31/05/2022

IBA's Chief Economist Dr. Stuart Hatcher identifies that demand is changing the relationship between oil price, USD, and airline failures.

These insights were first shared in our webinar, 'How is the airline industry performing in 2022?'. Click here to download the full presentation and view the recording.

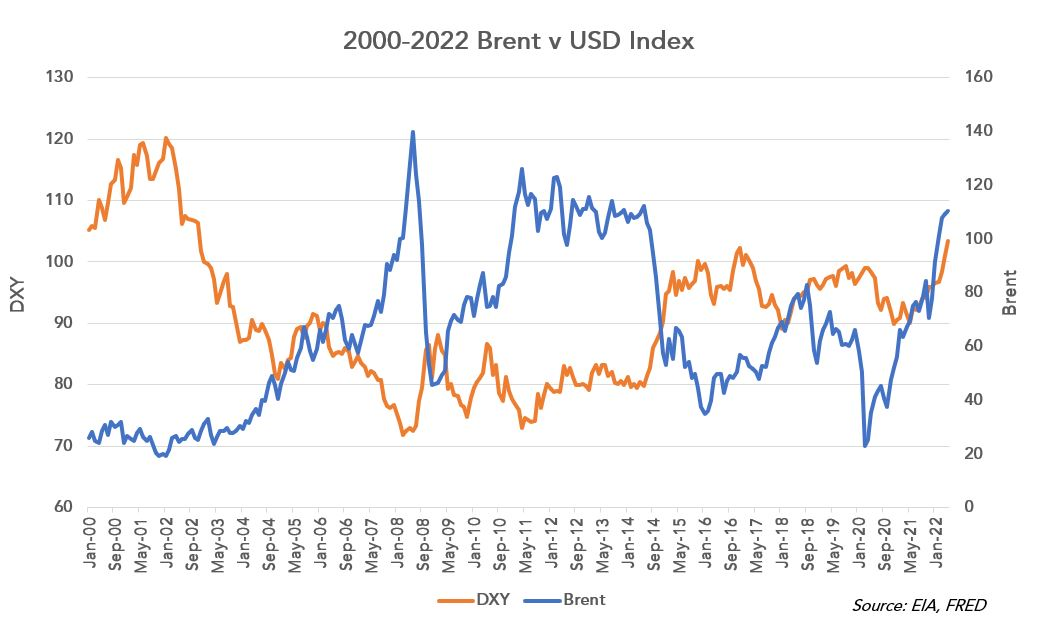

It is no secret that there is a natural inverse relationship between crude oil price and US dollar strength. It is also important to understand the impacts these have on airlines, and by extension, airline failures. The connection between oil price and fuel price is clear, but the strength of the US dollar also has an impact on non-USD denominated airlines, as many of their maintenance, leasing and purchasing costs are made in US dollars.

Traditionally, that inverse relationship means airlines only contend with one of these issues at once. An operator benefits from one and is disadvantaged by the other.

Our analysis shows that the unique combination of the rise in travel demand, the war in Ukraine and the United States becoming a net exporter of oil is temporarily causing both to move in an upward trajectory, breaking the usual pattern. Oil prices are close to the levels we saw in the early part of the last decade, and the US dollar is in its strongest position in 20 years.

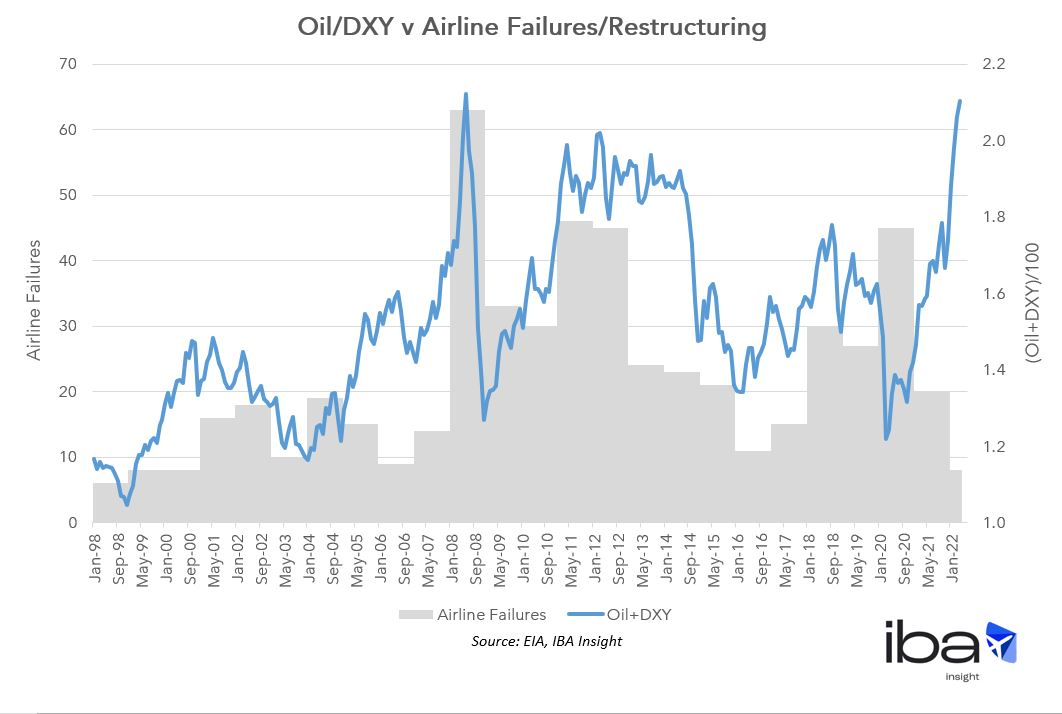

IBA Insight carefully tracks the relationship between these key financials and airline failures.

Of note is the dislocation and inverse relationship triggered by airline support, be this government loans, eased lessee commitments, or delivery deferrals during 2020.

Airline failures were high in 2020 as the industry sought the best ways to support airlines.

Failures in 2021 proved to be lower than anticipated as support became consistent

2022 is also proving to have fewer failures than we may expect, only 8 operators* have failed so far this year. This is primarily being caused by huge pent-up travel demand.

* Operators utilising aircraft with 25 seats or more.

We are not expecting a great deal of change in the number of failures until at least the end of Q3 of 2022. We do not know how long the surge in travel demand will continue, and whether the boom we are witnessing in Europe will be replicated in APAC when certain markets fully reopen.

We anticipate several sizeable airline failures towards the end of the 2022. That said, we do not anticipate the level of failures to exceed 2021 unless a recession occurs.

IBA Insight flexibly illustrates multiple asset, fleet, and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.

Author

See full profileRelated content