17/11/2023

The 2023 Dubai Airshow saw significant order movement, especially in the widebody market, which further proved the region’s unwavering interest in the aircraft class.

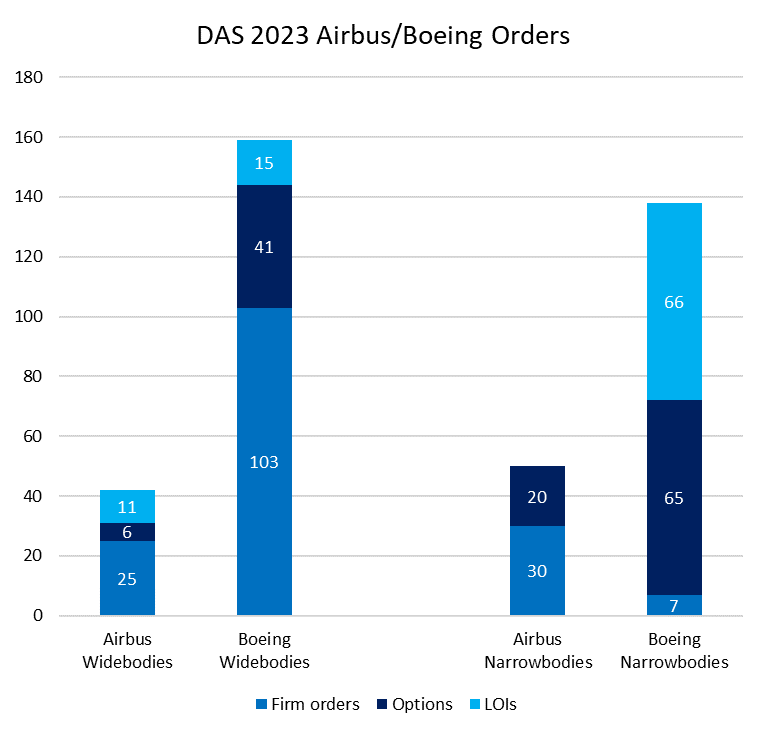

Boeing managed to secure most of the show’s widebody orders, mainly thanks to Emirates increasing its, already very sizeable, 777X backlog. This included an additional 55 777-9X as well as restoring the previously cancelled order for 35 777-8X. This brought the airline’s, already market-leading, 777X backlog to 205 aircraft. Additionally, the UAE’s biggest carrier also decided to readjust its 30 787-9 order, changing its composition from 787-9 only to 20 787-8 + 15 787-10.

Emirates order wasn’t the only winning front for the American manufacturer, as flydubai also announced its intention to take over the entire 787-9 order from Emirates. This moves them into the widebody market; however, the move is reportedly only to thicken routes. Boeing’s winnings also stretched to the narrowbody area, where SunExpress signed a letter of intention to acquire 17 737-MAX 10s as well as 28 737 MAX 8s, with an option for an additional 45.

The American manufacturer also saw an order from SCAT Airlines for 7 737 MAXs. These orders are very much needed if Boeing is to regain its market share in the narrowbody market.

Nonetheless, Airbus was not quiet at the show, with airBaltic placing a firm order for 30 A220-300s, with an option for an additional 20. As the world’s only all-A220 operator, they are seen as something of an ambassador for the type, especially given their commitment amid recent Pratt & Whitney engine issues. The European manufacturer also had greater success on Tuesday, after reaching a provisional agreement with Ethiopian Airlines for 11 A350s, with an option for 6 more. However, the airline did decide to place 11 787 and 20 737 MAX aircraft at the same time, with the option for an additional 15 Dreamliners and 21 MAXs.

Emirates was not finished at the show as they eventually decided to award Airbus the consolation sale of 15 additional Airbus A350-900. This was smaller than their initial stated intention of up to 50, due to engine issues to be resolved in the bigger -1000 variant. To add to the Airbus tally, as predicted in IBA weekly, EGYPTAIR has placed an order for 10 A350-900s.

Ultimately, the rumours regarding a Turkish Airlines order never came to fruition, as the airline is said to still be in talks with Airbus over its 350+ aircraft order. We are still waiting to see when the airline will reinvest their bumper 2022 profits. Nonetheless, both OEMs and therefore the broader aviation market will be pleased that the large appetite for growth in aviation continues to the close of 2023.

Written by Neil Fraser, CFA, Manager - Airline Analysis, and Piotr Grobelny, Aviation Analyst.

Related content