21/03/2022

Using a combination of data sources together with IBA's own research and insights from our aviation intelligence platform, we have identified four key trends that will define the performance of the air freight market in 2022.

It's no secret that the air cargo sector has seen a considerable uptick in activity following the outbreak of the COVID-19 pandemic in 2020. The resultant collapse in passenger air travel forced many operators to shift their strategies to stay competitive, and the boom in global eCommerce further strengthened the need for effective air freight to support global supply chains.

Despite this, the air cargo market remains a volatile one moving through the first months of 2022. Sanctions and airspace closures following the Russian invasion of Ukraine are likely to bring challenges to all areas of global logistics, and with significant re-routing required, air cargo is no exception.

Air cargo demand continues to outpace capacity in the market as of March 2022, with freight capacity remaining restricted and dedicated freighters proving unable to meet demand. According to IATA, January 2022 air cargo capacity has only increased by 3% YoY and remains around 9% below January 2019 levels. With the airspace restrictions brought about by the Ukraine crisis affecting over 30 countries, flight times between Europe-Asia and Asia-North America are being significantly increased as air cargo flights are rerouted.

Notable operators impacted include Nippon Cargo Airlines, Korean Air and Asiana, who have recently rerouted their cargo flights to avoid Russian airspace. Other operators have reduced or cancelled Asia flights altogether. This will likely exacerbate the current air cargo capacity restrictions as capacity is taken out of the market.

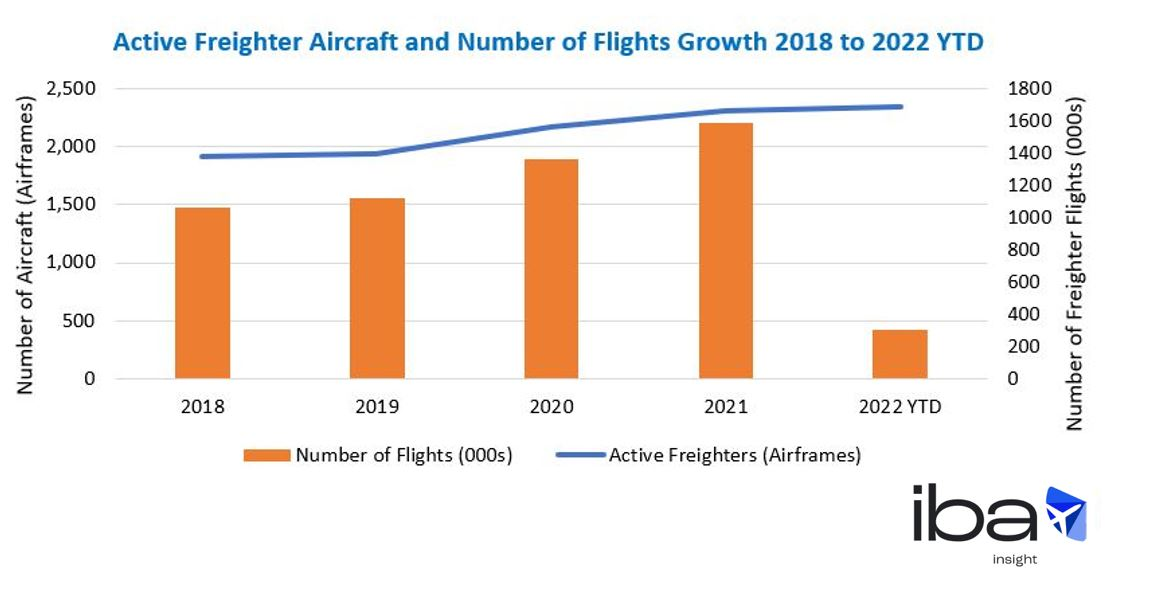

Older passenger-configured widebodies have fallen out of favour in recent times, making it an attractive time to acquire aircraft for passenger-to-freighter 'P2F' conversion at competitive prices. However, extended waiting periods facing P2F conversion programmes have slowed down the entry of new capacity to the market. It is no coincidence that the strongest growth seen within the freighter sector since 1999 coincides with the COVID-19 pandemic. The active freighter fleet grew by 234 aircraft in 2020, equating to 12%, with continued growth observed in 2021 with a further 138 aircraft becoming active, representing 6% growth YoY, according to commercial cargo aircraft fleet tracking intelligence from IBA Insight. The number of freighter flights also increased during 2020 with 21% YoY growth, compared to the number of passenger flights which decreased by 48% in the same period.

