15/06/2022

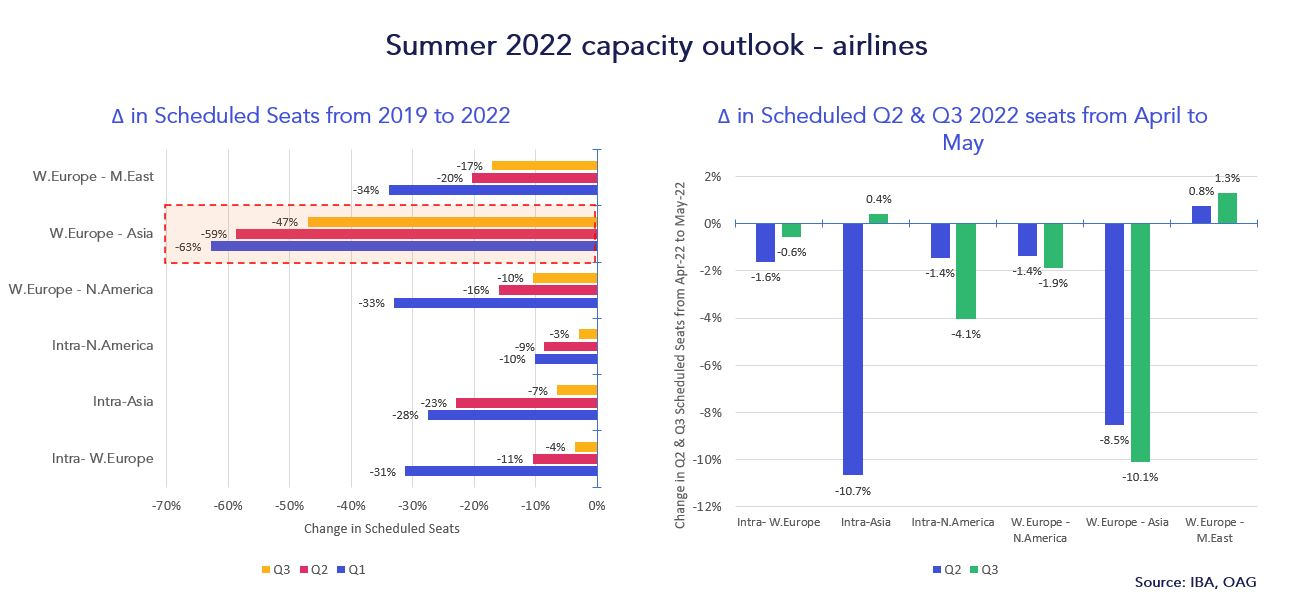

Our research reveals a positive overall trend in global capacity at airlines and airports globally, with performance edging ever closer to 2019 levels. Using this intelligence, we have mapped out the best and worst performing areas by airline and airport capacity as of mid-2022.

Best – Intra-North America

Worst – Western Europe to Asia

Global airline capacity shows positive trends on a quarter-by-quarter basis, with Q1 of 2022 being around 24% lower than 2019 levels. We forecast Q2 of 2022 will be between just 7-10% below 2019 levels.

Flights between Western Europe and Asia are proving the most challenged in terms of key global capacity flows. This is largely being driven by a cautious approach to easing of travel restrictions in APAC and airspace closures due to the Ukraine crisis.

Travellers in the UK face challenging delays at airports, driven largely by increased summer demand and staff shortages at both airports and airlines. Whilst media coverage of these issues has been substantial, it is important to note that operators have been quick to act in addressing delays, and that most UK passengers have been reaching their destinations on time. In recent discussions with the UK government, EasyJet CEO Johan Lundgren stated, “It's important to take a very sober view on what the summer has in front of us and how we're going to cope with that”. Airline recruitment efforts were initially hampered by Omicron variant travel restrictions in early 2022, making staffing a more notable challenge.

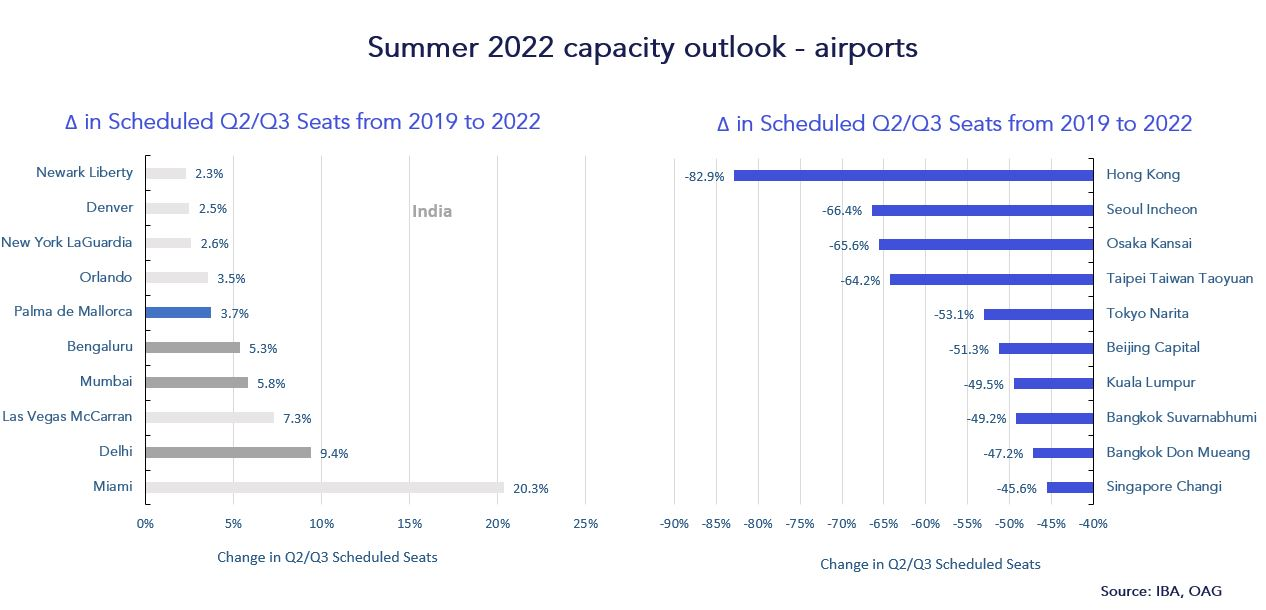

Best – USA and India

Worst – China and wider APAC

We used OAG data and IBA Insight to identify the top 100 largest airports by seat capacity in 2019, benchmarking airport capacity performance for comparison with 2022.

Our research identifies the United States and India as hotspots for recovery, with the most notable airports being Miami and Delhi. Miami has benefitted from a strong domestic travel market and recovery in Latin America.

Ongoing travel restrictions have limited recovery in China and the wider APAC region. International flight volumes in China have typically been up to 80% below 2019 levels, and domestic travel has downsized considerably since Chinese New Year.

Hong Kong also stands out as being particularly affected. Looking at this through the lens of carriers, we can see that whilst Cathay Pacific remains well-supported by the government, other operators such as Hong Kong Airlines (HX) are experiencing more profound challenges, resulting in staff taking unpaid leave.

These insights on airline and airport capacity originally appeared in our webinar 'How is the airline industry performing in 2022?'. Our regular webinars showcase a range of topics from aircraft and engine valuations to news and market updates. Webinars are just one of the ways we keep you updated on what's going on in the world of aviation finance.

Related content