01/02/2021

In our 2021 forecast for the year ahead, Dr Stuart Hatcher, Chief Revenue Officer at IBA, shares IBA's opinion on traffic, transactions, asset values and airline failures in 2021. 'Now that 2020 is behind us, we can begin to look forward to 2021 and beyond; we can consider whether there are signals we can be optimistic about. A long, slow vaccination process is underway but, although this is a positive development, when do we realistically foresee the current market's harsh conditions will start to ease?'

We talked a lot last year about pent-up demand and, whilst a certain level of apprehension about the safety of travel will surely keep many people confined within domestic shores, on several occasions we witnessed that removal of restrictions is enough to encourage some people to fly.

Those most vulnerable will soon have successfully received a vaccine and localised lockdown measures will be relaxed. It will, of course, be a slow-release initially because successfully receiving the vaccine and being effectively vaccinated are two quite different conditions. Governments evidently remain under increasing pressure to find solutions that will address issues of public safety and economic recovery simultaneously. The vulnerable need to be protected but businesses and jobs are also at risk and, although more debt is not the answer, borrowing will continue to rise for many sectors.

Perhaps the market was delirious with lockdown fatigue at the end of 2020, but we began to sense market optimism tentatively emerging. Now, however, it's clear the mood amongst airlines remains dire. New Covid strains have evolved and are creating further turmoil.

Airlines' schedules are being rewritten in the hope that Easter will provide some return to regular operations. But we cannot ignore the evidence; there is still a long way to go. Many operators managed to avoid failure in 2020. If the pandemic's disruption continues for longer than cash reserves and furlough schemes will allow, they will be faced with a choice between raising more debt or finding different strategies for avoiding a downward spiral if further collapses are to be prevented. The airlines that are drastically changing their businesses to adapt to the difficult market will find support more accessible and, provided they emerge from the crisis intact, they will be much stronger for it. For those that can't adapt or make faulty decisions, sacrifices will be necessary to provide the strongest with an opportunity to react to returning demand.

As a positive, oil demand remaining low has certainly caused the producers to react to maintain a steady price that is manageable, and they may improve (from the airline perspective) if oil demand fails to recover as expected. Similarly, currency, the bane of any non-US airline, has remained quiet and has eased dollar-denominated costs; the trigger for much of the pain in recent years. Optimists are pinning hopes that this is a reflationary step to counteract deflation and signal recovery.

