09/06/2021

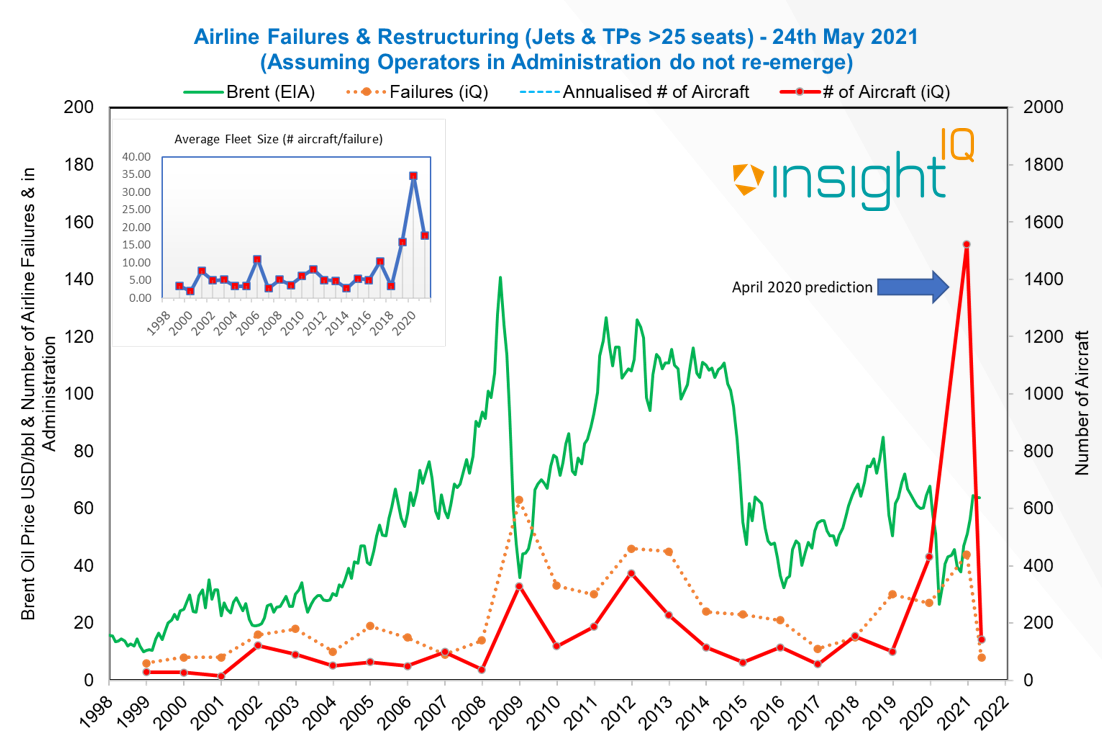

The historic correlation between high oil prices and airline failures is a proven trend. Combined with Coronavirus, they represent a clear and present danger to airlines.

The most notorious crises of the early and late 1970's saw crude oil prices inflated by up to 400%. Smaller but equally hard-hitting events such as the 'mini oil shock' of 1990 and the 2000 energy crisis proved that the stability of the market is constantly in the hands of demand, political tensions and the value of currency.

Although the Coronavirus pandemic has created a disconnect between oil prices and airline failures, it is vital to not lose sight of oil prices as an inherent driver of airline success and airline failures. The combination of the two could provide a perfect storm for an industry in turbulent times.

Despite being at the mid-point of 2021, the problems of 2020 are very much still with us. Based on our data, we expect to see the following key trends…

Significant numbers of aircraft returning to lessors or other financiers, whether in negotiated deals, repossessions or otherwise

Less airline restructuring, but more airline cessations (with particular attention to be paid to Air Namibia and Sky Regional)

It is equally important to highlight the positive stories emerging for airlines during Coronavirus. Our data shows that over 130 start-up airlines are planning to commence operations between 2021-2022. Almost 40% of these are based in Europe, and suggests these start-ups are grasping the opportunity to enjoy heavily discounted depressed asset and lease values, interest rates, maintenance, MRO service and pilot costs.

If you have any further questions please contact Stuart Hatcher.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.