24/11/2021

A review of narrowbody jet aircraft value trends in 2021

The youngest new generation narrowbody aircraft have resisted the negative effects of the pandemic most effectively and have staged the greatest value recovery. The outgoing generation of Narrowbody aircraft have not mimicked the recovery of the latest generation, however IBA has observed some positive trends.

IBA still sees the Airbus A320neo holding a premium over the Boeing 737 MAX 8 of around US$ 1.5 million in value terms across vintages, although this trend is expected to narrow into next year.

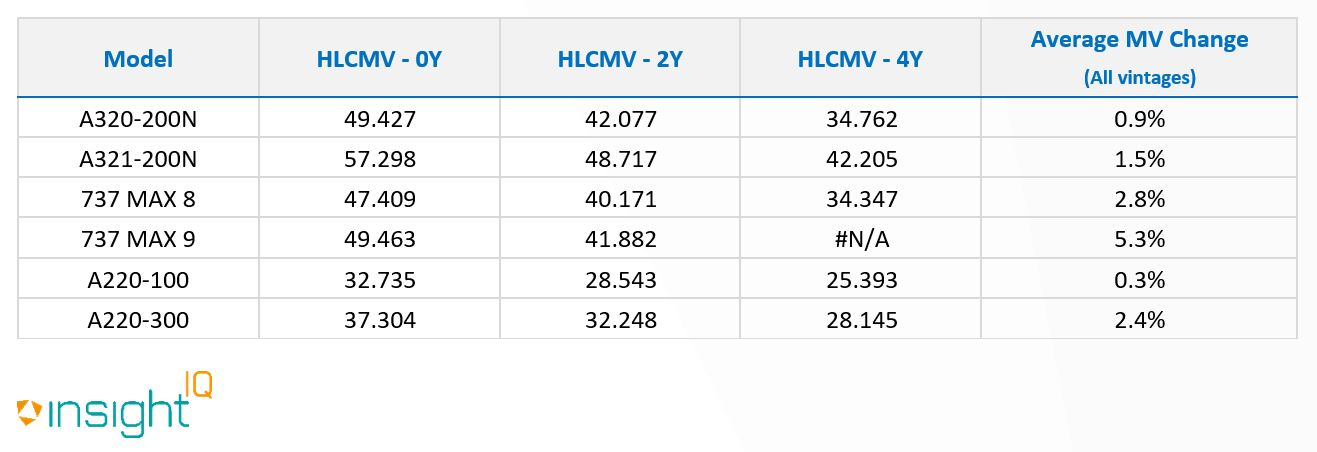

The Airbus A320neo family pricing is rising and pressure is bearing down on lease rate factors, a trend which looks set to continue into the 1st half of 2022. Value recovery has averaged approximately 0.9% across all vintages. Average Market Values remain disconnected from Base at around 91.4%. A new delivery example is valued at US$ 49.43 million, with some room for improvement as we look to the 1st half of 2022.

The Airbus A321neo is enjoying demand from the investor community and one of the strongest performers in the current market. IBA's market value for a non-ACF aircraft in a typical spec is approximately US$ 57.3 million, an improvement of around 1.8% since our January update.

Boeing 737 MAX values faced challenges even before the model was grounded, and declined further due to COVID. We continue to see a wide price range for the aircraft. In IBA's 1st half update, a new delivery Boeing 737 MAX 8 aircraft in a typical specification was valued at around US$ 45.2 million, which has since improved by around 4.9% to approximately US$ 47.4 million.

The Airbus A220-300 is a highly attractive asset, with a widening operator base and deepening order book of over 400 aircraft. IBA values a new delivery Airbus A220-300 at US$ 37.3 million, whilst the smaller A220-100 attracts a value of US$ 32.74 million.

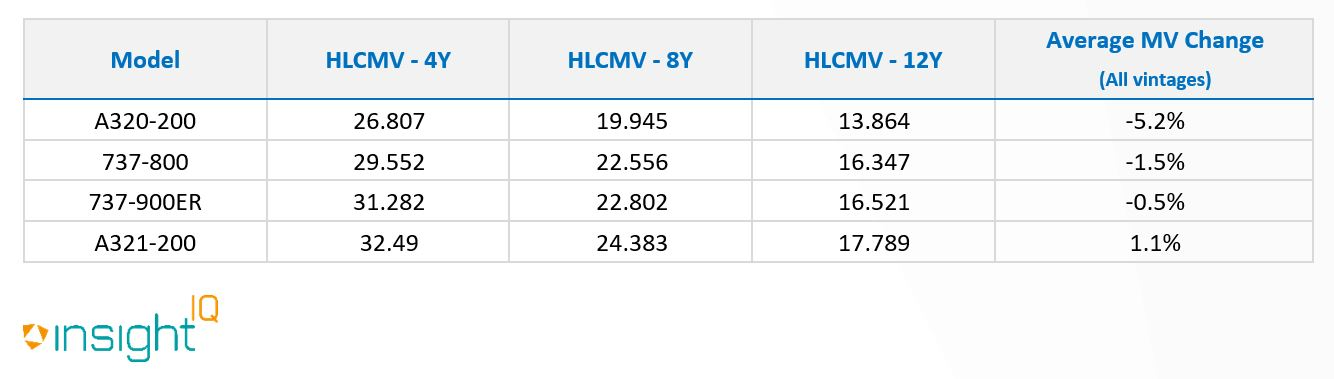

The outgoing generation of Narrowbody aircraft have not mimicked the recovery of the latest generation, though IBA has observed resilience amongst the larger variants.

The Airbus A320-200ceo trades at a discount to the Boeing 737-800 across all vintages. Values of aircraft up to 10 years old have declined by 5.07% on average.

The Airbus A321ceo is a strong performing outgoing generation aircraft. Values of new deliveries total US$ 47.948 million, an improvement of 3.2% on average compared with our 1st half 2021 update. Aircraft of 12 years or older declined on average 0.3%, whereas younger aircraft firmed by an average of 2.58%.

Boeing 737-900ER values stabilised relative to previous declines in 2022 though values declined by around 0.46% on a constant age basis. The youngest-900 aircraft still hold a premium over the mid-size Boeing 737-800, with the latest 2019 delivery valued at US$ 36.55 million (approximately US$ 3.29 million above the equivalent -800). This delta erodes to approximately US$ 300k on older vintages.

IBA's value opinion is fed by a combination of analysis, research, discussion with the trading and leasing community and comparison with similar data points. We compare, analyse, and scrutinise transactions we see in the market and discuss these amongst our elite appraiser team through regular value forums to ensure our value opinion is relevant, well-researched and of the highest quality.

If you have any further questions please contact Mike Yeomans.