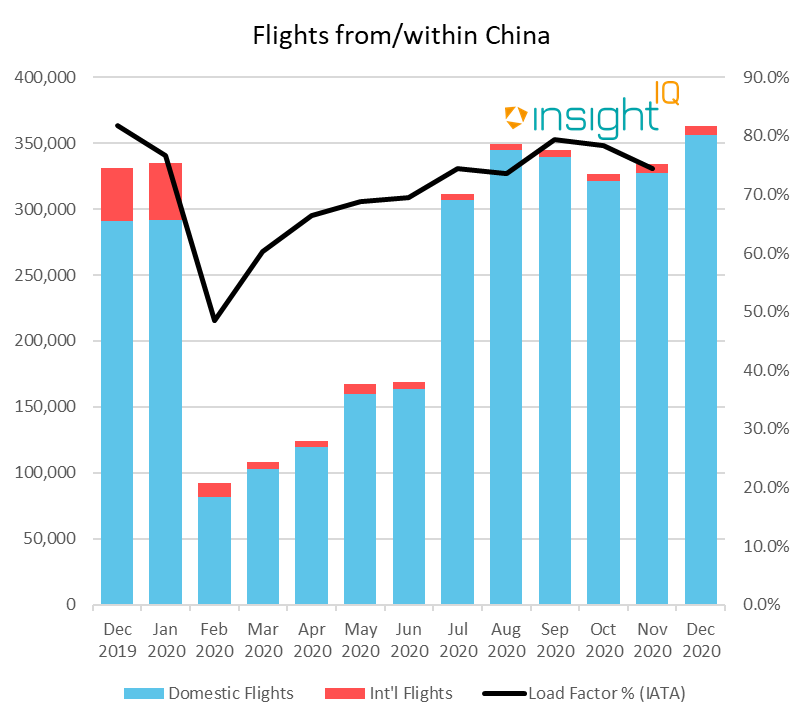

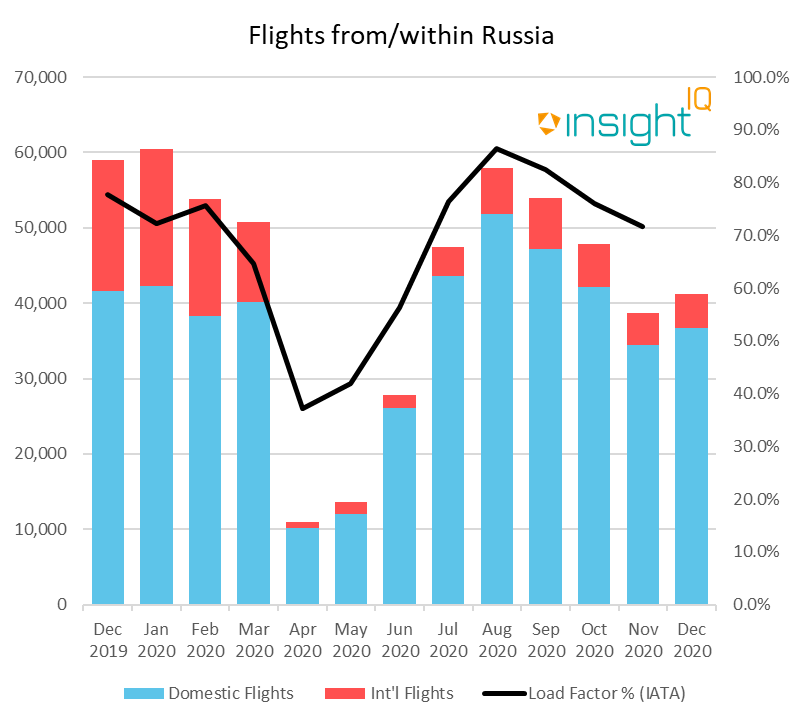

Returning to the subject of traffic, using data from IBA's InsightIQ Flights module, we did see some signs of recovery in 2020 with substantial gains in Chinese and Russian domestic operations over the summer, albeit followed by a drop once again for the latter as the winter months approached. Despite flight recovery, load factors were still significantly depressed within China but, with strong GDP expectations for 2021, figures will soon bounce back. Localised lockdown measures are rapid, so any surges in infection rates caused by new Covid variants are likely to be quickly contained.

IBA's analysis platform - InsightIQ, flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities.

Although to a lesser extent, we have also witnessed recovery profiles in other domestic Asian markets, such as Japan and Vietnam. By December, flights here managed to reach >80% of 2019 levels, although load factors remained very low. In contrast, load factors were much higher in Latin America whilst flight volumes remained down. This is clearly more effective operationally but, unfortunately, is equally efficient in relation to a viral transmission. Assuming sharp variances are inevitable in 2021, increasing capacity remains on the agenda for this year.

Lessors are not immune to the current market complexities either. However, given the level of available investment waiting to take advantage of lower sales pricing and better lease rate factors, we don't anticipate failure will result in the majority. A balanced portfolio with strong liquidity and the right approach to growth can certainly benefit from any improved deal terms that exist. For new deliveries with 'decent' operators, the line to support finance is still quite long which does mean airlines have the advantage if the economic situation becomes challenging for them. In truth, with interest rates as low as they are, long lease terms at decent levels are still hard to achieve unless the lessor feels confident about assuming more widebody risk. Lessors are more likely to discover compromises here.

