08/04/2024

Environmental, Social, and Governance (ESG) issues are now seen as a key risk to aviation investments, and authorities worldwide are demanding more transparency and stricter reporting standards. It’s never been more important to understand the pathways to net zero emissions and their real-term impacts on all key players across the industry.

Each month, IBA’s ESG Consulting team share key insights and the latest news from the growing world of sustainable aviation.

Image: Shutterstock // CAT Foto

In the biggest single project of its kind, the Japanese Ministry of Economy, Trade, and Industry (METI) have announced its intention to design and build a regional aircraft powered by next-generation technology. The project will leverage up to USD 33 billion in public and private funds across 10 years to 2035, although it’s unclear whether this represents an ambitious entry-into-service date.

METI says that all technology options are on the table, including hydrogen, and that Japan can’t contribute to a sustainable aviation industry while only manufacturing parts. This news comes only a year on from the scrapping of a Japanese conventionally powered regional jet program after a decade-long effort. It would appear Japan is turning to new routes of entry into the aircraft manufacturing market, potentially utilising the liquid hydrogen facilities operated by JAXA, the national space agency, which is one of the largest in the world.

With METI looking for collaboration with global partners to ease the delays faced by the previous domestic program, this represents an exciting opportunity to make serious strides towards clean, potentially hydrogen-powered, aviation.

Image: Pexels

The recent Amsterdam Court ruling against KLM's environmental messaging highlights a growing awareness of greenwashing, with advertisements making vague and general statements about environmental benefits. Specifically, painting an ‘overly rosy’ picture of the effects of their sustainability strategy. "Those measures only marginally lessen environmental impacts and give the wrong impression that flying with KLM is sustainable", the court said, requiring more concrete evidence of sustainability efforts. At the recent A4E Summit in Brussels, Air France-KLM CEO Ben Smith responded by saying that KLM’s fleet renewal and SAF uptake is a perfect example of concrete actions.

Not only does this ruling highlight potentially unethical business practices, but it is also a call for more stringent policies in the context of global aviation. CORSIA comes to mind; it is designed to pressure airlines into offsetting carbon emissions but places significant reliance upon the voluntary carbon market, the legitimacy of which remains a subject of considerable scrutiny. While the court did not mandate specific changes to KLM's messaging, the ruling serves as a powerful reminder that companies must back up their claims with concrete aviation emissions data and transparent methodologies.

For an airline like KLM, which has shown significant commitment to its transition plan, claims like these can be extremely damaging. With public knowledge of the validity of offsetting increasing, airlines must start leveraging their growing data capability to provide effective marketing on actual progress.

