23/04/2020

ABS Portfolios - What is the Current Level of Fleet Utilisation?

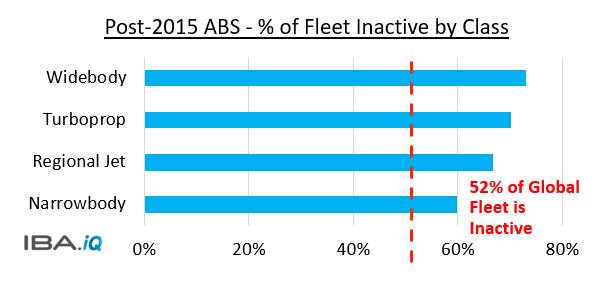

Using IBA.iQ Fleets, IBA's award-winning advisory team show that over 60% of aircraft within ABS structures (launched after 2015), are either parked or stored. In comparison, 52% of the global passenger fleet is inactive, indicating that aircraft within current ABS portfolios are less active than the global fleet average.

As a result, IBA expects to see cashflow pressures within aircraft ABS structures as operators seek rental payment holidays and groundings cause uncertainty in the level of unplanned maintenance costs.

This uncertainty has the potential to cause defaults in ABS structures in the medium term (six to 12 months from now) once the impact of holiday rentals, early returns and the total cost of unplanned maintenance impacts overall liquidity.

What is the Utilisation by aircraft groups with ABS structures?Looking at aircraft groupings, Narrowbodies show the highest level of utilisation amongst ABS portfolios, with 40% of the fleet active. As you would expect, the Widebody aircraft class has been hit the hardest with Covid-19 severely impacting long-haul and international travel, only 27% of the fleet is active.

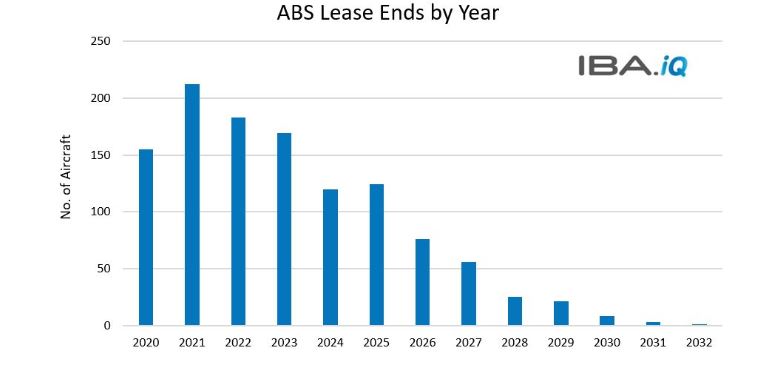

Scheduled Lease Ends within ABS Portfolios Looking at planned Lease Ends scheduled by year for aircraft within ABS structures, IBA.iQ Fleet data shows a large number of aircraft scheduled to return in the next four years - up to 600 aircraft. How many of these leases will be extended or returned early remains to be seen over the coming months. IBA anticipates the number of unplanned lease ends will increase as aircraft are grounded and operators face financial challenges, ABS structures will face significant costs which will not have been planned or modelled. These include ferry flights, maintenance, redelivery, reconfiguration and regulatory liaison.

Aircraft ABS structures are set to suffer the effects of aircraft groundings in the year ahead. A combination of prudent cash management and active engagement with lessees will be crucial to effectively managing outlooks in the medium and long-term.

If you have any further questions, comments or feedback please contact Mike Yeomans

Access the insight and data you need to maximise aviation investments, IBA.iQ is our online analysis platform offering essential fleet, values and market intelligence for the global aviation leasing, operating, finance and MRO community.

Sign up for a system demonstration