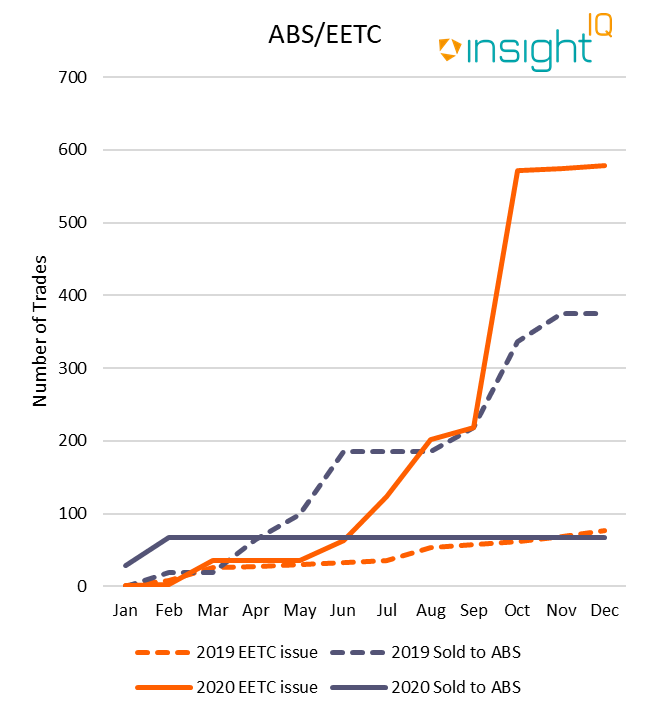

We expect an increase in sale leasebacks, as well as other trading activity in 2021 as equity, seeks a decent return. IBA's InsightIQ Fleets data illustrates that Enhanced Equipment Trust Certificates (EETC) hit record volumes last year alongside the collapse of ABS deals, we foresee more ABS activity this year. The first of the year has already been priced and its mix of aircraft and operators is diverse. It already appears more deals will follow provided the market doesn't change direction once more and failures significantly increase.

IBA's analysis platform - InsightIQ, flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities.

Many doubt the need for continued use of base values, which suggests growing expectation that market values will recover in a reasonably short period. Until markets reach a baseline from which to grow, calculating the true position of the bottom of the 'K' remains a challenge. As long as this remains the case, market values will continue to move in both directions depending on desirability.

We expect aircraft still in use with favourable terms attached and enough future longevity to attract the strongest market attention. As in previous demand downturns, aircraft size and age remain central to market predictions; cheaper and smaller assets tend to receive a boost as investors seek those that can efficiently benefit from weak traffic and oil demand. Is this likely in 2021? Yes, to a degree. However, despite witnessing a limited resurgence of right-sized operations in some markets, we certainly do not believe this is widespread enough to save them from the re-fleeting process. Impairments are therefore expected in 2021 across a wide area.

