11/08/2020

There is a growing realisation that the Airbus A380 programme may have been short lived: with first deliveries of the aircraft type in October 2007, the industry was surprised to note the first A380 retirement in August 2017 - not one full decade later and well short of the expected 20 to 30 year life span of a commercial aircraft. Did the initial retirement, the subsequent retirement of three more examples, and the impact of Covid-19 sound the death knell for the A380 programme?

According to InsightIQ, as of 1st of August, 2020, Emirates has a fleet of 247 passenger aircraft that consist of 132 Boeing 777 family aircraft and 115 A380 family aircraft. The A380 represents 47% of the overall fleet size, at an average of 6.3 years and the older frames reaching 13 years of age.

In this analysis, IBA explores the utilisation changes in Emirates' Airbus A380 fleet over the January to July 2019 period versus the January to July 2020 period, with the view that changes in utilisation rates with the largest operator of the aircraft type provide a good indication as to the future of the programme.

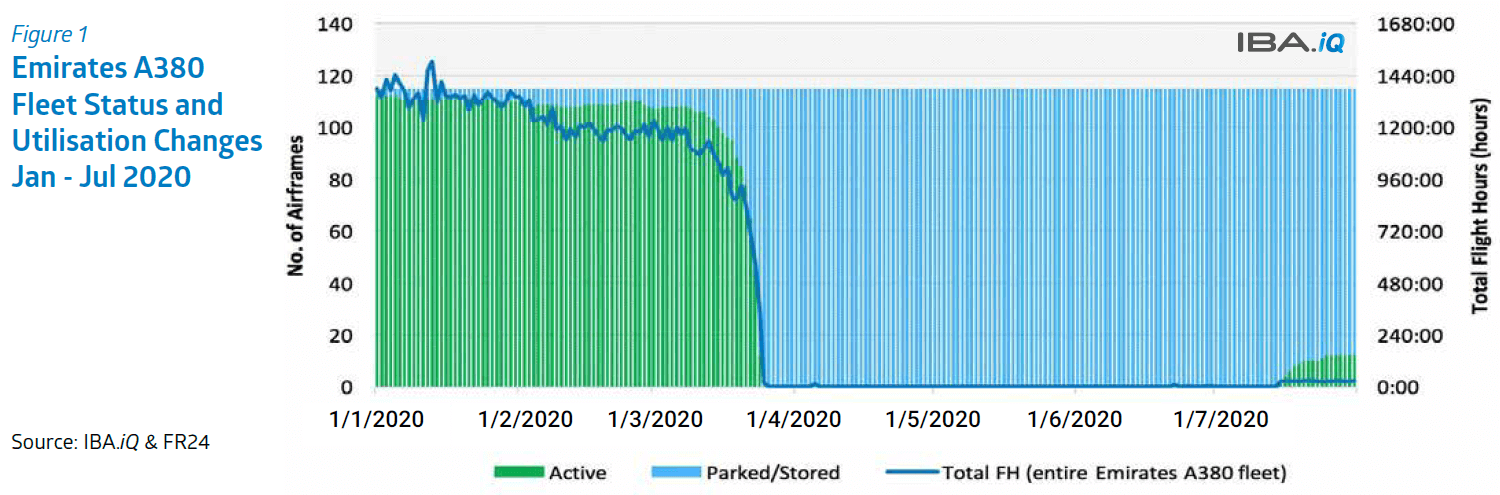

Figure 1 above shows the fleet status and utilisation changes of the Emirates A380 fleet for the January to July 2020 period. We note that although 12 of Emirates' A380s have returned to active service as of 25th July 2020, those aircraft have collectively flown less than 30 flight hours in total. The average daily utilisation for each active aircraft declined from approximately 12.3 hours per day on the 1st January to 2.2 hours on the 31st July, indicating severe under utilisation of the active fleet. For the days which each aircraft was active, the average FH:FC ratio declined from 7.3:1 at the end of July 2019 to 4.3:1 at the end of July 2020.

In the period from January to July 2020, Emirates conducted 13,449 flights with its fleet of 115 A380s, compared to 34,520 flights conducted over January to July 2019 with 112 A380s, representing a decline of 61% year on year (YoY). Until the end of February 2020 Emirates had flown 6.7% more seats on their A380s fleet than in 2019, however, by the end of March 2020, flown seats declined by 99.9% YoY as the entire A380 fleet was grounded.

Until the end of February 2020, average monthly A380 utilisation remained similar to that of 2019, at approximately 350 FH per month. However, the average daily utilisation for July 2020 declined to 14 FH per month. The A380s were in use at an average of 2.1 days per month in July 2020, compared to an average of 27 days in July 2019.

Between April and June 2020, there were very few noteworthy flights conducted by A380s except for some repatriation flights to London Heathrow in April, in addition to a few repositioning flights for storage/maintenance to Dubai DWC airport.

The top routes operated by Emirates' A380s did not change significantly over the January to July 2019 versus January to July 2020 period: with the top five routes being Dubai International Airport to London Heathrow, Bangkok Suvarnabhumi Airport, Paris Charles de Gaulle Airport, London Gatwick Airport, and Manchester Airport. While we note some very minor utilisation of the A380s so far in July 2020, with 17 return flights to London-Heathrow and Paris-Charles de Gaulle each, Emirates traditional A380 routes are currently being served by 777s on at least the LHR route, with 81 return flights undertaken in July 2020 compared to zero flights in July 2019.

