14/11/2022

In the second edition of our ‘Ask the Appraiser’ webinars, our experts Jonathan McDonald and Phil Seymour examine the trajectory of regional jet and turboprop aircraft values, identifying the hottest trends and the impact of macroeconomic factors on the market.

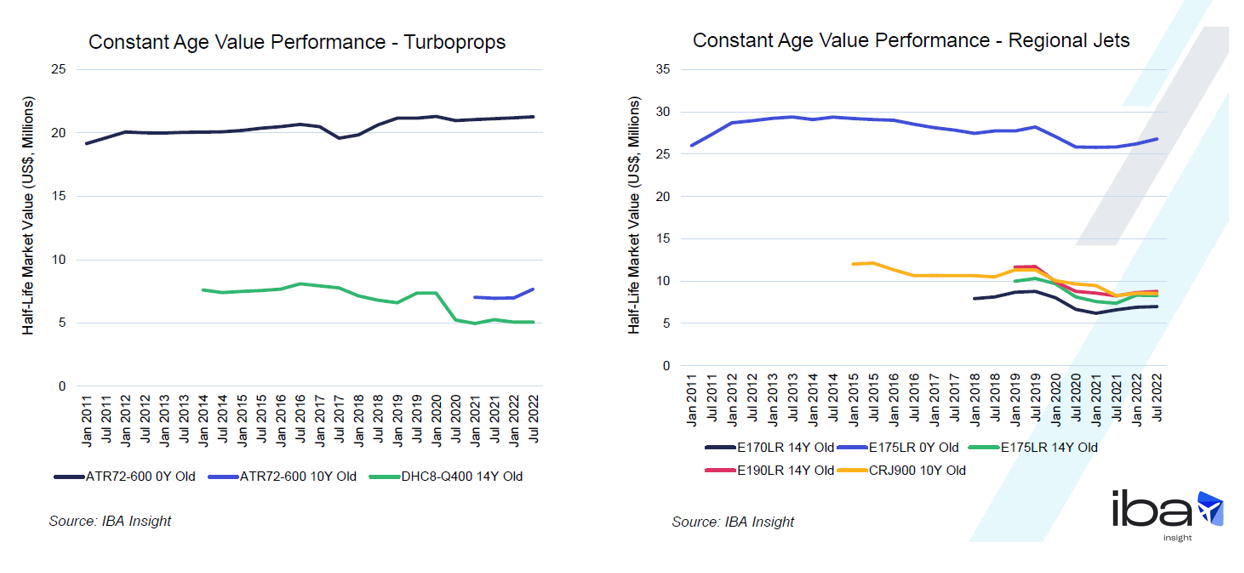

Aircraft values data from IBA Insight reveals the ATR72-600 leads the way in value stability amongst turboprops, and the Embraer E175LR for regional jets, Both aircraft showed more resilience to the impacts of Covid-19 than other types.

IBA has one of the largest and most experienced teams of certified senior appraisers in the industry who partner with aviation and financial sector clients globally to give independent advice on wide-ranging, complex asset valuation requirements.

Find out more about IBA Valuations

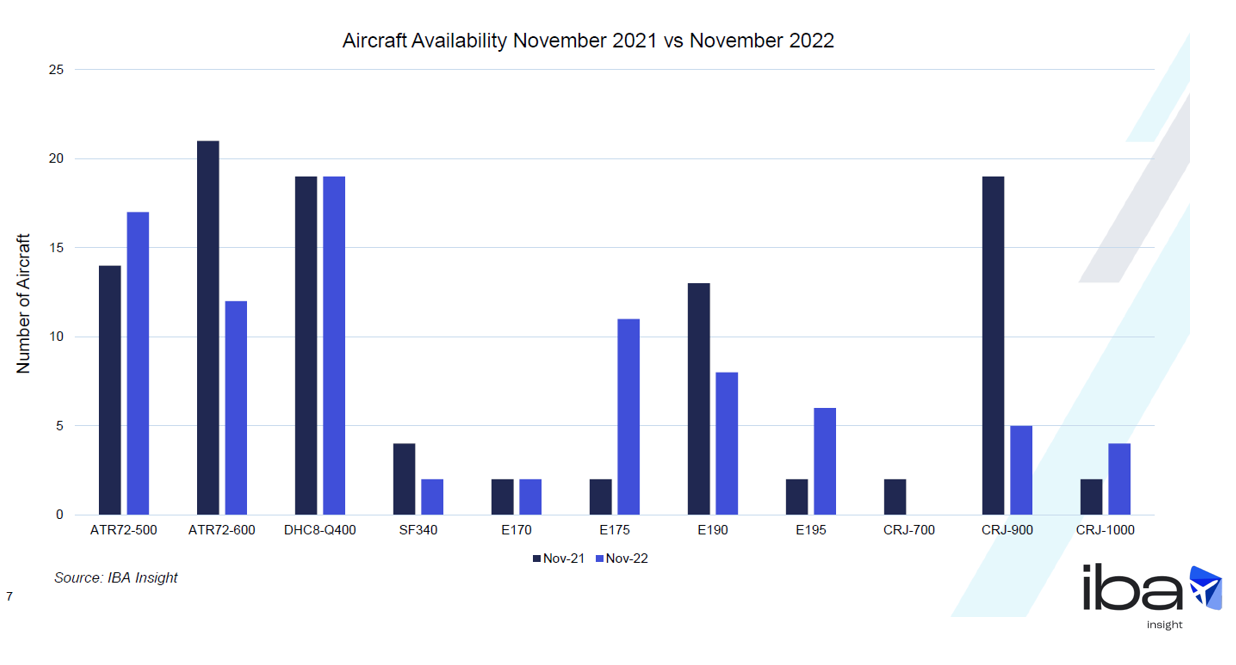

The general availability of turboprop and regional jets has been decreasing since November 2021, but with significant variations between aircraft types. Data from IBA Insight reveals that there were 21 ATR72-600 aircraft available in November 2021, but just 12 available in November 2022. By contrast, there were only two Embraer E175s available in November 2021, but this had climbed steeply to 11 of the type a year later.

Our insights reveal that the total number of parked and stored aircraft has decreased overall since November 2021, but with some exceptions. 46% of the Bombardier CRJ 1000 fleet was either parked or stored in November 2021, but this fell to 38.1% by November 2022. By contrast, 22.9% of the ATR 72-600 fleet was parked or in storage in November 2021 but, as of November 2022, this had increased to 30.3%.

There is a duopoly in the regional and turboprop marketplace between the Embraer E175 and ATR72-600. This is largely due to the Embraer E2 and Airbus A220 being more closely aligned to mainline aircraft

The Ukraine conflict continues to cause disruptions. Leased aircraft with operators including Ikar Airlines, S7 Airlines and UTAir are currently stuck in Russia

The pandemic had less of an impact on regional jets and turboprops than on the narrowbody and widebody aircraft market, with the ATR72-600 and E175LR proving the most resilient

There are likely to be rising operational costs for airlines, with increased labour and jet fuel costs. Furthermore, a strong US dollar combined with sanctions on Russian oil will add further pressure

Inflationary pressure on consumers and producers are expected to last until the end of the year, with values and lease rates unlikely to track 10% inflation