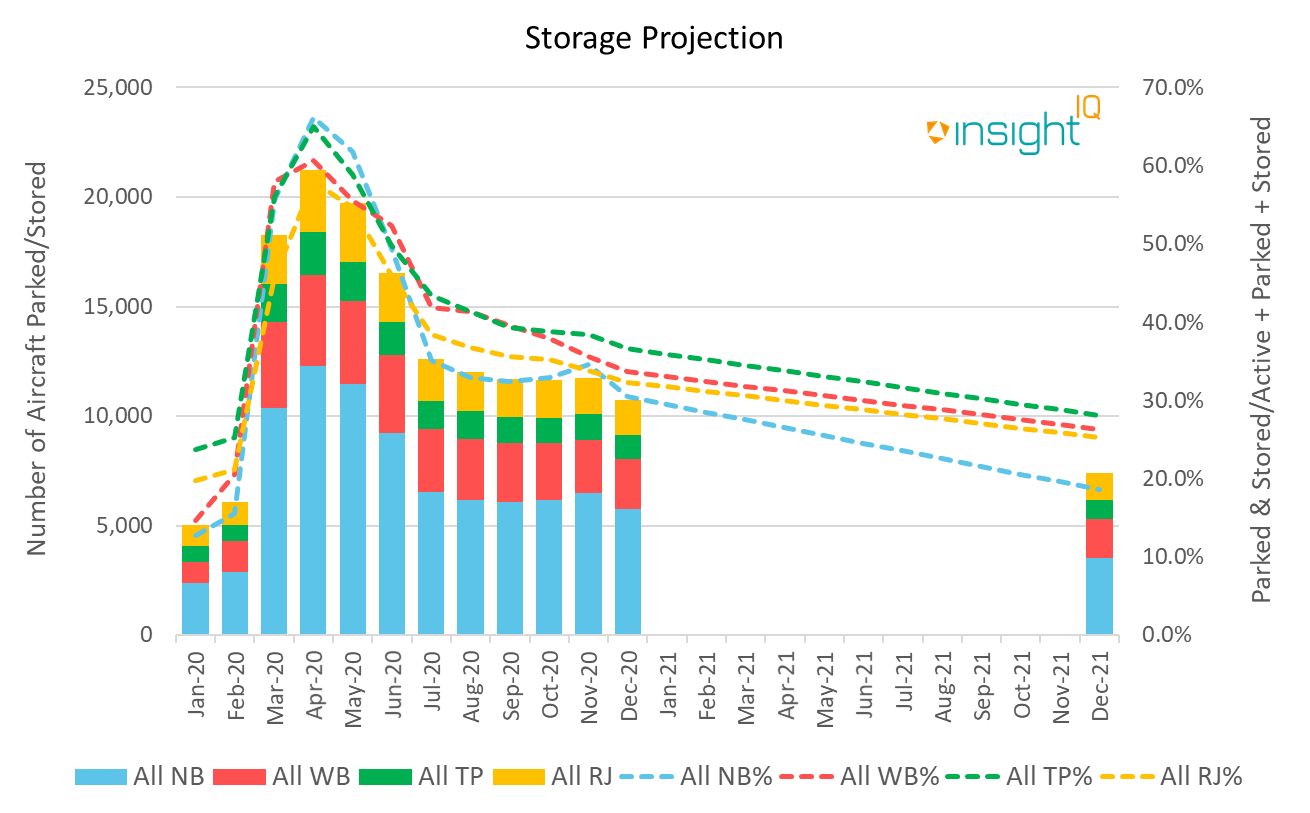

Typically, we would expect cash-strapped airlines (and there are a few) to opt for cheaper, older aircraft. However, we do recognise a re-fleeting is slowly underway. OEMs, governments, lessors and investors continue to push in that direction, but it won't suit everybody. New assets are not the best scenario for all in the market, airlines and investors alike, because they are expensive options for the returns they promise. From a supply and demand perspective, there is a vast oversupply of everything. Despite the depth of the trench, however, it does seem obvious that older widebodies will be worst affected whilst the latest generation of narrowbodies will return to form, eventually. As illustrated with InsightIQ Fleet data, it is apparent that current storage levels and availability remain volatile since the heavy summer drop, but once we get over the Spring hump, storage will ease.

Freighters and conversions will continue to receive attention this year despite the relatively low GDP recovery. This is because the passenger widebody fleet will take time to return to form and the growth of e-commerce has created demand. Apart from the usual 767 and 737-800 conversions, more A330s will step up as well as correctly timed 777-300ERs if the conditions for return make sense.

If we assume restrictions will ease once the vulnerable are acceptably protected against the virus, and countries comply with robust government-led track, trace and quarantine programs, we should see a strong resurgence of traffic of +50% compared to 2020 figures just in time for the northern hemisphere summer. But, regardless of how the controls are managed, travellers will predominantly remain within their regions. Business travel demand, however, will remain depressed until the 3rd quarter. Whilst a 50% rise in traffic sounds impressive, an increase of that amount still only returns the industry to half of its size a year ago. Naturally, capacity will increase, by around 30% we're expecting, but that will still leave many available aircraft parked up.

2021 has begun bleakly for the many people who're enduring another lockdown. However, if we can concentrate hard enough to peer through the uncertainty of mounting debt, rising unemployment, and new viral variant surges, there is a flicker of positive pressure which is determined to restore some growth and normality.

IBA's analysis platform - InsightIQ, flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate, fleet, and flight data eases appreciation of historic and future aircraft concentrations and operator profiles.

Author

See full profileRelated content