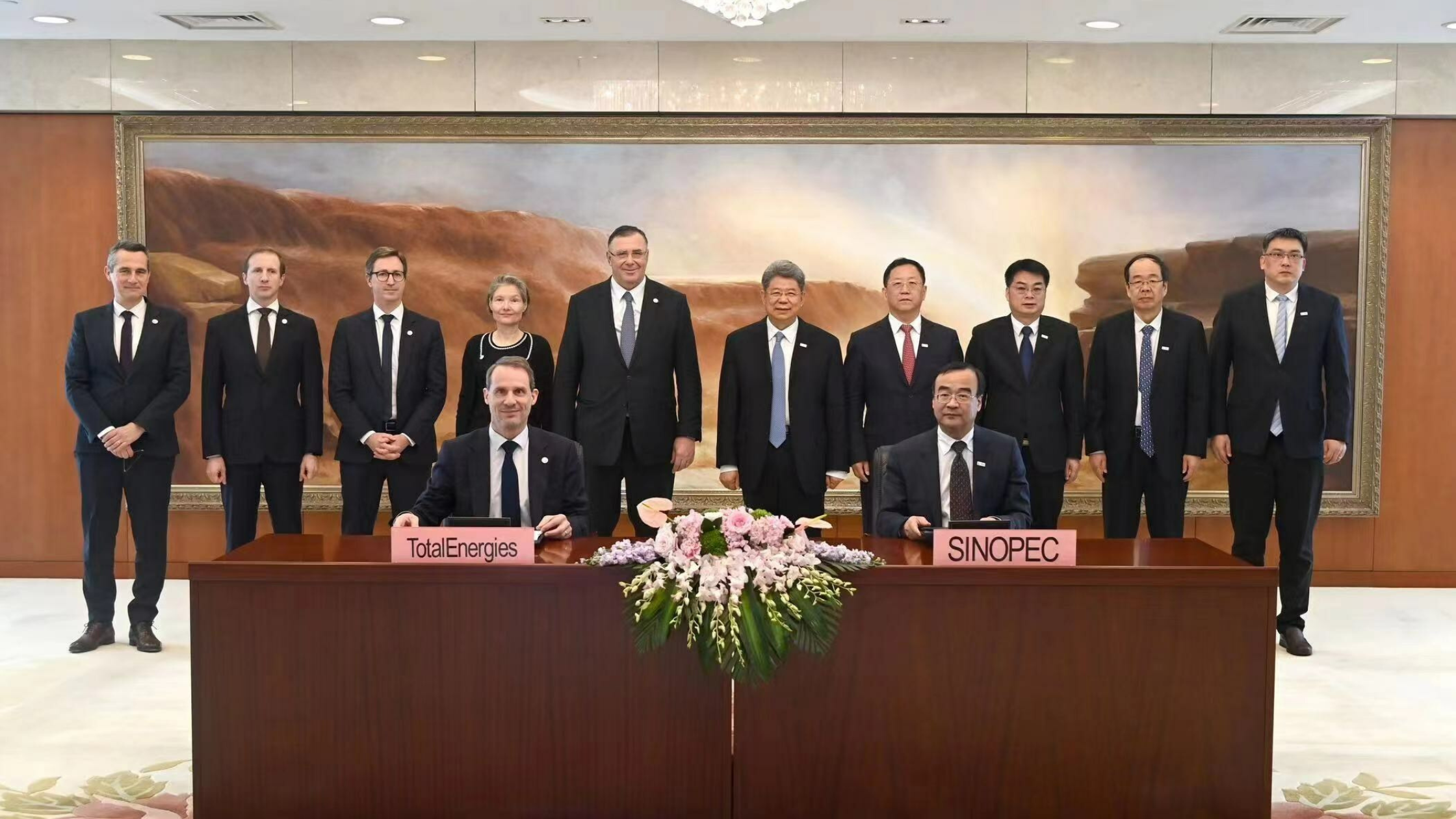

Image: PR Newswire

China’s Sinopec has announced, in a partnership with French fuel supplier TotalEnergies, a second Sustainable Aviation Fuel (SAF) plant to be jointly built and operated at one of their refineries in China. The plant will run on used cooking oil, of which China is the largest producer in the world. So large is China’s output that they have started exporting to the US to assist in the implementation of the SAF Grand Challenge and Inflation Reduction Act.

As Sinopec is a state-owned company, this fits with the aviation biofuel aims of the 14th 5-Year Plan, adding to their existing 100,000-tonne per year plant in Zhenhai. While this is a promising development, with other privately funded projects aiming to begin production in the next few years, a lack of policy to incentivise producers and operators could mean China is in the unique position of having limited demand for SAF. Unlike in the EU, where airlines are incentivised to purchase SAF to reduce ETS exposure and producers must meet mandates under ReFuel EU, China’s SAF industry is at risk of lacking the necessary impetus.

If China is to become the major contributor to the global market that its resources and financial backing suggest it could, integration into environmental policy for all stakeholders is required.

IBA's ESG Consulting team supports with advice on sustainable finance, ESG ratings, ESG strategy and understanding emerging technologies in aviation. Our expert insight is powered by cutting-edge insights from our award-winning IBA NetZero aviation emissions reporting platform.

To find out more, please get in touch.