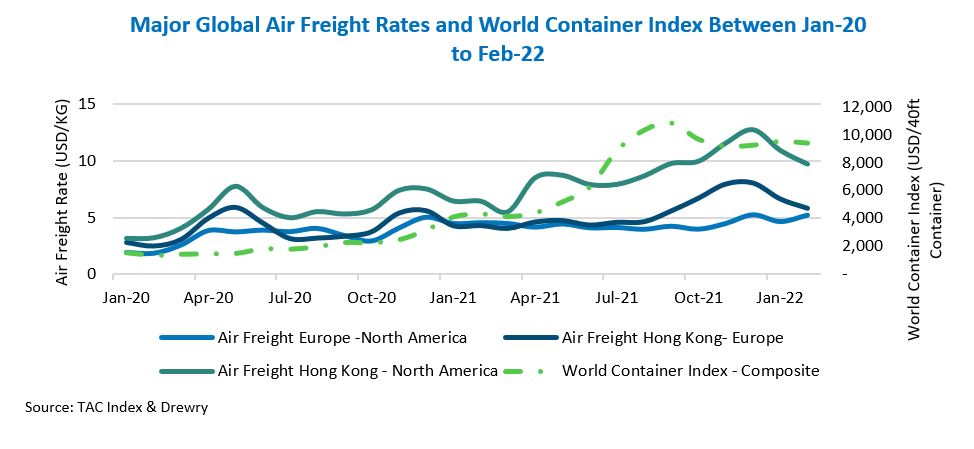

As predicted in our air cargo demand highlight, air freight rates continue to be inflated as passenger aircraft belly cargo capacity remains restricted, and the introduction of new aircraft into the market is slow. Sentiment in the air cargo industry indicates rates are expected to continue to increase in the near term, but surcharges from cargo carriers are likely due to network disruptions, surging fuel prices and the war in Ukraine. FedEx is one notable operator to recently apply such surcharges to most of their shipments. As of February 2022, air freight rates per kilogram on Hong Kong/Asia to North America and Europe routes remain elevated at approx. US$ 10 (51% YoY) and US$ 6 (35% YoY), respectively.

How do global air freight rates compare against the World Container Index?

Global supply chain disruption continues, with heightened eCommerce demand thanks to a shift in consumer spending habits, which has pushed ocean shipping rates to >7x their 2019 levels. According to the World Container Index (WCI) composite index, the sea freight rates to transport a 40ft container have increased two-fold since February 2021 and are currently up by 118% YoY. Rates have remained relatively steady since October 2021 despite the ongoing uncertainty and increased congestion at European ports.

The price of the Very Low Sulphur Fuel Oil (VLSFO) used by cargo ships has more than doubled since the start of 2021. In addition, the disruptions impacting the rail freight networks between Europe and Asia and lockdowns imposed in China mean that rates seem likely to increase in the near term.

The price of WTI crude oil and kerosene-type jet fuel has peaked at levels last seen in 2012 as of March 2022, reaching highs of USD $119 per barrel (91% YoY) and USD $3.7 per gallon (120% YoY) respectively. The uncertainty caused by the conflict in Ukraine is expected to push prices higher, particularly if more sanctions are applied to the Russian energy sector. Nevertheless, an increase in oil production by OPEC members is likely to stabilise the price. These higher oil prices will likely result in extra costs of transporting air cargo being passed on to consumers. The chart below shows the Cushing, OK WTI crude oil spot price against the U.S. Gulf Coast kerosene-type jet fuel spot price between Jan 2018 and March 2022.

.png)

While many world economies are opening up for travel, air cargo capacity as supported by belly cargo is yet to recover to its pre-pandemic levels.

Soaring oil prices alongside reciprocal airspace bans and sanctions are likely to delay the passenger market recovery over a longer timeline.

We expect capacity in the air cargo market to continue to be restricted in the near to mid-term, and air freight rates to remain high in the near term.

New capacity will be required, driving demand for dedicated factory freighters and P2F-converted aircraft.

IBA's experts provide you with valuable analytics and insight for your asset and financing strategies and specialised consultancy services in the air cargo market and beyond. Our advisory teams can offer you a full range of services, including cargo market analysis, P2F conversion management and fleet selection strategies to reach fully informed investment conclusions, while taking into consideration historical, current, and future market conditions.