08/11/2019

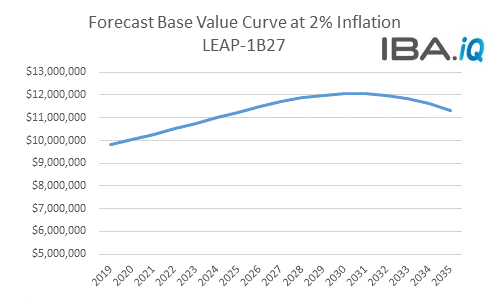

For CFMI, it would appear that the impact of the 737 MAX grounding has not been detrimental to the LEAP-1B. There remains a strong market outlook for this engine and looking at the Base Value, Half Life, it is performing well and is on par with competing engines in the market. As illustrated in the chart below, there has been no impact on values.

Keeping to the positive, prior to the grounding, it was widely known that CFMI was as much as 4 weeks behind schedule on deliveries - an issue which no longer exists with CFMI opting to maintain production levels to 'catch up' on deliveries. They have also made good use of the 'grounding time' to help resolve some early teething issues without causing further AOG events. As an example, the fuel nozzle coking issue will have a remedial fix before the end of 2019, before re-entry to service, with a full fix in early 2021.

There is however, one major after-effect of the grounding for the engine platform which cannot be mitigated. MROs globally are currently struggling with the maintenance demand requirements of other engine models including the CFM56-5B, CFM56-7B and V2500-A5. Shop visits for deliveries of both current production and stored 737 MAX aircraft will coincide for as much as 2-3 years post grounding, meaning that it's possible there could be a new bow-wave of shop visit demand for the LEAP-1B in the future.

Our large team of engine and aircraft analysts and 6 ISTAT qualified appraiser's specialise in a broad range of aviation assets including commercial jets, engines, helicopters, business jets and landing slots. If you're interested in understanding how we approach our engine valuations and and what factors influence their value. Click here to listen to our short webcast.

When it comes to fleet data, aircraft valuations and market trend analysis, our up-to-date, comprehensive and accurate data platform IBA Insight is essential for future transaction due diligence and risk evaluation.

Related content