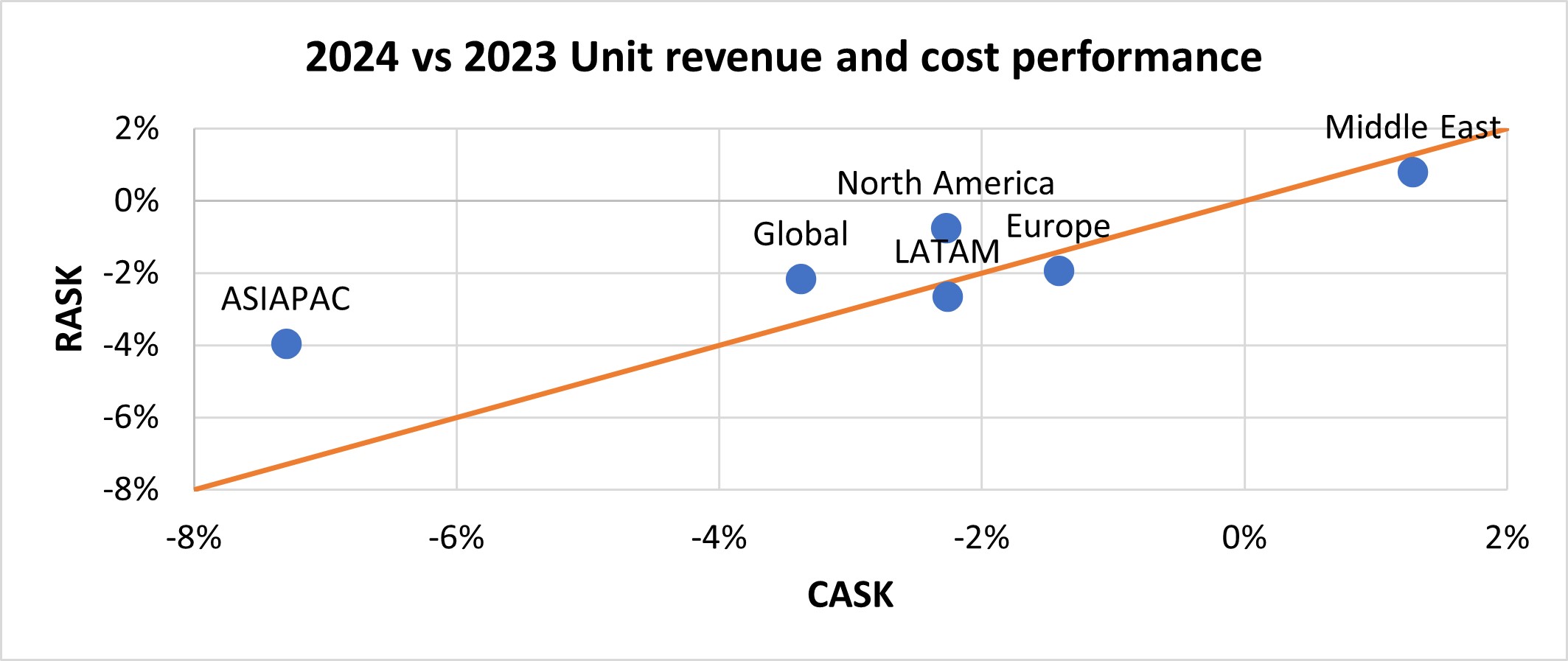

“We can confidently predict that ticket price growth will slow, and costs will eventually stabilise. With capacity growth set to continue, and demand slowing in some segments, airlines will likely need to reduce fares to meet load factor and market share targets.”

An IATA survey of its members is already indicating that fares are likely to stabilise or even reduce over the next twelve months. Unit revenue (RASK) will therefore reduce in most regions with APAC reducing the most at -4% year on year.

Figure 2 – Year-on-year RASK and CASK change by market region. Above the line improving EBIT and below worsening.

Source: IBA Airlines

“Slowing inflation across many economies and stabilising labour markets will help to slow the cost increases. Most regions are expected to show small unit cost improvements and globally, CASK (Cost of Available Seat Kilometer) could fall by as much as 3% year on year. APAC is likely to have the largest CASK decrease due to the large capacity increase planned.”

Taylor added that: “Globally, EBIT margins are expected to improve slightly, largely driven by improved performance of airlines in the APAC region. Europe, Middle East, and Latin America (LATAM) regions are expected to decrease in margin, although there will be a mixed range of performance across airlines.”