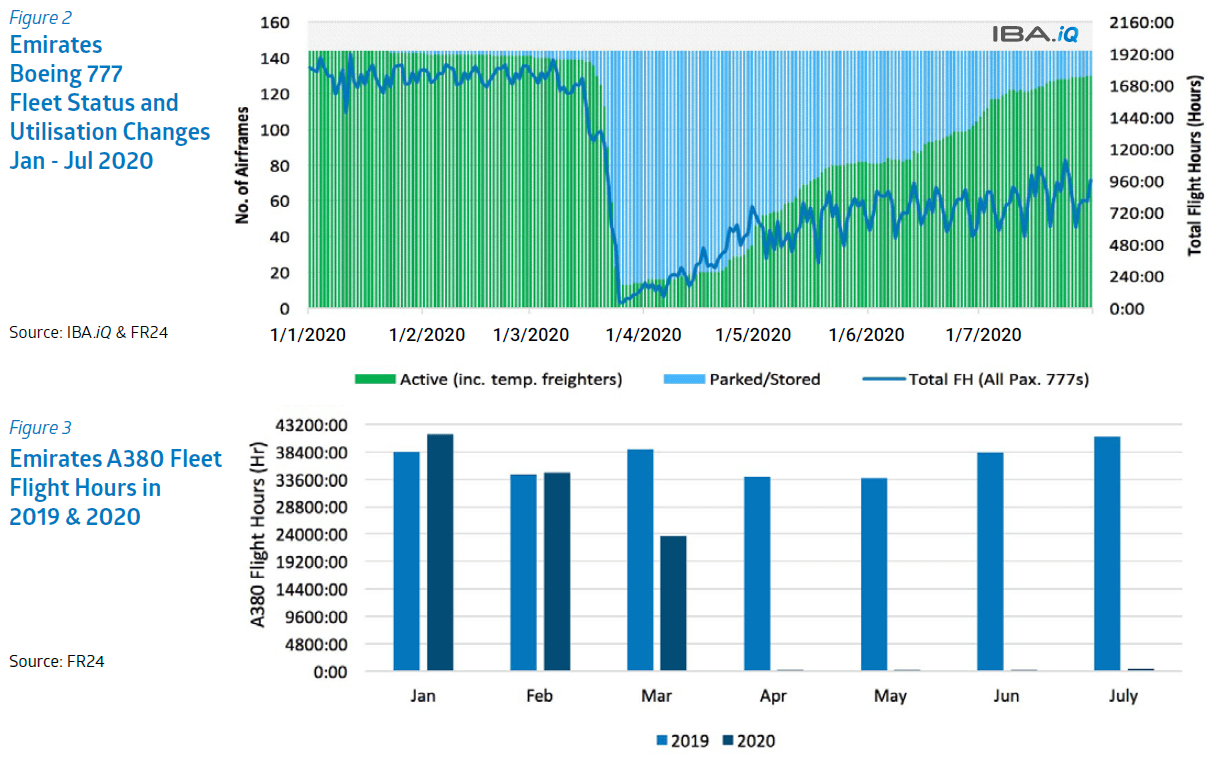

We note this trend in Figure 2 which shows Emirates' Boeing 777 fleet returning to service and gaining utilisation much more rapidly than the A380 fleet. There are potentially a number of reasons for this, with lower cash operating costs, low seat capacity to match depressed demand due to Covid-19 being key among them.

Figure 3 illustrates the Emirates A380 fleet flight hours in 2019 and 2020. In the same period of Jan-July 2019, Emirates' A380 fleet spent almost 250,000 hours in the air, compared to 100,000 hours in 2020. The drop in flying hours is seemingly due to Emirates withdrawing its A380s from service and instead operating these routes with the Boeing 777 fleet. IBA notes other routes where B777s have substituted A380s include: Dubai to Auckland (flight time approx. 18hr), Los Angeles (flight time approx. 16hr) and Sydney (flight time approx. 13hr), which prior to March 2020, were only served with the A380. The decline in the use of the A380 has also affected Emirates ultra-long haul flights, such as Dubai to Auckland, now it appears to be operated with the Boeing 777 with an intermediate stop in Bangkok.

In May 2020, Emirates President Tim Clark announced that the "A380 is dead" and that the A350 and 787 will have a place in Emirates fleet, however, Mr. Clark has also indicated that Emirates has no immediate plans to retire the A380s prematurely. At the same time, unconfirmed rumours emerged that Emirates has already started looking at retiring the A380s in the future, with plans to retire 46 Airbus A380 by 2027 which represents 19% of the fleet.

The data presented appears to support Mr. Clarks past comments. In what appears to be a recovery period for Emirates in July 2020, the Airbus A380 seems to be much slower out of the gates than the airline's Boeing 777 fleet, with lower demand and therefore less need for seat capacity driving these decisions. We note a number of Emirate's top routes are now being served by the Boeing 777. We also note a number of the airline's A380s have been moved to storage. It certainly seems as though Emirates is in no hurry to return its A380s to service, and with predictions of recovery to 2019 levels of passenger traffic expected in 2024, it appears the A380 may have fallen out of favour even with its largest operator for the foreseeable future.

If you have any further questions or comments please get in touch: Rami Abdel Aziz, Aviation Analyst

The data used within this analysis was derived from InsightIQ our leading online data intelligence platform. The intuitive system gives you an instant connection to your portfolio values, historical data, utilisation of aircraft, fleet data and visibility into trends, risk and the impact of macro- economic variables.

Discover what makes InsightIQ the leading aviation intelligence platform