23/07/2021

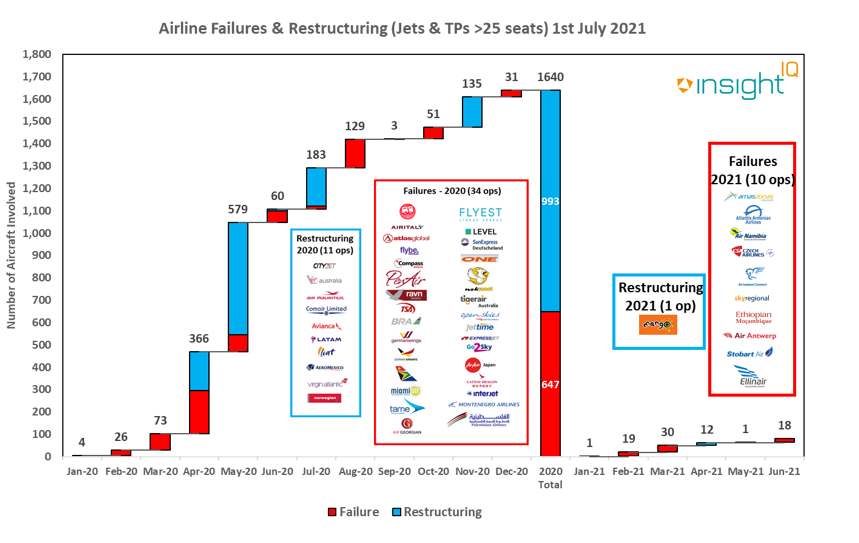

The majority of pre-pandemic airline failures were driven by rising costs and oil prices. Despite 2020 presenting a record number of airline failures and restructurings, it is very likely that this figure would be higher if it were not for lessor, OEM and government support. We used intelligence from IBA's InsightIQ platform to examine the connections between leased aircraft and airline failures.

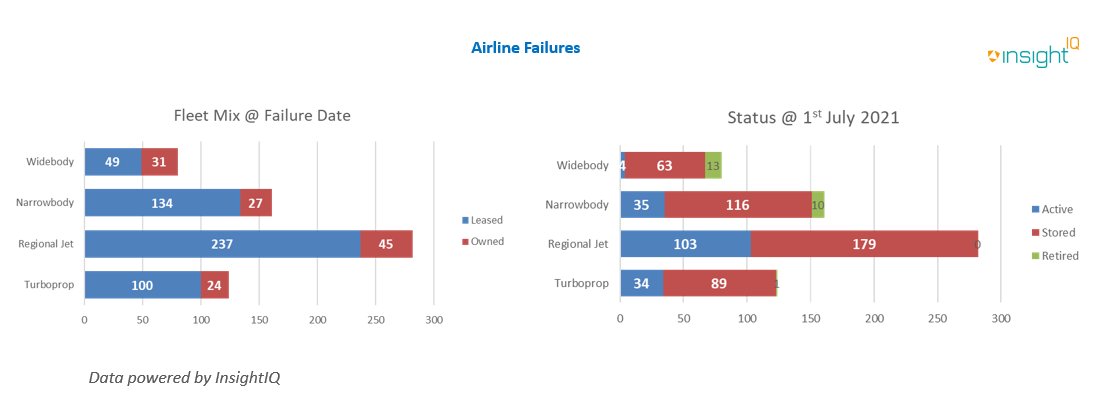

As seen in previous years, IBA has identified a correlation between high concentrations of leased aircraft and airline failures, as such it is a key factor when we consider the susceptibility of airlines to failure. Out of 647 aircraft involved across all airline failures in 2020, 80% were leased. Similarly, around 71% of aircraft effected by restructuring were leased. In previous years, this relationship was clearly present in the cases of Air Berlin, Monarch Airlines and Thomas Cook.

InsightIQ fleet data shows that the fleet mix and current status of the 647 aircraft involved in failed airlines. We know there is a bias towards leased aircraft and regional jets. 69% of aircraft from failed airlines remain in storage. Only 176 aircraft have been returned so far, and only around 4% of these have since been retired from service. Other observations include:

Many US regional aircraft have been redeployed within the fleets of other US carriers.

34 turboprops and 39 narrow and widebody aircraft have returned to service.

The A320 CEO faced the bulk of narrowbody retirements owing to a shorter supply of 737-800s in the market, alongside the widebody Airbus A330 and A340.

Though hardest hit by reduced utilisation and retirement, the widebodies' predicament has been partiality alleviated due to most being held by major flag carriers (and thus benefiting from more government support).

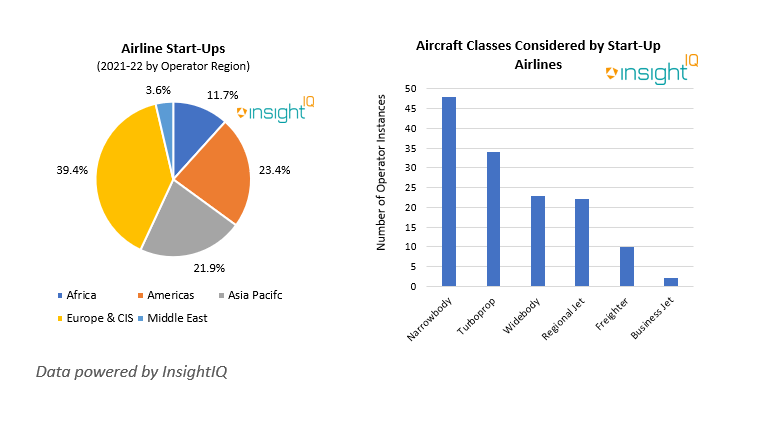

Following our recent revelation that over 130 start-up airlines are planning on commending operations by 2022, IBA can reveal that around 30 are now close to launch. Around 100 start-ups are further behind these operators, and of keen interest to lessors with available aircraft. Of these airlines, there is a focus on short haul and regional market segments, though Low-Cost Long-Haul (LCLH) remains of interest to some start-ups. Around 40% of these are based in Europe and narrowbody types are typically proving a preferred choice.

For start-ups, the choice of asset type is crucial. Reliable mid-life assets with established maintenance regimes, freely available spares, multiple leasing options and no certification issues are preferable. Success, as ever, will depend on the start-up's management teams, business plans, competition and foreign exchange exposure.

2021 has shown little change from 2020 thus far, but fleet reduction activity from a number of operators signals attempts to avoid Chapter 11. Weaknesses in certain operators' business models are likely to be exposed as government support, deferrals and payment holidays come to an end. The third quarter of 2021 is likely to prove a tough one, with new variants continuing to hamper international travel.

IBA anticipates further hand-backs are likely in the Latin America region.

If you have any further questions please contact Stuart Hatcher.

A full list of start-up airlines is available to subscribers of our InsightIQ aviation intelligence platform. You can also view our recent July 2021 Market Update Webinar on demand to get more information about start-ups, failures and restructuring.

IBA's InsightIQ analysis platform flexibly illustrates multiple asset, fleet and market positions, actual and potential, to inform client choices and identify acquisition opportunities. Immediate access to crucial aircraft, engine, lease rate and fleet data eases appreciation of historic and future aircraft concentrations and operator profiles.