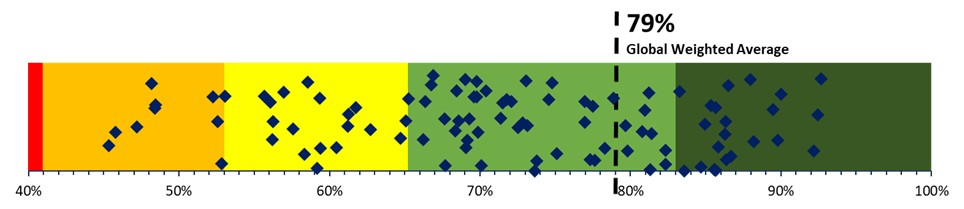

“Finally, we will see all regions apart from North America start to reduce debts built up during the pandemic. The largely healthier operating results and balance sheets will mean that many airline risk ratings will improve. With fares levelling, government support ending and costs remaining high, the number of failures could increase.”

Figure 3- Risk profile of the largest 100 airlines

Source: IBA Airlines

Mike Yeomans, Director of Valuations and Consulting at IBA predicts that airlines will continue to extend leases and pay more to keep hold of aircraft in 2024. He said: “As engine durability and quality issues continue to afflict the OEMs and negatively impact their target delivery outputs, airlines will face a competitive used aircraft market and have little option but to extend their existing leases at premium rates. The negotiating power will rest firmly in the laps of the lessors in 2024. According to IBA’s forecast, extension trends are already above 90% and will remain at these high levels through 2024.”

“Rising interest rates have devalued encumbered assets, making trading a challenge, and suppressing deal volumes for some lessors. Inflation has peaked and interest rates will begin to decline in 2024 according to our forecast. Following a recent wave of M&As, lessors will look to rationalise and de-risk their portfolios, creating growth opportunities for other players in the market. The growing lease rate environment matched with the gradual easing of interest rates will unlock the demand for lessor-to-lessor trading that recent market conditions have stifled.”

IBA expects to see an undersupply of aircraft throughout 2024, as OEM production and MRO capacity remain under pressure.

“Our data suggests that retirement volumes have declined consistently since 2019 for the most popular narrowbody and widebody passenger and freighter aircraft models. We expect this trend to continue into 2024 as airlines retain their owned aircraft in service and extend terms on their leased fleets.”

Yeomans added: “In 2023, the pace of replacement of previous generation aircraft has been far slower than expected. IBA’s early modelling of when the neo and MAX fleets would overtake the ceo and NG, suggested an approximate 2026 timeframe. This will now stretch beyond 2030 for both families. As a result, many ceo and NG aircraft enjoy an extension to their economic lives, so we expect Base Values to receive a commensurate uplift in 2024.”

“Demand for leased mid-life narrowbody aircraft will remain strong in 2024 and rates will rise above their pre-pandemic levels. Expect to see aircraft placed at rates in the mid-US$200,000 range for the Airbus A320ceo and Boeing 737-800, while Airbus A321-200 lease rates will trend higher and could exceed US$300,000 per month in some deals.”

“We can expect that lease rates of some mid-life widebodies will double from Covid-19 lows and values will continue to surge upwards. Consequently, lease rates can be expected to rise further. Market lease rates for mid-life aircraft in the 10–12-year age category could be expected to lease in the mid-US$300,000 range in 2024. We’ve already seen higher rates on shorter-term extensions to motivated airlines.”

“Overall, the trading market shows that in 2024, airlines will need to extend lease rates in order to keep hold of their aircraft. ease and the OEM production and MRO capacity are strained, any opportunities for growth must be seized.”

- ENDS -

About IBA

IBA delivers the best of all worlds - deep aviation consultancy expertise, and cutting-edge and actionable data insights, all delivered by a proven, expert team with a strong customer focus.

An independent, innovative and forward-thinking business, IBA has over 35 years of heritage and experience in aviation. Having won the Sustainable Technology award for its IBA NetZero platform in 2023 and for its Carbon Emissions Calculator in 2022 and being named 'Appraiser of the Year' by their clients for five years, IBA prides itself on its integrity, fierce independence, and continual innovation.

The key to IBA’s success is its people – some of the best in the industry, based in multiple locations across the globe – real experts who are passionate about aviation and go the extra mile for their clients.

IBA media contacts

Charlie Hampton / Faye Clarke

Email: [email protected] / [email protected]

Mobile: +44 (0)7884 187297