12/11/2020

Using InsightIQ's analytics, in this analysis we have focused on airlines with aircraft having more than 25 seats and the primary concern is with fixed costs. A combination of cash reserves, payment holidays and government aid is being used for survival. Inevitably, as the crisis persists, the ability to repay debt becomes more remote.

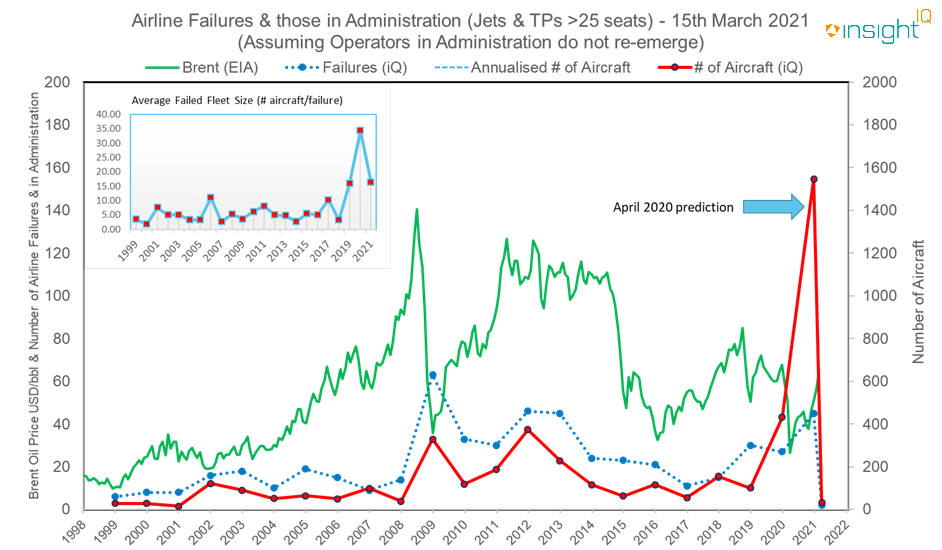

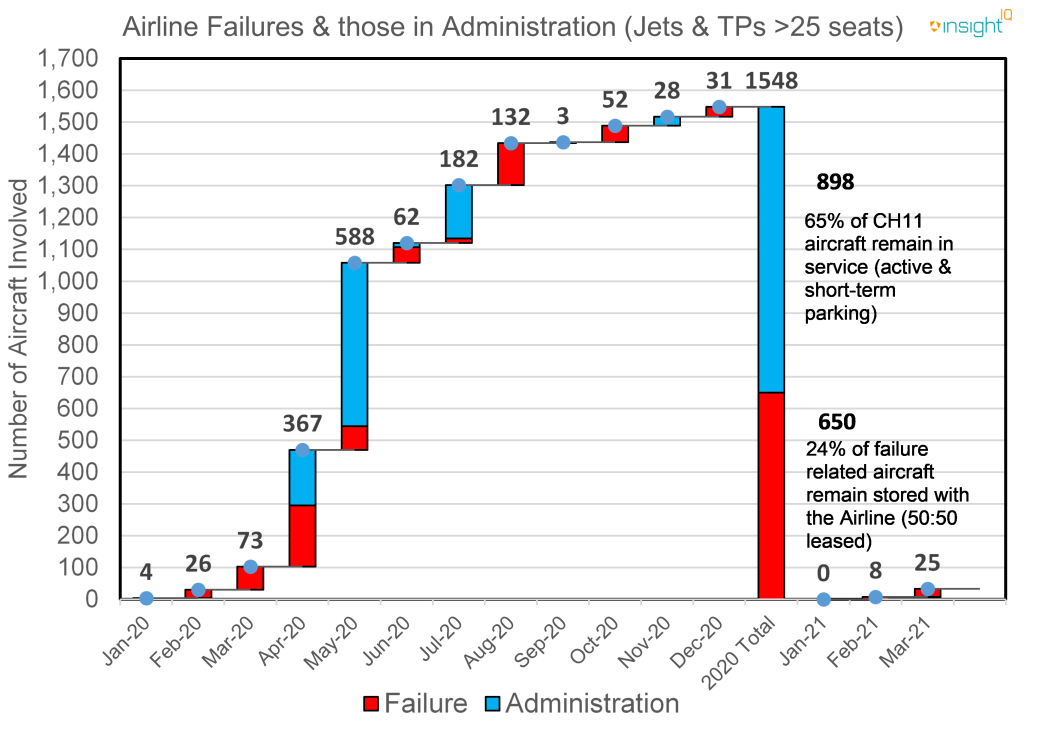

The failure rate to the end of October has remained relatively flat since June, Cathay Dragon and Air Asia Japan being new casualties. Despite positive vaccine progress, which is an important step towards the resurgence in demand, the economic fallout from the crisis will be considerable.

We therefore expect more failures from now until the end of Q1 next year, as cash reserves are depleted and initial bail out support runs dry. Recent news about the operator Norwegian and government support raises questions about the future of the carrier and suggests further difficulty.

The charts below show Airline failures in Administration/ failed from Administration.

Looking ahead, labour costs may need to be reduced by around 40%, capacity has to shrink and more finance will have to be raised for many airlines to continue. For those who can adapt their business models though, we envisage growth opportunities.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.